Ethereum’s newest mark decrease changed into fueled by increased altcoin inflows to cryptocurrency exchanges. Experts attribute the fall in Ethereum’s mark to disclose transfers from the NFT market OpenSea.

OpenSea Transaction Volume Risky For Ethereum

Based mostly totally on Etherscan recordsdata, OpenSea has been unloading hundreds of ETH on the market within the old couple of weeks. Within the same way, NFT creators on the platform absorb profited, basically based on the statistics. The volume of NFT trading on OpenSea continues to climb in January.

Since the initiate of 2022, OpenSea, the largest NFT market, has considered phenomenal NFT sales. Based mostly totally on Dune Analytics, month-to-month NFT sales on OpenSea currently exceed $4.5 billion. This sum surpasses their old month-to-month sales legend of $3.5 billion and is anticipated to upward push additional.

The volume of Ethereum exiting has gradually climbed over the final two weeks. 21,000 Ethereum had been at once transferred from OpenSea’s wallet to Coinbase.

Connected article | OpenSea Transaction Volume Shows That NFTs Are No longer Slowing

As the selling of NFTs will enhance, so reach royalties and disclose transfers from OpenSea. The precipitous upward push of the NFT market would possibly perhaps well perhaps well pork up Ethereum inflows to exchanges equivalent to Coinbase.

As royalties from OpenSea, an additional 35,300 Ethereum had been distributed to NFT issuers. Colin Wu, a Chinese journalist and crypto analyst, argues that the surge of Ethereum inflows from OpenSea to Coinbase spurred the fabricate bigger in promoting stress.

Historically, a surge in promoting stress causes the altcoin’s mark to tumble. Colin Wu tweeted:

“OpenSea and NFT issuers would possibly perhaps well perhaps well also very effectively be idea to be likely the most pressures for ETH to crash. Within the past two weeks, the amount of ETH transferred at once from OpenSea Pockets to Coinbase reached 21,000, and the amount of ETH transferred to royalty distributors reached 35,300.”

