We are at a level in time where “NFT” is a family length of time. In step with DappRadar, NFT market capitalization has handed $22 billion, a 22,000% snort in contrast to the same length a year ago. So as digital asset ownership appears to be reaching a height, the demand now is – what’s the next sizable thing for NFTs?

In the quick future, the leasing and borrowing of NFTs as a source for producing passive profits for dwelling owners and gaining added fee for debtors will do away with the heart stage within the industry.

NFT leasing has been already beginning to win traction, primarily by the utilization of closed ambiance scholarships on P2E video games comparable to Axie or virtual land inner particular metaworlds comparable to The Sandbox. These initial examples of NFT leasing functionalities, pushed by one of the well-known terminate crypto initiatives within the industry, aid solidify and bid the upward push of an upcoming tough economy revolving round broader NFT use cases and utilities.

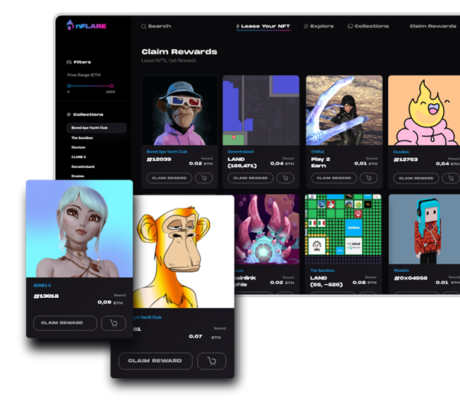

Whereas these closed-ambiance NFT leasing protocols introduce a viable industry mannequin that affords appealing passive revenue streams, there might perhaps be an even bigger utter and a mighty elevated seemingly for large positive factors generated by leasing of NFT ownership rights, and here is where nFLARE DAO enters the physique: a self-governed market for NFT asset leases.

A ®evolutionary unusual mannequin of NFT marketplaces

As social creatures, humans care about where they stand within the social hierarchy and how others gaze them, so while you give somebody the impression that you’ve got got quite loads of cash, in all likelihood they’ll cling a bid notion of you. In the particular world, some folk hire a Ferrari for the weekend so that they’ll appear more prosperous, which in flip opens alternatives and broadens their connections. On social media, this salvage of “peacocking” is terribly total. Of us pay loads to cling a high-priced NFT as their profile utter for every week, in particular now that Twitter NFT validation has made it more relevant than ever earlier than, or merely as a marketing ploy to spice up the credibility of their commercial profile.

However if we step apart the digital social ladder, the pure financial good judgment of making leasing NFT rights readily accessible on a huge scale is renowned in its seemingly for producing fee, financial or otherwise, and has a large reach within the course of niches.

The use cases

Not like most property in crypto that don’t fulfill a exact utility, if primitive as supposed, NFTs offer exact helpful use cases for avid gamers, investors, bid material creators/artists, and naturally, merchants having a be aware to generate passive profits deriving from their particular area of interest of ardour or work. About a of the examples of NFT leasing we can look encompass:

- In-recreation leveled up characters, property, equipment, and future skins

- Metaverse exact estate investments

- Copyrighted collectibles readily accessible as online and offline merchandise

- Copyrighted bid material that would be primitive as ingenious in audio and video for royalties or as consignment stock in galleries and exhibitions

- DeFi instruments

- Little salvage entry to to venues

Gaming

Play-to-Develop (P2E) gaming is and could perhaps composed be a vertical operating independently of market sentiment, because it doesn’t topic if the crypto market as a whole is bullish or bearish, avid gamers will win what they win – play video games and make rewards while doing it. Making this area of interest of the industry, which is already chubby, an effortless target for borrowing NFTs in P2E gaming.

Some stats to realize the market half:

There are roughly 3.1 billion avid gamers within the course of the globe, with round 1.42 billion in Asia, 383 million in Latin The United States, 261 million in North The United States, and approximately 668 million within the course of Europe. Oh, and the Gaming industry revenue reached $175.8 billion in 2021.

