In a galaxy a ways distant, there exists a decentralized exchange that doesn’t price an arm and a leg to use…

Osmosis is the most filled with life decentralized exchange within the Cosmos ecosystem, and it permits tokens on “IBC-properly suited” blockchains care for Cosmos, Regen, Akash, and extra to be swapped, with prices below $1.00.

The Cosmos “Cosmoverse” goals to rethink how cryptocurrency projects work together. In preference to pledging allegiance to a single blockchain for greater or for worse, Cosmos projects preserve full sovereignty over their particular particular person blockchains, while moreover leveraging the strengths of the increased Cosmos network and beyond.

Osmosis has viewed like a flash growth since its originate in late 2021. Osmosis is a decentralized protocol founded by Osmosis Labs founders Sunny Aggarwal and Josh Lee. Upon elevating $21 million in an October 2021 token sale, Osmosis has generated a accurate core of customers and established itself as a core feature all one of many most realistic ways by device of the Cosmos ecosystem.

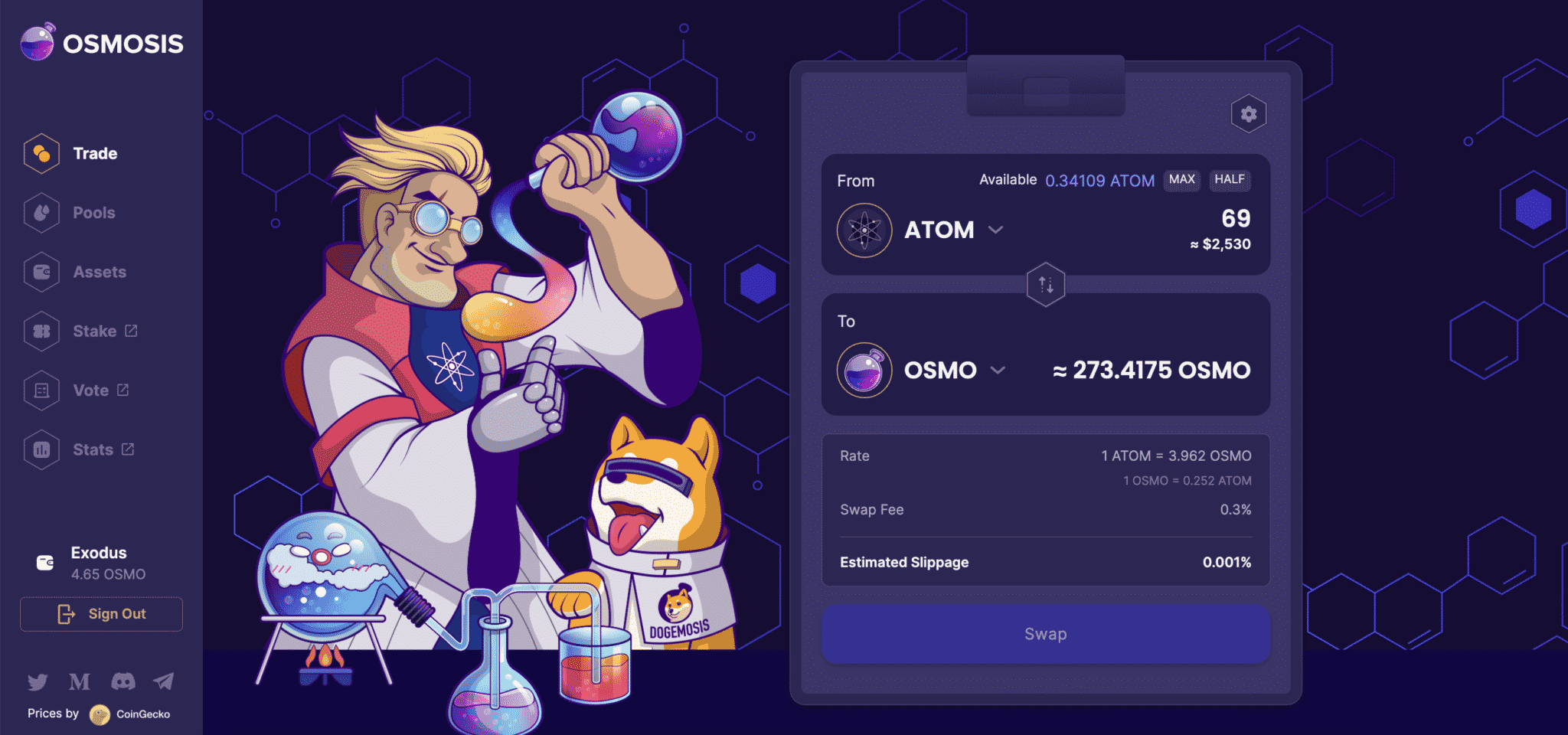

The Osmosis dwelling web page

As a decentralized exchange, Osmosis has turn out to be in particular standard within the DeFi for its tons of liquidity pools, with marketed APRs between 20% and 120% for IBC-properly suited pairings care for ATOM/COSMO, AKT/OSMO, and tons others.

CoinCentral spoke with Osmosis Founder Sunny Aggarwal about building within the Cosmos ecosystem, DEX aspects Osmosis is tinkering at, the price proposition for liquidity suppliers. Sunny is moreover a Cosmos and Tendermint developer.

What makes the Cosmos ecosystem essential for entrepreneurs, builders, and customers?

Unlike other blockchain platforms, Cosmos is no longer a singular blockchain that builders manufacture on high of. As an different, it’s a network, an “web of blockchains” which can be all linked and ready to talk with every other resulting from an modern inter-blockchain consensus mechanism that permits generalized heinous-chain communication between disparate chains.

The imaginative and prescient of the Cosmoverse is to permit any blockchain projects to preserve full sovereignty over their chains while moreover reaping the advantages of being ready to talk and transact with other chains.

The Cosmos dwelling web page

Gorgeous because the age of empires crumbled sooner than our present political paradigm of nation-states swept the globe, we judge that a model that prioritizes sovereignty permits for communities to pursue their queer objects of inside interests to the most extent, with most flexibility, as they manufacture tons of projects. And real as some nations in this day’s world are extra insular and others extra launch to commerce or immigration, every group within the Cosmoverse can pick as it goes real how tightly constructed-in it wants its blockchain to be with other chains.

We judge this device permits innovation to happen as like a flash as most likely and has extra attainable to scale than every other model.

Would possibly well presumably well you conceal how Osmosis is popping into the center of gravity within the Cosmos ecosystem?