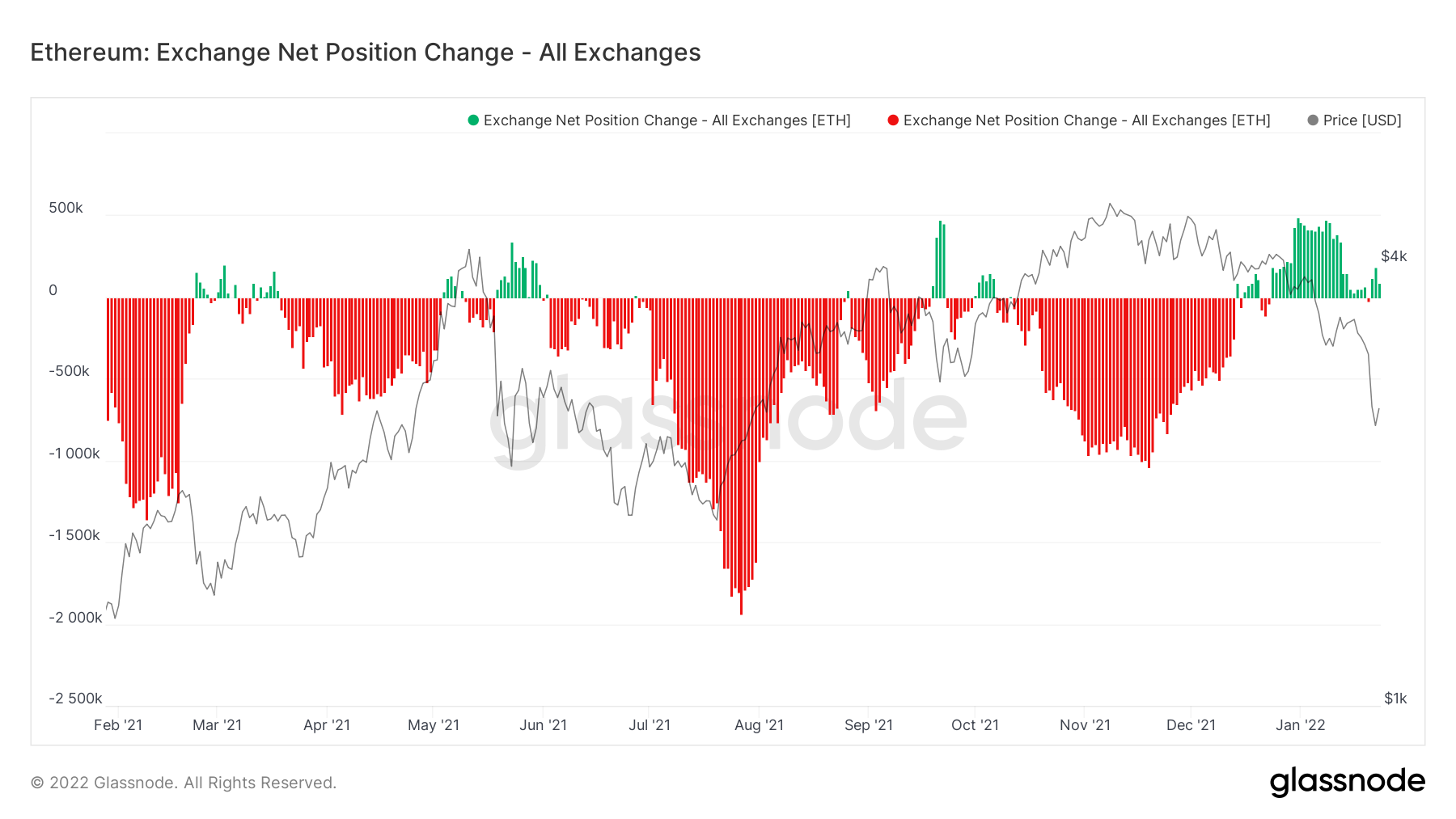

Analysts absorb noticed that the earn outflow for Ethereum in 2021 changed into comparatively orderly. The earn inflow of Ethereum has increased severely at some stage within the final month.

ETH/USD nosedives to $2,200. Offer: TradingView

IAmCryptoWolf, a pseudonymous cryptocurrency analyst, assessed the Ethereum mark pattern and forecasted that a soar within the altcoin’s mark around $2,300 would act as noteworthy barrier.

$ETH.

Engaged on 78.6fib, month-to-month 21EMA and horizontal day-to-day and weekly enhance 2.2-2.3k.

Since we misplaced 3k key enhance, a soar on this dwelling will act as noteworthy resistance. Within the identical dwelling we will moreover absorb day-to-day DMA50 curving down on the side of the WMA50 and WEMA21 resistances pic.twitter.com/ngR2YsCzqC— Wolf 🐺 (@IamCryptoWolf) January 23, 2022

Ethereum Web Enviornment Commerce - All exchanges. Offer: Glassnode

Alternatively, OpenSea is no longer the sole motive for the fall within the mark of ETH. Based mostly totally on Coinmarketcap recordsdata, ether is down extra than 35% one year up to now. Over $746 has been deducted from the mark of ETH within the old 14 days, as it has fallen below $3,000. ETH is currently trading at $2,407, a -3.71% decrease over the old 24 hours.

Other Components That Might perhaps moreover Situation off Designate Fall

Several causes absorb contributed to the crypto market crisis, alongside with a big market selloff basically based on a coverage shift by the US Federal Reserve Bank. The altering coverage route of Russia toward crypto is amongst the contributing components to establish in thoughts.

Market participants, on the assorted hand, remain bullish on Ether within the crash. Several upgrades that the network intends to roll out this one year are fueling these expectations. For starters, the next stage of Ethereum’s crawl to turning into a proof-of-stake (PoS) blockchain is deliberate for this one year. Several forecasts claim that the merger will select put within the first half of 2022. This improvement will fabricate bigger the Ethereum network’s scalability and a great deal make a contribution to making Ether issuance deflationary.

Consequently, it will assist adoption and, within the crash, power up the mark of Ethereum.

Connected article | TA: Ethereum Nosedives, Indicators Display masks Signs of Bigger Downtrend

Featured Characterize from Shutterstock | Charts by Glassnode, and TradingView