Regenerative Finance, or ReFi, is an experiment to create monetary incentives to intention down carbon emissions, “regenerate” the atmosphere and indirectly reverse climate change.

Sounds wild, huh?

However, here’s the crazier fragment—it’ll genuinely work.

The next files to ReFi isn’t a vaporware pitch or a ploy to promote you a ineffective token. This ReFi files’s aim is to power awareness into how this niche, but snappily-rising sector could perchance additionally unbiased impact one of the most key infrastructure and functions wished to kind a regenerative financial system vastly extra shining, and power obvious climate action.

By the end of this read, I hope you, too, was optimistic relating to the flexibility of crypto to kind a dent in climate change.

A little bit of about me, my name is Nihar Neelakanti, Co-founder and CEO of Ecosapiens, a metaverse enabling patrons to fight climate change. Our alpha product is the area’s first carbon-backed NFT.

Let’s delivery firstly.

An Introduction to Regenerative Finance

Fossil fuels gain a great deal of flack, but they’ve been an straight forward miracle for humanity. They’ve stimulated productiveness and industrialization that lifted billions of folks out of poverty, improved our total quality of lifestyles, and increased our longevity—amongst varied enhancements in the human condition.

On the opposite hand, the miracles introduced about by fossil fuels dangle attain with a label: carbon emissions released as a consequence of our financial exercise dangle straight resulted in the rise of global temperatures. These will enhance in temperatures harm all of us. The worst penalties of global temperature upward push consist of engulfing sea levels, human displacement, drought, floods, and an intensification of pure mess ups.

Just a few moonshot tips exist to attend mitigate and adapt to climate change, including thunder air carbon in discovering, fusion energy, and even the colonization of Mars.

Today time, we’re having a behold at something very much nearby—how crypto can

- incentivize the reduction of the global carbon footprint, and

- regenerate pure assets.

And no, this isn’t one other a form of “slap a blockchain sign on it and elevate cash” tips—the true execution here is captivating.

Take these examples:

- StepN, a web3 every day life app, has managed to shrink its customers’ carbon footprint by practically 6 million tonnes by incentivizing them to … rush extra.

- Gitcoin, the leading crypto-basically based entirely mostly, delivery source bounty platform, has created a channel for parents and organizations to deploy practically $65M USD in over 2,800 web3 for public items initiatives through quadratic funding.

- KlimaDAO has rallied its neighborhood to take in practically 18M tonnes of carbon credits, identical to taking 3.8 million vehicles off the boulevard for a twelve months.

Based in 2017, Gitcoin was once a pioneer in the dwelling, with the founder Kevin Owocki reasonably literally writing the e book on ReFi: Greenpilled: How Crypto Can Regenerate the World.

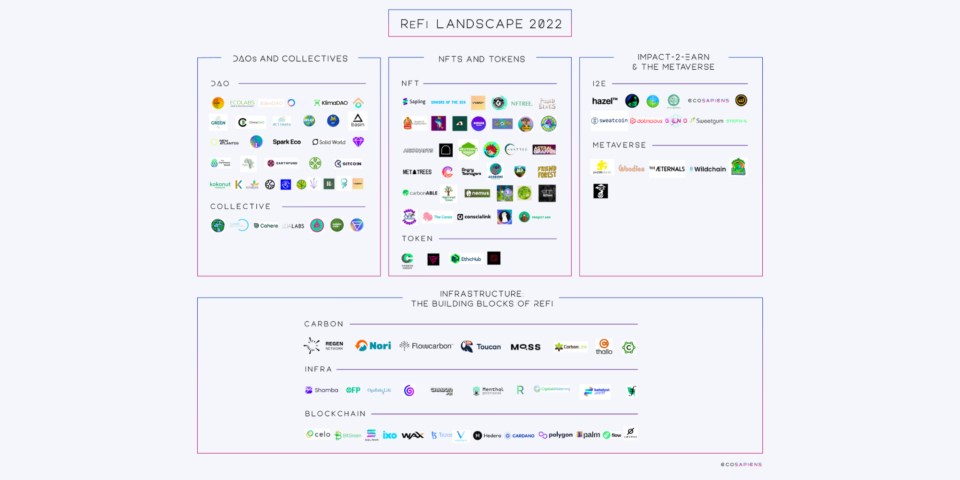

There are over 100 ReFi corporations this day, and the tempo continues to develop. Many famous challenge capital institutions similar to a16z and USV are actively investing in the category; contemporary funds treasure Allegory are centered exclusively on the intersection of crypto and climate.

