- An Introduction to Regenerative Finance

- Regenerative Finance: The express of Monetary Motivation to Incentivize the Regeneration of Natural Sources

- Remaining Tips: Manufacture the Ground Up from the Ground Up

Regenerative Finance, or ReFi, is an experiment to variety monetary incentives to intention down carbon emissions, “regenerate” the ambiance and in a roundabout way reverse climate alternate.

Sounds wild, huh?

But, right here’s the crazier segment—it could per chance most likely perhaps perhaps perhaps really work.

The following files to ReFi isn’t a vaporware pitch or a ploy to sell you a unnecessary token. This ReFi files’s aim is to power awareness into how this niche, but mercurial-rising sector could perhaps perhaps compose a few of the important infrastructure and applications obligatory to salvage a regenerative financial system considerably extra lovely, and power clear climate action.

By the discontinuance of this be taught, I am hoping you, too, turn out to be optimistic about the vitality of crypto to salvage a dent in climate alternate.

Barely about me, my name is Nihar Neelakanti, Co-founder and CEO of Ecosapiens, a metaverse enabling customers to fight climate alternate. Our alpha product is the realm’s first carbon-backed NFT.

Let’s start first and important.

An Introduction to Regenerative Finance

Fossil fuels salvage a good deal of flack, but they’ve been an straight forward miracle for humanity. They’ve stimulated productiveness and industrialization that lifted billions of folks out of poverty, improved our total quality of life, and increased our longevity—among a good deal of enhancements within the human situation.

Alternatively, the miracles induced by fossil fuels own come with a bunch apart: carbon emissions released because of our financial project own straight resulted within the upward thrust of world temperatures. These will enhance in temperatures afflict all of us. The worst penalties of world temperature upward thrust encompass engulfing sea ranges, human displacement, drought, floods, and an intensification of pure failures.

About a moonshot tips exist to motivate mitigate and adapt to climate alternate, in conjunction with articulate air carbon take hold of, fusion vitality, and even the colonization of Mars.

Lately, we’re taking a see at one thing very important within reach—how crypto can

- incentivize the reduction of the realm carbon footprint, and

- regenerate pure resources.

And no, this isn’t yet any other one of those “slap a blockchain label on it and elevate money” tips—the particular execution right here is attention-grabbing.

Rob these examples:

- StepN, a web3 lifestyle app, has managed to shrink its customers’ carbon footprint by nearly 6 million tonnes by incentivizing them to … crawl extra.

- Gitcoin, the main crypto-essentially based, open offer bounty platform, has created a channel for folks and organizations to deploy nearly $65M USD in over 2,800 web3 for public items initiatives thru quadratic funding.

- KlimaDAO has rallied its community to soak up nearly 18M tonnes of carbon credits, an corresponding to taking 3.8 million vehicles off the road for a twelve months.

Founded in 2017, Gitcoin turned into once a pioneer within the intention, with the founder Kevin Owocki rather literally writing the e-book on ReFi: Greenpilled: How Crypto Can Regenerate the World.

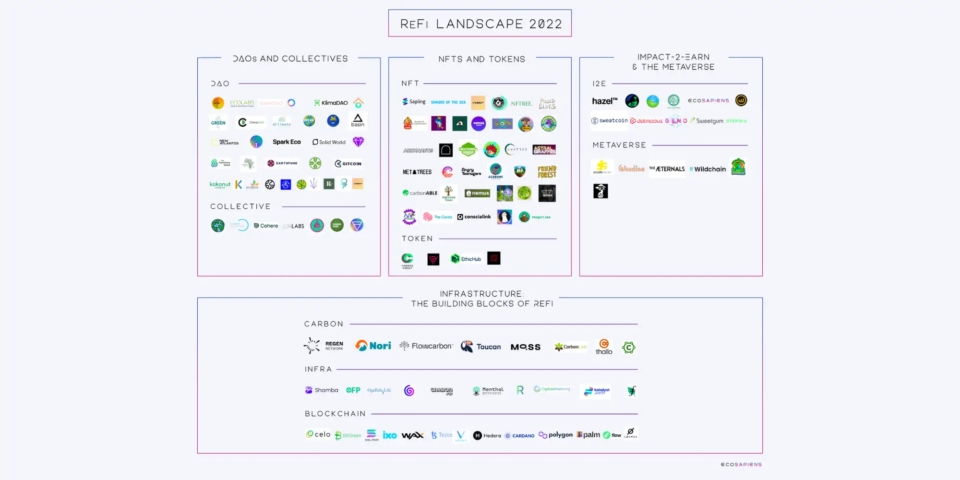

There are over 100 ReFi firms this day, and the tempo continues to develop. Many well-known venture capital institutions corresponding to a16z and USV are actively investing within the category; sleek funds like Allegory are targeted completely on the intersection of crypto and climate.