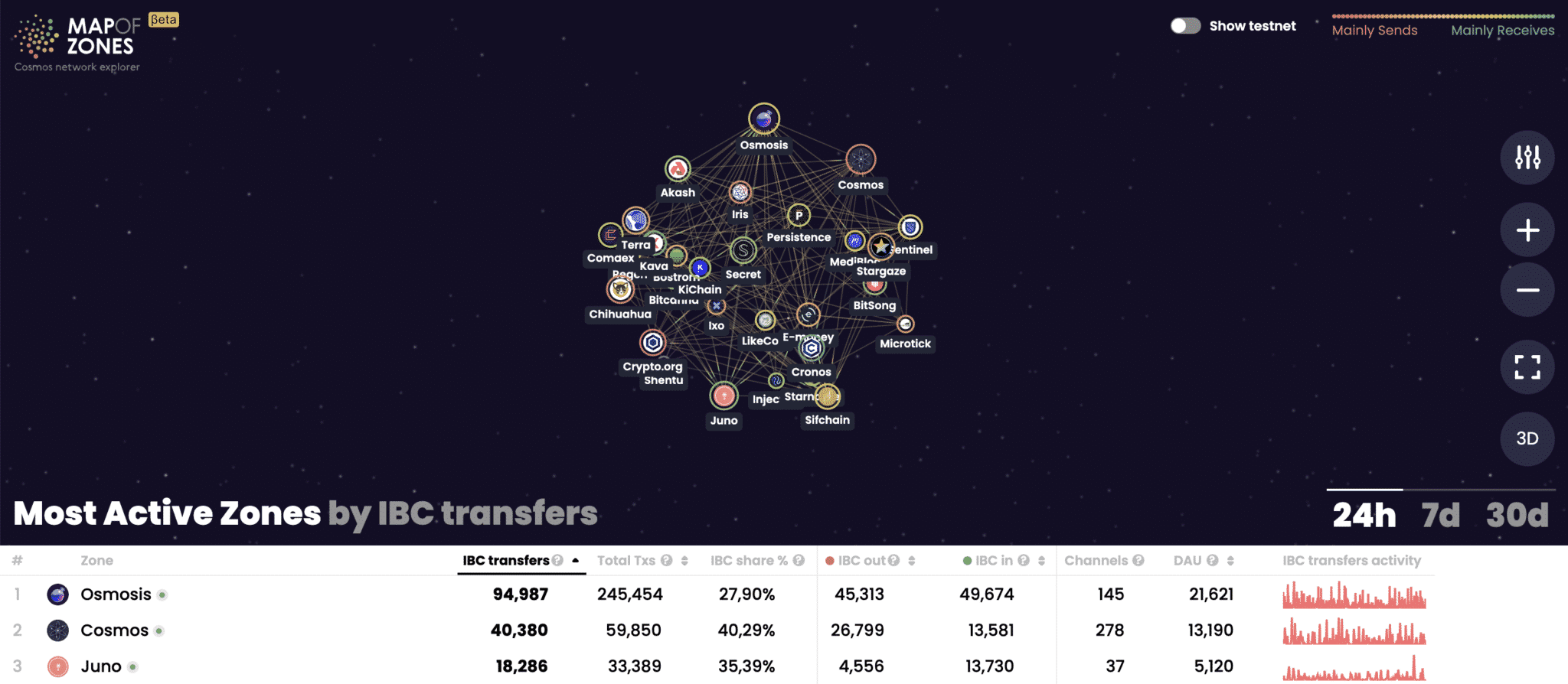

As explained, Cosmos is a web connecting many different blockchains. The group-developed Scheme of Zones is a tall real-time visualization of this web, and it reveals how Osmosis is extra deeply connected with the different chains within the Cosmoverse than every other blockchain.

The Cosmos Scheme of Zones

No longer easiest is it connected to virtually every other chain within the Cosmos, nonetheless there’s moreover extra inter-blockchain communication going on between Osmosis and these other chains than every other project within the ecosystem.

Grand of that has to enact with real how sizzling DeFi is on the 2d – it makes sense that a decentralized exchange may perhaps be the largest hub within the Cosmoverse.

Osmosis permits for dynamic adjustments of swap prices, multi-token liquidity pools, and custom-curve AMMs. Would possibly well presumably well you say why an LP may perhaps moreover are eager to use one among these other programs?

Our perception is that the develop field of AMMs is silent vastly underexplored. By developing custom curves, we will acquire a device to develop original pools that may enact issues care for concentrated liquidity and IL resistance. Nonetheless even bigger than that, with a rethinking of reason about AMMs, we will acquire a device to develop them into automated algorithms for issues we may perhaps moreover no longer even deem of this day as market-making, nonetheless fairly original primitives such as index fund model pools and even leverage pools.

DeFi is about taking tons of the mature monetary primitives this day, and enabling them to work in a extra continuous algorithmic formula, and sturdy AMMs / bonding curves are the technique to that.

What makes Superfluid staking queer?

With Superfluid Staking, traders no longer hang to select between staking and performing as a liquidity supplier in token exchange pools, which strategy they’ll enhance their incomes vitality. In notion this in all fairness straightforward – must you’re an LP and already locked into conserving tokens, then you definately’re moreover offering the total advantages of staking to those chains, so why no longer formalize that relationship and be rewarded as such?

Osmosis is uniquely suited to permit every actions simultaneously due to this of it’s constructed from the bottom up as a Cosmos DeX and subsequently is station up to address the inter-blockchain contracts wanted to fabricate Superfluid Staking work.

