Key Takeaways

- Bitcoin has considered a significant enlarge in slothful tokens exchanging fingers, that might perhaps perhaps additionally consequence in high volatility.

- The ETH offer on exchanges has plummeted, while prices sit in the “opportunity zone.”

- BTC and ETH might perhaps perhaps additionally rapidly resume their uptrend if these on-chain metrics remain intact.

Bitcoin and Ethereum appear paddle for prime volatility as quite a lot of on-chain metrics imply that shopping stress is accelerating. Quiet, these cryptocurrencies must overcome one obstacle to resume the uptrend.

Bitcoin Whales Are Wait on

Bitcoin and Ethereum will be ready for a bullish circulate.

Bitcoin has rebounded strongly after diving below $41,000 earlier as of late. The leading cryptocurrency was once in a neighborhood to manufacture over 3,500 capabilities after the steep correction to attain a high of $43,750 on the time of writing.

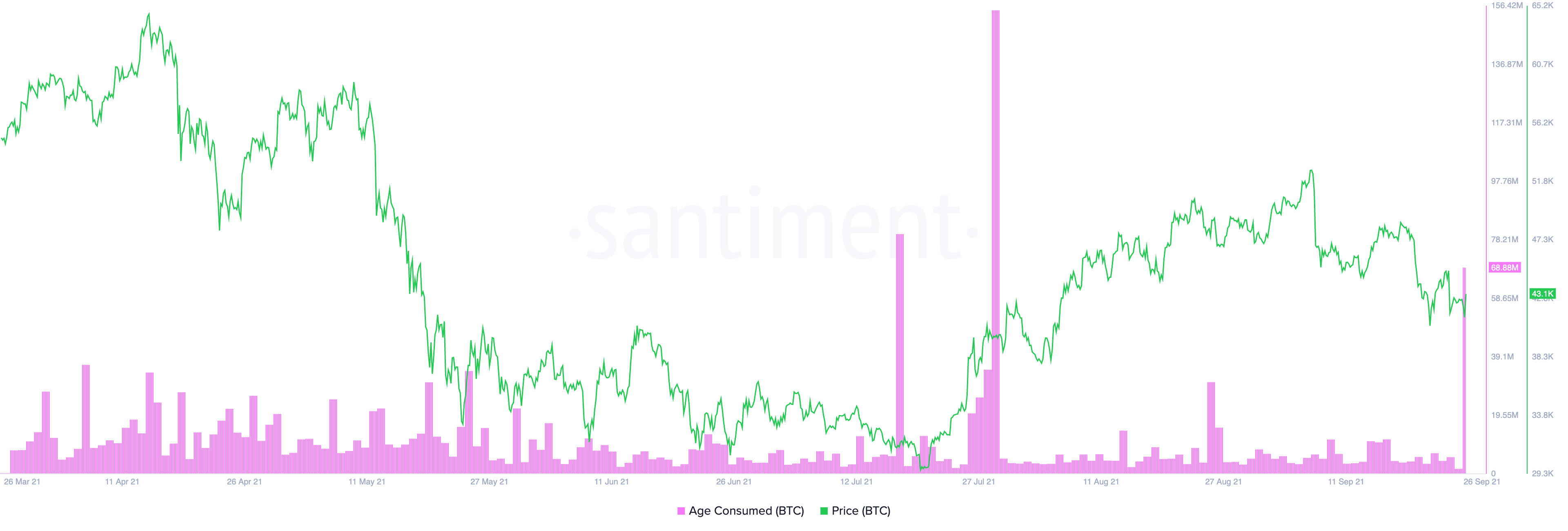

Santiment’s Token Age Consumed index recorded a significant spike in slothful BTC now exchanging fingers up to now few hours as prices tumbled.

This on-chain metric measures how many coins have fair now no longer too lengthy up to now moved addresses multiplied by the sequence of days since they final moved. Though the circulate of former tokens is now no longer necessarily a number one label indicator, it has resulted in spikes in volatility over the last few months.

If history repeats itself, Bitcoin might perhaps perhaps additionally expertise additional volatility in accordance with most approved token movements.

Whales behavior means that the incoming spike in volatility will be to the upside. Within the final 24 hours, wallets on the network with 100 to 10,000 BTC have added extra than 80,000 BTC to their holdings, worth $3.32 billion.

The surprising enlarge in upward stress means that sizable investors are looking out for to get at a lower cost in preparation for an upswing.