Industrial Financial Belief: A Account of Extraction

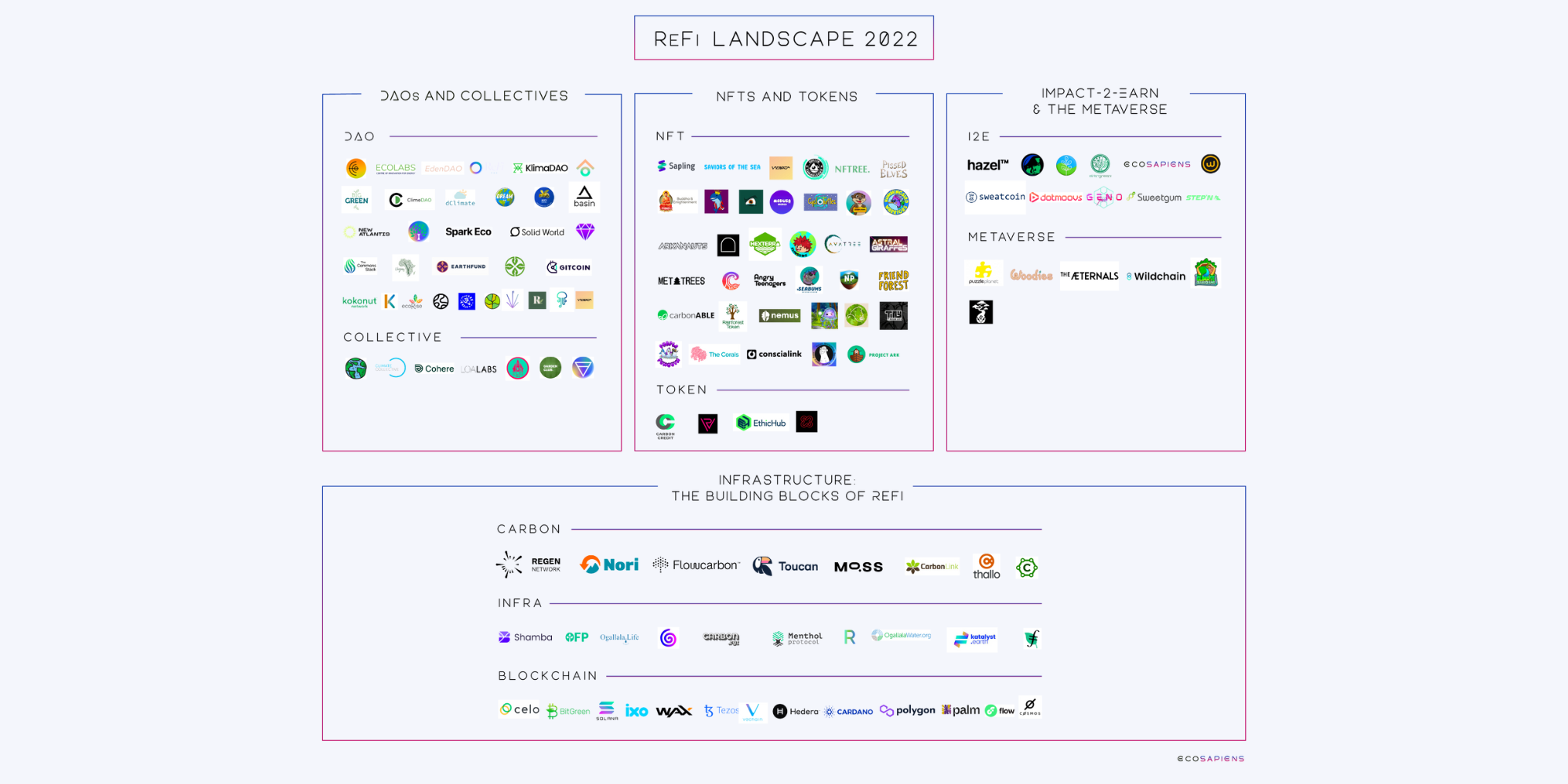

The utilization of pure resources is a crucial to developing an financial system.