What are your tips on the tug of conflict between CeFi and DeFi?

There’s a time and a plight for every to co-exist, nonetheless within the waste, this speculative on line casino sport will act because the Malicious program that ushers within the original decentralized monetary device of the prolonged flee.

For now, CeFi is tall for offering fiat onramps into DeFi, nonetheless once the switch has flipped and the majority of mainstream customers hang been onboarded into DeFi, then that’s must you know we’re working in this original DeFi paradigm and relegating Wall St and central exchanges to relics of history.

Would possibly well presumably well you say the Cosmos ecosystem’s developer project?

Thanks to Osmosis offering the utility that the Cosmos ecosystem wanted, the total Internet of Blockchains has exploded in growth real this summer season. Nonetheless even sooner than this growth, the Cosmos ecosystem model strategy used to be repeatedly about prioritizing offering the final word tools with developer ergonomics at high of mind, which is presumably why so many projects picked up the Cosmos stack to deploy their appchains.

With Osmosis breaking launch liquidity rails for the total ecosystem, it extra incentivizes builders to fabricate all one of many most realistic ways by device of the Cosmoverse. You may even conceive of Osmosis as another dev instrument that solves the reveal of exchange listings for the prolonged tail of Cosmos appchains.

Soon, with Confio, the team that developed CosmWasm, adding their orderly contracting solution to Osmosis, this would well allow a brand original host of builders to attain abet with out problems manufacture within the ecosystem and manufacture complementary products and original aspects to the Osmosis platform.

Would possibly well presumably well you say the AMM/DEX evolution, and one of many most realistic ways you survey Osmosis fitting within the DeFi history books?

Computerized market makers hang been an captivating theory talked about in tutorial circles for many years, and the theory used to be first launched to the crypto group by the Gnosis team who proposed developing an automatic market-making orderly contract for prediction market shares the usage of the LSMR algorithm created by Robin Hanson.

Whereas one of the important most earlier designs garnered dialogue and pastime, the main team to construct on developing a working building of the theory and bringing it to market used to be Bancor. By taking the recordsdata within the abet of bonding curves, and mixing them to fabricate a market-making mechanism that may perhaps moreover be weak to commerce a orderly diversity of sources, no longer real bespoke ones.

Uniswap then came along and constructed a noteworthy more uncomplicated and cheap solution, by as a exchange of the usage of bonding curves, weak the infamous x*y=okay algorithm (aka constant product) to present plight pricing for sources. The efficiency and ease of Uniswap propelled it to turn out to be one among the largest DeFi protocols.

The adopted Balancer and Curve, which every expanded upon the model created by Uniswap by editing the curves. Curve modified the constant product algorithm to develop what’s known as the constant sum algorithm, to develop an AMM specialised in buying and selling stablecoins and other care for-sources. Meanwhile, Balancer took the easy x*y=okay algo and figure out fabricate it multi-dimensional i.e. x*y*z=okay

Osmosis is working to extra develop the develop field of AMMs with an complete reimagining of them.

As an different of thinking of reasoning about AMM’s by their constraints (e.g. Uniswap XY=Good ample), we should silent plight them by their LP payoff curves. (As is weak in a variety of the ACE papers =p)

The zero price payoff curves hang very insightful geometric interpretations.

— Dev (@valardragon) November 25, 2021

This would possibly well perhaps moreover allow the introduction of original AMM varieties, for primitives such as index fund pools and leverage pools, which completely hedge impermanent loss. Also, due to this of Osmosis is its have blockchain, it is miles device extra with out problems modified and updated than an app constructed atop a blockchain care for Ethereum.

As an illustration, the Osmosis Labs team is engaged on an update to the core layer of the Osmosis blockchain in elaborate to encrypt the MemPool, the place transactions are queued up sooner than being added to original blocks on the chain. This privateness improve will discontinuance attacks care for frontrunning which hang plagued other Dexes.