Industrial Financial Theory: A Legend of Extraction

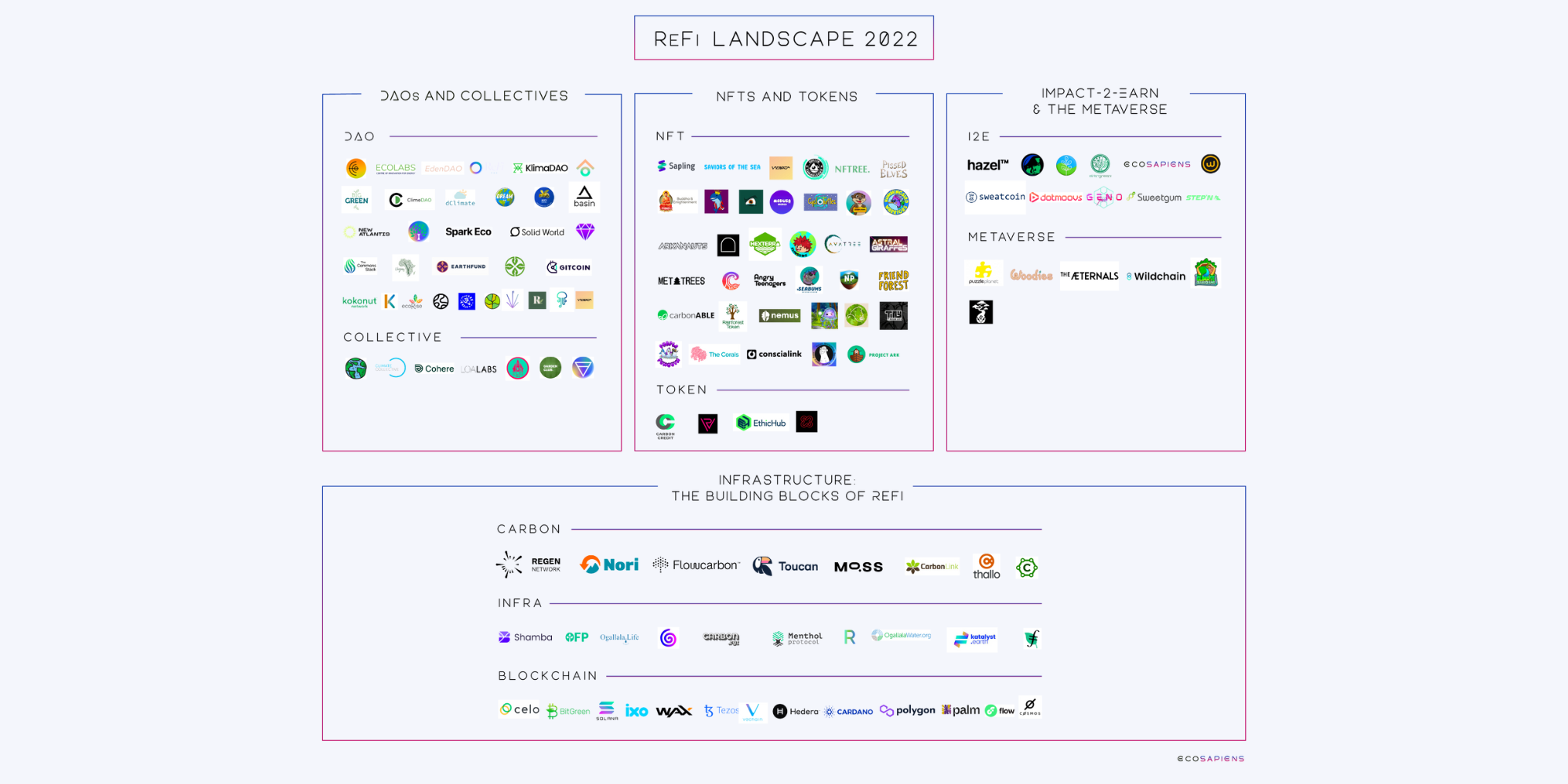

The utilization of pure assets is elementary to constructing an financial system.

