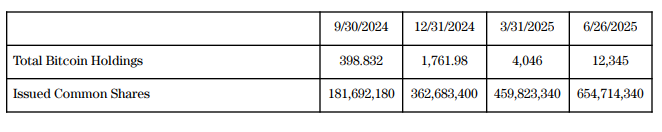

Metaplanet Inc., broadly recognized as Japan’s leading Bitcoin treasury company, has launched these days the acquisition of an additional 1,234 Bitcoin, bringing its total holdings to 12,345 BTC. The own used to be valued at ¥19.27 billion at an moderate designate of ¥15.6 million per Bitcoin.

Metaplanet has bought 1,234 BTC for ~$132.7 million at ~$107,557 per bitcoin and has accomplished BTC Yield of 315% YTD 2025. As of 6/26/2025, we save 12,345 $BTC bought for ~$1.20 billion at ~$97,036 per bitcoin. $MTPLF pic.twitter.com/vsnbCLGjZB

— Simon Gerovich (@gerovich) June 26, 2025

This acquisition is a element of the corporate’s newly launched “555 Million Thought,” a approach concentrating on the accumulation of 210,000 BTC by the finish of 2027, much like 1% of Bitcoin’s total supply. The initiative replaces the earlier “21 Million Thought,” which had aimed for 21,000 BTC by 2026.

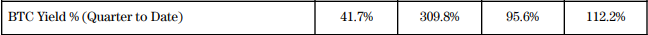

BTC Yield, the corporate’s proprietary key performance indicator (KPI) tracking Bitcoin per fully diluted share, has persisted to upward thrust. It jumped from 41.7% in Q3 2024 to 112.2% quarter-to-date. This elevate displays a BTC Fabricate of 4,538 and a corresponding hypothetical BTC ¥ Fabricate of ¥71.2 billion, highlighting the effectiveness of the corporate’s capital allocation approach.

Capital markets exercise has accomplished a central role in funding these purchases. Since January 2025, Metaplanet has accomplished a sequence of zero-coupon, non-ardour-bearing bond issuances, raising more than ¥90 billion and USD 121 million. All issuances were redeemed early, the utilization of proceeds from stock acquisition rights exercised below the now fully accomplished “210 Million Thought.”

“On June 25, 2025, the Firm accomplished the early redemption and total reimbursement of the 16th, 17th, and 18th Series of zero-coupon, non-ardour-bearing Frequent Bonds issued to EVO FUND,” the corporate acknowledged in the press release.

As of June 26, 2025, Metaplanet has expanded its issued total shares to over 654.7 million. This rising share harmful displays the corporate’s job of the utilization of equity financing to convert capital right away into Bitcoin, reinforcing its dedication to changing into a prolonged-term institutional holder of Bitcoin.