Key Takeaways

- The cryptocurrency procedure has “no valid payment” and can suffer from extra losses, Jim Cramer instructed on CNBC’s Sing Field Tuesday.

- The ragged hedge fund supervisor pointed to one of the crucial up-to-date wave of crypto firms struggling from liquidity points as he slammed the procedure.

- Cramer’s feedback approach months after he stated that investors can also “with out trouble” stable returns of 35 to 40% from investing in Ethereum. He also previously launched that he had sold into the asset.

Cramer memorably stated in April that he was once “a believer” in Ethereum and instructed that investors can also “with out trouble” bank 40% returns on the asset. It was once trading at around $3,000 on the time.

Jim Cramer Adjustments Tune on Crypto

Now that crypto prices absorb dropped, Jim Cramer has indicated that he is rarely any longer significant of a fan of the emerging asset class in spite of every thing.

“Crypto essentially does appear to be imploding. Went from $3 trillion to $1 trillion. Why must always composed it discontinue at $1 trillion? There is just not any longer any valid payment there,” says @jimcramer on #crypto. “What an unpleasant asset. NFTs sold to you. Made up.” pic.twitter.com/09e5ST8q0N

— Sing Field (@SquawkCNBC) July 5, 2022

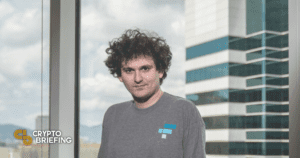

Speaking on CNBC’s Sing Field Tuesday, the ragged hedge fund supervisor discussed the months-long downward pattern spilling all over world markets, remarking that he was once most attracted to one of the crucial up-to-date train of the cryptocurrency market. “Crypto essentially does appear to be imploding. When it goes from $3 trillion to $1 trillion, why must always composed it discontinue at $1 trillion? There’s no valid payment there,” he stated in admire to the provocative decline in the world crypto market capitalization all around the last eight months, ahead of commenting on the rising number of companies coping with turmoil due to the one of the crucial up-to-date market crumple. “How many companies can Sam Bankman-Fried place?” he added.

Final week, the U.S. arm of Bankman-Fried’s FTX replace struck a deal with BlockFi to provide the agency for up to $240 million amid the lender’s insolvency points. Alameda Examine, the trading agency based by Bankman-Fried, also stepped in to bail out Voyager Digital last month as the agency launched it was once struggling its absorb liquidity disaster. The spillover results of Terra’s most modern implosion and Three Arrows Capital’s blowup absorb wreaked havoc all around the industry and partly contributed to one of the crucial up-to-date market creep. After a series of firms published their troubles, Bankman-Fried instructed Forbes that he thinks many more exchanges can also honest be “secretly bancrupt.”

Cramer’s Previous Comments on Ethereum

Cramer’s most modern feedback will most likely approach as a surprise to just a few given his old thoughts on crypto. In April, he declared on Sing Field that he thought Ethereum was once “terrific” and that he was once “a believer.” He then stated that investors “can also with out trouble obtain [returns of] 35 or 40%.” ETH has since dropped from a sign of $2,970 to $1,100, which implies somebody who invested when he made the feedback would absorb accrued losses of over 60%.

Cramer also stated in June 2021 that he beloved Ethereum over Bitcoin on tale of “other folks utilize [ETH] with a aim to hold things,” revealing that he had sold ETH and would proceed to add to his holdings. It was once trading correct over $2,000 on the time. Forward of diving into Ethereum, he in fact helpful investors allocate 5% of their portfolios to Bitcoin as it was once main the crypto bull breeze in early 2021.

Along with the remainder of the cryptocurrency market and diversified risk-on sources, ETH has had a rocky 2022, down about 70% 365 days-to-date. Notably, predominant tech stocks adore Meta, Netflix, and PayPal absorb all posted losses of over 50% amid the Federal Reserve’s passion rate hikes and rising fears of a world recession.

While Cramer pointed to one of the crucial up-to-date crypto agency blow-usaand NFT market to develop his case for why the procedure had no payment, he didn’t level out any most modern innovations adore DeFi trading, stablecoins, Layer 2 rollups, or the worth of NFT art itself in his feedback.

For the length of market downturns, crypto believers are acknowledged for making calls to one yet every other to “HODL” and “hold the dip,” mantras that point out for keeping onto and accumulating more coins at any time when charts flip crimson. No matter his old feedback, it would seem that Cramer is rarely any longer undoubtedly one of them.

Disclosure: On the time of writing, the author of this fragment owned ETH and a whole lot of different diversified cryptocurrencies.

The tips on or accessed through this web pages is obtained from honest sources we deem to be gorgeous and official, however Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any knowledge on or accessed through this web pages. Decentral Media, Inc. is rarely any longer an funding book. We discontinue no longer give custom-made funding advice or diversified financial advice. The tips on this web pages is topic to swap with out witness. Some or all of the knowledge on this web pages can also honest change into outdated-usual, or it’ll also honest be or change into incomplete or incorrect. We can also honest, however are no longer obligated to, replace any outdated-usual, incomplete, or incorrect knowledge.

It’s good to composed never develop an funding decision on an ICO, IEO, or diversified funding in line with the knowledge on this web pages, and that it’s good to composed never clarify or in every other case rely on any of the knowledge on this web pages as funding advice. We strongly point out that you just consult an licensed funding book or diversified qualified financial genuine whenever you happen to can also very effectively be in search of funding advice on an ICO, IEO, or diversified funding. We discontinue no longer salvage compensation in any originate for inspecting or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

Jim Cramer of Mad Cash Recommends 5% Portfolio Allocation to Bitcoin

TV personality and ragged hedge fund supervisor Jim Cramer recently advocated for Bitcoin on his Mad Cash cover, watched by hundreds of thousands. Cramer Cites Bitcoin Allocation Cramer went on air to…

Jim Cramer Likes Ethereum, Describes as “a Currency”

Licensed finance broadcaster Jim Cramer says he’s bullish on risk-on sources, including retail, meme stocks, and Ethereum. Jim Cramer Plans to Gain Ethereum The in style host of CNBC’s Mad…

Third-Tier Exchanges “Secretly Bancrupt,” Says FTX’…

Sam Bankman-Fried, whose FTX replace recently bailed out distressed crypto firms BlockFi and Voyager Digital to a combined tune of $800 million, has warned that more crypto replace screw ups are…