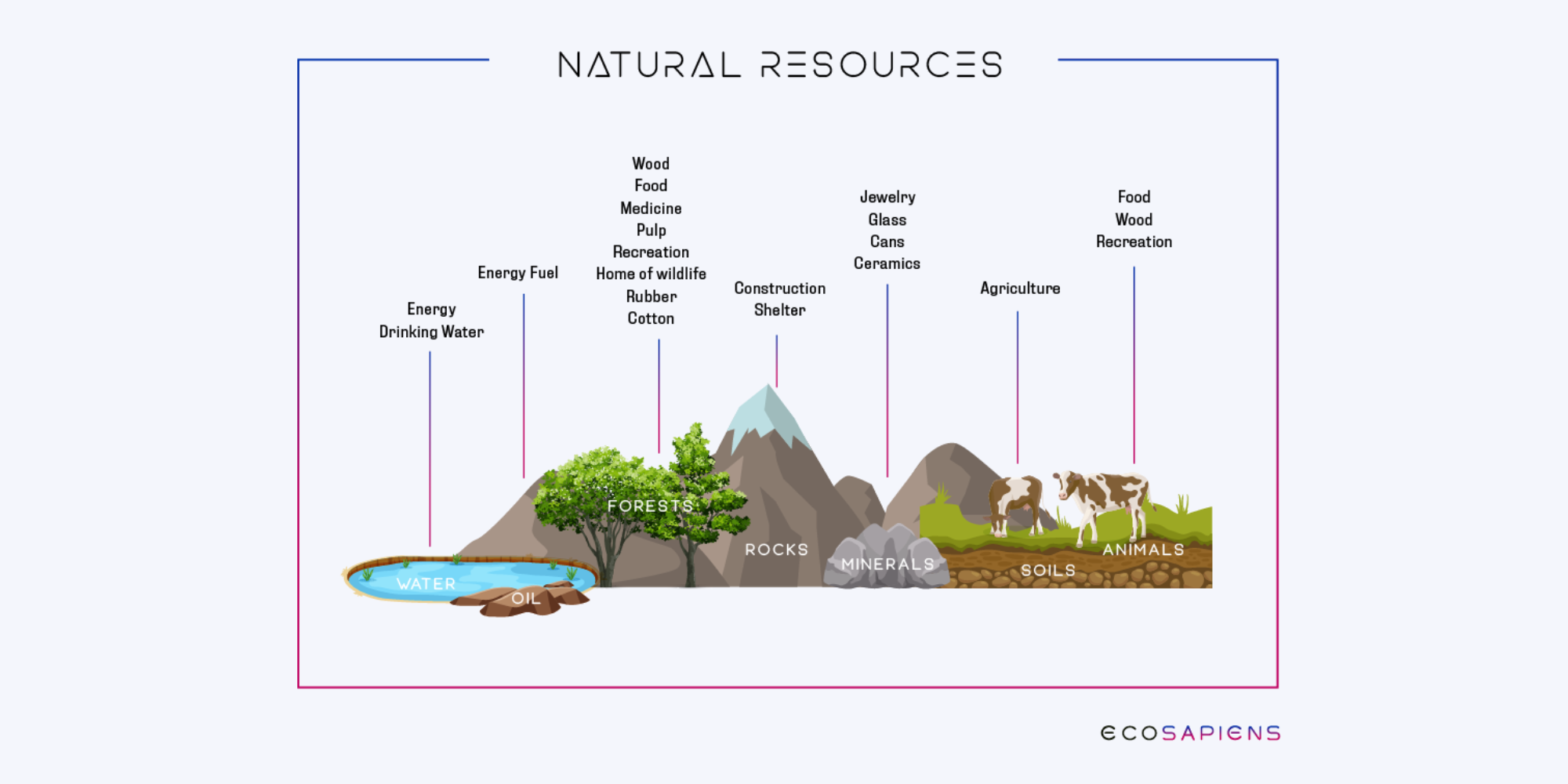

Per the components of production financial mannequin, after we mix Land(pure assets), Labor, and Capital with Entrepreneurship, we gain Production (price advent). The fruits of production come economies and toughen productiveness and quality of lifestyles.

*Divulge: Accurate thru this text, capitalized “Land” refers to pure assets.

Extra assets mean faster financial enhance and, ideally, a better quality of lifestyles for each person.

Right here are about a examples of pure assets:

Whereas pure assets shall be replenished, overexploitation can consequence in a resource’s whole collapse. What happens when pure assets (“Land”), one of the most pillars of the components production, fade?

Now we dangle got two dichotomies to appear for humanity’s relationship with the atmosphere’s finite assets—Man vs. Man and Nature vs. Man.

Scenario 1: Man vs. Man

Veteran Greeks and Romans are one of the most earliest examples of scaled resource extraction.

“Forests equipped the vital topic materials for building and practically the splendid gas source of the classical world, and depletion of this source precipitated several crises,” masks J. Donald Hughes with J. V. Thirgood in “Deforestation, Erosion, and Woodland Administration in Veteran Greece and Rome,” Journal of Woodland History 26, no. 2 [April 1982], p. 60). “As forests retreated with land clearance, picket decreased in availability and increased in label, contributing to the ruinous inflation that plagued unhurried antiquity. Competitors for woodland assets ignited armed forces conflicts, creating bushes demands.”

Once a native resource has been depleted, civilizations delivery to explore elsewhere to fill up these assets, most steadily by increasing their empires thru trade or, worse yet, armed forces power.

On this instance, we examine Man competing with Man for extra assets.

Scenario 2: Nature vs. Man

After we exploit pure assets beyond their skill to regenerate, we are missing assets and shall be left with negative externalities that additional degrade society.

