- Cryptocurrencies lend a hand growing in popularity

- Bitcoin’s tag dynamics changed with institutional traders’ adoption

- Bitcoin is now correlated with belongings in the dilapidated monetary market

Since digital currencies exist, the alternate superior exponentially in a minute of more than a decade. Currently, more than 22,000 cryptocurrencies are half of one among essentially the most dynamic markets on the earth.

The giant more than just a few of currencies brings about a challenges to traders and traders. First, crypto exchanges receive it complex to checklist all cryptocurrencies; thus, traders might maybe maybe well moreover accelerate away out some opportunities.

Second, many initiatives in the crypto space failed. Statistics whisper that 9 in ten blockchain initiatives will fail.

For example, in 2023 on my own, 83 coins disappeared for quite lots of reasons, equivalent to failing ICO, no cause, scams, or they’d no quantity.

Therefore, to stay a ways from being caught in initiatives doomed to fail or to be scammed, many traders desire cryptocurrencies with a gigantic market capitalization and neatly-established in the investing neighborhood. In other phrases, if a cryptocurrency becomes half of institutional traders’ portfolios, the possibilities are that this might maybe maybe peaceful exist in the medium and prolonged timeframe.

Bitcoin is such a digital currency.

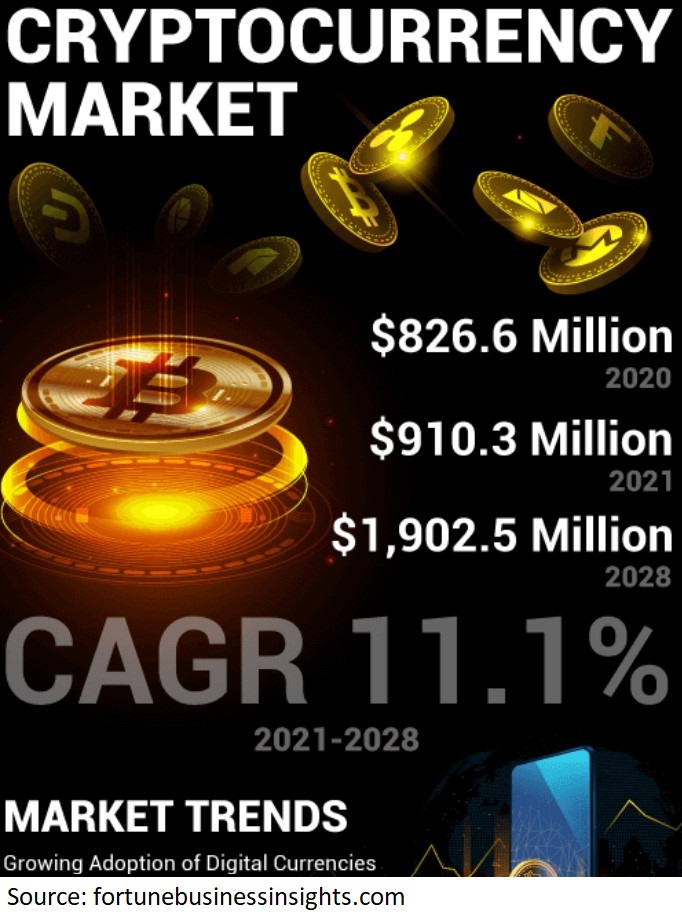

Bitcoin’s dynamics changed with the growing adoption of digital currencies

As the investing neighborhood embraced digital currencies, Bitcoin turned into half of more and more institutional traders’ portfolios.

However the adoption came with some costs.

Grab the chart above. It shows Bitcoin’s tag evolution since its inception.

When it first traded above $1,000, Bitcoin caught every person’s consideration. Then, when it reached $20,000 for the predominant time, every person talked about a bubble.

So solid used to be the resistance level that it took Bitcoin about a years to overcome it. Respecting the interchangeability theory, resistance has turn into toughen now now not too prolonged ago.

But such big strikes are now now not liable to be viewed in the long term. Because Bitcoin’s correlation to dilapidated monetary markets elevated, it is now now not actually for the associated rate to triple or double without the same strikes in other places.

Summing up, Bitcoin might maybe maybe well moreover be a comely investment for the prolonged timeframe, however the rising adoption of cryptocurrencies will make it more and more complex for the associated rate to stream the technique it did sooner than.