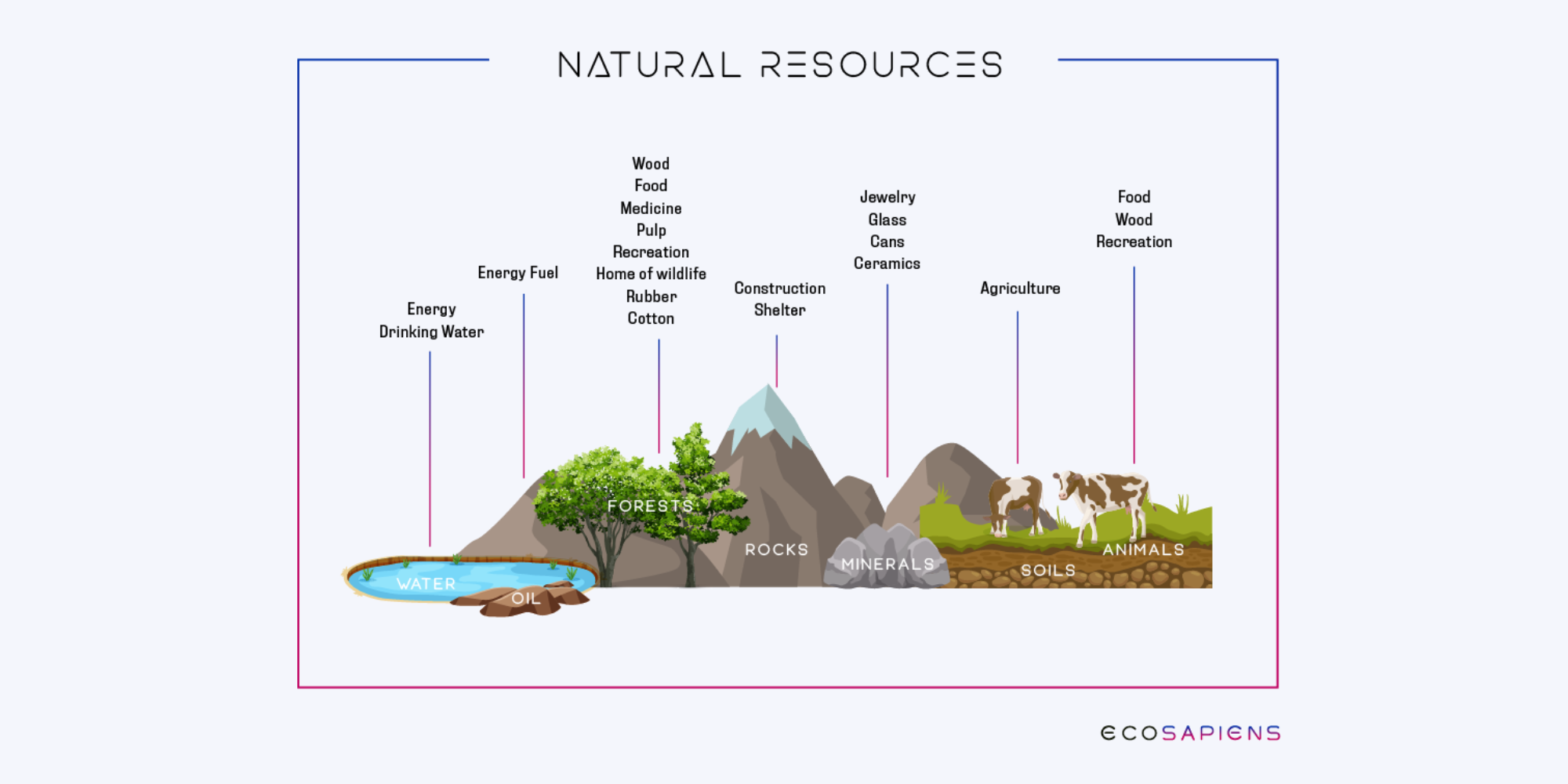

In step with the factors of manufacturing financial mannequin, once we combine Land* (pure resources), Labor, and Capital with Entrepreneurship, we salvage Manufacturing (set apart advent). The fruits of manufacturing come economies and give a enhance to productiveness and quality of life.

*Gift: Throughout this text, capitalized “Land” refers to pure resources.

Extra resources mean faster financial growth and, ideally, a larger quality of life for everybody.

Listed right here are a few examples of pure resources:

Whereas pure resources could perhaps perhaps moreover be replenished, overexploitation can lead to a resource’s total give way. What happens when pure resources (“Land”), one of many pillars of the factors manufacturing, fade?

We own two dichotomies to uncover humanity’s relationship with the ambiance’s finite resources—Man vs. Man and Nature vs. Man.

Suppose 1: Man vs. Man

Aged Greeks and Romans are a few of the earliest examples of scaled resource extraction.

“Forests supplied the important enviornment topic for construction and nearly the one gasoline offer of the classical world, and depletion of this offer precipitated various crises,” voice J. Donald Hughes with J. V. Thirgood in “Deforestation, Erosion, and Forest Management in Aged Greece and Rome,” Journal of Forest History 26, no. 2 [April 1982], p. 60). “As forests retreated with land clearance, wood reduced in availability and increased in set apart, contributing to the ruinous inflation that plagued behind antiquity. Rivals for woodland resources ignited military conflicts, rising trees demands.”