Investigate cross-check no additional than the Mayans for a historical warning. In the 9th century CE, the Mayan Empire was once one of the most prosperous civilizations in the area—then without warning, it was once gone. The easiest that it’s doubtless you’ll additionally specialize in of clarification for its mysterious disappearance is that it resulted from drought as a consequence of deforestation.

The Mayans transformed the land to withhold one of the most highest inhabitants densities in history. They removed practically the total woodland and replaced it with agricultural crops. … By slicing down the woodland, the Mayans changed their native climate. … Rainstorms grew to was much less overall. (NASA Earth Observatory, paras. 2–3)

Folk are experiencing the the same topic this day: the combustion of fossil fuels and exploitation of our forests and oceans consequence in negative externalities that impact human health and price our financial system an extra and extra enormous sum of money. On this contest between Man and Nature, Nature is defeating Man.

The industrial financial idea works completely when Land, Labor, and Capital are mumble, but the cycle of prosperity breaks when Land now no longer exists.

This draw is on the coronary heart of two steadily politicized tugs-of-war: Nature vs Man and Man vs Man.

To wreck the combative cycle of Man vs. Man (or Nature vs. Man) in our collective trudge to impact reasonably finite assets, we must create an financial plot where industrialists (capitalism maxis) are straight incentivized to toughen the planet and fill up pure assets.

Regenerative Finance: The utilization of Financial Motivation to Incentivize the Regeneration of Pure Sources

At its most basic stage, ReFi is the premise of appraising the cost of pure assets—no longer basically based entirely mostly on the cash flows from their exploitation but reasonably on their preservation and regeneration.

As an example, whilst you happen to could perchance be a landowner in the Amazon this day, imagine that it’s doubtless you’ll perchance perchance presumably generate increased ongoing financial price from conserving the rainforest than from deforesting the land for bushes, agriculture, or cattle grazing.

Better level-headed, imagine it was once financially shining to gaze out barren land and actively invest in reforesting it.

This procedure results in the abilities of Land, which mobilizes the components of production and leaves a person with extra $$ in their pocket.

Imagine that—a map forward to simultaneously resolve the planet and shall be found in the financial system. It’s a in discovering-in discovering.

For a regenerative financial mannequin to work, now we want to:

(1) resolve the cost of preservation/regeneration,

(2) kit it true into a tradable asset,

(3) create liquidity for that asset.

Step 1: Pricing Pure Resources by Their Price as Carbon Sinks

The idea of a carbon market was once unveiled in the 1997 Kyoto Protocol as a mechanism to incentivize carbon-emission reduction.

By placing a label on carbon, the Protocol introduced a explicit environmental commodity on a world scale.

Pure assets can now be priced by their price as “carbon sinks,” a.okay.a. society’s valuation of a ton of carbon removed from the atmosphere. After we select away carbon from the air, we reap cleaner air, decrease temperatures, and create varied obvious externalities. These obvious effects shall be financially quantified by the tonne and licensed into what is a carbon credit.

In essence, the cost of a ton of carbon is derived no longer from the advent of a ton of emissions; as an alternate, it’s miles basically based entirely mostly on the cost of the unpleasant externalities derived from the removal of a ton of carbon emissions.

For this reason, forests, oceans, and varied pure assets shall be valued in conserving with the amount of carbon they in discovering. As an example, the increased the cost per ton of carbon, the extra shining it becomes to gain into the industry of planting contemporary forests (and deriving profits from carbon credits) as an alternate of slicing down the trees for bushes.

