Key Takeaways

- DODO is made up our minds to launch on Arbitrum, and believes that Arbitrum will surpass of us’s expectations.

- While in the origin, liquidity will be unfold between Layer 2s and sidechains cherish Polygon and Binance Trim Chain, if Layer 2 delivers this could occasionally also finally prevail.

- The most in model amble in DeFi prices hasn’t affected most initiatives as they all enjoy greater than sufficient funds to continue constructing the model forward for finance.

In an interview with Crypto Briefing, the founder and CEO of DODO trade Lei Mingda talks Arbitrum, scaling Ethereum, Polygon, Binance Trim Chain, Three Arrows Capital, concentrated capital, and the model forward for DODO in a multichain world.

Onboarding Millions to Layer 2

DODO is a decentralized trade that pioneered concentrated liquidity, the foremost feature of Uniswap v3, again in August 2020. The trade achieves concentrated liquidity through a proactive market maker algorithm that robotically allocates funds to a particular vary dynamically, achieving a decrease impress impact on transactions with much less an crucial liquidity in DODO’s swimming pools.

The twist of the proactive market maker is arguably one of the most handiest advantages DODO has over the minimize-throat competition for liquidity between decentralized exchanges. While Uniswap‘s v3 concentrated liquidity feature relies on customers transferring their liquidity, DODO does it robotically spherical the connected impress vary. As transferring liquidity will be dear, DODO’s automatic blueprint favors smaller customers.

While this option has been integrated into the trade since its launch, future updates for DODO sing us loads about the total course of DeFi for the 2nd half of 2021. Excessive on the agenda for most DeFi protocols, including DODO, is bringing their protocol to Layer 2 scaling solutions cherish Arbitrum. The trade’s CEO, Lei Mingda, is bullish on Arbitrum. He says of the Optimistic Rollup resolution:

“Layer 2 works even higher than I expected. Arbitrum is a nice project and a team with a solid background. That doesn’t imply there obtained’t be points at launch though, however the product is ready and works effectively. Causes why they haven’t opened it to the general public is that they wish all the pieces to be ready and examined sooner than Arbitrum becomes available in the market to the general public.”

DODO’s Multichain Future

DODO was furthermore one of the most first exchanges to port its protocol on Binance Trim Chain. The Ethereum clone has had a sophisticated few months because it first brought millions of customers to the community, using DeFi and the Ethereum Virtual Machine. With regards to Layer 1, DODO is chain agnostic. Its contrivance has been following the actual person say, which has resulted in the implementation of the protocol on Ethereum, Binance Trim Chain, and Polygon. Discussing Binance Trim Chain’s like a flash increase, Mingda says:

“Binance Trim Chain is a really crucial accomplice of DODO, however its recognition has taken a hit currently. The most arresting hassle is Binance’s “switch lickety-split destroy things” model, which has resulted in nice increase when the chain wasn’t if truth be told ready and battle-examined. Now they’re paying for that.”

One amongst the foremost reveals of energy for DeFi in the arriving months steadily is the duel for liquidity between sidechains cherish Polygon and Binance Trim Chain and Layer 2 solutions cherish Optimism or Abritrum. While the first two already enjoy established particular person bases, Layer 2 will utilize pleasure in higher security by straight leveraging Ethereum’s main chain security. Mingda predicts Layer 2 would maybe maybe buy in the very prolonged time duration. He says:

“Sidechains enjoy developed stable userbases so in the brief to mid-time duration there’s going to be a destroy up between these two solutions. At final, if Layer 2 delivers, that’s the build the money will lope. Splitting capital spherical diversified chains is an hassle, however here is one thing DODO’s market maker algorithm is ideally suited to, because it makes up for decrease liquidity.”

The Convey of DeFi

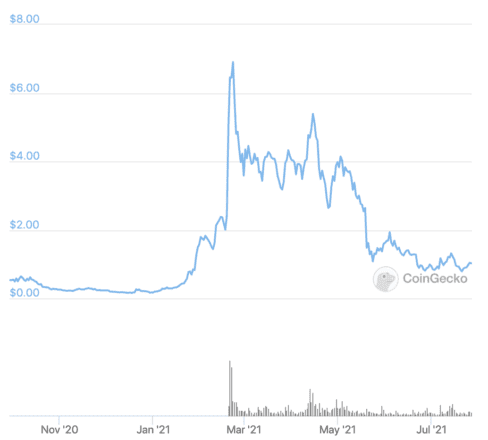

Mingda furthermore has arresting phrases of data concerning basically the most in model downward impress trajectory of DeFi tokens. Between February and Might maybe presumably presumably also, DODO’s token traded spherical $4. This day, the token adjustments hand barely above $1. Reflecting on DODO’s impress, Mingda says:

“We don’t care about that, and we can sing you other initiatives don’t care both. We’re too busy constructing to care about secondary market prices. DeFi tokens crashing is a really fashioned phenomenon that has happened continuously sooner than. The entire DeFi groups enjoy greater than sufficient money to continue constructing and we shouldn’t dismay about the industry.”

Indeed, the trade has the lush of being backed by Three Arrows Capital, one of the most foremost funding funds in the crypto home. The trade enjoys biweekly calls with founding partners Su Zhu and Kyle Davies, two veterans of the crypto home who can properly sing DODO’s increase.

The facts on or accessed through this internet location is got from autonomous sources we judge to be moral and first rate, however Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any data on or accessed through this internet location. Decentral Media, Inc. is no longer an funding handbook. We invent no longer give customized funding advice or other financial advice. The facts on this internet location is field to trade without note. Some or the total data on this internet location would maybe maybe also was outdated, or it would maybe maybe be or was incomplete or erroneous. We would maybe maybe also, however are no longer obligated to, change any outdated, incomplete, or erroneous data.