Disclaimer: That is a Press Delivery equipped by a third occasion who’s guilty for the declare. Please habits your possess evaluate sooner than taking any action per the declare.

Read our Selling Pointers Here

The crypto market remains to be reeling from the record-breaking $19 billion liquidation event. This flash shatter had analysts calling it a “controlled deleveraging”. On the assorted hand, furious traders are pointing the finger at market makers for orchestrating the chaos.

This event has thrown the PEPE rate prediction into disarray, serving as a reminder of the market’s volatility. For investors, this moment of crude alarm is moreover a moment of crude substitute. The shatter has created a uncommon nick rate window, and dapper cash is purchasing for property cherish DeepSnitch AI which will most likely be built to thrive on this real ambiance.

The $19 billion shatter: A coordinated assault or a healthy reset?

Delivery curiosity on decentralized exchanges decreased from $26 billion to below $14 billion, wiping out billions in leveraged positions. The fallout was big, with crypto lending protocols seeing record-breaking rate surges as the system strained below stress.

Some analysts argue it was an organic and mandatory deleveraging. A violent nonetheless indirectly healthy reset for an over-extended market. They gift the pure traipse with the circulation of capital as the principle driver.

Then again, a rising preference of traders and on-chain researchers are telling a assorted story. They snarl that market makers deliberately created a “liquidity vacuum” to deepen the correction. By pulling their bids and asks from the repeat books at a vital moment, they allegedly exacerbated the promote-off. This brought on a cascade of liquidations that don’t desire in every other case occurred.

As one excellent observer illustrious, key market makers “pulled all the pieces from the books” at the pause of the shatter, only to near assist hours later once the injure was done.

Top crypto picks: PEPE Coin prediction falters, as investors safe DeepSnitch AI

DeepSnitch AI: The particular purchase after the $19 billion shatter

The $19 billion crypto shatter was a present for loads of. It created the one only hunting for substitute of the one year, allowing dapper investors to safe excessive-seemingly property whereas the leisure of the market panics. DeepSnitch AI, with its presale rate protected from the chaos, is the prime beneficiary of this moment.

That is your likelihood to safe the dip on an asset with explosive upside sooner than the inevitable market recovery begins. DeepSnitch AI is perfectly positioned as a “meme coin with utility,” the final crossover asset for the following bull lumber.

Moreover, there’s a mighty community-first account of “snitching on whales” that can rally retail traders who are drained of being manipulated. That is combined with the classic meme coin system: a low-rate entry level throughout the presale that offers the aptitude for outsized, triple-digit returns.

However unlike its predecessors, this mission is being built with a mighty engine. The upcoming SnitchFeed feature could be the community’s valuable weapon. It’s an intelligence dashboard designed to bellow whale actions and market manipulation in true time. It’s the applying that turns the meme into a reality.

Moreover, DeepSnitch AI’s staking program offers a map to reward the community for its long-time length vision. This fresh combo of viral branding and gleaming utility is why it has the aptitude to outperform both pure hype coins cherish PEPE and intricate AI tokens.

Pepe rate prediction

The PEPE rate prediction has taken a severe hit following the market-wide liquidation. The token has decreased by over 26% within the closing seven days, massively underperforming both the crypto market and its peers within the Ethereum ecosystem. This spirited decline has pushed its 14-day RSI down against oversold territory. It confirms the overwhelmingly Bearish sentiment surrounding the coin.

It’s trading under both its 50-day and 200-day engaging averages. The PEPE rate chart isn’t having a discover ideal for momentary holders. Moreover, its Anxiety & Greed Index is currently showing “Anxiety” due to community’s terror following the shatter. PEPE was tormented by the latest market volatility, with a technical forecast now predicting a extra 24% fall by next one year.

It’s trading under both its 50-day and 200-day engaging averages. The PEPE rate chart isn’t having a discover ideal for momentary holders. Moreover, its Anxiety & Greed Index is currently showing “Anxiety” due to community’s terror following the shatter. PEPE was tormented by the latest market volatility, with a technical forecast now predicting a extra 24% fall by next one year.

