The label of Ethereum has no longer precisely lived up to its promise as the month has long gone on, without reference to a stellar birth up to the month. Whereas this bearish stress has been neatly-liked in the overall cryptocurrency market, regulation uncertainty has been an further command for ETH, igniting a unfavorable sentiment across the “king of altcoins.”

Curiously, the most novel on-chain revelation reveals a substantial quantity of Ethereum has made its system to exchanges to this level in March, suggesting that merchants is doubtless to be shedding self assurance in the prolonged-timeframe promise of the cryptocurrency.

Are Investors Losing Self assurance In Ethereum?

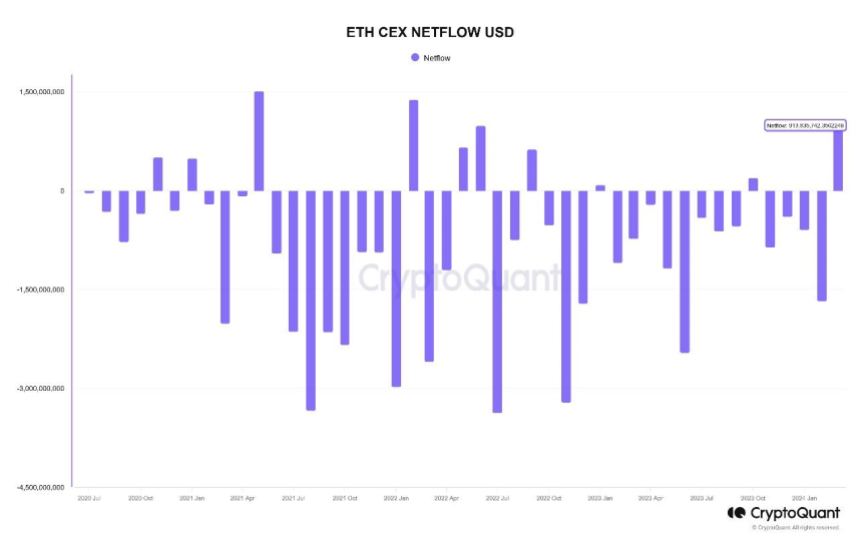

Based on info from CryptoQuant, greater than $913 million has been recorded in bag ETH transfers to centralized exchanges to this level in March. This on-chain info became once printed via a quicktake publish on the information analytics platform.

This bag fund dash represents the largest volume of Ethereum transferred to centralized exchanges in a single month since June 2022. Even supposing March is quiet every week from being over, this commerce influx appears an whole deviation from the sample seen over the past few months.

Chart showing total monthly netflow of ETH on centralized exchanges | Sources: CryptoQuant

As confirmed in the chart above, October 2023 became once the final time cryptocurrency exchanges witnessed a particular bag waft. It’s worth noting that there became once well-known dash of Ethereum tokens out of the centralized platforms in subsequent months up except this month.

Meanwhile, a separate info level that supports the extensive exodus of ETH to centralized exchanges has come to light. Smartly-liked crypto analyst Ali Martinez printed on X almost 420,000 Ethereum tokens (a much like $1.47 billion) possess been transferred to cryptocurrency exchanges in the past three weeks.

The waft of gargantuan amounts of cryptocurrency to centralized exchanges is in most cases opinion of as a bearish signal, as it will even be a signal that merchants might maybe well be enchanting to sell their resources. Within the extinguish, this might maybe increasingly set downward stress on the cryptocurrency’s label.

Sizable fund actions to shopping and selling platforms might maybe well additionally signify a shift in investor sentiment. It is doubtless to be a signal that merchants are shedding faith in a particular asset (ETH, in this case).

Moreover, the most novel regulatory headwind surrounding Ethereum specifically accentuates this hypothesis. Based on the most novel file, the United States Securities and Alternate Commission is enthralling a pair of probe to categorise the ETH token as a security.

ETH Trace

As of this writing, the Ethereum token is valued at $3,343, reflecting a 4% label decline over the past /4 hours. Based on info from CoinGecko, ETH is down by 11% in the past week.

Ethereum loses the $3,400 level again on the daily timeframe | Source: ETHUSDT chart on TradingView

Featured image from Unsplash, chart from TradingView

Disclaimer: The ideas discovered on NewsBTC is for instructional applications

simplest. It doesn’t signify the opinions of NewsBTC on whether or no longer to purchase, sell or attach any

investments and naturally investing carries risks. You’re told to behavior your bear

analysis before making any funding choices. Insist info supplied on this web place

totally at your bear threat.