The under is from a most modern version of the Deep Dive, Bitcoin Magazine’s top rate markets e-newsletter. To be amongst the first to receive these insights and totally different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

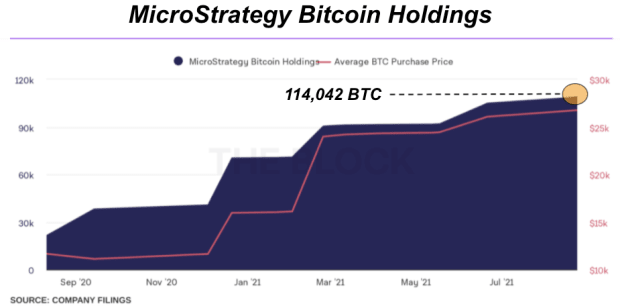

MicroStrategy’s Relentless Bitcoin Accumulation

Michael Saylor announced at this time over Twitter that MicroStrategy has bought an additional 5,050 bitcoin for $242.9 million in money at an reasonable designate of $48,099 per bitcoin, inserting the firm’s total holdings at 114,042 bitcoin.

With 114,042 bitcoin and approximately 8.58 million shares infamous, investors now maintain 1.3 million sats per MicroStrategy fragment, with the bitcoin per fragment up 2%. As MicroStrategy factors extra common inventory to fund their bitcoin on the lookout for spree, investors stop some of their possession throughout the elevated equity dilution. In return, they obtain extra bitcoin per fragment of MicroStrategy inventory.

Over the earlier few weeks in their August 24 and September 13 bulletins, MicroStrategy has offered an additional 793,232 shares for a total $577 million to put off extra bitcoin. As previously announced in July, their Delivery Market Sale Settlement allows them to sell up to $1 billion in contemporary inventory. To this level, Michael Saylor is following through along with his long-established idea to put off as noteworthy bitcoin as conceivable through any and every financial automobile at his disposal. And it doesn’t look esteem he’s stopping anytime soon.

For the explanation that firm’s adoption of a bitcoin common on August 11, 2020, MSTR shares win elevated by 419.9%, outpacing the worth of bitcoin, which returned 279.0% at some stage in the same length.

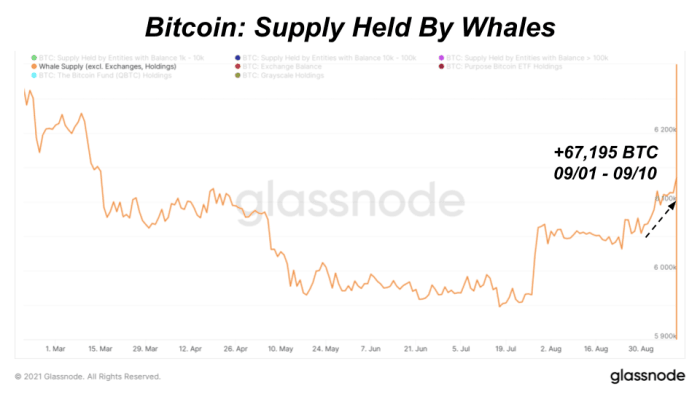

Whale Looking at

Bitcoin provide held by whales is trending up in the month of September – up 67,195 bitcoin totaling 6.13 million. That’s up 3.1% from this 365 days’s low befriend in July indicating elevated demand from greater institutional investors over the final two months. Provide held by whales involves entities that take over 1,000 bitcoin, with the exception of alternate balances and totally different identified holdings esteem GBTC. MicroStrategy’s most modern 5,050 bitcoin stand up 7.5% of this transfer.

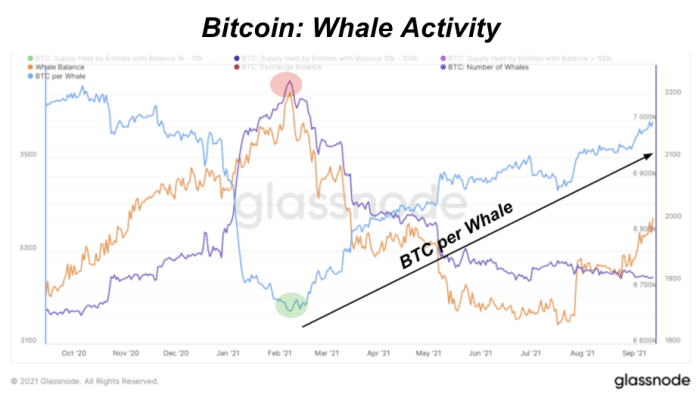

When adding up the bitcoin provide held by entities with a balance of 1,000-10,000, 10,000-100,000, or over 100,000 BTC, and subtracting alternate balances from the metric, a decided portray emerges. Since February, every the total whale balance began to decline as neatly as the quantity of whale entities (entities being a heuristic labeling of a cluster of addresses associated with one one more on the blockchain); then one more time the BTC per whale began to expand rather greatly.

In straight forward phrases this form that lots of convicted whales persisted to comprise no subject the upside and downside volatility since the month of February, and following the summer designate drawdown of over 50%, aggregate BTC balance held by whales has resumed its uptrend.

TLDR: Each total BTC holdings by whale entities as neatly as the reasonable BTC preserving per whale are rising. The big money is on the lookout for merely now. The numbers don’t lie.

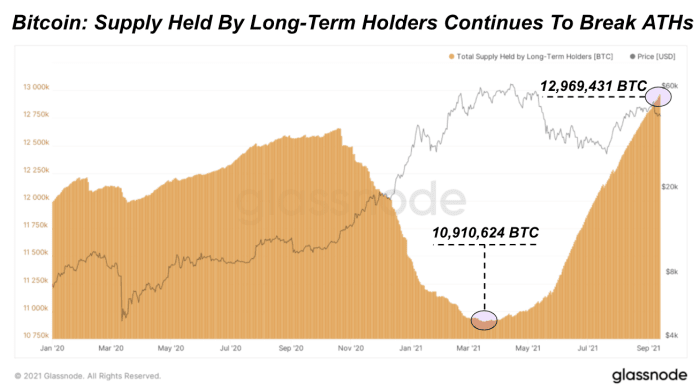

Lengthy-Time length Holder Provide Continues To Smash All-Time Highs

The provision of bitcoin that is held by lengthy-term holders continues to interrupt all-time highs on a each day foundation, with the total bitcoin held by the cohort being over 2 million extra than it changed into on March 17, which changed into the low accept 2021. Here’s with out a doubt a bullish catalyst and presentations how fetch-handed HODLers were accumulating throughout the volatility of 2021.

With the classification of lengthy-term holders being 155 days (for reasons defined under), the unique date for a UTXO to be regarded as a “lengthy-term” holder is April 11, 2021, merely three days sooner than the local top of the bitcoin market. Despite this, there win by no formula been extra bitcoin held by lengthy-term investors. Extremely bullish.

The time threshold for a bitcoin balance to be regarded as “lengthy-term” is 155 days, and here’s thanks to the statistical significance of the recordsdata when backtesting UTXO exercise potentialities. For added recordsdata on the quantification of lengthy-term versus quick-term holders, learn here.