Nasdaq has submitted a groundbreaking proposal to the U.S. Securities and Alternate Price (SEC) that might well transform the operational framework of Bitcoin trade-traded funds (ETFs). The proposal, centered on BlackRock’s iShares Bitcoin Have confidence (IBIT), seeks to introduce “in-variety” bitcoin redemptions, providing a streamlined and value-effective different to the present cash redemption process.

What Are In-Variety Redemptions?

Below the proposed machine, institutional players is called authorized participants (APs) – to blame for growing and redeeming ETF shares – might well decide to trade ETF shares straight for bitcoin instead of cash. This innovation eliminates the must promote bitcoin to generate cash for redemptions, simplifying the technique whereas reducing operational charges.

While this option would only be on hand to institutional participants and no longer retail investors, experts point out that the improved efficiency might well no longer straight profit on a typical basis investors. By reducing operational hurdles, in-variety redemptions agree with the aptitude to build Bitcoin ETFs more streamlined and value-efficient for all market participants.

Why the Alternate?

The money redemption model, implemented in January 2024 when situation Bitcoin ETFs were first well-liked by the SEC, became as soon as designed to relief monetary institutions and brokers from handling bitcoin straight. This means prioritized regulatory simplicity eventually of the nascent phases of Bitcoin ETFs.

Then again, the quickly development of the Bitcoin ETF market has created original opportunities to red meat up its infrastructure. With evolving guidelines and a more former digital asset ecosystem, Nasdaq and BlackRock now gawk a pathway to adopt a more efficient in-variety redemption model.

Advantages of In-Variety Redemptions

- Operational Efficiency:

- Reduces the complexity and different of steps within the redemption process.

- Streamlines ETF operations, saving both time and charges.

- Tax Advantages:

- Holding off the sale of bitcoin minimizes capital features distributions, making ETFs more tax-efficient for institutional investors.

- Market Stability:

- Reduces promote force on bitcoin eventually of redemptions, seemingly stabilizing the asset’s designate.

Regulatory and Market Context

Nasdaq’s proposal coincides with significant regulatory developments below the decent-Bitcoin Trump administration. Recent coverage shifts, such because the repeal of Workers Accounting Bulletin 121 (SAB 121), agree with paved the ability for broader cryptocurrency adoption. The removal of SAB 121 eradicated barriers that previously uncomfortable banks from providing cryptocurrency custody services and products, growing a more favorable ambiance for innovations cherish Nasdaq’s in-variety redemption model.

BlackRock’s Bitcoin ETF: A Market Chief

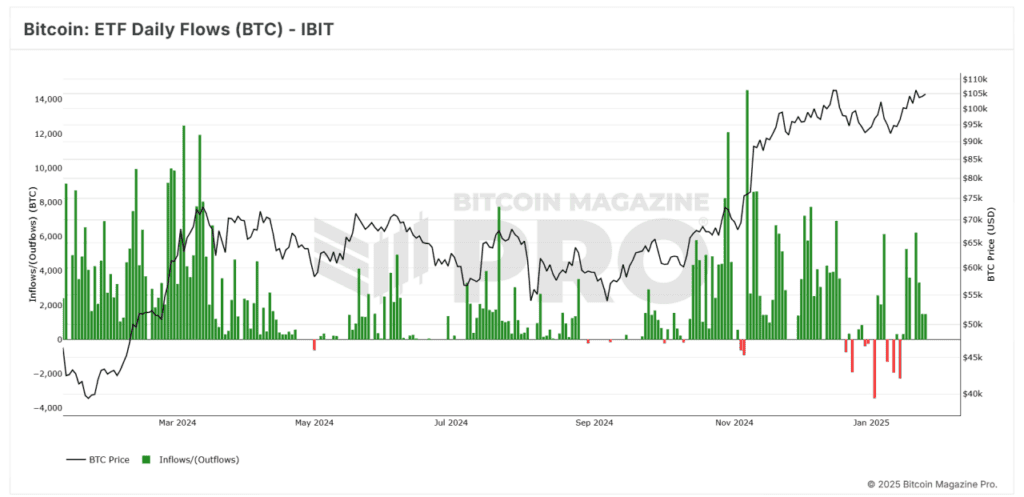

Since its 2024 launch, BlackRock’s iShares Bitcoin ETF has emerged as a market leader, with over $60 billion in inflows. The fund’s consistent development highlights institutional demand for Bitcoin funding merchandise. Innovations cherish Nasdaq’s in-variety redemption model might well extra relief IBIT’s appeal to institutional investors.

Articulate their own praises the consistent upward pattern of inexperienced candles, reflecting stable and steady inflows.

Conclusion

Nasdaq’s proposal to introduce in-variety redemptions for BlackRock’s Bitcoin ETF represents a pivotal moment for the Bitcoin ETF market. By simplifying redemption processes, providing tax efficiencies, and reducing promote force on bitcoin, the model stands to critically relief the appeal and efficiency of Bitcoin ETFs for institutional investors.

As the Bitcoin ETF market matures and regulatory improve continues to grow, innovations cherish this are poised to force extra adoption. If well-liked, Nasdaq’s proposal might well ticket a significant step ahead, solidifying Bitcoin ETFs as a cornerstone of institutional digital asset funding whereas no longer straight benefiting retail participants.

With a favorable regulatory local weather and growing institutional hobby, the prolonged scoot of Bitcoin ETFs looks brighter than ever.