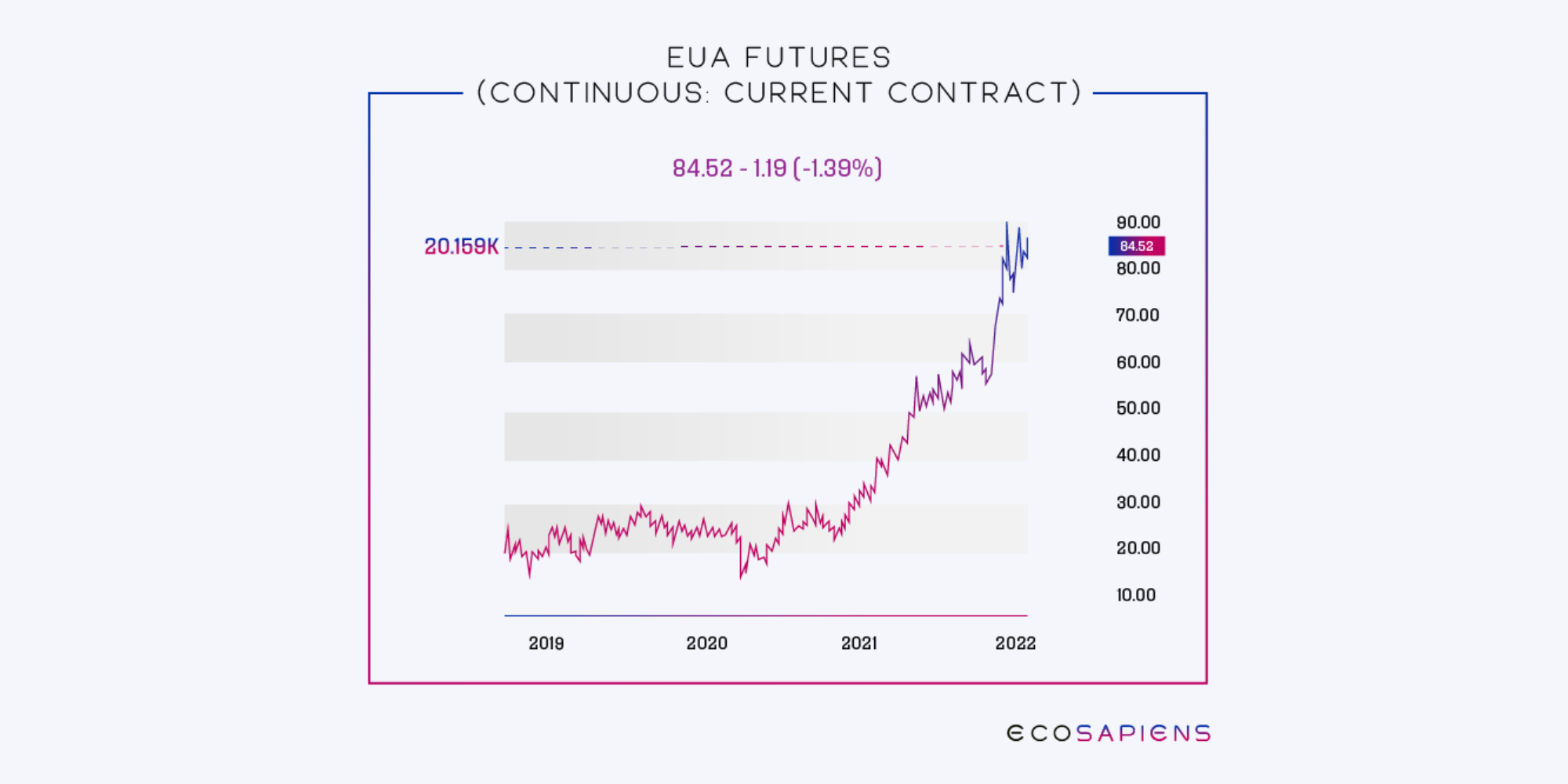

This entice has been extra and extra efficient since 2019, when the cost per ton of carbon crossed 40 USD—a critical threshold in making nature-basically based entirely mostly regeneration (trees, kelp, soil, etc.) vastly extra financially motivating, leading to a enhance in tree planting.

The price climb is basically as a consequence of quiz outpacing supply. We won’t whisk too deep into the quiz forces of carbon in this text, but to defend it straight forward and straight forward, there are several merchants of these carbon credits. Some are polluters who are required to take these credits as a consequence of regulatory requirements; in contemporary times, on the opposite hand, an increasing want of enterprises similar to Stripe, Microsoft, Amazon, United Airlines, and others dangle been shopping them voluntarily to attend originate their very delight in catch-zero targets. For a deep dive on the carbon credits, examine this McKinsey file.

Data from CarbonCredits.com

Now that we’ve established what a carbon is, let’s masks how they’re issued. First, for a carbon sink (let’s spend a reforested hectare of land) to gain issued a carbon credit, the carbon in discovering doable of that woodland has to be measured, reported, and verified (MRV) by the tonnes of carbon captured over the lifetime of the mission.

Just a few contemporary corporations are leveraging lidar, satellite imagery, and drones to originate MRV at lightning speeds and decrease price; Perennial Earth is one firm that is scaling up MRV for carbon soils.

Once MRV is done, these carbon credits are issued by agencies similar to Verra and CAR, amongst others, and equipped through brokers, indirectly making their map to merchants.

The course of of linking carbon mission developers with MRV and indirectly the purchaser is incredibly complex, bottle-necked, and mired with transparency and duplicity points.

Blockchain abilities can streamline the issuance and liquidity facet of carbon and kind it extra equitable for all events fervent.

Step 2: Tokenizing Carbon with Crypto: Introducing ReFi

ReFi is regenerative finance on the blockchain.

