The stablecoin market has witnessed one in all basically the most unstable moments in its historical previous this month as TerraUSD (UST) lost its peg and momentarily threatened the perceived stability of its competing stablecoins.

On the other hand, prior to UST’s advent, a competitors between USDC and USDT turn into already in fleshy swing.

USDT vs. USDC

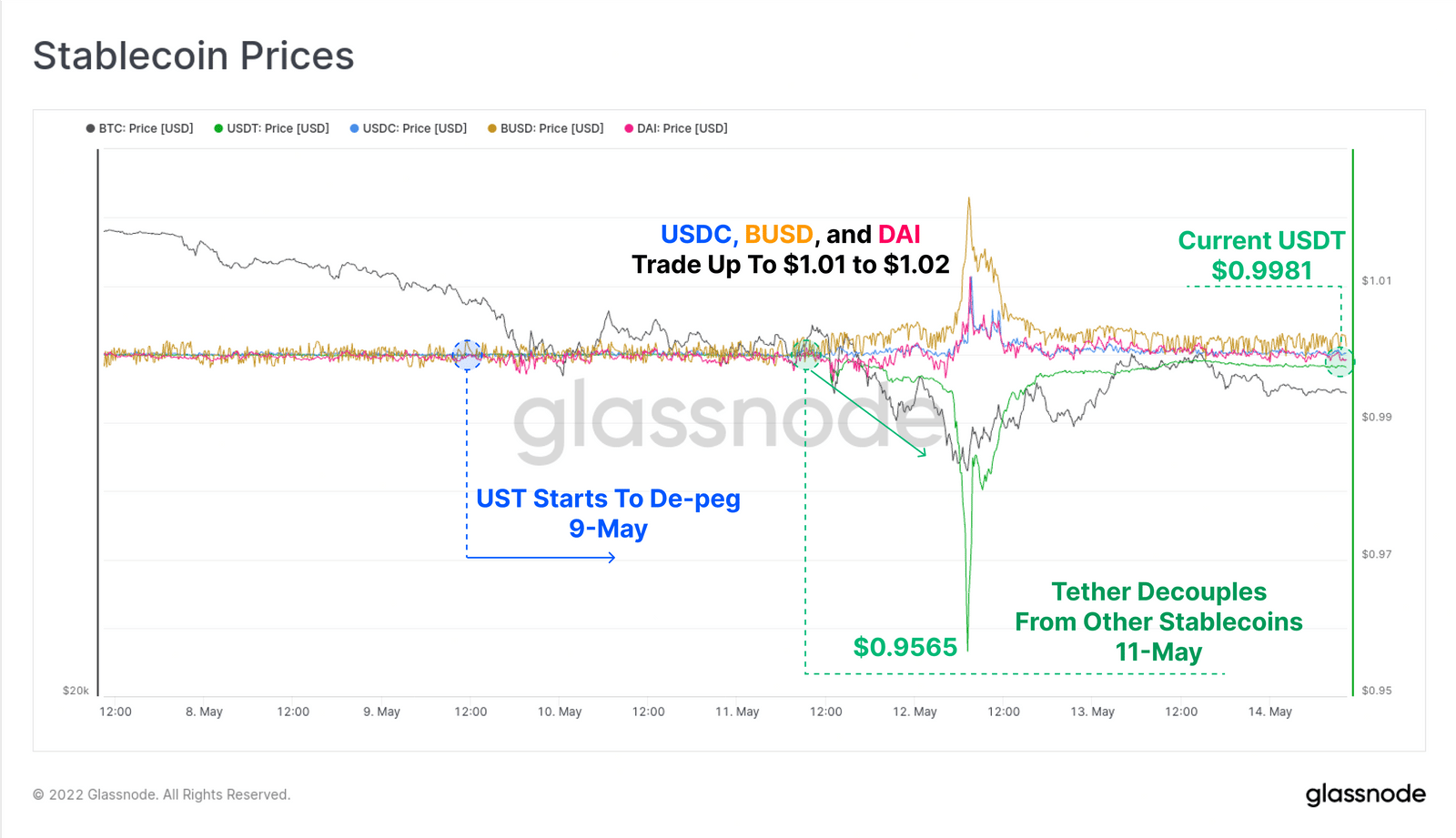

At the time of writing, UST, a stablecoin intended to substitute at $1, is value roughly $0.068 or 6 cents. The day it lost its peg (the fracture of Might perhaps 9), Tether (USDT) and USD Coin (USDC) had been also impacted.

