The price circulation faltered after the initial threat-on with all eyes will likely be on the person tag file due on Friday. The USD index is terminate to its 17-month high and greenback lengthy positions absolute best since June 2019.

Closing week, the market changed into as soon as spooked by the blended US jobs file that has investors now making an strive forward to a more aggressive tightening by the Federal Reserve.

US payrolls were underwhelmed in November, but at the identical time, there changed into as soon as a 1.1 million jump in jobs that pushed unemployment the general fashion down to 4.2%.

“We mediate the Fed will look the economy as famous closer to fat employment than previously thought,” talked about Barclays economist Michael Gapen.

“Therefore, we rely on an accelerated taper at the December assembly, adopted by the first rate hike in March.”

I have been a trader for 8 years, every 18 months or so now we possess this dialog about how this time the Fed is de facto going to taper and raise charges. It has beneath no circumstances fucking took device it is beneath no circumstances going to happen. Mountainous have market rally when market soon realizes this is the case, imo

— wantonwallet (@wantonwallet) December 6, 2021

This week all eyes will likely be on the person tag file due on Friday. The main US inflation figure will repeat the market more about the early tapering and create bigger in curiosity charges.

As Omicron emerged in extra countries, Asian part markets had a cautious originate on Monday. Whereas the fresh COVID-19 variant remains a field, there are experiences that cases had light signs.

There changed into as soon as slight threat-on tag circulation in the fresh week that saw crypto assets recording a little uptick. After momentarily going for $49,455, Bitcoin slid mosey into reverse against $47,000. As for Ether, it is again beneath $4k after recuperating to $4,255 over the weekend.

The total crypto market cap is restful struggling beneath $2.3 trillion as the sentiments turn to “indecent fear,” at a level no longer considered since July.

In the area shares market, Japan’s Nikkei eased some irrespective of the authorities alive to in elevating its economic growth forecast to myth for a file $490 billion stimulus package.

On Wall Avenue, after the worst originate of December in twenty years, S&P 500 added 0.4%, and Nasdaq futures 0.1%.

However with the Fed turning more and more hawkish, BofA chief funding strategist Michael Hartnett is bearish on equities for next yr as he expects a “charges shock” and a tightening of financial instances whereas favoring proper estate, commodities, volatility, and money.

Short Treasury yields are in reality being pushed increased. Ten-yr U.S. yields also rose off but are quiet down from 1.669% two weeks again.

The USD index remained spherical 96.25, terminate to the 17-month high of 96.9, which it hit in boring November. As we reported, greenback-lengthy positions possess also climbed to the very ultimate since June 2019.

“We rely on the greenback to upward push as markets tag in extra rate hikes,” talked about Commonwealth Financial institution of Australia strategist Kim Mundy.

“This week’s November CPI knowledge also can position off markets to tag in a more aggressive tightening cycle.”

Receive the Fed changed into as soon as hawkish 1H’21 and the taper tantrums of Would possibly additionally simply 2021? What about the 2013 taper tantrums?

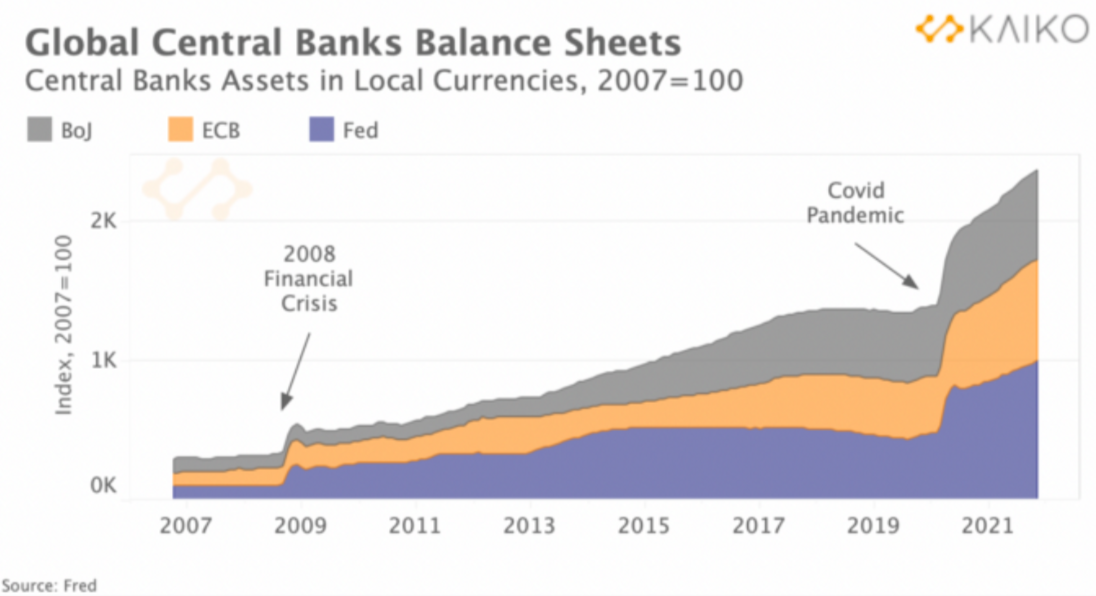

Spurious alarms. The Fed supported Wall St by shopping for $11 trillion of assets in 18months, spurring a $56 trillion surge in world fairness market cap.

7/9 pic.twitter.com/hHY3i38Cf1

— Mira Christanto (@asiahodl) December 4, 2021

Great cherish unstable assets, gold has also been getting hit since mid-November, when it changed into as soon as spherical $1,875 per ounce to dash the general fashion down to $1,760 on Friday. Currently, the bullion is shopping and selling beneath $1,780.

The safe-haven yen has also eased some with the cautiously brighter mood this Monday, though a bumpy roam forward looms with Omicron and U.S. inflation knowledge. Subsequent week the Fed, European Central Financial institution (ECB), Financial institution of England (BOE), and Financial institution of Japan (BOJ) will likely be assembly.

“Omicron headlines are intriguing in the coolest route, and the threat-off sentiment also can ease off soon,” talked about analysts at OCBC Financial institution in Singapore.

![]()