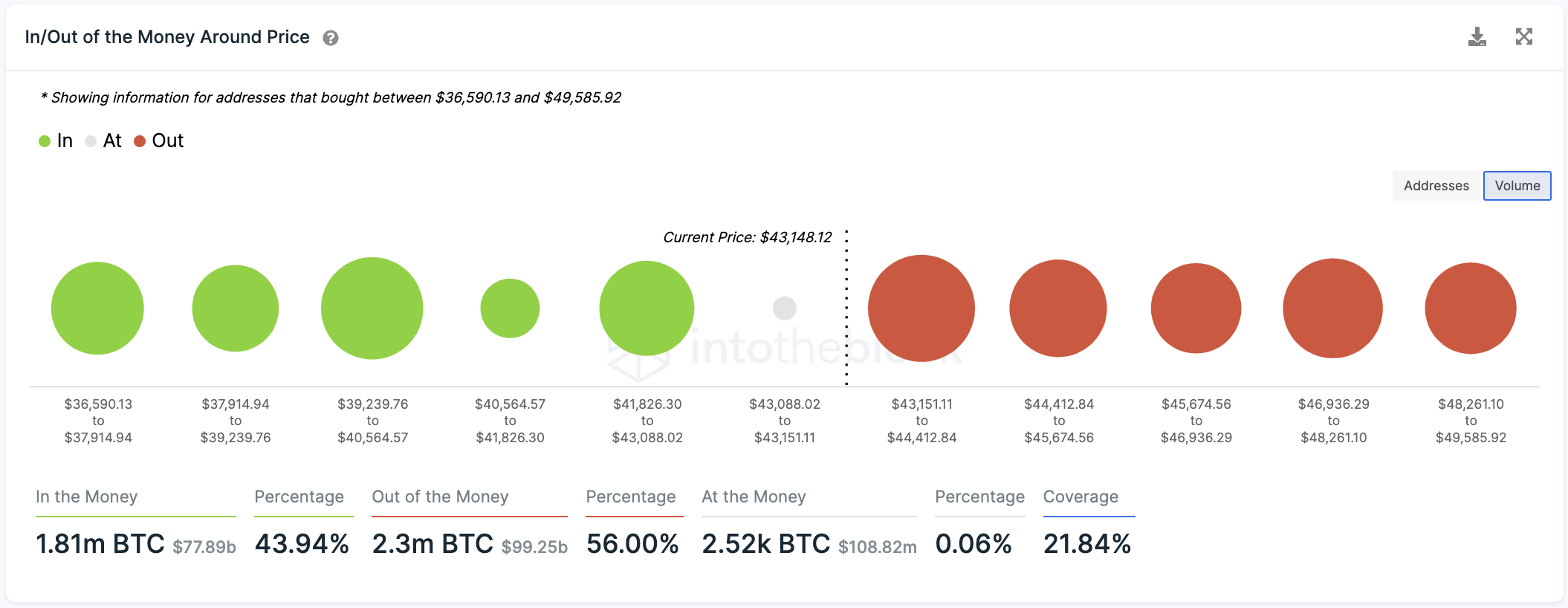

Though the percentages appear to settle on the bulls, Bitcoin faces stiff resistance ahead. IntoTheBlock’s In/Out of the Cash Spherical Label (IOMAP) model presentations that 1.2 million addresses have beforehand bought 1.05 million BTC between $43,150 and $45,670.

These holders will be looking out for to destroy even on their underwater positions as prices strive to attain additional, containing the upward stress. Attributable to this truth, most productive a decisive on every day foundation candlestick cease above this offer barrier might perhaps perhaps additionally signal the starting of a brand fresh uptrend.

On the quite a lot of hand, the IOMAP cohorts level to that the largest increase wall underneath Bitcoin lies between $41,830 and $43,000. Roughly 760,000 addresses are holding almost about 430,000 BTC around this label level. Slicing thru this rely on zone might perhaps perhaps additionally consequence in a downswing to $39,000 as there is no longer this kind of thing as a other pastime set that might perhaps perhaps additionally attend falling prices at bay.

