Whenever you happen to’re wondering whether your tiny replace ought to accept cryptocurrency, peep no additional- we’ll scoot you via the pros and cons. By the stay of this article, you’ll be ready to confidently salvage the call on whether or not accepting crypto is correct for your replace. Accepting cryptocurrency as a tiny replace comes with a ramification of advantages alongside with:

- Attracting clients who exhaust crypto.

- Preserving your replace from positive fraud.

- Potentially establishing an revolutionary belief for your mark.

With these advantages in thoughts, it’s no surprise that 36% of US-basically basically based tiny and medium-sized enterprises (SMEs) accept cryptocurrency as a rate. Out of the corporations accepting cryptocurrency, 47% include been in replace for decrease than 5 years, and 21% include been round for over two decades. However what can it attain for your tiny replace?

Whenever you happen to’re wondering whether your tiny replace ought to accept cryptocurrency, peep no additional– we’ll scoot you via the pros and cons. By the stay of this article, you’ll be ready to confidently salvage the call on whether or not accepting crypto is correct for your replace.

What Is Cryptocurrency?

Cryptocurrency is a big term referring to a style of replace that makes exhaust of blockchain technology. Cryptocurrency is decentralized in nature, that manner that somewhat than being managed by a central monetary institution or govt, investors will switch funds without delay to sellers with out a intermediary.

Being decentralized furthermore adjustments the manner cryptocurrency is saved. In a dilapidated monetary market, the forex is held by a firm (on the total a monetary institution) to safeguard it. When making transactions with cryptocurrency, americans are required to store their very like crypto in a non-public wallet.

Pockets choices consist of centralized exchanges corresponding to Binance and Coinbase, or decentralized extensions corresponding to MetaMask. Bodily hardware wallets corresponding to Trezor and Ledger are furthermore huge choices and very much more stable than their digital picks.

For replace owners, cryptocurrency is a brand novel rate manner that would also furthermore be converted into fiat or feeble for investments. It gives clients a brand novel rate choice, and enables for easy snide-country payments.

What Agencies Exercise Crypto?

Even supposing these corporations made headlines after they permitted crypto payments, an estimated 15,174 agencies of all sizes worldwide accept Bitcoin on my own, making over 328,370 Bitcoin transactions daily. This quantity continues to develop yearly, with each investors and replace owners slowly accepting cryptocurrency as a legit manner of transaction.

So what advantages advance from accepting cryptocurrency?

Advantages of Cryptocurrency For SMEs

As cryptocurrency technology continues to innovate, accepting crypto has quite a lot of benefits over dilapidated point-of-sale (POS) systems.

Decrease Transaction Fees

As a replace owner you know how frustrating charges might also furthermore be. A veteran 2-4% rate might also not appear love mighty, but when you happen to might even include transaction volumes in the thousands, it’ll hasty add up.

Reckoning on the cryptocurrency permitted, crypto can decrease charges from 2+% to decrease than 1% per transaction. To illustrate, rate supplier BitPay costs charges of 1% per transaction.

Extra Safety

Did you have in mind the truth that round 80% of all chargebacks are proven to be counterfeit? Attributable to cryptocurrencies’ decentralized nature, retailers are stable from counterfeit chargebacks. A lot love cash payments, all payments are last as they’ll’t be managed by a third celebration.

Elevated Price Convenience

Crypto payments enable tiny agencies to accept payments from investors who might also not otherwise be ready to pay for his or her products. To illustrate, crypto payments are more accessible for parents in international locations the set making a fiat transaction might well well be too costly or the course of too inconvenient. This opens up a brand novel market of clients that might well well otherwise be locked out due to the monetary boundaries.

Disadvantages of Cryptocurrency For SMEs

Irrespective of its many advantages, cryptocurrency doesn’t advance with out downsides. Right here are one of the most most disadvantages of accepting cryptocurrency.

Technical Barriers

Technical boundaries are with out a doubt one of many largest factors slowing down cryptocurrency adoption. Irrespective of its advantages, there’s somewhat a steep discovering out curve in relation to using cryptocurrency. For those unaccustomed to digital payments, right here’s not most effective daunting but a full roadblock.

To launch with cryptocurrency, a replace owner must space up a digital wallet on a cryptocurrency replace. From there, they include to combine their wallet with their store to accept payments. This course of is a little tricky first and main set, and also it is most likely you’ll well favor to set in the time to learn it sooner than accepting crypto payments.

