Despite the ban in early 2021, Nigerians are shopping and selling hundreds and hundreds of bucks fee of bitcoin in mediate-to-mediate markets every month.

Nigeria has been main the diagram in which for Bitcoin adoption in Africa no matter its goverment’s most unusual efforts to prick fetch admission to to Bitcoin services and products to its folks. In February, the Central Monetary institution of Nigeria (CBN) bolstered laws from 2017 that prohibits regulated monetary establishments from going through bitcoin or facilitating funds for bitcoin exchanges. However the ban, Nigerians comprise resorted to mediate-to-mediate (P2P) shopping and selling and moved practically $40 million in BTC volume in the wonderful 30 days.

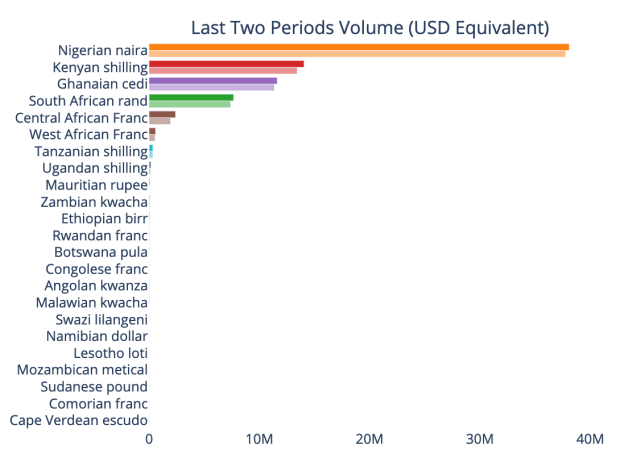

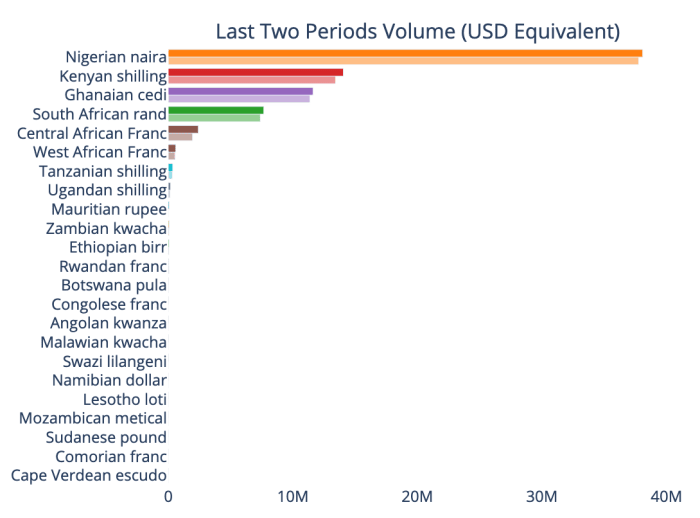

In step with knowledge from analytics platform UsefulTulips, the Nigerian naira (NGN) has been the Sub Saharan African fiat currency most traded for BTC in the previous two periods of 30 days. From July 4 to August 4, 2021, Nigerians comprise traded a USD equal of $38,083,688 in two P2P platforms, Paxful and LocalBitcoins. Within the previous 30-day length, from June 4 to July 4, bitcoin shopping and selling in the most most critical P2P markets in Nigeria amounted to $37,761,748.

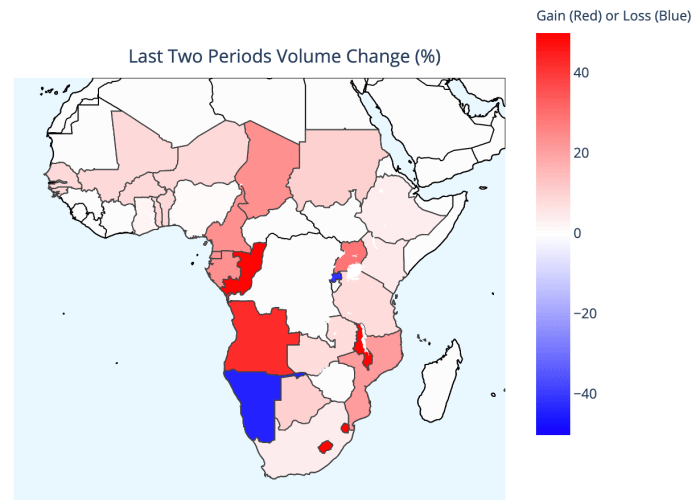

The Kenyan shilling (KES) ranks second and has additionally considered critical shopping and selling volume for bitcoin. The Jap African country traded an equal of $14,054,477 in the most most unusual 30-day length. Within the previous length, Kenyans moved reasonably less –– a total of $13,423,999 in volume. Ghana trails closely, with its fiat currency, the cedi (GHS), appealing $11,614,047. Within the 30 days sooner than that, the country moved $11,367,511. A pattern has fashioned in Sub-Saharan Africa, as practically all international locations comprise elevated their bitcoin shopping and selling volume in mediate-to-mediate markets.

As the accurate mediate-to-mediate electronic cash system, Bitcoin can’t be with out concerns bent to arbitrary guidelines of governments. Nigerians were proving since February that banning banks and exchanges from participating in Bitcoin doesn’t undermine the community nonetheless strengthens it. A clear demonstration that Bitcoin is certainly antifragile and can’t be banned.