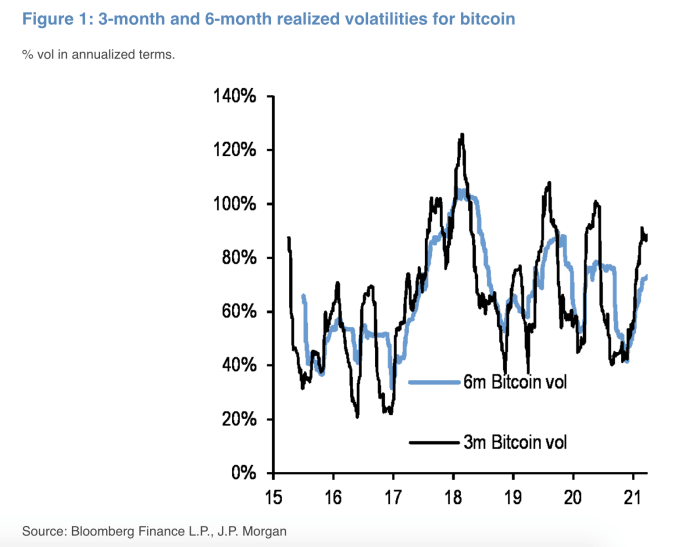

JPMorgan, in an email mark launched to customers on Thursday, cited reducing Bitcoin volatility as a sure for institutional curiosity within the asset. In an article masking the unlock by Bloomberg, strategists in conjunction with Nikolaos Panigirtzoglou at JPMorgan wrote:

“These tentative signs of Bitcoin volatility normalization are encouraging… In our knowing, a seemingly normalization of Bitcoin volatility from right here would seemingly reduction to reinvigorate the institutional curiosity going forward.”

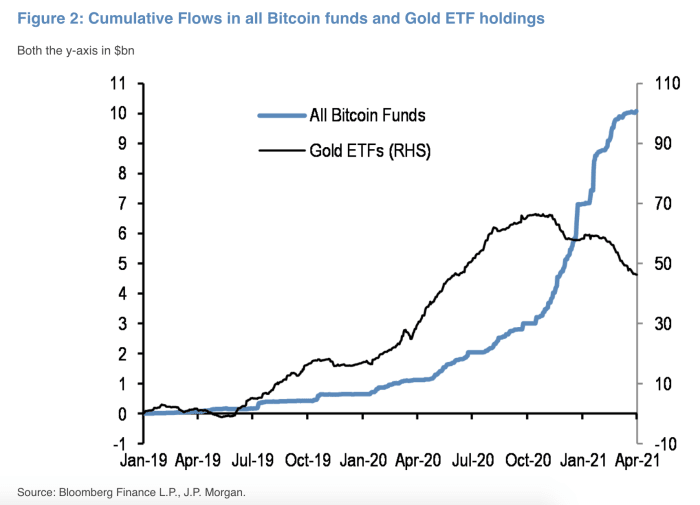

On the basis of Bitcoin’s declining long length of time volatility, the strategists revised their Bitcoin heed scheme to align with internal most market funding in Gold.

“Brooding about how worthy the financial funding into gold is, such a crowding out of gold as an ‘different’ currency implies worthy upside for bitcoin over the long length of time… Robotically, the Bitcoin heed would own to rise [to] $130,000 to study the total internal most sector funding in gold,” JP Morgan reportedly acknowledged within the e-mail.

As time passes and the Bitcoin heed continues to waft on the support of extra adoption and entrance into the station, inquire of of extra upward heed scheme revisions from JPMorgan and others, who own historically remained a ways too bearish. Matching the internal most sector funding in gold is factual the originate, as Wall Avenue will reach to earn out.