That is an knowing editorial by Pierre Corbin, the producer and director of “The Gigantic Reset And The Upward thrust of Bitcoin” documentary.

In the 18th century, the Dutch launched the concept of mutual funds, allowing investors to diversify between different world bonds. The same idea used to be embraced in London in the 19th century. This idea is what allowed corporations cherish F&C Funding Belief to be based in 1868. F&C managed a portfolio of excessive-yielding world bonds, which pushed ahead the concept of portfolio diversification by inserting together different securities that lowered the possibility of the portfolio. That is correct in monetary idea, and anybody who has a increased education in finance surely labored on building different objects spherical that. At the time, they believed that adding any roughly further asset into a portfolio lowered its possibility — we now know this is no longer the case.

In spite of all the pieces, London used to be the put the money used to be at the time. After beating France true via the Napoleonic Wars, the U.K. established its web page as the arena’s strongest empire and unfold the British pound internationally. This diversification idea used to be a grand cause to invest to your total world. Stock exchanges began sprouting all the procedure via the arena and had been a signal of a developed capital metropolis. Per William Goetzmann of the Nationwide Bureau of Financial Evaluate, “Between 1880 and 1910, bigger than half the arena’s markets had been launched.”

The British empire used to be far-reaching and majestic, but after World War I, World War II and the a couple of bankruptcies within this period, it had to pass aside and let but every other solid power take over: the united states.

The U.S. has grown its affect in a identical trend:

- That is the put the money heart used to be.

- By leveraging world markets and world investments.

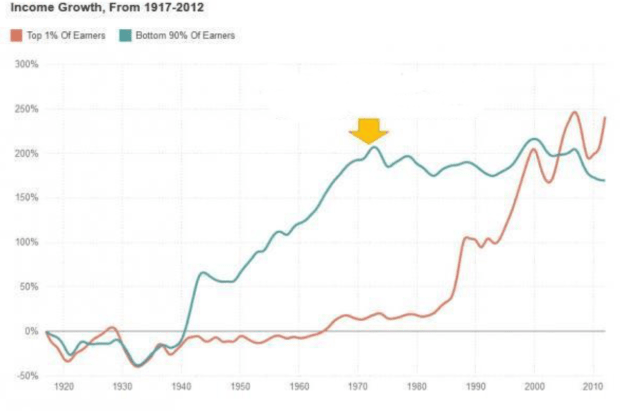

The U.S. dollar used to be at the center of this growth, and the U.S. used to be on high of issues of the forex, giving them big leverage over the rest of the arena. Since then, time and time once more, the united states has former militia power to connect and to protect the reputation of the dollar. We’ve viewed this in Iraq and in different world conflicts. The U.S. has to protect the reputation of the dollar because with out the reputation of world reserve forex, the reputation quo of the U.S. is at possibility and may maybe maybe want big impacts on the U.S. and world economy. In point of fact that in attempting to defend its reputation and the system created as a outcomes of the Bretton Woods settlement, the U.S. leaders maintain slowly destroyed the worth of the U.S. dollar and maintain impoverished their electorate along the manner. There are some sure charts that illustrate this prolonged-term phenomenon that can maybe presumably be viewed here.

This, of course, is no longer handiest a U.S. phenomenon, but is correct for the rest of the arena too. By utilizing the petrodollar, and since the U.S. dollar is the realm reserve forex, every different forex has been devalued faster, leading to the the same outcome, if no longer worse, all over the put else.

At the fresh time, it appears cherish we are at a transferring point. The combat for U.S. dollar hegemony goes solid in Europe, precisely in Ukraine. The headlines of your total world focus handiest on the battle, but hurry away out to point out what goes on in the background with the fiat system, at the possibility of exhibiting the precise geopolitical plays. The BRICS nations maintain given sure hints about their mid-to-prolonged-term knowing in regards to the procedure forward for the U.S. dollar. They’ve officially launched that they’re building a brand original reserve forex in retaining with precise inviting sources, which consist of a couple of treasured metals, further forcing the U.S. to take a explore at to toughen their web page as the arena police. We’re seeing this via the affect that used to be former following the of the presidential elections in Pakistan and the net site they’re attempting to soak up the China-Taiwan relationship.

The combat for the U.S. dollar shall be occurring on but every other continent: Central The united states has at all times been below big affect from the united states. Thomas Jefferson once stated, “In with out reference to governments they cease, they may maybe maybe be American governments, no longer to be focused on the never-ceasing broils of Europe. The united states has a hemisphere to itself.” This supposed the U.S. may maybe maybe presumably be obvious European nations hurry away the put, so that they are able to affect the put themselves.

A puny nation, historically destroyed by the U.S. and their overreach in the put, is attempting to detach from the dollar for the explanation that nation adopted it 20 years in the past, following the wretched local monetary policy that used to be in reputation for decades. In September 2021, in a ancient pass, El Salvador, the smallest nation in the put, used to be the foremost nation on the earth to adopt bitcoin as just correct tender, sparking the fire that pressured the U.S. executive to place its eyes on the put once more. Since then, El Salvador has develop into a more main matter in world media. On account of this pass, El Salvador’s tourism has increased by 30% for the explanation that commence of the Bitcoin Law, and as mentioned by their president, Nayib Bukele, the El Salvador nasty home product (GDP) grew 10.3% in 2021, the foremost year in their history to maintain a double-digit GDP express.

On the realm scene, even supposing, their geopolitical relationships appear to maintain changed for the explanation that nation’s adoption of bitcoin. The finest signal of this is the Accountability for Cryptocurrency in El Salvador (ACES) Act launched by U.S. senators Jim Risch (R-Idaho), Bob Menendez (D-N.J.) and Invoice Cassidy (R-La.). The procedure of this laws is to permit the U.S. to visual show unit the adoption of bitcoin in El Salvador and take actions if they set in thoughts that it’ll picture a possibility for the U.S. economy. As a reminder, the U.S. GDP in 2021 used to be $23 trillion, while the El Salvador GDP used to be $28.7 billion. This makes the El Salvador economy an say of magnitude smaller than the one in the U.S. It appears cherish the procedure of this laws is to no longer mitigate the hazards El Salvador represents to the U.S. economy, but to maintain a sufferer in case they set in thoughts bitcoin to be harmful to the U.S. dollar.

Samson Mow, CEO of JAN3, described this the finest:

Yet one more main indicate prove is the reputation of Nayib Bukele in the put. Adopting bitcoin comes with adopting better prolonged-term values. He’s among the most neatly-liked presidents in the history of his nation and is the most neatly-liked president in Latin The united states.

For the explanation that adoption of bitcoin in El Salvador, different worldwide locations in the put maintain thought to be adopting it too, but maintain slowed their adoption because of external stress. Honduras is slowly bright ahead even supposing, because of areas or cities acting independently in the hopes of attracting foreign investments and tourism.

The U.S. executive’s combat for the dollar is an fascinating memoir. We’re at a turning point in history, the put the dollar can also lose its reserve forex reputation, and the U.S. executive will enact nearly anything else to protect it. One in all their actions on this course is to censor bitcoin adoption on the earth.

That is a guest post by Pierre Corbin. Opinions expressed are entirely their private and enact no longer primarily say those of BTC Inc. or Bitcoin Journal.