Ethereum Appears Undervalued

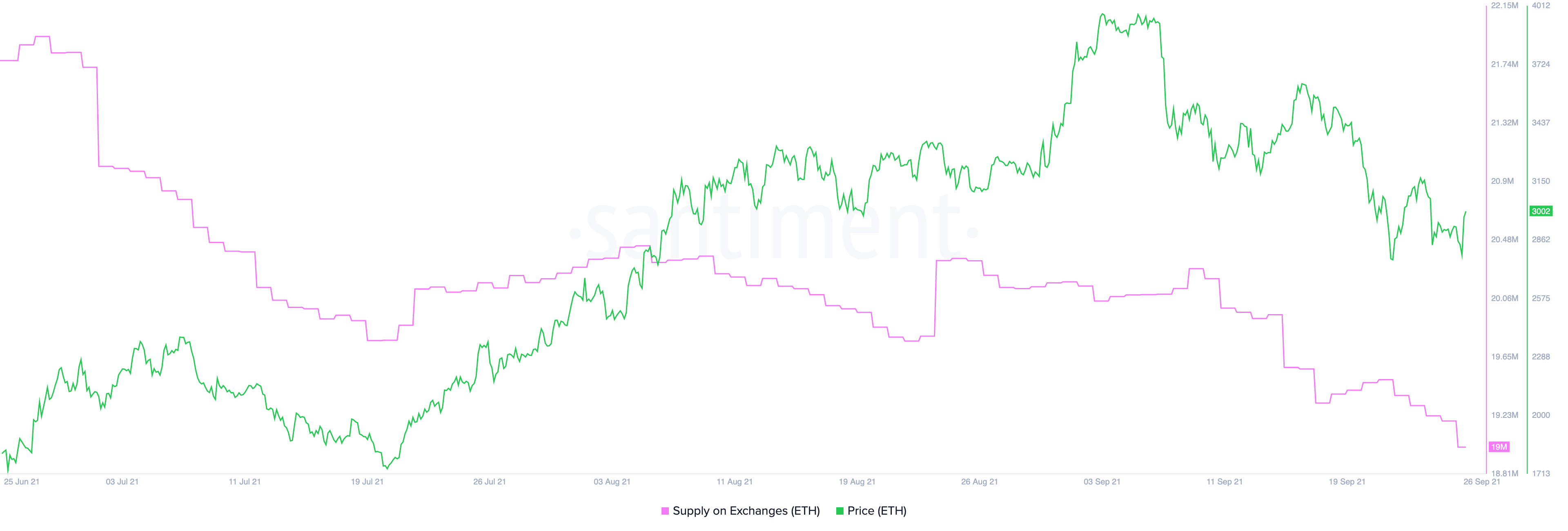

The sequence of Ethereum tokens held on cryptocurrency exchanges continues to decline at an exponential price. Over the final month by myself, extra than 1.35 million ETH have been depleted from shopping and selling platforms, representing a 6.63% decline.

The declining ETH offer on identified cryptocurrency substitute wallets paints a sure image for Ethereum’s future label development. It technically reduces the sequence of ETH accessible to sell, in consequence capping the downside doable.