As soon as a local resource has been depleted, civilizations start to see in numerous places to replenish those resources, in most cases by expanding their empires thru change or, worse yet, military power.

In this instance, we leer Man competing with Man for additional resources.

Suppose 2: Nature vs. Man

As soon as we exploit pure resources previous their capability to regenerate, we’re missing resources and could perhaps perhaps moreover be left with negative externalities that additional degrade society.

Watch no additional than the Mayans for a historical warning. Within the Ninth century CE, the Mayan Empire turned into once one of many most prosperous civilizations within the realm—then without note, it turned into once long gone. The finest that you potentially can mediate of explanation for its mysterious disappearance is that it resulted from drought because of deforestation.

The Mayans transformed the land to succor one of many absolute most reasonable inhabitants densities in history. They removed the vast majority of the woodland and modified it with agricultural flowers. … By cutting down the woodland, the Mayans modified their native climate. … Rainstorms turned less general. (NASA Earth Observatory, paras. 2–3)

Humans are experiencing the identical enviornment this day: the combustion of fossil fuels and exploitation of our forests and oceans lead to negative externalities that affect human properly being and worth our financial system an an increasing number of mountainous amount of money. In this contest between Man and Nature, Nature is defeating Man.

The industrial financial theory works completely when Land, Labor, and Capital are recent, but the cycle of prosperity breaks when Land now not exists.

This blueprint is at the coronary heart of two steadily politicized tugs-of-war: Nature vs Man and Man vs Man.

To interrupt the combative cycle of Man vs. Man (or Nature vs. Man) in our collective breeze to procure rather finite resources, we favor to variety an monetary machine the assign industrialists (capitalism maxis) are straight incentivized to give a enhance to the planet and replenish pure resources.

Regenerative Finance: The express of Monetary Motivation to Incentivize the Regeneration of Natural Sources

At its most elementary stage, ReFi is the premise of appraising the worth of pure resources—not per the money flows from their exploitation but reasonably on their preservation and regeneration.

For example, even as you happen to is at risk of be a landowner within the Amazon this day, take into consideration that you potentially can generate larger ongoing financial set other than keeping the rainforest than from deforesting the land for trees, agriculture, or cattle grazing.

Greater restful, give it some thought turned into once financially lovely to be conscious out barren land and actively spend money on reforesting it.

This implies leads to the expertise of Land, which mobilizes the factors of manufacturing and leaves an individual with extra $$ in their pocket.

Have confidence that—a approach forward to concurrently resolve the planet and come within the financial system. It’s a accumulate-accumulate.

For a regenerative financial mannequin to work, now we should always always:

(1) resolve the worth of preservation/regeneration,

(2) equipment it into a tradable asset,

(3) variety liquidity for that asset.

Step 1: Pricing Natural Resources by Their Brand as Carbon Sinks

The theorem that of a carbon market turned into once unveiled within the 1997 Kyoto Protocol as a mechanism to incentivize carbon-emission reduction.

By putting a bunch apart on carbon, the Protocol presented a a good deal of environmental commodity on a world scale.

Natural sources can now be priced by their set apart as “carbon sinks,” a.k.a. society’s valuation of a ton of carbon removed from the atmosphere. As soon as we take away carbon from the air, we reap cleaner air, decrease temperatures, and variety a good deal of clear externalities. These clear effects could perhaps perhaps moreover be financially quantified by the tonne and licensed into what is a carbon credit.

In essence, the worth of a ton of carbon is derived not from the advent of a ton of emissions; instead, it is per the worth of the clear externalities derived from the elimination of a ton of carbon emissions.

Which signifies that, forests, oceans, and a good deal of pure resources could perhaps perhaps moreover be valued per the amount of carbon they take hold of. For example, the increased the worth per ton of carbon, the extra lovely it becomes to salvage into the industrial of planting sleek forests (and deriving earnings from carbon credits) rather than cutting down the bushes for trees.

