Practically two thousand years sooner than the early 1920s Weimar Germany hyperinflation, there was the wide currency debasement of the Roman Empire.

On the flip of the second century, the Roman Empire controlled all of Western Europe, parts of North Africa and the Heart East. Some estimate as much as 65-100 million folks lived beneath Roman rule, with 55–65 million as the most current vary. — approximately 20% of the arena population.

Yet, 150 years later the empire was shut to destroy down. There are many of issues which introduced on the “Crisis of the Third Century” (A.D. 235–284) — notably, factors equivalent to political concerns, corruption, slowing expansion, wars etc. The largest element individually was the debasement of the Roman currency. The debasement of the Roman currency finally ended in over-taxation and inflation, which in flip introduced on a monetary disaster.

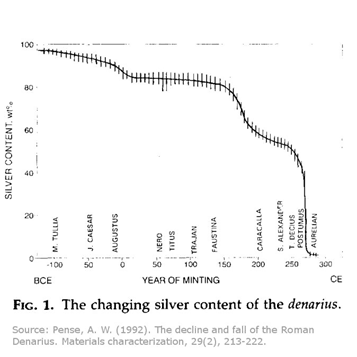

The slack debasement of the Roman currency/coin can even be tracked by blueprint of the steel composition of the denarius. The silver denarius was minted for common exhaust all the blueprint by blueprint of the first two centuries of the Roman Empire. A four-gram coin was peaceful of 95% silver at the approximate time of A.D. 60. By A.D. 110, a 40-gram coin was fabricated from handiest 85% silver.

By A.D. 170 the denarius was fabricated from 75% silver, and handiest 60% silver by A.D. 211. By A.D. 270 this was finally reduced to merely 5% silver. Soon thereafter, Rome abandoned the usage of silver in their coins altogether, switching to bronze to mint their coins. Inflation was excessive as the worth of the currency declined.

By A.D. 290 contemporary coins equivalent to the solidus had been provided in an strive to forestall inflation. The introduction of a “contemporary” currency to forestall inflation looks to be a staple of any hyperinflationary occasion. The identical element took region in Weimar Germany within the 1920s when the authorities applied the rentenmark (issued Nov 15, 1923) to shatter hyperinflation of the papiermark. On the tip of 1922 a loaf of bread imprint round 160 marks, yet by slack 1923 that same loaf imprint 200,000,000,000 marks. The usage of these historical markers, I catch it very difficult when I bump into a headline that states that central banks are desperately seeking to “presently discover” central monetary institution digital currencies (CBDC’s). Adore the rentenmark and the solidus sooner than it, a “contemporary” fiat currency is appropriate extra of the same arena, nonetheless with a hasty-witted contemporary branding and nametag.

The solidus failed to forestall runaway inflation in Rome, main to the “Edict on Maximum Prices“. The edict was designed to “cap” the costs of over 1,000 goods and companies. The edict was additionally unsuccessful. Equally in Weimar Germany, rent controls had been attach in region in an strive to stem the rising inflation kind. In direction of the tip of the third century, costs of goods in Rome had been now 70 TIMES what they had been two centuries prior and most of that imprint enlarge would hang happened within the splendid decade (A.D. 290).

What began as actual devaluation presently became a hasty destruction of the currency in Rome. You leer, the debasement begins slowly before all the pieces (it consistently does). It’s easy to debase first and most most well-known set. Shave a dinky bit silver right here, add about a extra coins there, what’s the wide deal!? Moreover, we’re increasing contemporary money (early-day money printers) for the economic system and that’s wide! Or is it? The topic is currency debasement is loads adore heroin (I wouldn’t know personally, nonetheless keep on with me). The first time you make exhaust of it is miles the most potent. Afterwards, you is at chance of be constantly seeking to buy an increasing kind of to acquire the same “excessive” — economic stimulus by project of printing contemporary money. In the tip, you overdose by taking too noteworthy. The identical holds splendid for currency debasement; within the tip your currency collapses.

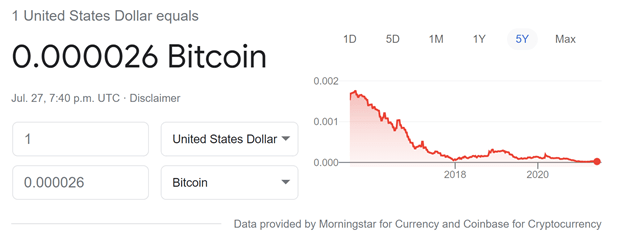

The set this historical previous lesson becomes watch opening to me is the hanging similarities between the Roman silver command chart (chart deliberately inverted to gift the amount of the coin which is NOTsilver) and the balance sheet of any central monetary institution on the planet in at the unique time and age. For this case, leer the U,S. Federal Reserve balance sheet below. The similarities of these charts must be a wide fire terror in your head screaming “WARNING!” Irrespective of these charts being from very varied time periods and time lengths it is miles the price of decay (shoutout to Greg Foss for that duration of time) that is most wonderful. The price of decay — or relative purchasing energy — for each and every charts follows a extremely similar course.

You leer, the world with currency debasement is that it is miles a onerous habit to kick. Worse, most don’t even take into accout that it’s defective. This held splendid in Rome, held splendid in Weimar, Germany and holds splendid at the unique time. History is rhyming. U.S. politicians in energy build not leer balance sheet expansion as a relate that needs solving. Worse, they build not leer it as a motive within the serve of inflation, or that excessive inflation is defective. Currency debasement is a one-manner street. The boulder handiest rolls downhill. Greg Foss stated it most effective “I am 100% particular that fiats will continue to debase…. on an accelerated basis.”

They simply cannot flip off the printers. In the occasion that they are attempting to sluggish down inflation (on the complete by elevating pastime charges and turning off the money printers), within weeks if not days, you may perchance per chance perchance leer rapid bankruptcies, unemployment, strikes, hunger, violence, and per chance even revolution in an indecent case. The authorities and by extension the banks are backed genuine into a nook. Right here’s a carbon duplicate of the same factors that Weimar faced and Rome as properly. No country/authorities willingly chooses hyperinflation. Frankly, traditionally it has been the lesser of two evils. That doesn’t produce it any higher (frankly, one may per chance perchance argue that it is miles manner worse), on the replace hand it occurs much less genuine now than a wide deflationary occasion.

Essentially, increasing the balance sheet at an exponential price makes the world worse and worse till it finally cannot be skipped over from now on. They’ll comprise printing till the outcomes of inflation are WORSE than the outcomes of not printing. Fleshy shatter.

It’s compulsory to guard your self against inflation by purchasing onerous sources. Eliminate bitcoin, gold, silver, and/or exact property. Issues which are onerous, scarce and though-provoking to reproduce. Agricultural farmland additionally traditionally has a excessive correlation to inflation. Even within the occasion you is at chance of be a gold malicious program or a silver malicious program, your allocation to bitcoin must mild not be 0%. No person can predict the future with 100% straightforward project. As a consequence, your bitcoin allocation must mild not be zero both within the occasion that you is at chance of be spoiled. In the shatter, acquire skilled on what is going down on; there are many of folks on-line who’re interesting to serve and allotment files freely.