Key Takeaways

- Snowdog has crashed over 90% following the protocol’s deliberate token buyback.

- At some level of the buyback, most attention-grabbing 7% of SDOG holders had been in a position to promote their tokens at a profit.

- Some people of the Snowdog community bear accused the developers of utilizing the buyback to exit their positions first, leaving all people else retaining the get.

Snowdog, a self-styled decentralized reserve meme coin, has been accused of pulling the rug on its community after crashing over 90%.

Snowdog Plummets 90%

SnowdogDAO has despatched traders reeling this Thanksgiving.

The Avalanche-primarily primarily based mostly OlympusDAO fork plummeted over 90% Thursday night after the protocol’s deliberate token buyback resulted in a huge selloff.

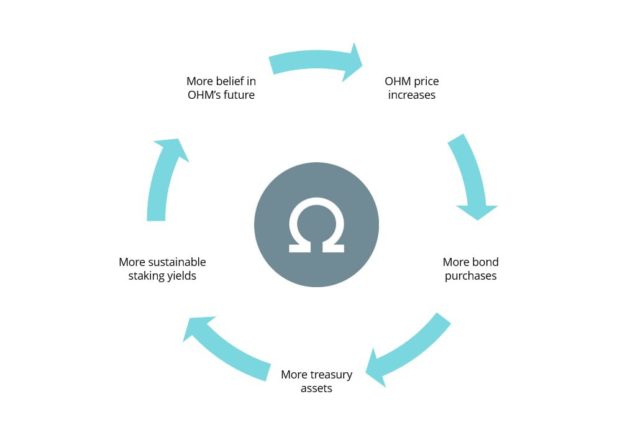

Snowdog, which kinds itself as a “decentralized reserve meme coin,” allowed customers to mint SDOG tokens at a discounted price by depositing varied belongings as collateral. Snowdog attracted liquidity in powerful the same manner as OlympusDAO, the predominant protocol to build up the a total lot of the so-known as “liquidity flywheel” model. In fresh weeks, many OlympusDAO forks bear emerged on Ethereum and varied blockchains amid rising curiosity in the protocol.

Snowdog differed from varied OlympusDAO forks in that it most attention-grabbing deliberate to be active for eight days. The protocol launched on open that it would employ all of the belongings in its treasury after eight days to orchestrate a “huge buyback” of Snowdog tokens ahead of transitioning right into a meme coin by fractionalizing every SDOG token by a component of 1 billion.

The deliberate buyback resulted in a total lot of holders amassing SDOG tokens in anticipation of a substantial model amplify. On the other hand, when the buyback started gradual Thursday, the Snowdog token as a replacement plummeted, in the end shedding over 90% of its pre-buyback cost.

The worth wreck precipitated many in the Snowdog community to accuse the developers of “pulling the rug” by utilizing the buyback to exit their positions first, leaving varied traders caught in their positions as costs crashed.

On the other hand, others bear refuted this accusation, pointing out that the transaction data doesn’t point out any proof of foul play.

Early Friday morning, the Snowdog team printed a post-mortem describe detailing why the SDOG token crashed. The developers apologised for failing to obviously instruct how the buyback would seemingly impact costs. An excerpt of the describe learn:

“We wished to orchestrate an occasion that would possibly perhaps furthermore grasp the attention of the crypto ecosystem while procuring leisure to folks watching it from the sidelines… For the $SDOG model to be above market model ahead of buyback (~$1200), sellers needed their $SDOG to be section of the predominant 7% of the provision being sold.”

With most attention-grabbing 7% of the SDOG offer having the capability to be sold at a profit all the procedure by the buyback, many holders had been forced to promote below market model or face extra losses, ensuing in a 90% drawdown.

The post-mortem furthermore outlined future plans for the SDOG token, detailing how the team aims to realize lengthy-term cost for holders. On the other hand, many community people bear declared that they bear got lost curiosity in the mission following the wreck. Whether the Snowdog community will have the flexibility to recuperate from the incident stays to be seen.