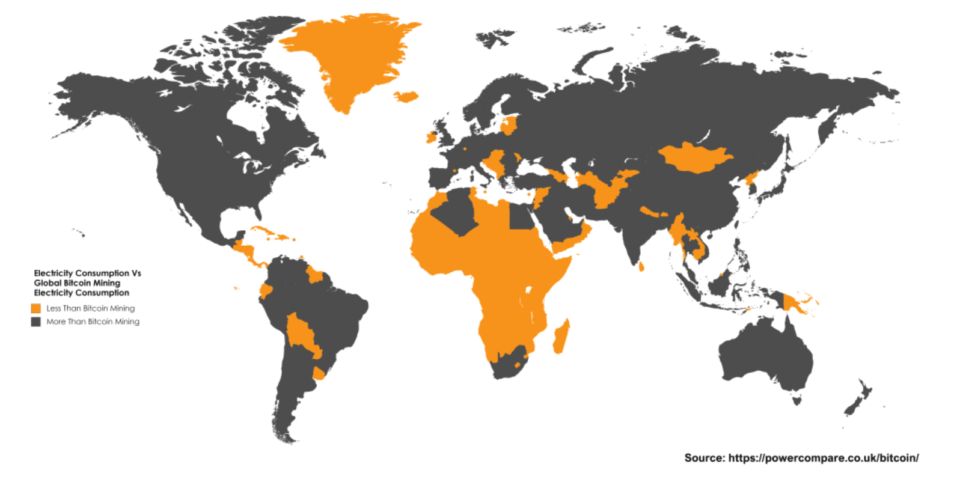

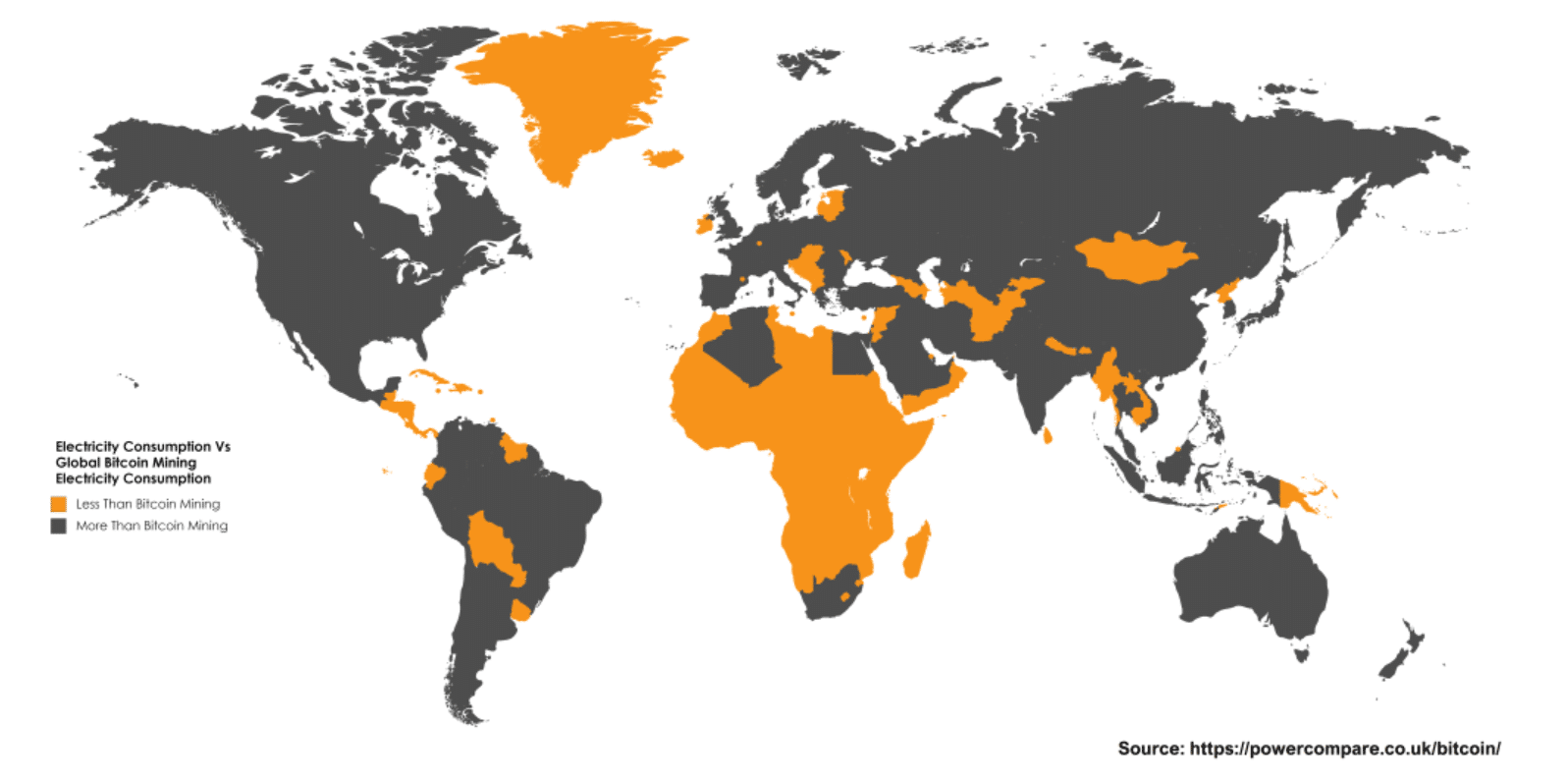

Bitcoin has an energy be concerned. Attributable to the coin’s proof of work disbursed consensus algorithm, Bitcoin mining is creating a big carbon footprint. Miners dissipate an estimated 29.05TWh of electricity yearly. That’s 0.13% of the sector’s annual energy consumption, which is extra than 159 countries together with nearly all of Africa.

Coupled with the competitive nature of mining, Bitcoin’s exponential enhance is largely to blame for this rampant energy consumption. Mainstream public consideration and a enhance in transaction quantity like handiest exacerbated the be concerned, as the Bitcoin Vitality Consumption Index estimates that mining strength expenditures increased by 29.98% from October to November.

At this exponential rate, the cryptocurrency’s meteoric rise has it on tempo to thrill in extra energy than the total of the US by 2019.

The Contributing Components

In uncover to successfully diagnose the muse motive in the help of this energy disaster, we must dig into the connection between Bitcoin’s network enhance and its mining mechanics.