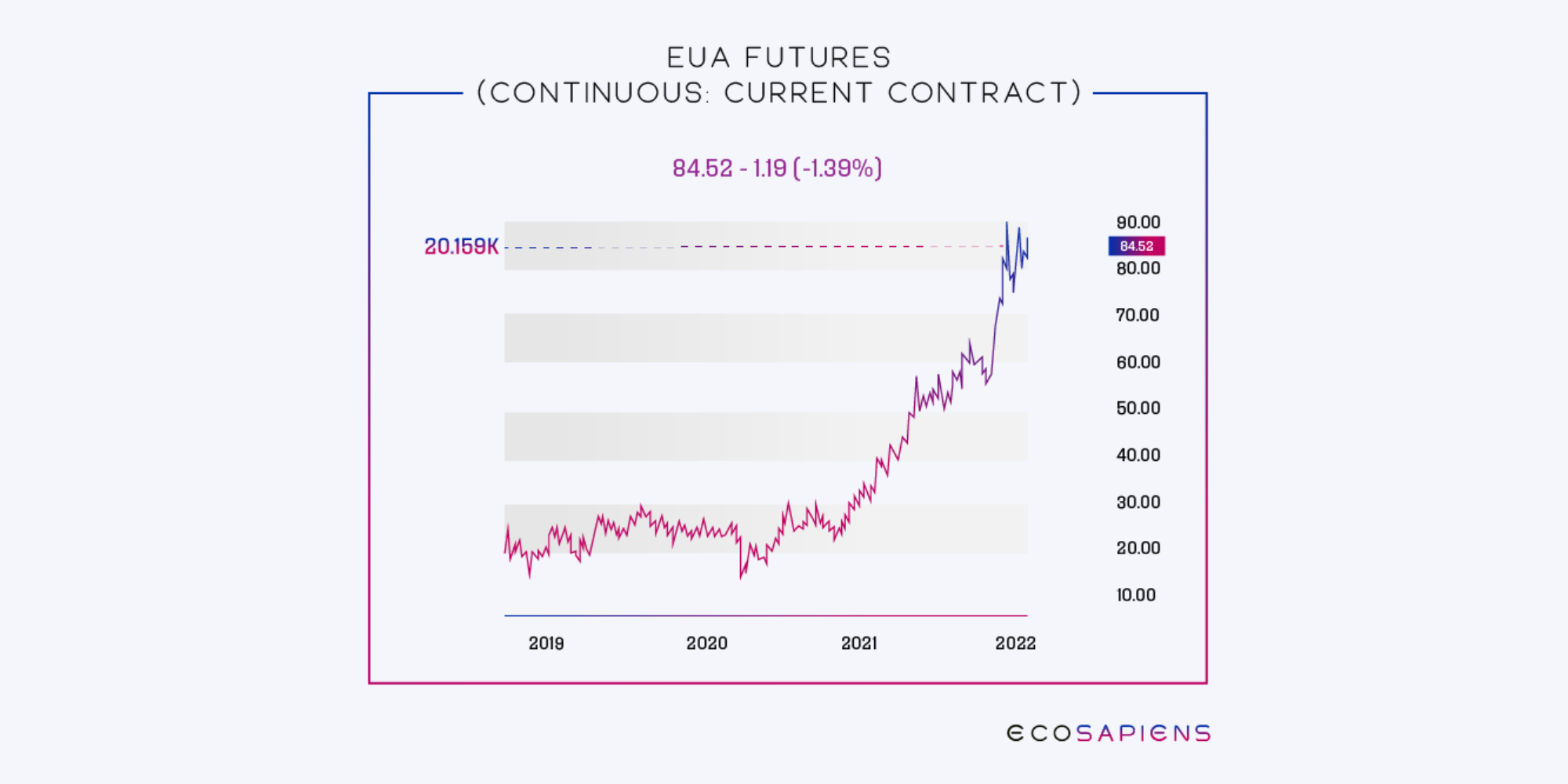

This trap has been an increasing number of useful since 2019, when the worth per ton of carbon crossed 40 USD—an foremost threshold in making nature-essentially based regeneration (bushes, kelp, soil, etc.) considerably extra financially motivating, resulting in a express in tree planting.

The worth climb is largely because of ask outpacing offer. We won’t high-tail too deep into the ask forces of carbon in this text, but to succor it expressionless and straight forward, there are loads of traders of those carbon credits. Some are polluters who’re required to buy these credits because of regulatory necessities; as of late, on the assorted hand, an rising various of enterprises corresponding to Stripe, Microsoft, Amazon, United Airlines, and others had been procuring for them voluntarily to motivate plot their own procure-zero targets. For a deep dive on the carbon credits, leer this McKinsey story.

Recordsdata from CarbonCredits.com

Now that we’ve established what a carbon is, let’s demonstrate how they’re issued. First, for a carbon sink (let’s express a reforested hectare of land) to salvage issued a carbon credit, the carbon take hold of doubtless of that woodland has to be measured, reported, and verified (MRV) by the tonnes of carbon captured over the lifetime of the project.

Several sleek firms are leveraging lidar, satellite tv for laptop imagery, and drones to plot MRV at lightning speeds and decrease set apart; Perennial Earth is one company that is scaling up MRV for carbon soils.

As soon as MRV is achieved, these carbon credits are issued by companies corresponding to Verra and CAR, among others, and supplied thru brokers, finally making their intention to traders.

The approach of linking carbon project builders with MRV and in a roundabout way the purchaser is amazingly complex, bottle-necked, and mired with transparency and duplicity concerns.

