TLDR

- Nigeria’s SEC is increasing novel rules to tax cryptocurrency transactions on regulated exchanges

- A comprehensive crypto tax framework bill is expected to be accredited in Q1 2025

- The country plans to speak rotund crypto alternate licenses this 365 days for centralized platforms

- KuCoin has already applied a 7.5% VAT on shopping and selling charges for Nigerian customers

- Fresh inclinations happen amid ongoing tensions between Nigerian authorities and Binance

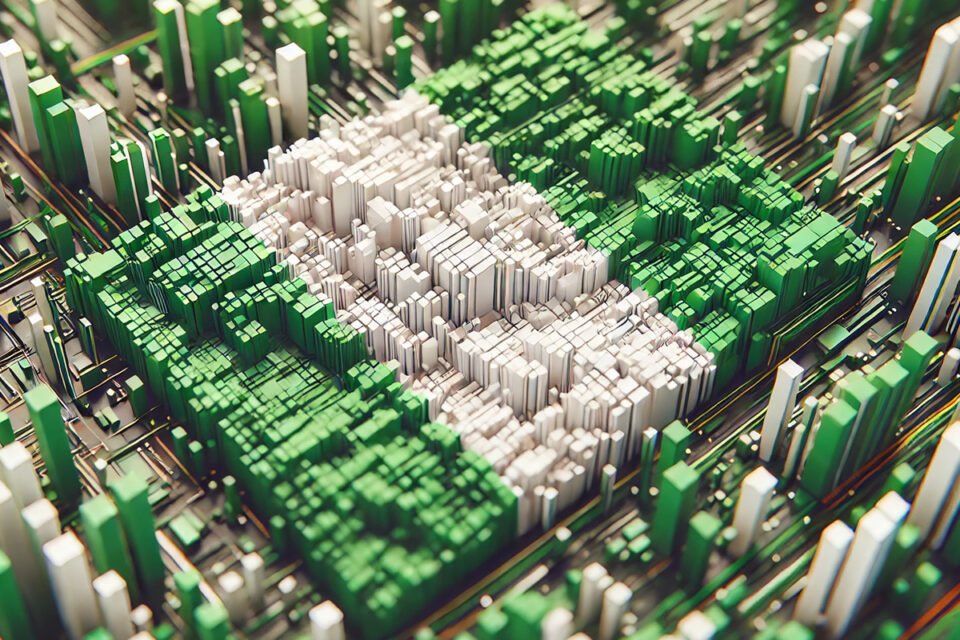

The Nigerian Securities and Commerce Price (SEC) is increasing novel regulations that can bring cryptocurrency shopping and selling and digital transactions below the country’s tax framework. The transfer comes as phase of a broader initiative by President Bola Tinubu’s administration to amplify authorities revenue and scale again the budget deficit.

The SEC is at display engaged on principles that will seemingly be obvious all eligible transactions on regulated exchanges are incorporated within the formal tax system. A bill outlining the framework for taxing crypto transactions and introducing other levies is ahead of lawmakers and is expected to be adopted within the key quarter of 2025.

Some cryptocurrency exchanges operating in Nigeria bask in already begun implementing tax measures. KuCoin, a most indispensable shopping and selling platform within the country, started gathering a 7.5% value-added tax (VAT) on shopping and selling charges from its Nigerian customers in 2024.

The Nigerian authorities’s push for cryptocurrency taxation comes at a time when the country’s young, tech-savvy population has increasingly more turned to digital assets. Many Nigerians exhaust cryptocurrencies as a hedge against excessive inflation and the naira’s steep depreciation against the buck since mid-2023.

Alongside side the novel tax rules, the SEC plans to lengthen the scope of crypto licensing. This involves issuing permits that can enable residents to commerce on formal centralized exchanges where transactions will also be monitored and taxed.

The SEC expects a late shift toward centralized exchanges, citing increased protections and comfort for traders. This transfer aligns with the regulatory body’s efforts to extinguish a more structured digital asset shopping and selling atmosphere.

Fiscal Reforms

These inclinations are phase of President Tinubu’s fiscal reforms since going on of work in 2023. Final week, Nigerian lawmakers accredited a 54.Ninety 9 trillion naira ($36.4 billion) spending arrangement for 2025, highlighting the authorities’s believe monetary planning and revenue generation.

The SEC has already made progress in regulating the cryptocurrency sector. In 2024, the commission applied a licensing framework that granted provisional licenses to platforms love Busha and Quidax as registered virtual asset service suppliers (VASPs).

Binance

The novel tax initiative comes amid ongoing tensions between Nigerian authorities and Binance, one of the most sphere’s largest cryptocurrency exchanges. Fresh disputes bask in centered round regulatory compliance considerations.

On February 14, 2025, Nigeria’s Minister of Data and Nationwide Orientation, Mohammed Idris, addressed allegations made by Binance executive Tigran Gambaryan. The minister denied claims that Nigerian officials had sought bribes from Binance representatives.

The authorities additionally countered Gambaryan’s assertions that crypto exchanges weren’t manipulating the naira. Officers mentioned that Binance had attempted to pay a $5 million deposit to salvage Gambaryan’s free up.

The sphere used to be finally resolved via a diplomatic settlement with the US, leading to Gambaryan’s free up on humanitarian grounds.

While the SEC has no longer disclosed particular revenue projections from the novel crypto tax framework, the initiative shows Nigeria’s plan as one of the most leading nations in cryptocurrency adoption.

The transfer toward taxation and regulation of digital assets represents a shift within the authorities’s come to cryptocurrency shopping and selling. This switch comes as authorities peep to balance the increasing recognition of digital assets with the need for oversight and revenue generation.

Essentially the most smartly-liked regulatory inclinations repeat a more structured come to cryptocurrency shopping and selling in Nigeria, with formal licensing and taxation frameworks being place in location for the digital asset market.

Editor-in-Chief of CoinCentral and founding father of Kooc Media, A UK-Based fully Online Media Firm. Believer in Launch-Source Software program, Blockchain Technology & a Free and Beautiful Cyber web for all. His writing has been quoted by Nasdaq, Dow Jones, Investopedia, The Unique Yorker, Forbes, Techcrunch & More. Contact Oliver@coincentral.com