This day, there are farms where NFT gaming characters and equipment are professionally constructed, leveled up, and provided. The downside is that the proprietor of the NFT is losing on the appreciation fee of the asset within the long bustle. Leasing NFTs alternatively, which furthermore purpose as a multiplier of the aptitude yield on the distinctive funding, solves this downside and introduces a gather-gather scenario for every the lessor and the lessee of the NFT asset.

Thru NFT leasing, avid gamers, as debtors, can lease NFTs they’ll’t cling sufficient money to determine out or that are already leveled-up and use them to salvage entry to restricted areas or as instruments for boosting their in-recreation rewards. Lenders (the NFT dwelling owners leasing out the asset) will receive a gash again, by a revenue-half mannequin, of whatever cryptocurrency the borrower earns while playing, equivalent to scholarships, but within the course of a quantity of initiatives and a quantity of property.

Taking a be aware to amass royalties?

NFTs as authenticated reflections of artwork are already liked by galleries, museums, and exhibition venues. Positively, the next step within the adoption of NFT backed artwork will revolve round folk leasing out their copyrighted NFT bid material (visible artwork, audio items, trending characters, and collectibles) as merchandise within the course of commerce and ecommerce channels, dividing the earnings from the sale between the lender of the NFT and the borrower. Alternatively, artists can generate passive profits by leasing the rights to their NFT backed bid material to creators and KOLs in change for royalties paid from the utilization of the property in movies and audio within the course of social channels.

The bid estate boost

The potentialities of producing revenue from NFTs in exact use case capabilities and never most productive within the contemporary speculative nature of chasing attach pumps are rising independently of market traits. With mega-corporations comparable to Meta (Facebook) and Microsoft heavily investing within the formula forward for the metaverse and driving its adoption into their large user bases, demand for virtual land will most productive develop.

As smaller corporations open as much as appear at gigantic corporations into this dwelling, searching for virtual high space exact estate for marketing, savvy investors (in crypto, finance, and exact estate) that cling already began to realize that the demand for leasing virtual exact estate will exponentially shoot within the arriving years, will title lucrative funding alternatives within the salvage of virtual exact estate for commercial leasing capabilities, producing high yields.

As folks use more time online, more organizations will contrivance into this dwelling, and plan more and loads like exact-world properties, virtual exact estate is and could perhaps composed be sought after for its fee in online promotions, as high space HQs by corporations, and as precious land for eCommerce by enterprises diverse from VR casinos to expertise events, online outlets, and every thing in between.

A hybrid of Technology & Neighborhood

nFLARE is no longer “yet any other NFT market”. It’s no longer yet any other formula for whales to appear at wash trading or about chasing hype.

nFLARE is set commercializing exact use-cases of NFTs as instruments for producing a passive profits for lessors and added fee to debtors, or in other words – it’s about opening up a secondary economy within the NFT industry.

P2E, DeFi, copyrights, virtual exact estate, and originate salvage entry to to restricted events are correct about a of the forms of utilities that can look elevated demand by opening up the NFT dwelling to just a few leasing potentialities.

Because the functionalities of NFT leasing change into more broadly readily accessible, the attach of NFT initiatives will hover and the property’ lifetime fee will upward push severely by producing fastened profits from leasing costs, which is able to develop because the attach of the NFT itself is leveled up over time.

Whereas the advance of collateralized natty contracts or an uncollateralized NFT leasing multisig wallet is rather easy, the particular vitality driving a utility mission is its neighborhood and the fashion it harnesses its participants’ power and reaches to propel the mission ahead. Right here’s the cause nFLARE is constructed up as a DAO-managed market, in plan of a centralized one, combining contemporary shared-rewards tokenomics to incentivize participants.

NFT leasing is projected to be the next sizable thing within the crypto dwelling. A DAO harnessing the vitality of an big neighborhood to persuade the market itself and the plan in which it interacts with third-occasion metaverse initiatives will plan the long-established for a next-expertise mannequin of neighborhood-managed NFT marketplaces.