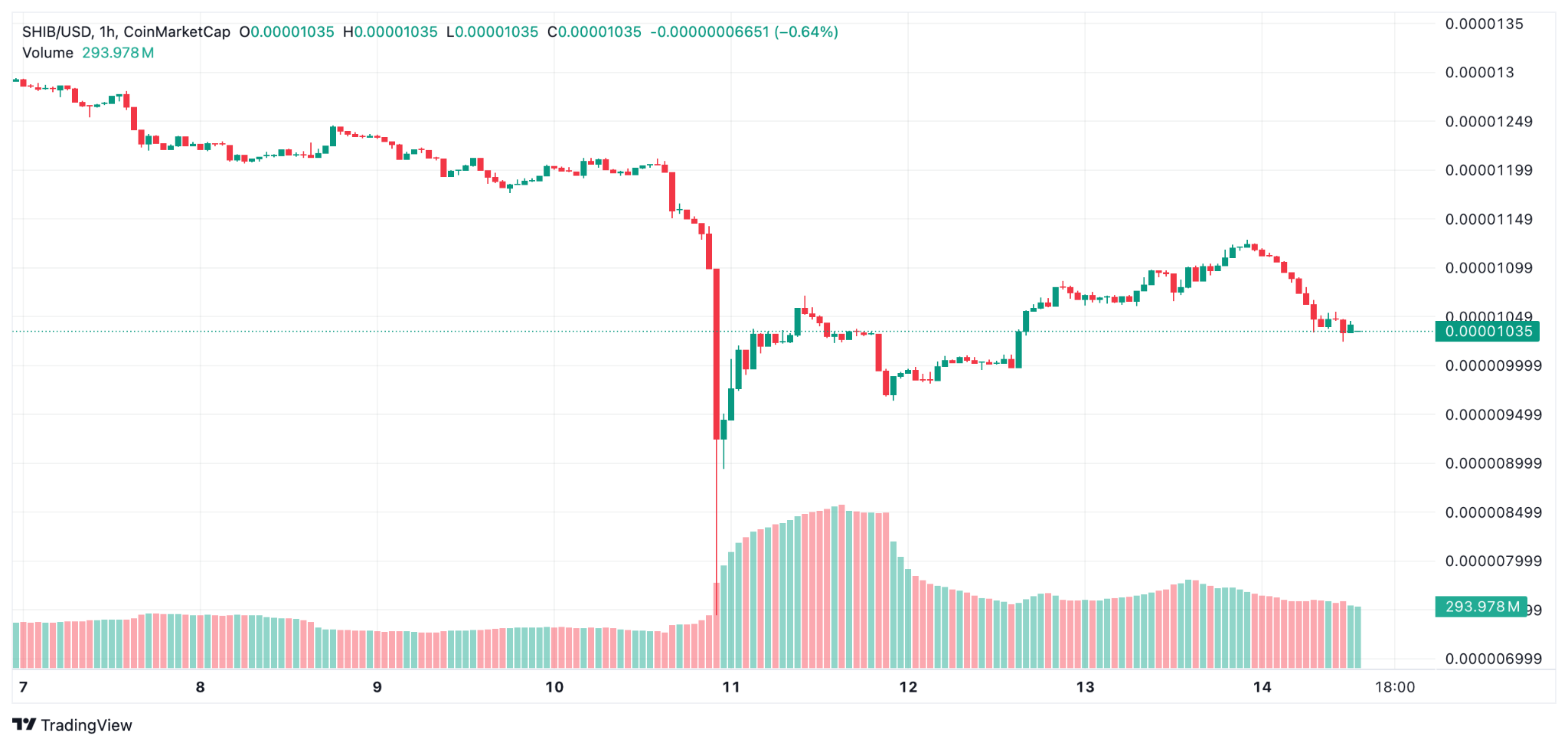

Shiba Inu market efficiency

Shiba Inu has moreover been hit laborious by the market downturn, underperforming with a 17% decline over the previous week. Relish PEPE, the sentiment is Bearish, and the Anxiety & Greed Index is showing “Anxiety.” It’s moreover trading under its key long-time length engaging averages, a classic bearish signal for technical traders.

Then again, a spicy on-chain style offers a counter-account. As of October thirteenth, a big 408 billion SHIB tokens had been moved off exchanges. That is a vital event. Gigantic outflows cherish this in general demonstrate that tokens are being moved into inside most wallets for long-time length holding, now now not for selling.

Then again, a spicy on-chain style offers a counter-account. As of October thirteenth, a big 408 billion SHIB tokens had been moved off exchanges. That is a vital event. Gigantic outflows cherish this in general demonstrate that tokens are being moved into inside most wallets for long-time length holding, now now not for selling.

Closing verdict

The $19 billion shatter created chaos, nonetheless it absolutely moreover created readability. It uncovered the market’s vulnerabilities and showed each and every crypto user why they need an edge. That chaos is your substitute.

DeepSnitch AI offers the becoming mixture of viral meme energy and vital utility, all readily available ideal now at a small presale rate. That is your likelihood to behave whereas others are frozen in alarm. Many are already hunting for the dip in preparation for the bullish months of November and December.

Visit the legit DeepSnitch AI internet situation to stable your quandary sooner than the market wakes up.

FAQs

FAQs

What’s the PEPE forecast after the market shatter?

The PEPE coin prediction has turned bearish within the immediate time length. The most fresh shatter has damaged the market construction, and technical indicators counsel a seemingly for added downside.

How can I interpret the PEPE rate chart?

The fresh PEPE rate chart shows the token is in a clear downtrend. It’s trading under its key 50-day and 200-day engaging averages. The 14-day RSI is low, indicating selling stress. Merchants would on the total notice a break assist above these engaging averages as a signal of a seemingly pattern reversal.

What makes DeepSnitch AI a “meme coin with utility”?

DeepSnitch AI is steadily known as a “meme coin with utility” because it combines viral branding with the gleaming instruments of a utility token. Its upcoming SnitchFeed feature is being built to invent true, actionable knowledge to traders.

How does staking attend a mission cherish DeepSnitch AI?

The staking program rewards community members for holding the token within the long time length. By locking up their tokens, they attend decrease the readily available present on the market.

Disclaimer: This media platform offers the declare of this article on an “as-is” basis, with out any warranties or representations of any model, reveal or implied. We deem no duty for any inaccuracies, errors, or omissions. We present out now now not deem any duty or liability for the accuracy, declare, images, movies, licenses, completeness, legality, or reliability of the knowledge presented herein. Any issues, complaints, or copyright complications connected to this article desires to be directed to the declare supplier talked about above. Read our Selling Pointers Here.