In the November Month-to-month File, we talked about the Accumulate Unrealized Profit/Loss (NUPL) indicator exhibiting the market in a healthy converse of unrealized profit in comparison to previous cycles. We can extra wreck down that indicator into rapid holder and prolonged-term holder groups.

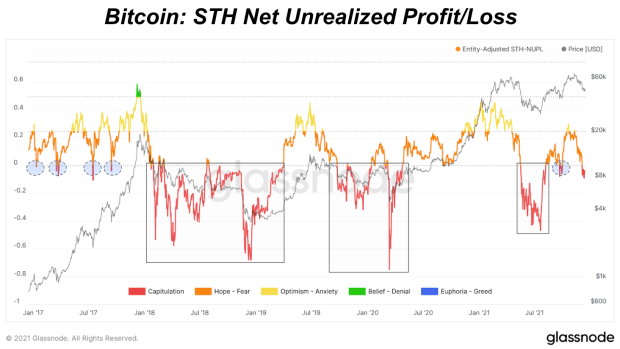

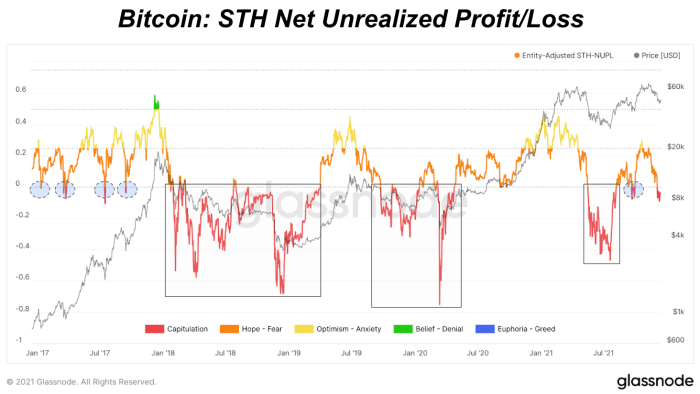

As for rapid holders, certainly one of the considerable largest shut to-term issues is that there are increasing unrealized losses available within the market. As mark continues to alter below the rapid holder mark foundation spherical $53,000, there’s a rising possibility that extra of the new traders capitulate and sell their bitcoin at a loss, riding the mark decrease. This on the total is a endure market forming or a possibility for holders to know more affordable bitcoin.

Sessions of sustained, rapid holder capitulation spark new endure markets as new, rapid holder attempting to obtain is the first bull cycle driver. But, we are in a position to appear in many bull market dynamics that the rising unrealized losses of rapid holders is frequent and is inclined to be rapid-lived as prolonged as prolonged-term holders include conviction, ready out for bigger costs.

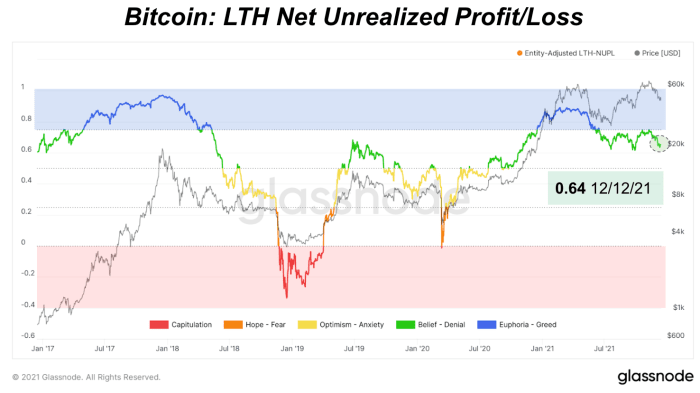

Right here’s a diversified chronicle for prolonged-term holders who seem quite contented and largely in a healthier converse of profit on the contemporary mark relative to their realized mark (mark-foundation). To this level with basically the most accepted mark drawdown, prolonged-term holder provide is in a a bit declining to neutral converse. There’s healthy, no longer excessive profit taking honest appropriate now signaling a market on help in a ranging and consolidating converse.