A quant has identified some similarities between the most modern and summer season 2020 Bitcoin markets by on-chain recordsdata.

Bitcoin Replace Provide Shock Ratio Has Suddenly Risen Lately

As outlined by an analyst in a CryptoQuant post, there seem like some similarities between the most modern market trend and that throughout the summer season of 2020.

The “exchange provide” is a hallmark that measures the total quantity of Bitcoin show on wallets of all exchanges.

This provide is at all times assumed to be the selling provide of the crypto as investors most incessantly switch their coins to exchanges for selling purposes.

The provide in cold wallets of investors, on the different hand, is likely being held for accumulation, and is now no longer going to be sold.

The ratio between this investor wallet provide and the exchange reserve is called the “exchange provide shock ratio.”

When the value of this metric goes up, it methodology the provision on exchanges is losing and investors are filling up their cold wallets.

Linked Reading | Bitcoin Futures Foundation Nears One-twelve months Lows, How Will This Have an effect on BTC?

On the different hand, a downtrend suggests a push to sell from sellers as they deposit their Bitcoin to centralized exchanges.

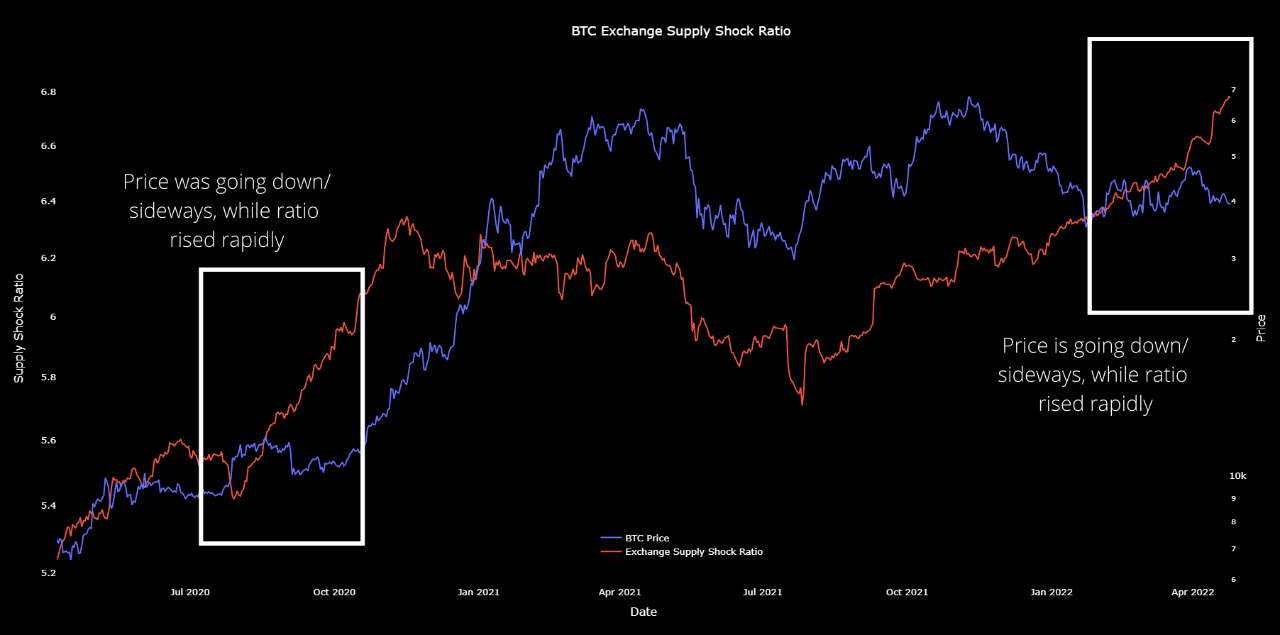

Now, right here’s a chart that reveals the trend in the BTC exchange provide shock ratio over the last couple of years:

The value of the indicator appears to be like to had been on the upward push honest as of late | Source: CryptoQuant

Within the above graph, the quant has marked the relevant developments of similarity between the Bitcoin markets of summer season of 2020 and of correct now.

It appears esteem throughout both the sessions, the value used to be trending down or transferring sideways, while the exchange provide shock ratio had been without observe going up.

Linked Reading | Institutional Investors Bearish On Bitcoin, Ethereum. Here’s What They’re Wanting for

No topic the struggling price for the time being, investors absorb confirmed demand for the crypto as they’ve been without observe accumulating honest as of late (equal to wait on then).

What followed a few months after the summer season of 2020 used to be the initiating of a brand fresh Bitcoin bull bustle as a result of the resulting “provide shock.”

The BTC price is carefully tied to the stock market currently, and the analyst believes it’s seemingly that once it decouples, a equal shock is vulnerable to be there this time as successfully.

BTC Tag

At the time of writing, Bitcoin’s price is trading around $39.8k, down 7% in the past week. Over the remainder month, the crypto has lost 15% in value.

The below chart reveals the trend in the value of the coin over the last five days.

The value of the crypto appears to be progressively climbing wait on up after the drop down a few days in the past | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com