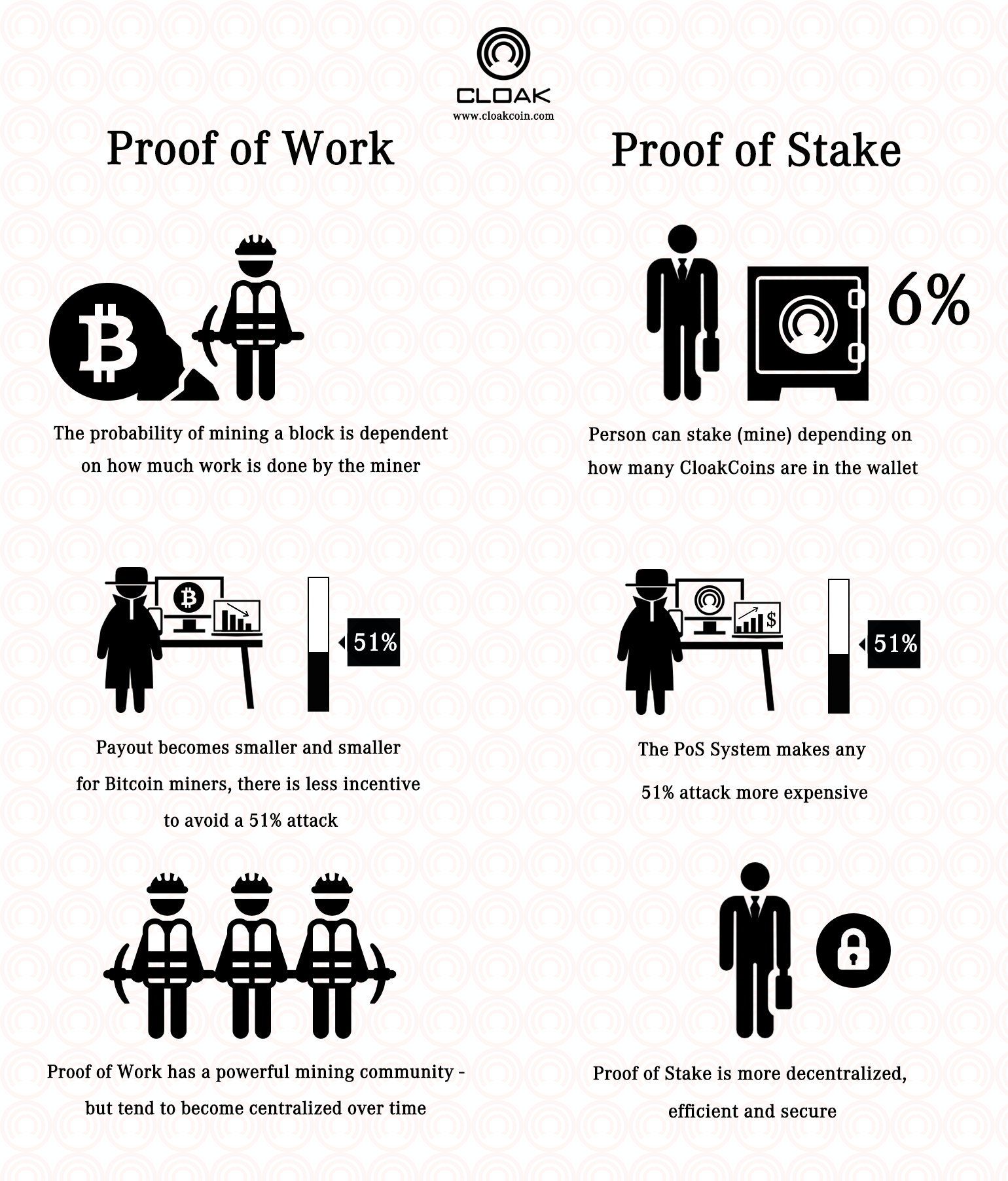

Below Bitcoin’s proof of work model, miners compete with one another to originate obvious a disbursed consensus (the capacity by which Bitcoin circulates) on the blockchain. Miners commit their computing strength to envision the transactions sent via the network.

To function so, the pc systems solve the encryption puzzles that stable each transaction and, as soon as solved, retailer them as hashes in the blocks on the overall public ledger. The first miner to withhold out primarily the most up-to-date block receives a block reward in Bitcoin.

Because it’s possible you’ll perhaps presumably search in the image, the competitive nature of proof of work incentivizes miners to commit as noteworthy processing strength to the blockchain as possible. The extra highly efficient your mining rig, the sooner it’s possible you’ll perhaps presumably solve the transaction encryptions, and the extra most likely you are to withhold out a block and rep its rewards.

Aid in Bitcoin’s infancy, it at risk of be that you are going to reliably mine with a graphics card or a bound-of-the-mill pc processor. But those days are long long past. As extra miners jumped on the Bitcoin gravy put together, extra sophisticated mining tool changed into as soon as developed to provide miners an edge. This hardware fingers bustle culminated in software-sigh integrated circuit (ASIC) mining. In TLDR phrases, ASIC miners are processors that are extra efficient and highly efficient than CPUs or GPUs.

And they left the true mining procedures in the grime. Severely, when you were attempting to compete with ASIC mining rigs the utilization of your pc or graphics card, it’d be indulge in attempting to rating the Monaco Large Prix with a Vespa.

Even a single ASIC isn’t sufficient to compete with the gigantic-league mining pools. The largest mining cooperatives rig up heaps of of ASICs to originate big processor pools. In uncover to cease competitive with other miners, these pools will add hardware to their rigs’ to elongate total hashing strength (output).

You potentially search the build right here’s going. Mining rigs obviously require electricity, and the more challenging they must work, the extra strength they delight in. As such, proof of work’s competitive incentives invariably consequence in an exponential lengthen in energy consumption.

And this doesn’t even consist of be concerned will enhance. Every 2,016 blocks, Bitcoin undergoes a be concerned adjustment. This adjustment is supposed to scale block be concerned to envision mining hash charges so that no miner solves algorithms too immediate, sucking up your total block rewards in the technique. What this implies, though, is that the extra miners there are on the network, the extra advanced it becomes to resolve the encrypted algorithms after each adjustment. This would additionally mean that mining rigs must work more challenging to cease competitive, thus spicy even extra strength.