Law Uncertainty

The decentralized nature of cryptocurrency is seen as a income to many, but it absolutely has drawbacks. In point of fact, cryptocurrency has advance below scrutiny in the regulatory landscape, the set lawmakers want to manipulate it.

Now, this might also peep love a factual element for replace owners. Extra regulation manner more protection, precise? The plot back is that novel rules furthermore imply more uncertainty for the future. What might also very properly be an acceptable apply now might also very properly be problematic in 5 years. Right here’s exacerbated by the taxation rules on cryptocurrency, that are already extraordinarily complex due to the cryptocurrency being a somewhat novel belief.

Cryptocurrency Volatility

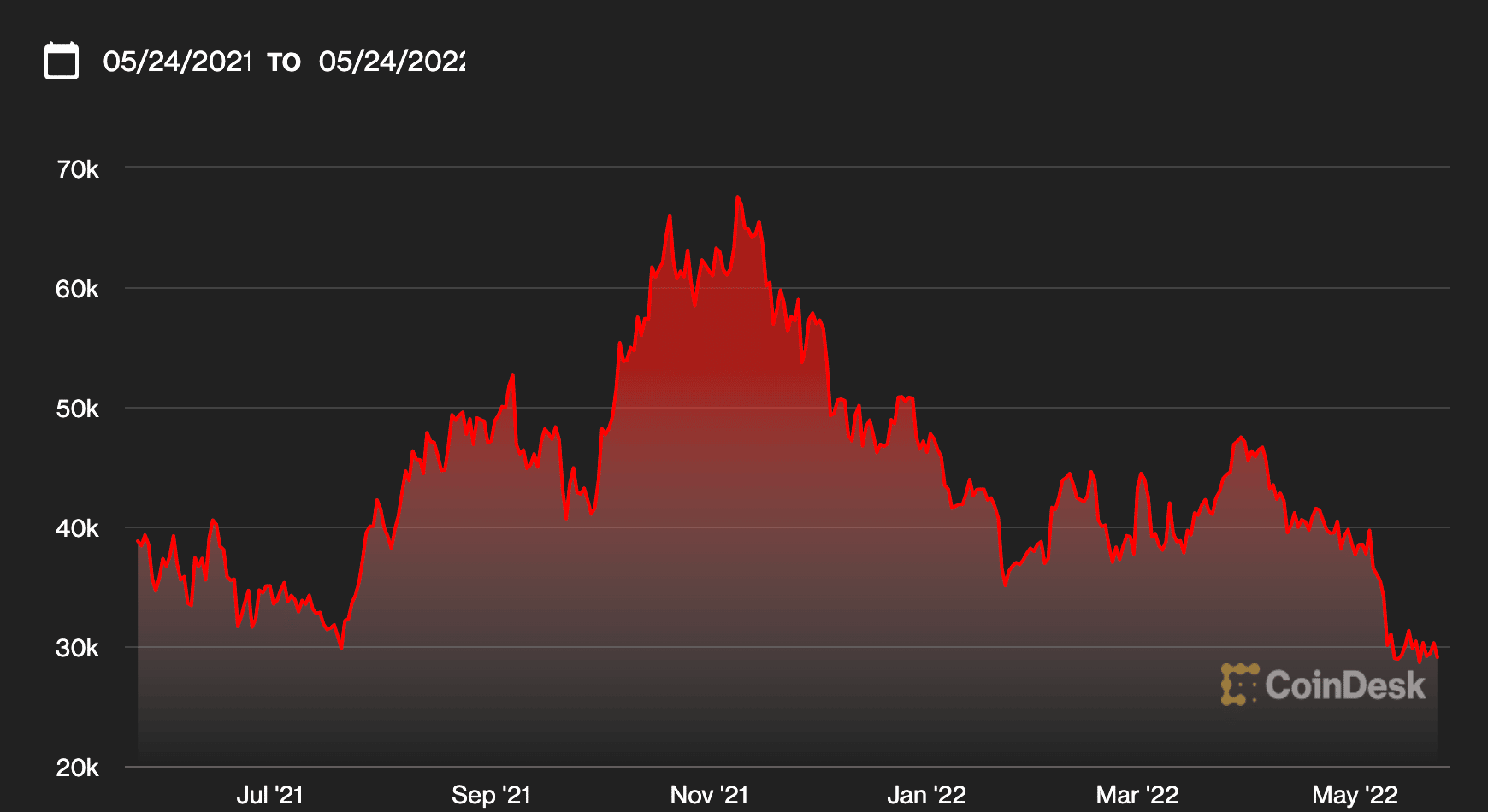

Image this: You urge a store that sells TV’s. In the morning, you promote a high-of-the-line TV for 0.1 Bitcoin. On the time of sale, Bitcoin became price $60,000. You celebrate and take the break day. The next day Bitcoin is price $40,000. Your transaction misplaced 33% of its rate in a single day. Celebrations are over.