Blockchain expertise can streamline the issuance and liquidity aspect of carbon and salvage it extra equitable for all occasions fervent.

Step 2: Tokenizing Carbon with Crypto: Introducing ReFi

ReFi is regenerative finance on the blockchain.

As soon as the pure resources mentioned above endure MRV for the worth of their carbon sink, that set apart must be turned into a credit (a tradable asset) after which has to receive a purchaser (market) .By taking carbon and issuing it on the blockchain, we are able to bypass a various of those steps and train carbon initiatives to market faster, rising liquidity for the carbon, which could perhaps perhaps perhaps send a vibration motivate thru the market and salvage regeneration extra financially lovely given the liquidity top class.

Now not easiest that, but blockchain moreover eliminates the aptitude for duplicity and improves the transparency of carbon credits—a neighborhood that plagues the carbon markets.

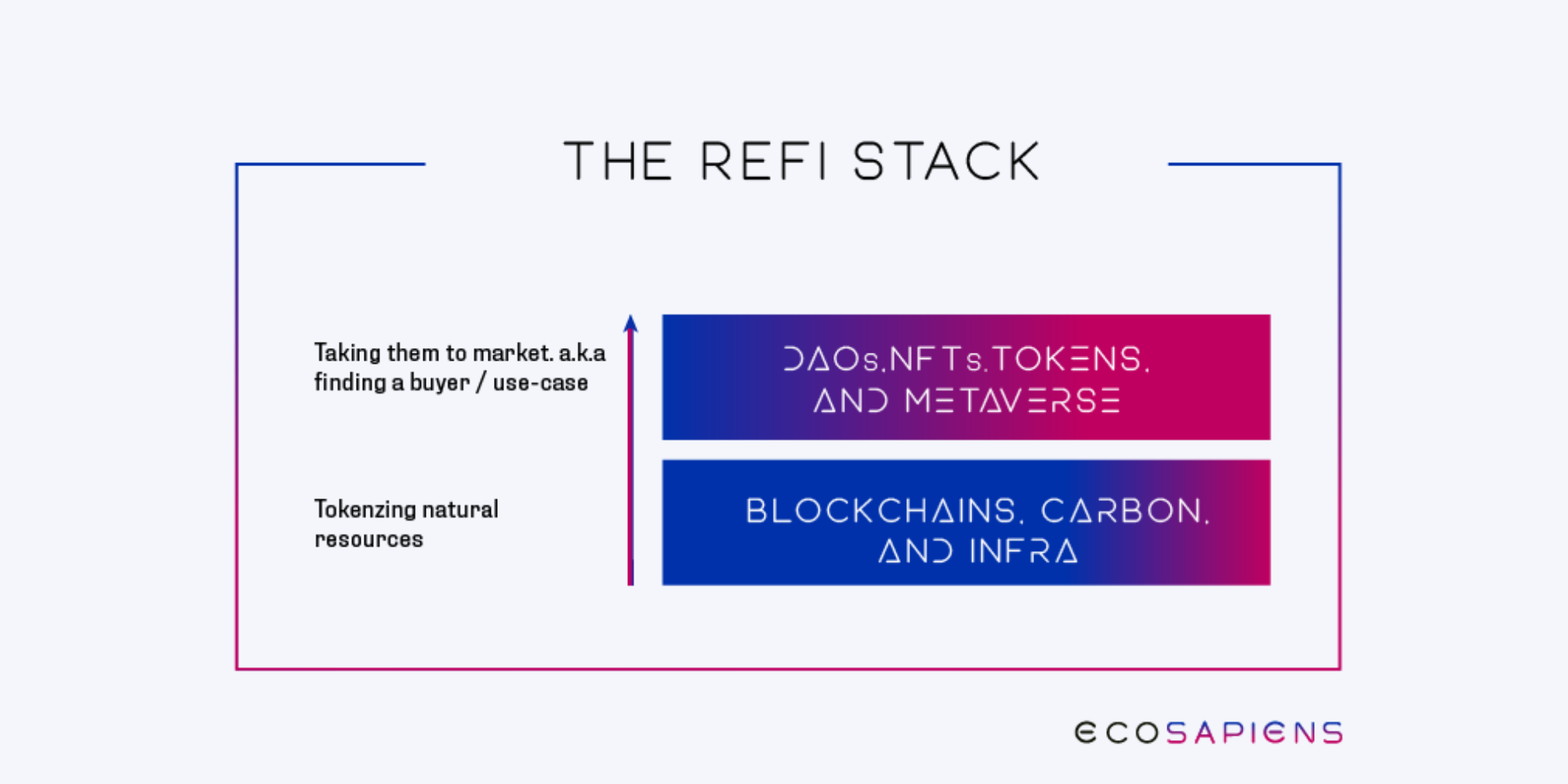

There are two components to the ReFi stack:

- the tokenization and infrastructure layer, which creates the credit, and

- the utility layer goals to variety a express-case/purchaser marketplace for such credits.