The extinct lost its peg and fell to as petite as $0.95, whereas the latter, alongside with the likes of Binance USD (BUSD) and DAI, turn into buying and selling at a top class of $0.01 to $0.02.

On the other hand, it’s value noting that USDT didn’t in actuality lose it’s peg– its market tag momentarily slipped underneath $1.00. This could perhaps merely sound admire mental gymnastics, nonetheless the variation is a key motive USDT is gentle around and UST isn’t. If someone supplied USDT for $0.95, they may merely redeem it for a fleshy $1.00 from Tether, because the resources are collateralized by U.S. buck reserves. UST, alternatively, turn into a obvious narrative, as there turn into no fiat reserve on hand to redeem the fleet devaluaing UST.

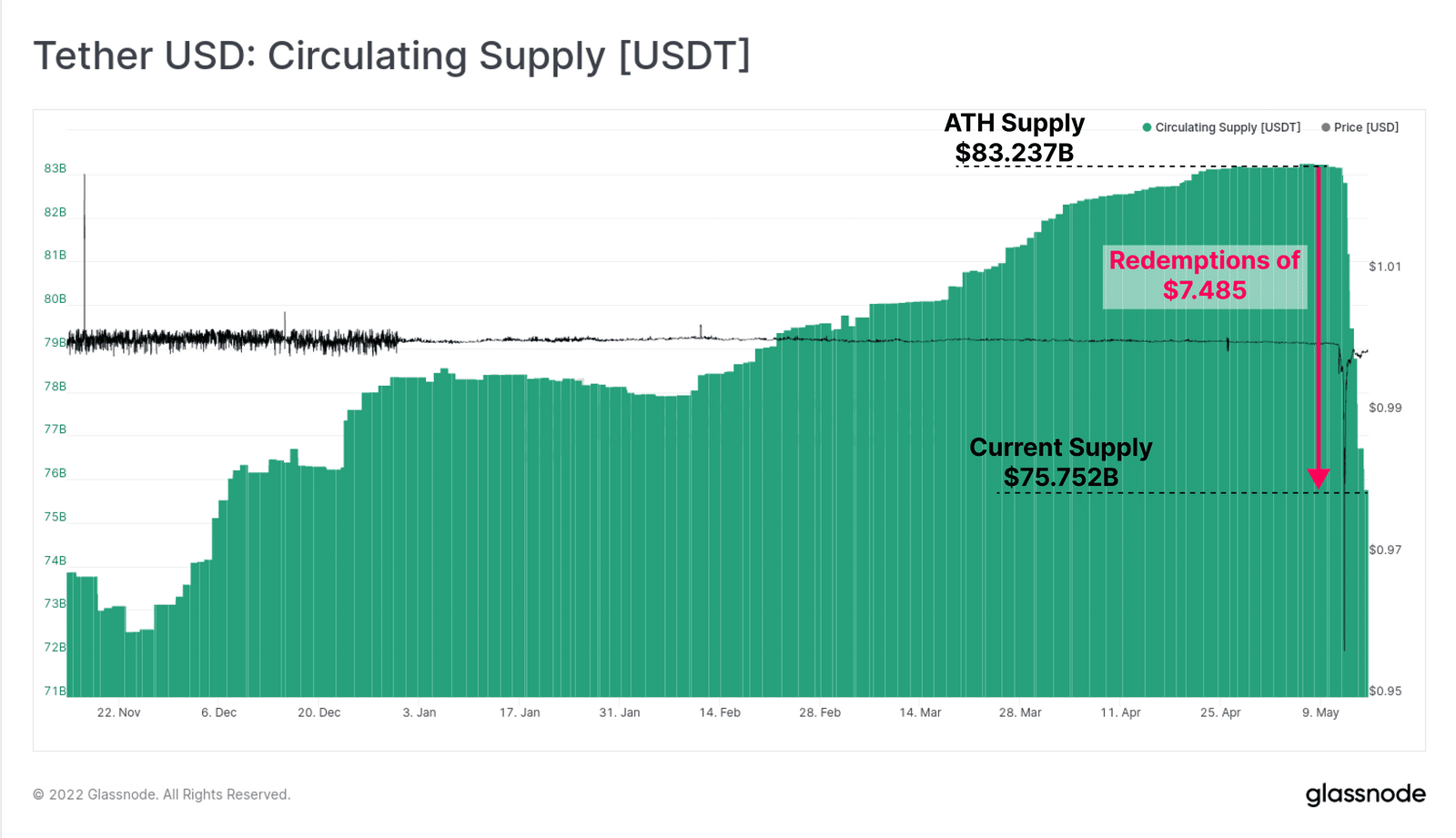

This alerted the stablecoin team since Tether is the ideal stablecoin with a market capitalization of $73.1 Billion. As a consequence, Tether holders began moving their USDT present, with many opting to redeem and promote their USDT sooner than it adopted the UST course.

As confirmed by Tether themselves, inside of 24 hours of Might perhaps 11, about $300 million value of USDT turn into redeemed, and it processed one other $2 Billion USDT redemptions the following day.