Once the pure assets talked about above undergo MRV for the cost of their carbon sink, that price must be grew to was true into a credit (a tradable asset) after which has to discover a purchaser (market) .By taking carbon and issuing it on the blockchain, we can bypass a necessity of these steps and raise carbon initiatives to market faster, increasing liquidity for the carbon, which would perhaps perchance ship a vibration attend thru the market and kind regeneration extra financially shining given the liquidity top class.

No longer most productive that, but blockchain additionally eliminates the functionality for duplicity and improves the transparency of carbon credits—a matter that plagues the carbon markets.

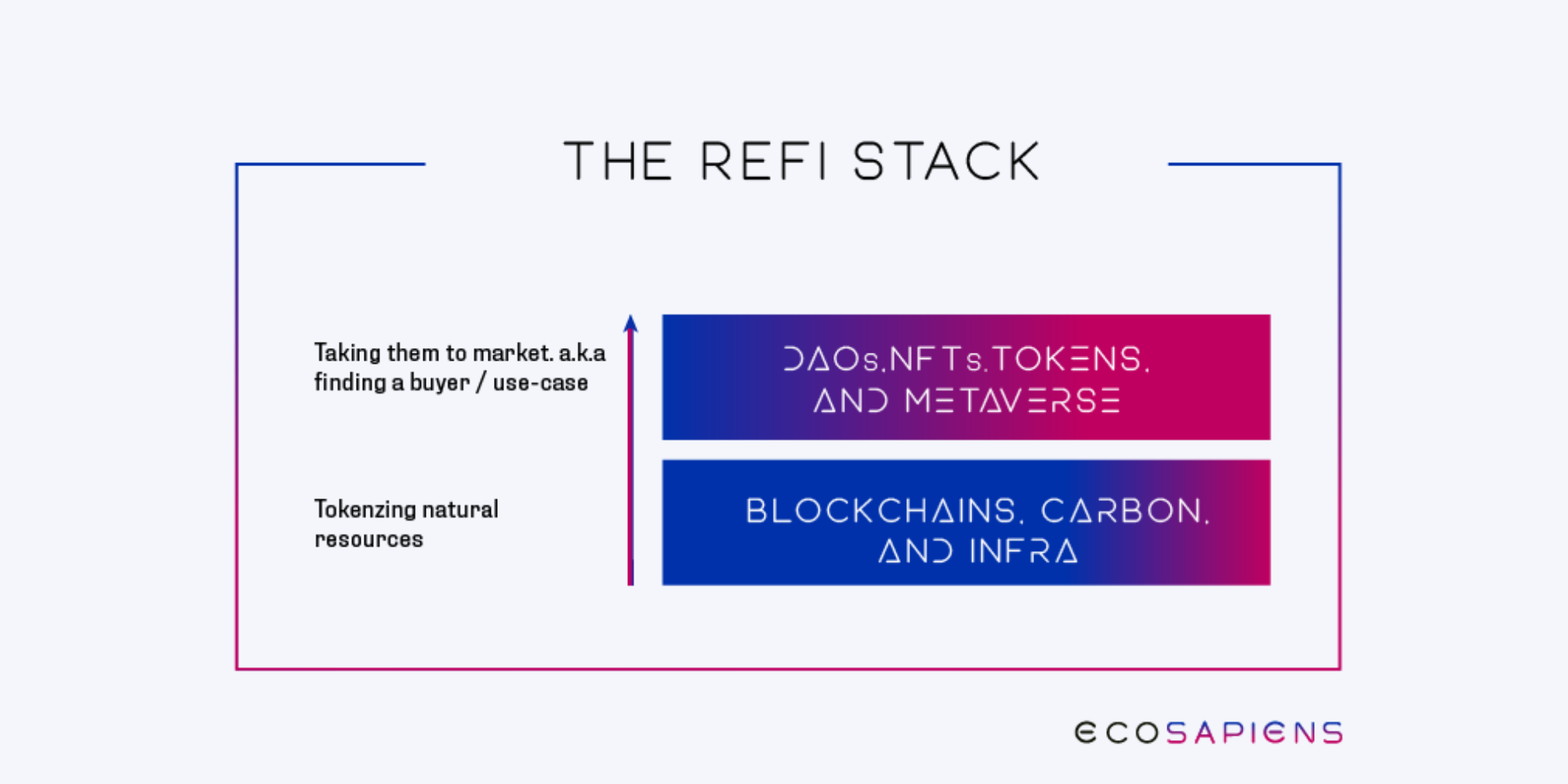

There are two parts to the ReFi stack:

- the tokenization and infrastructure layer, which creates the credit, and

- the appliance layer targets to create a spend-case/purchaser marketplace for such credits.

Infrastructure: The Building Blocks of ReFi

The foundational layer that allows your whole ReFi plot to trudge contains Layer 1s, Layer 2s, carbon suppliers, and infrastructure instruments.