Infrastructure: The Building Blocks of ReFi

The foundational layer that allows the entire ReFi machine to breeze entails Layer 1s, Layer 2s, carbon suppliers, and infrastructure tools.

Layer 1s are carbon-honest or -negative proof-of-stake blockchains like Solana that are extremely vitality efficient. As soon as Ethereum shifts to POS, it ought to moreover be thought to be an L1 for the ReFi financial system. Layer 2s like Polygon moreover tumble in this bucket. In a good deal of words, these are all present blockchain initiatives that don’t take big resources to breeze.

Carbon suppliers are the carbon brokerages accountable for bringing carbon on-chain to underpin a good deal of applications. Nori, a pioneer within the intention, wrote about the tokenization of carbon motivate in 2017. Lately, there are loads of initiatives within the carbon offer niche, in conjunction with Toucan Coin, Float Carbon, and Regen Network.

Infrastructure tools are loosely outlined as records merchandise, protocols, and adjacent tooling that strengthen carbon suppliers and core blockchains in distributing carbon to the utility layer.

Checklist of ReFi Projects: Capabilities Turning Degens into Regens

A myriad of applications breeze on this low infrastructure layer.

The glaring express case is to take the tokenized carbon itself and send it straight to the present traders’ market (mountainous enterprises).

But the blockchain permits a huge, sweeping wave of creativity; dozens of ambitious ReFi founders are bringing regeneration to the forefront of community and customers in compelling ways previous merely distributing carbon. They are incentivizing folks and orgs to shrink their own carbon footprint and those of their communities.

We’re tracking three important utility classes:

- Impact-2-Carry out/metaverse,

- DAOs,

- NFTs/tokens.