Within the interchain framework, it is miles moreover most likely to glue any selection of blockchains to Osmosis the usage of the Tendermint consensus mechanism, which strategy that the tokens accessible on Osmosis may perhaps moreover no longer be minute to, grunt, ERC tokens. A bridge between Osmosis and Ethereum is the main slated to be constructed, and others are within the works for the prolonged flee.

Does the customizability of launching a pool on Osmosis launch LPs to extra threats (rug pulls, etc)? If no longer, how so?

Any device that’s on the decentralized/launch/permissionless aspect of the spectrum tends to generate tons of innovation, meaning a greater magnitude of experimentation occurs. Gorgeous as within the DeFi summer season of 2020, or even the dotcom bubble, there’ll be tons of illegitimate projects, ponzis, and unbiased correct-wanting noteworthy every other money dangle you may perhaps well deem of. It is natural to survey projects that in truth dangle price flourish and separate themselves from the pack over time.

Along side tokens to Osmosis is permissionless, and so it’s important for the group to fabricate tooling and tutorial materials to again customers to due diligence and fabricate safe choices. The growth groups make contributions to this by developing requirements care for Assetlists to again fragment recordsdata on sources, while the Osmosis DAO has created a Team Toughen DAO that helps develop materials and doctors to educate customers.

What makes a liquidity pool most enticing on Osmosis? If I’m a huge LP, how can I develop my pool the final word?

On the total, the APR is the main thing osmosis natives are attracted to, as we hang viewed a variety of the liquidity chasing the greater-yielding pools since originate. On moderate, a variety of the pools hang remained above 100% APR since their inception. This yield is derived from the osmosis day-to-day-epoch inflation that subsidizes LP rewards and delegators that validate the chain. Osmosis has popularized the pattern of matched external incentives.