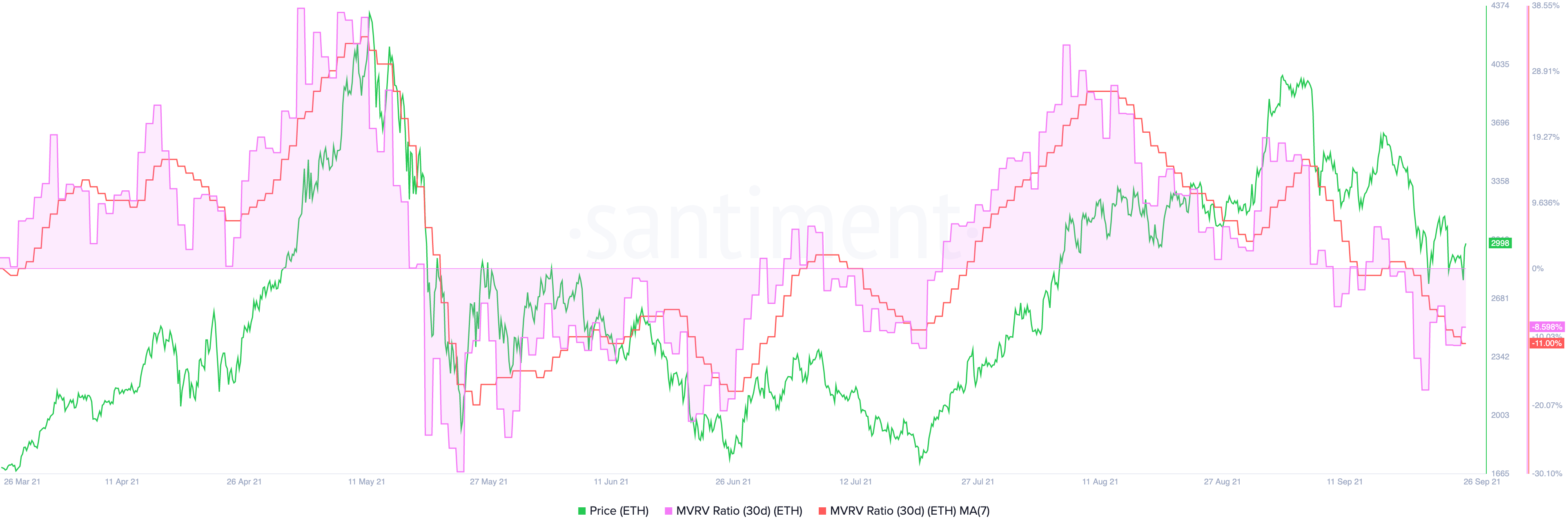

Furthermore, the Market Label to Realized Label (MVRV) index means that Ethereum is undervalued on the contemporary label ranges. This classic index measures the everyday revenue or loss of addresses that obtained ETH up to now month. Each time the 30-day MVRV moves below 0%, a bullish impulse tends to spend.

The 30-day MVRV ratio is now hovering at -8.6%, indicating that ETH sits in the “opportunity zone.” The lower the MVRV ratio turns into, the higher the likelihood of an upward label circulate.

Though Ethereum is sitting on high of used increase, transaction history presentations that it most productive has one obstacle to beat to resume the uptrend.

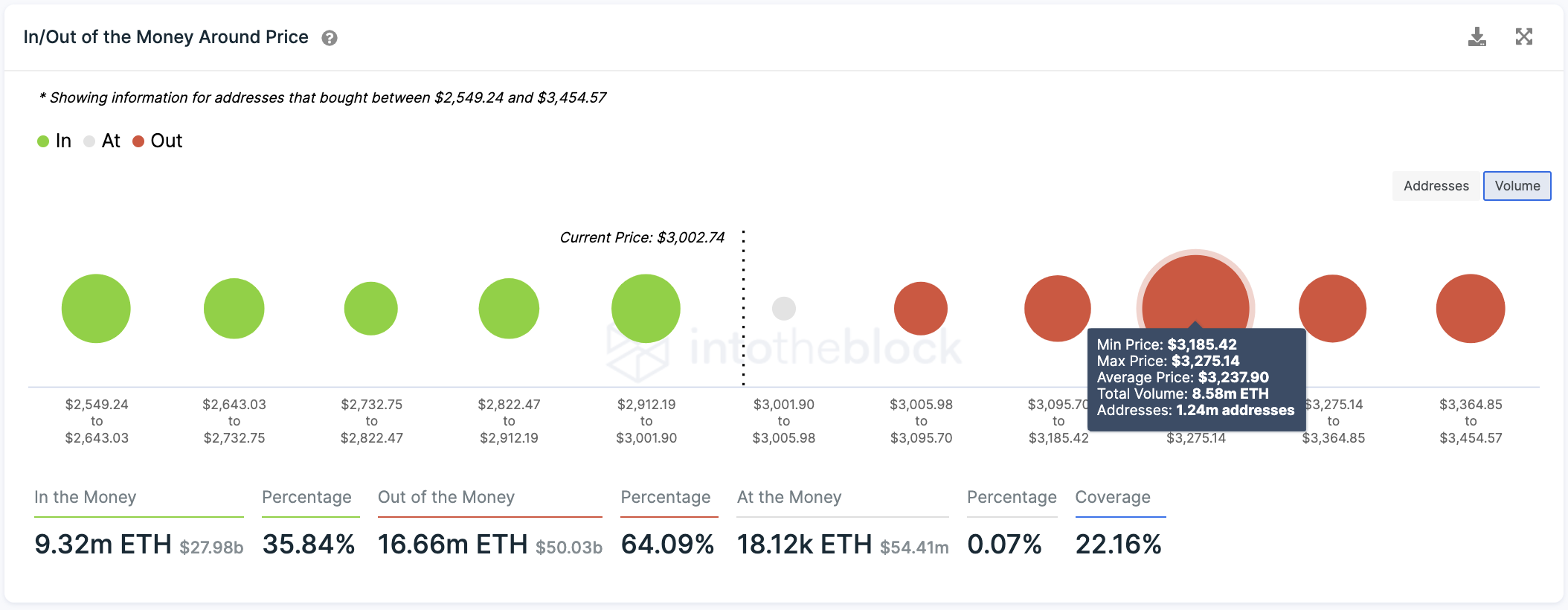

Bigger than 1.2 million addresses have obtained approximately 8.6 million ETH between $3,185 and $3,275. A decisive candlestick cease above this resistance barrier might perhaps perhaps additionally propel ETH against $4,000 or fresh all-time highs.

Quiet, investors must pay cease attention to the $2,900 increase level as any indicators of weak spot around it can additionally encourage market participants to sell. Below such distinctive conditions, Ethereum might perhaps perhaps additionally fall to $2,500.