Meta’s new head of fintech, Stephane Kasriel, has stated that the media massive has no plans to steer away from its NFT-focused approach no topic the present sharp downturn available within the market.

Key Takeaways

- Meta’s new head of fintech, Stephane Kasriel, has reaffirmed the social media massive’s plans referring to NFTs.

- Despite the falling hobby in NFTs over present months, Meta aloof sees a massive different within the space and believes it will utilize digital goods to develop its accumulate $3 trillion economy over the next 10 years.

- The monthly NFT buying and selling quantity has fallen from a anecdote excessive of $17.16 billion in January to round $1.1 billion final month.

The diminishing hobby in NFTs hasn’t melancholy Fb father or mother company Meta from pursuing its huge strategic wager on the expertise.

Meta Keeps Direction as NFTs Lose Flooring

Despite the downward construction available within the market, Meta has signaled unwavering conviction in its strategic wager on NFTs.

In a Wednesday interview with the Financial Times, the social media massive’s new fintech lead Stephane Kasriel stated that the company would be sticking with its plans for NFTs and the digital collectibles economy. “The different [Meta] sees is for the totally different of hundreds of hundreds or billions of these who are using our apps nowadays to be in a web site to construct up digital collectibles, and for the hundreds of hundreds of creators available that may perhaps maybe doubtlessly blueprint digital and digital goods to be in a web site to promote them thru our platforms,” Kasriel stated, including that he thinks the firm may perhaps maybe produce its accumulate $3 trillion economy from digital goods over the next decade.

Last October, Trace Zuckerberg’s firm signaled its strategic pivot in the direction of the digital world and the digital resources economy by altering its title from Fb to Meta to realign its ticket image with its ambitions for the Metaverse. Zuckerberg later offered in March that the company had plans to raise NFTs to its checklist-focused social media platform, Instagram. The company also filed 5 trademark functions for its payments product, Meta Pay, hinting at a potential leap into the crypto space with a Web3 pockets and cryptocurrency substitute.

Of the entire family names in Wide Tech, Meta has thus a long way been essentially the most aggressive in its embrace of the brand new digital collectibles economy, with Kasriel now finest reaffirming the company’s stance on the challenge.

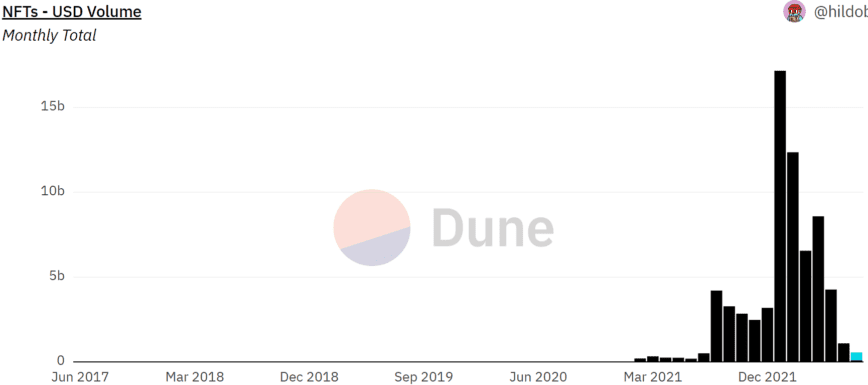

In line with Dune files, the monthly NFT buying and selling quantity—a benchmark indicator for investor hobby within the asset class—has fallen from its anecdote excessive of $17.16 billion in January to round $1.1 billion in June. This month buying and selling quantity is forecasted to hit $460 million.

Commenting on the waning hobby available within the market, Kasriel acknowledged the fact of the crypto “hype cycle” and stated there had been “different things that are not going to outlive.” Despite the cyclical nature of the market, he reaffirmed that the firm is sticking with its plans to preserve NFTs mainstream by making them cheap and easy to preserve end and trade.

Having realized from its outdated failed are attempting to originate the world stablecoin known as Diem, Meta is now persevering with with caution. “We’re looking out to figure out what the regulatory panorama is in shriek that we don’t make investments in things that are within the slay going to alter into huge-controversial or accumulate shut down,” Kasriel stated, including that the company is making investments with added realism in regards to the nascent nature of the trade and expertise.

Disclosure: At the time of writing, the author of this article owned ETH and a entire lot of different diversified cryptocurrencies.

The solutions on or accessed thru this web just is got from self reliant sources we mediate to be shapely and legitimate, nevertheless Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any files on or accessed thru this web just. Decentral Media, Inc. isn’t an funding marketing consultant. We dwell not give personalised funding advice or diversified monetary advice. The solutions on this web just is topic to alternate without watch. Some or the total files on this web just may perhaps maybe change into outdated, or it will be or change into incomplete or inaccurate. We would, nevertheless are not obligated to, change any outdated, incomplete, or inaccurate files.

You would aloof never accumulate an funding decision on an ICO, IEO, or diversified funding per the knowledge on this web just, and you would aloof never give an explanation for or in every other case count on any of the knowledge on this web just as funding advice. We strongly recommend that you just consult a certified funding marketing consultant or diversified qualified monetary legitimate whenever you furthermore mght can very effectively be making an try for funding advice on an ICO, IEO, or diversified funding. We dwell not get compensation in any tag for examining or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

Witness elephantine terms and prerequisites.

Fb Changes Company Name to Meta, Plans NFT Enhance

Trace Zuckerberg has offered that Fb will alternate its company title to Meta, though the company’s signature social media platform will preserve the title Fb. The company’s shares are situation…

Meta Might maybe Open Crypto Exchange, Trademark Filings Cover

Meta has filed 5 trademark functions within the U.S. for its rebranded Meta Pay payments product. The trademarks point to that the company would be looking out to originate a assortment of…

NFTs Are Coming to Instagram (“Hopefully”)

Trace Zuckerberg, chief government officer of Meta (beforehand Fb), has stated that non-fungible tokens would be integrated into Instagram “within the end to term.” Meta to Endeavor Into NFTs Speaking nowadays…