Layer 1s are carbon-neutral or -negative proof-of-stake blockchains treasure Solana that are highly energy efficient. Once Ethereum shifts to POS, it’ll additionally be even handed an L1 for the ReFi financial system. Layer 2s treasure Polygon additionally fall in this bucket. In varied phrases, these are all existing blockchain initiatives that don’t select enormous assets to trudge.

Carbon suppliers are the carbon brokerages accountable for bringing carbon on-chain to underpin varied functions. Nori, a pioneer in the dwelling, wrote relating to the tokenization of carbon attend in 2017. Today time, there are several initiatives in the carbon supply niche, including Toucan Coin, Drift Carbon, and Regen Network.

Infrastructure instruments are loosely defined as records products, protocols, and adjoining tooling that give a receive to carbon suppliers and core blockchains in distributing carbon to the appliance layer.

Checklist of ReFi Initiatives: Applications Turning Degens into Regens

A myriad of functions trudge on this defective infrastructure layer.

The evident spend case is to decide on out the tokenized carbon itself and ship it straight to the existing merchants’ market (enormous enterprises).

However the blockchain permits a mammoth, sweeping wave of creativity; dozens of bold ReFi founders are bringing regeneration to the forefront of neighborhood and patrons in compelling methods beyond merely distributing carbon. They are incentivizing folks and orgs to shrink their very delight in carbon footprint and these of their communities.

We’re tracking three predominant application lessons:

- Impression-2-Have/metaverse,

- DAOs,

- NFTs/tokens.

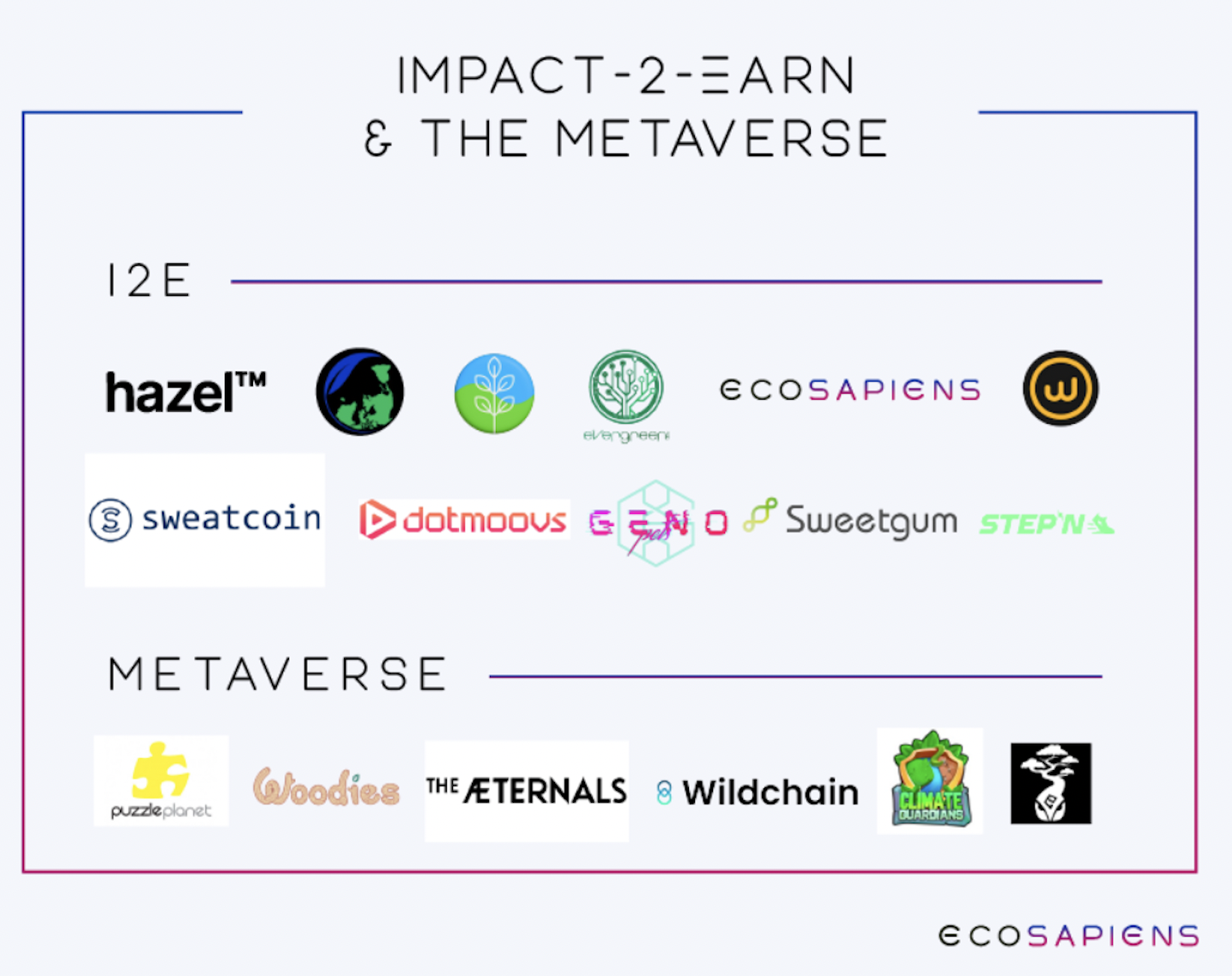

Impression-2-Have and the metaverse are made from corporations leveraging tokenomics and game/culture to incentivize frictionless true-world impact.