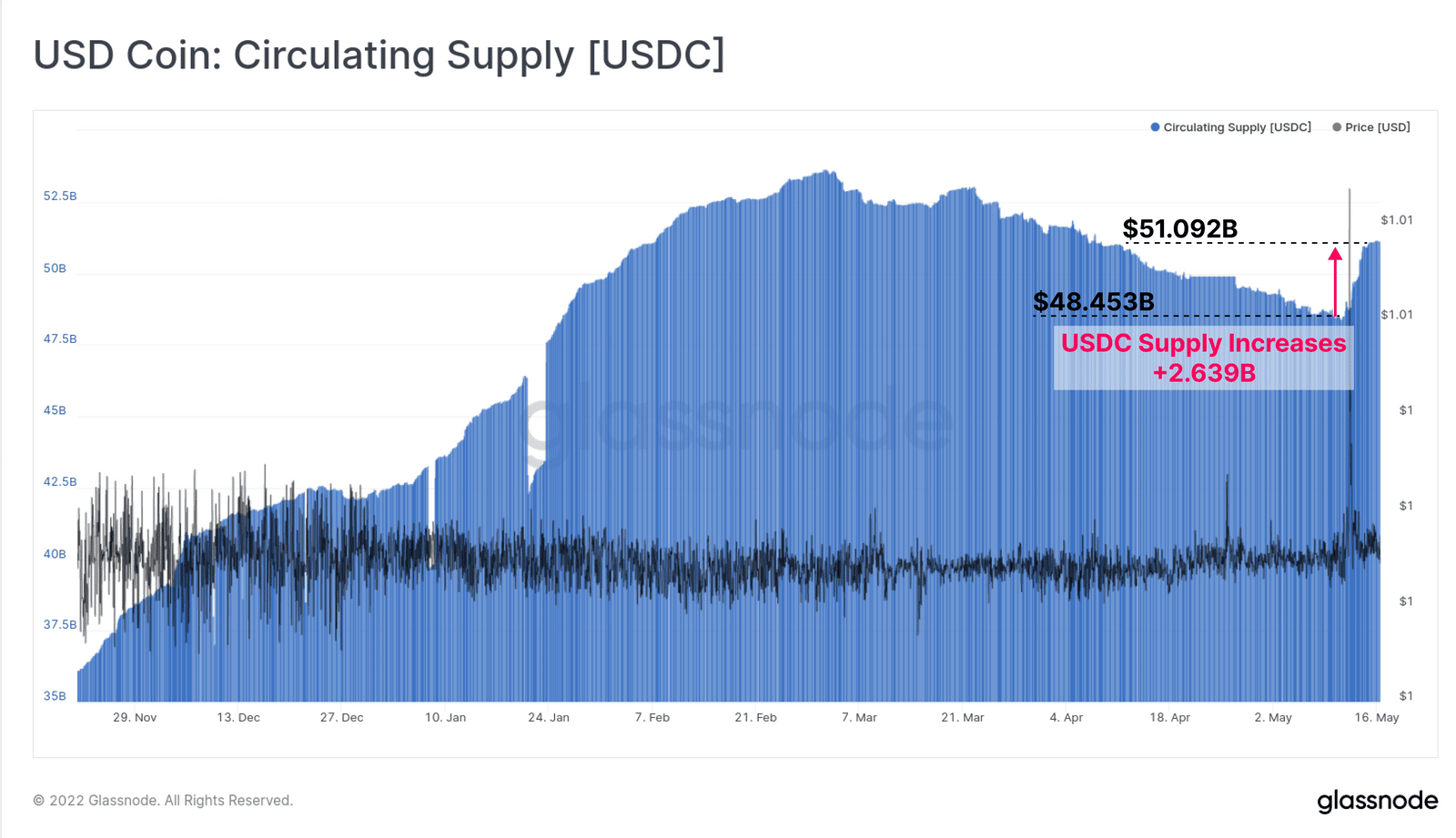

The the same turn into no longer the case with USDC alternatively, as contradictory to Tether, the USD Coin infamous higher set apart a question to within the market. Tether’s circulating present which at its top in direction of the starting of Might perhaps 2022 turn into at $83.23 billion, slipped to $75.75 billion within the span of 4 days as $7.4 billion value of USDT turn into redeemed.

On the other hand, USDC’s circulating present shot up from $48.45 billion to $51.09 billion within the identical duration. At present time the stablecoin’s circulating present is at $53 billion and is on the verge of flipping the Binance Coin (BNB), which shares a the same market cap.