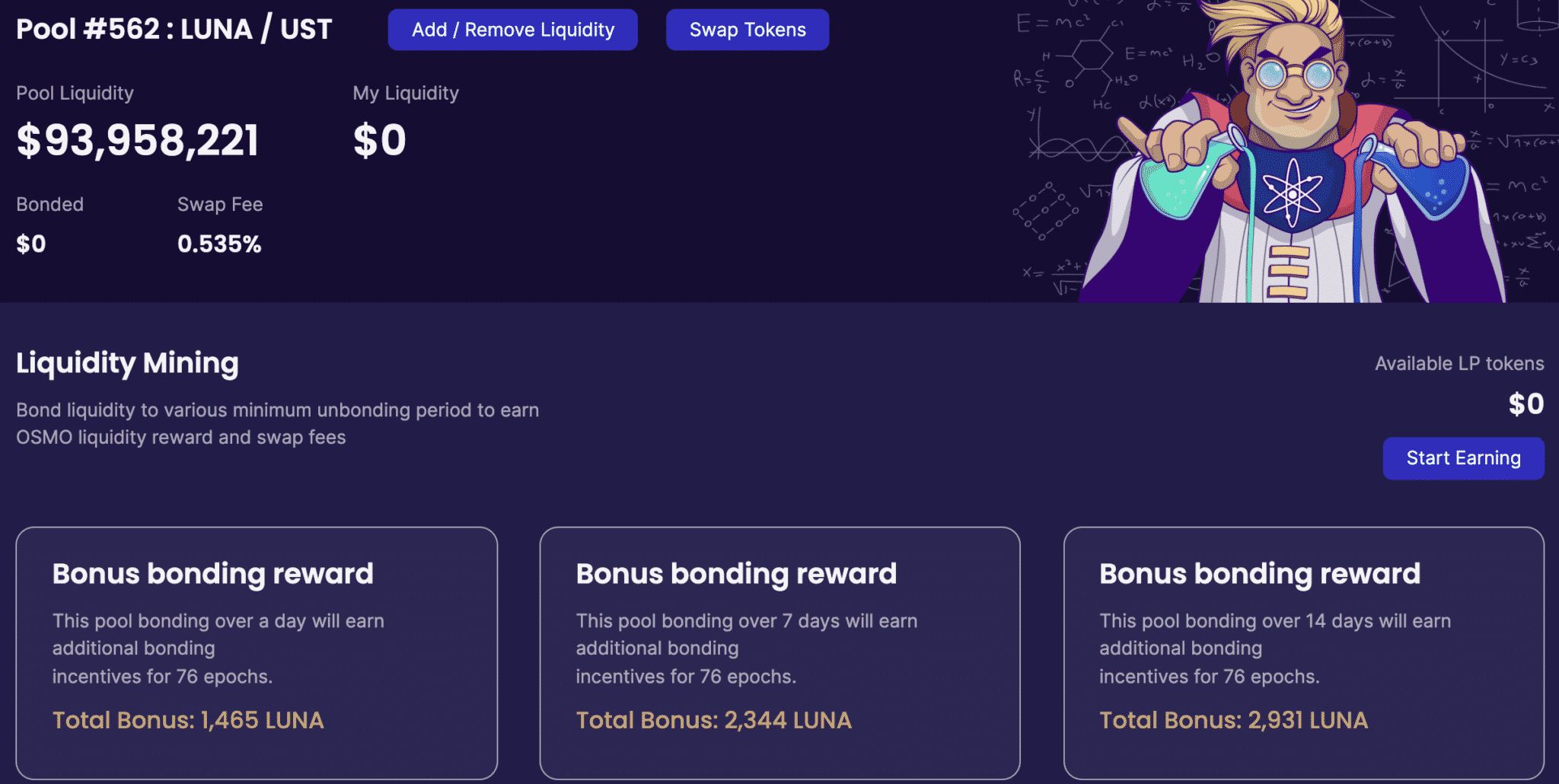

Snatch the LUNA/UST pool, shall we grunt; it earns OSMO day-to-day epoch rewards, swap prices, and LUNA rewards for the reason that Terra group voted to examine OSMO incentives on the UST pools. These ‘triple incentive’ pools hang attracted a worthy amount of the liquidity on Osmosis and hang confirmed profitable in bootstrapping temporary liquidity.

The LUNA/UST pool on Osmosis

How are LPs protected against attainable malicious governance attacks?

Osmosis is governed by staked $OSMO token holders, who’re prolonged-time length incentivized to survey the platform grow. With the introduction of superfluid staking, LPs will be represented within the staked station, and thus will be ready to vote in governance proposals, thus being ready to signify their interests and provide protection to against misaligned incentives.

What are your tips on liquidity supplier mercenaries, the place LPs circulation from pool to pool looking for the final word yields, generally to the alarm of the pool they leave?

Many AMMs are littered with temporary mercenary farming, wherein liquidity suppliers snappy eradicate away and add abet liquidity from pools in pursuit of the final word yields. AMMs infrequently help this device of farming by device of “vampire attacks,” wherein a protocol gives special incentives to liquidity suppliers from other protocols for migrating their liquidity over.

If ample LPs are undertaking temporary yield programs, it’ll motive extreme disruption to the quality of the AMM. Liquidity inside pools becomes unstable, resulting in an inconsistent and unreliable buying and selling abilities for customers.

As an different, with Osmosis we are eager to fabricate a platform conducive to Prolonged-Time-frame Liquidity. Osmosis reduces temporary farming by technique of a tool of Bonded Liquidity Gauges.

Bonded Liquidity Gauges are mechanisms for distributing liquidity incentives to LP tokens which hang been bonded for a minimal amount of time. 45% of the day-to-day issuance of OSMO goes towards these liquidity incentives.

Osmosis customers can eradicate to bond their LP tokens after depositing liquidity. The same to OSMO staking, LP tokens stay bonded for a particular size of time, excluding customers are allowed to eradicate the scale of their very have unbonding length. Staking requires a two-week unbonding length.

This encourages the prolonged-time length locking of liquidity and helps discontinuance issues care for vampire attacks.

Thanks, Sunny!

For extra recordsdata, folks can test out the Osmosis place at https://app.osmosis.zone/, or connect with Sunny by device of his personal web site.

For a deeper dive, we counsel going by device of the Cosmos SDK documentation, our guides on Cosmos, Osmosis, and liquidity pool fundamentals.