Right here’s a hypothetical be troubled, but cryptocurrency fluctuations are extraordinarily overall. In 2021 on my own Bitcoin reached highs of $65,000 and lows of $30,000 per coin. This makes it vital for replace owners to mark their products, but furthermore manner they’ll favor to switch their cryptocurrency into a more stable alternative hasty and on a typical foundation.

Companies are readily accessible on BitPay and Coinbase that in an instant replace cryptocurrency according to the cryptocurrency’s most modern cash rate. Even supposing this somewhat solves the subject of volatility, it removes choices for replace owners who want to help their cryptocurrency for investments.

Safety Concerns

As with every novel technology, cryptocurrency comes with a alternative of security risks. In inequity to fiat currencies such because the U.S. dollar, cryptocurrencies can’t be insured. This diagram that if cyber criminals hack a particular person’s wallet, they’d not include any manner of being compensated.

However, advancements are being made to toughen crypto security. To illustrate, Coinbase holds decrease than 2% of a buyer’s digital forex online, and all accounts are stable by FDIC insurance. This covers as much as $250,000 in losses if Coinbase is hacked.

This sounds huge, but it absolutely doesn’t duvet non-public wallet assaults. This makes it a particular person’s responsibility to offer protection to their non-public yarn and makes them utterly liable for any hacks.

How You Can Find Cryptocurrency

Whenever you happen to’ve finished your analysis and judge cryptocurrency payments are a factual choice for your replace, there are a few steps fervent to launch.

The course of is analogous to establishing a brand novel yarn with your monetary institution, with cryptocurrency terms changing your dilapidated monetary jargon.

The first element you’ll favor to attain is convey easy suggestions to accept payments. You’d even include got two choices:

- Utilizing a rate processor

- Accepting manual payments

Utilizing a rate processor is basically one of the most suitable choice when you happen to would not include any old crypto trip. Integrating with a rate processor is a easy setup course of that incorporates platform support choices when you happen to urge into any concerns. PayPal and BitPay are huge choices for this.

Whenever you happen to favor to favor to manipulate the payments your self, the course of is a little more complex. You’ll favor to launch by establishing a wallet on a cryptocurrency replace corresponding to Coinbase.

You’d also attain this by signing up for an yarn. Coinbase will then salvage a wallet for you that would also furthermore be feeble by clients to send payments. From right here, you’ll favor to add a cryptocurrency rate characteristic to your online page. Right here’s on the total in the design of a QR code.

As soon as a crypto rate has been made, you’ll favor to withdraw it. You’d also attain this by arresting it to one other cryptocurrency wallet corresponding to MetaMask when you happen to ought to favor to help your crypto, or by transferring your crypto to your monetary institution yarn via an replace for fiat.

Is Cryptocurrency The Future For Dinky Agencies?

As with every replace decision, it’s well-known to include in thoughts your replace mannequin, goals, and buyer defective sooner than accepting crypto, making positive it’s helpful for your replace.

In precisely a decade, the cryptocurrency industry has flourished with positive aspects that might well well revolutionize quite a lot of global industries; and it is going to resolve quite a lot of help-room inefficiencies for tiny agencies.

First and main look, the cryptocurrency appears to be a promising choice for each tiny agencies and their clients. Elevated corporations include proven that crypto payments might also furthermore be made safely and more are adopting crypto payments daily.

For tiny agencies, it could well well well also furthermore be feeble to decrease charges, toughen protection from fraud with the blockchain’s last settlement, and magnify the accessibility of companies international, all of which toughen the effectivity of your day after day operations. As technology continues to salvage, these advantages will proceed to develop.

However, accepting cryptocurrency has some drawbacks. For one, regulatory uncertainty and rate volatility might well well dissuade a tiny replace owner from making accepting crypto a core portion of its replace.

However, with ample analysis replace owners can put into effect cryptocurrency with out having to take too mighty risk. Because the market continues to develop and provider provider protections are applied, cryptocurrency is looking love a promising choice for replace owners.