As an example, someone can rush extra and be rewarded with carbon tokens, lowering their carbon footprint all thru.

Transfer-to-Have objects (fragment of a broader Impression-to-Have ecosystem) are in their infancy, but we’ve seen several apps treasure StepN and Sweatcoin impact a foothold (I’m sorry) available in the market.

Just a few metaverse functions aim to kind carbon reduction and environmental restoration stress-free and accessible in a virtual setting.

As an example, Climate Guardians introduce a play-to-wait on mannequin whereby interacting with in-game NFTs preserves the Amazon rainforest in true lifestyles. On the backend, part of proceeds from NFTs goes toward retiring carbon credits tied to the Amazon. Players can even vote upon and thunder where these funds are allocated.

One more application, Wildchain, enables customers to adopt and elevate rare species in their cell game digitally: 100% of profits generated from the sale of their NFTs whisk toward supporting wildlife rangers, preserving pure wildlife habitats, planting trees, and the utilization of native folks in the physical world.

At the time of writing, its neighborhood has “adopted” 3,187 animals, planted 18,300 IRL trees, and created 183 employment workdays for true folks on the bottom.

Plant a tree in the metaverse = gain a tree planted IRL.

We classify our delight in firm, Ecosapiens, in this category. We’re on a mission to with out tell enable any individual to fight climate change with the area’s first carbon-backed NFT. Possession grants you entry to the Ecoverse, our imaginative and prescient for a paunchy-stack sustainability platform, DAO, and metaverse.

DAOs and collectives role up folks to power capital or time toward true-world impact.

Organizations harness the flexibility of ownership to collectively role up folks to provide grants, funding, mindshare, advertising, and perception to stimulate the neighborhood and additional power IRL impact.

Carbon isn’t materially underpinning these organizations, but DAOs and varied crypto-basically based entirely mostly collectives mixture tell, impact, and advertising with overall blockchain-basically based entirely mostly infrastructure give a receive to.

Gitcoin and ReFi DAO are two famous gamers in this fragment of the ecosystem.

NFTs and tokens are the “Greenchips” riding capital and culture toward climate action.

Whereas there are several “bluechip” NFTs, similar to CryptoPunks and Bored Ape Yacht Membership, many upstart founders are leveraging NFTs, a.okay.a. the Greenchip NFTs, to redirect greenbacks in crypto toward planet-pleasant causes treasure animal conservation, biome restoration, carbon sequestration, and varied pure resource safety initiatives. Whereas early, tokens signify an alternate map to NFTs as a map to entry obvious impact initiatives thru crypto.

These assets are liquid on marketplaces similar to Opensea, Notify.com (the leading carbon-neutral NFT marketplace), Nifty Gateway, SushiSwap, and others.

Last Solutions: Manufacture the Ground Up from the Ground Up

“There are no passengers on Spaceship Earth. We’re all crew.”

Web3 and blockchain abilities gave us a recent lens to gaze problems spanning decades, if no longer centuries—but its repute is basically basically based entirely mostly on its singular focal point on earnings.

ReFi targets to make spend of crypto for appropriate by harnessing the functionality on the intersection of earnings and motive and introducing the premise that it’ll pay to attend the planet.

In a map, it’s one of the most shiny sandboxes for building blockchain-basically based entirely mostly functions with the mass allure with out the “crypto folks building for crypto folks” stigma looms over the cryptocurrency trade.

We level-headed dangle a prolonged map to whisk, but these initiatives are mission-driven and clear to kind thru the undergo market because, despite all the issues, our planet is aware of no bull or undergo, excluding true bulls and bears, of course.

We all dangle the functionality to kind a topic materials impact thru the flexibility of neighborhood and web3– the magic is in tying a true-world human incentive to flip Degens into Regens. In doing so, we can leverage this “magic net cash” and its associated abilities to heal our Dwelling.

Never Toddle over One more Opportunity! Rep hand selected news & files from our Crypto Consultants so as to additionally kind educated, knowledgeable choices that straight have an effect on your crypto profits. Subscribe to CoinCentral free newsletter now.