Starting up to procure the image? The extra folks buy into Bitcoin, the extra miners might perhaps be attracted to the currency for its valuation. With extra miners comes extra energy consumption to gasoline competition, and with a growing network, each be concerned adjustment will handiest exacerbate energy consumption by making miners work more challenging.

Now that we’ve gotten that out of the capacity, let’s turn this be concerned on its head and ogle at a capability resolution.

Proof of stake is an substitute algorithm for reaching a blockchain’s disbursed consensus. It came onto the scene in 2012, with Peercoin, NXT, and BlackCoin as its major early adopters.

No miners exist below the proof of stake model. As a replacement, they are replaced with validators (or forgers) who’re guilty of validating transactions. In general, validators stake a particular quantity of proof of stake currency in that blockchain’s core pockets.

That currency’s network might perhaps well perhaps also then deterministically pick out them to fabricate the next block. The different mechanism varies by algorithm, as it might perhaps perhaps perhaps perhaps even be chosen at random or in conserving with a combination of variables, akin to total wealth and the quantity of time it has been staked.

It’s crucial to display camouflage that proof of stake offers no block rewards, handiest transaction fees, so theoretically, the model doesn’t engender the a similar competitive impulse because the proof of work arrangement. Whereas you are going to also rep extra frequent decisions and increased transaction fees the extra you like staked, you aren’t attempting to beat somebody to the punch akin to it’s possible you’ll perhaps perhaps be with Bitcoin.

With proof of stake, you handiest need sufficient energy to strength a blockchain’s core tool. No must kill energy on an ASIC and a cryptographic hashing program. To diagram to the racing analogy, it’s akin to being awarded a prize for starting your automobile as an different of the utilization of it to bustle. You wait in line at the starting gate on your participation trophy, and you don’t must be concerned about losing the extra gas to full the bustle sooner than your fellow opponents.

In a nutshell, proof of stake considerably cuts support on energy consume. Now not handiest does it narrate a much less energy-intensive program, nonetheless validators don’t must up the ante in opposition to one another to remain viable as miners function below a proof of work consensus. They don’t rep block rewards, nonetheless they additionally don’t must face the defective energy fees that miners confront. If we weigh proof of stake’s transaction fees with out its notable operation fees, it comes out akin to proof of work’s rewards in opposition to its fees, especially for folk that might perhaps well presumably’t withhold pricey mining rigs.

Supreme Thoughts: Will Bitcoin on Proof of Stake Ever Happen?

In Might well perhaps presumably 2017, Vitalik Buterin unveiled plans to transition the Ethereum blockchain to a proof of stake algorithm known as Casper.

Novel at the time, Proof-of-Stake’s delivery on the 2nd largest crypto asset changed into as soon as an gargantuan endorsement for the proof-of-stake arrangement; and the ecosystem has largely shifted in opposition to PoS.

Proof of stake might perhaps well perhaps also thoroughly be the future for blockchain. Ethereum’s commerce indicates as noteworthy, as Vitalik Buterin sees price in the mechanism’s pros as they capitalize on Bitcoin’s cons.

Bitcoin’s energy disaster is with out doubt one of the first with out a doubt immense trials facing the cryptocurrency as it marches in opposition to public prominence. Pitfalls and barriers akin to these are to be expected in this form of nascent abilities, nonetheless it absolutely’s the accountability of the neighborhood at spacious to adapt to these tribulations. There’s no motive to possess that addressing proof of work’s shortcomings must peaceable compromise our belief in Satoshi Nakamoto’s introduction–rather the opposite. If we are looking out to ogle Bitcoin prevail, we must remain vigilant in our criticisms and proactive with our solutions, on yarn of as it at this time stands, Bitcoin is heading in the staunch direction to turning into unsustainable in the terminate to future.

Perchance proof of stake might perhaps well perhaps avert Bitcoin from self-sabotage. If Ethereum’s algorithm commerce capacity anything, it must be a obvious signal to the crypto neighborhood that proof of work can no longer persist in its most up-to-date declare.

The search files from is, will the market adapt?

Below no circumstances Circulate over One more Different! Procure hand chosen news & files from our Crypto Consultants so it’s possible you’ll perhaps presumably originate trained, told choices that straight affect your crypto profits. Subscribe to CoinCentral free newsletter now.