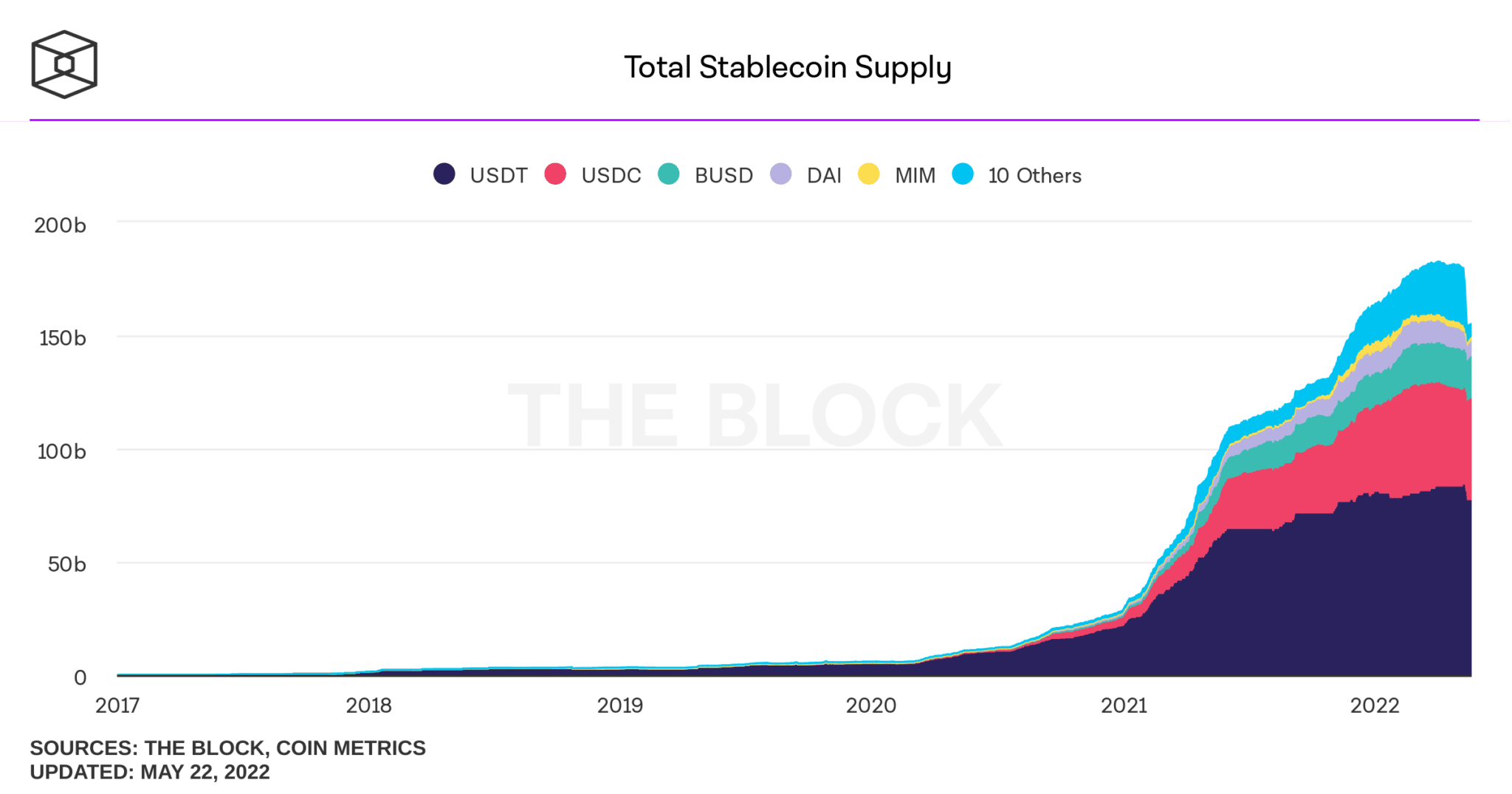

Furthermore, taking a stare upon the growth chart for both the stablecoins (USDT and USDC), one can witness that within the duration of 365 days, i.e., since Might perhaps 2021, USDC has infamous a magnificent perfect reveal than USDT.

At the moment remaining year, the overall circulating present of Tether turn into sitting at 62.48 billion, while the identical for USDC turn into at 20.24 Billion.

On the other hand, all the contrivance via the span of 12 months, as Tether’s present grew by 23.5% to attain $73.1 billion, USDC’s present increased by 163.3% touching $53.5 Billion.

Even within the rising crypto market, USDC is noting higher set apart a question to.

The most most contemporary proof of the identical is the starting up of crypto trade FTX’s companies of equity buying and selling which, as per the announcement, could perhaps perhaps merely moreover be conducted by the utilization of USDC as a technique of fee for procuring the shares and shares of a firm such as Apple, Tesla, Disney, and a lot of others.

Faith in Stablecoins’ Reserves

Radiant that Terra’s Luna Foundation Guard’s $3 billion reserve didn’t present protection to the peg of TerraUSD, the topic surrounding the reserve for other stablecoins rose as effectively.

While in kill consequence of UST’s depegging, other algorithm-backed stablecoins had been no longer affected, Tether’s reserves had been undoubtedly on the team’s crosshair.

Within the previous, too, Tether has been reluctant to be clear about its reserves. The firm did instruct to indulge in an external audit conducted, alternatively it didn’t assemble any document of the identical audit.

The doubts rose to the extent the build the financial analysis firm Hindenburg even supplied a reward of $1 Million to any individual who produced recordsdata about Tether’s reserves and peg in October 2021.

To additional elevate concerns, around Might perhaps 20, Tether, in its attestation document, acknowledged that the reserve’s industrial paper turn into reduced by 17%, from $24.2 billion to real $20.1 billion within the foremost quarter of 2022.

The the same turn into additional slashed by 20% because the second quarter of 2022 began.

As an alternative, the reserves backing the stablecoin noticed a 13% lengthen within the U.S. Treasury payments rising from $34.5 billion in Q4 2021 to $39.2 billion in Q1 2022. These payments now signify nearly half of of Tether’s $73 billion reserves.

Going forward, whether or no longer Tether finds extra crucial choices about its reserves is unknown, nonetheless stablecoins could perhaps perhaps merely face online page firmly gaining investor belief attributable to a ripple end from UST.