Banking big JPMorgan acknowledged in a existing Wednesday that bitcoin and cryptocurrencies are truly among its preferred “quite a lot of” investments, Markets Insider reported.

Resources deemed as unsafe, which on the total comprises bitcoin within the minds of official and institutional investors, have plunged in 2022 amid tighter monetary policies and multiple decades-excessive inflation numbers within the U.S. and around the sector.

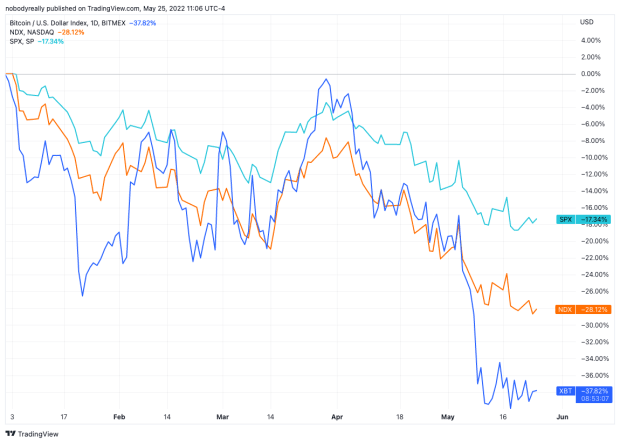

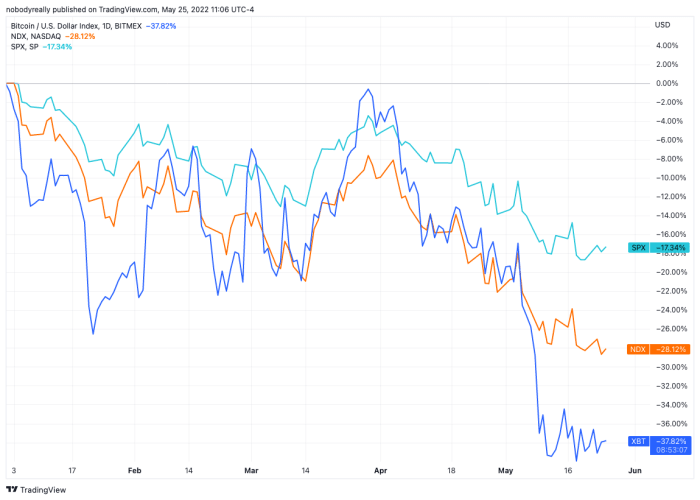

Bitcoin and equities have broadly tumbled to this level this one year towards a backdrop of much less liquidity within the marketplace and low possibilities for the Russian-Ukrainian battle to attain support to a end anytime soon. Image supply: TradingView.

On the opposite hand, Bitcoin’s steep promote-off, as well to that of diversified cryptocurrencies, has been extra profound that in diversified quite a lot of investments equivalent to non-public fairness, non-public debt, and true estate, JPMorgan reportedly acknowledged. Therefore, the bank envisions extra room for rebound within the “digital sources” class than in diversified quite a lot of sources.

“We thus replace true estate with digital sources as our preferred quite a lot of asset class collectively with hedge funds,” the bank’s strategists wrote, per the file.

JPMorgan’s strategists reportedly acknowledged within the present that the bank turned into as soon as sticking to its survey that $38,000 turned into as soon as a gorgeous brand for bitcoin – about 27.5% elevated than its $29,798 brand at press time on Wednesday morning. Bitcoin’s discounted valuation is fragment of explanation why the bank has a extra optimistic outlook for the digital forex going forward.

“The previous month’s crypto market correction appears to be like extra like capitulation relative to closing January/February and going forward we investigate cross-test upside for bitcoin and crypto markets extra on the total,” the present acknowledged, per the file.

Despite the bigger fantastic thing about the sector, JPMorgan reportedly acknowledged within the present that it has switched Bitcoin and cryptocurrencies from an “chubby” ranking to a “underweight” one – which manner that the bank is now much less serious about the asset class and recommends a lower publicity in an investment portfolio.