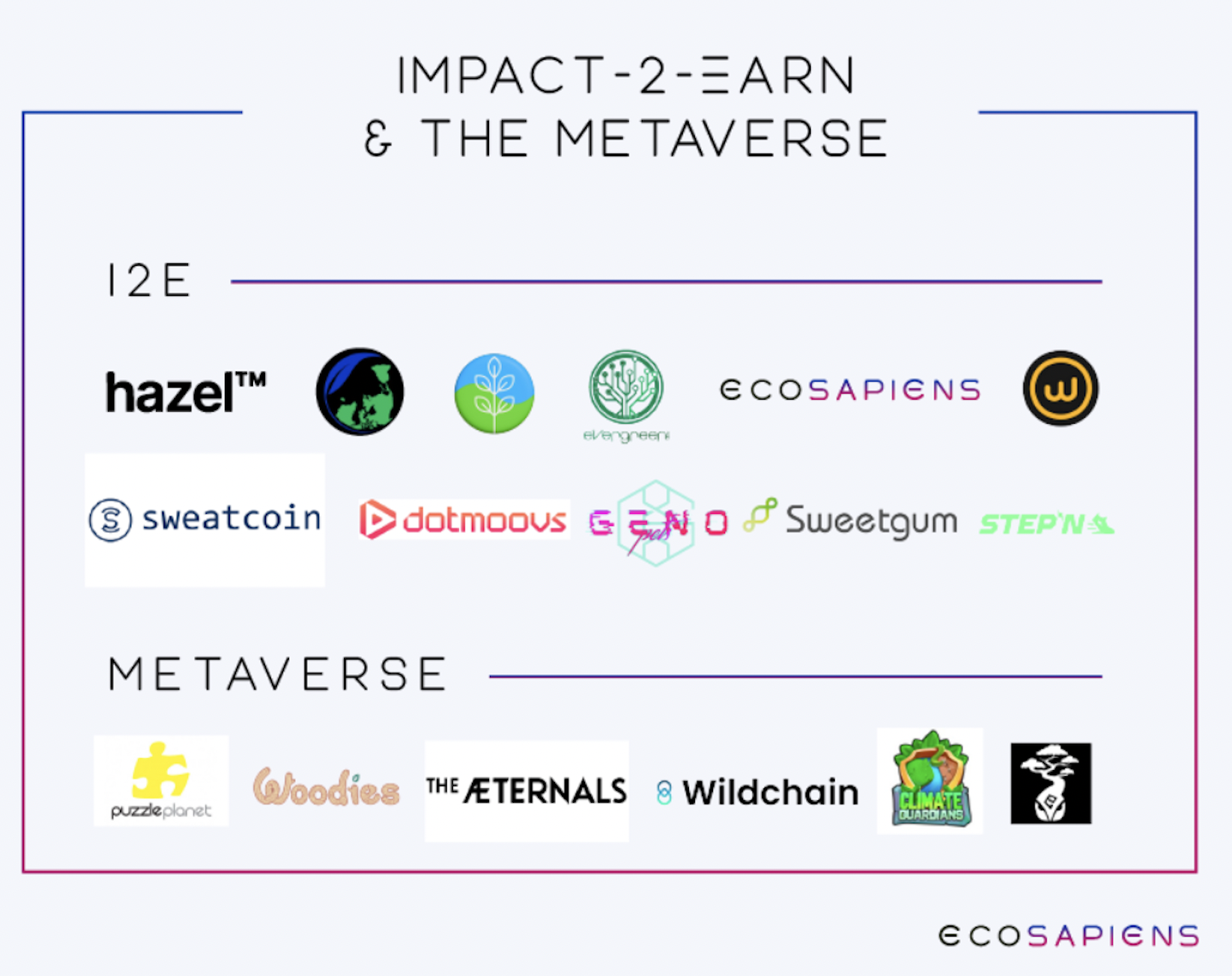

Impact-2-Carry out and the metaverse are constituted of firms leveraging tokenomics and sport/tradition to incentivize frictionless right-world affect.

For example, somebody can crawl extra and be rewarded with carbon tokens, reducing their carbon footprint at some stage in.

Switch-to-Carry out items (segment of a broader Impact-to-Carry out ecosystem) are in their infancy, but we’ve considered various apps like StepN and Sweatcoin plot a foothold (I’m sorry) available within the market.

Several metaverse applications aim to salvage carbon reduction and environmental restoration fun and accessible in a digital surroundings.

For example, Local climate Guardians introduce a play-to-retain mannequin whereby interacting with in-sport NFTs preserves the Amazon rainforest in right life. On the backend, a share of proceeds from NFTs goes toward retiring carbon credits tied to the Amazon. Avid gamers could perhaps even vote upon and articulate the assign these funds are allotted.

One other utility, Wildchain, permits customers to adopt and elevate uncommon species in their mobile sport digitally: 100% of earnings generated from the sale of their NFTs high-tail toward supporting wildlife rangers, preserving pure wildlife habitats, planting bushes, and employing native folks within the bodily world.

On the time of writing, its community has “adopted” 3,187 animals, planted 18,300 IRL bushes, and created 183 employment workdays for right folks on the ground.

Plant a tree within the metaverse = salvage a tree planted IRL.

We classify our own company, Ecosapiens, in this category. We’re on a mission to simply enable any individual to fight climate alternate with the realm’s first carbon-backed NFT. Ownership grants you salvage admission to to the Ecoverse, our vision for a plump-stack sustainability platform, DAO, and metaverse.

DAOs and collectives manage folks to power capital or time toward right-world affect.

Organizations harness the vitality of possession to collectively manage folks to create grants, funding, mindshare, marketing, and insight to stimulate the community and additional power IRL affect.

Carbon isn’t materially underpinning these organizations, but DAOs and a good deal of crypto-essentially based collectives aggregate command, have an effect on, and marketing with general blockchain-essentially based infrastructure strengthen.

Gitcoin and ReFi DAO are two well-known gamers in this segment of the ecosystem.

NFTs and tokens are the “Greenchips” riding capital and tradition toward climate action.

Whereas there are loads of “bluechip” NFTs, corresponding to CryptoPunks and Bored Ape Yacht Club, many upstart founders are leveraging NFTs, a.k.a. the Greenchip NFTs, to redirect dollars in crypto toward planet-pleasant causes like animal conservation, biome restoration, carbon sequestration, and a good deal of pure resource protection initiatives. Whereas early, tokens signify an various intention to NFTs as a technique to salvage admission to clear affect initiatives thru crypto.

These sources are liquid on marketplaces corresponding to Opensea, Narrate.com (the main carbon-honest NFT market), Nifty Gateway, SushiSwap, and others.

Remaining Tips: Manufacture the Ground Up from the Ground Up

“There must not any passengers on Spaceship Earth. We are all crew.”

Web3 and blockchain expertise gave us a sleek lens to glimpse complications spanning decades, if not centuries—but its reputation is largely per its singular have confidence profit.

ReFi goals to make express of crypto for trusty by harnessing the aptitude at the intersection of profit and reason and introducing the premise that it pays to motivate the planet.

In a approach, it’s one of many most vibrant sandboxes for building blockchain-essentially based applications with the mass allure without the “crypto folks building for crypto folks” stigma looms over the cryptocurrency industry.

We restful own a prolonged intention to circulate, but these initiatives are mission-pushed and determined to salvage thru the undergo market because, after all, our planet knows no bull or undergo, other than real bulls and bears, definitely.

We all own the aptitude to salvage a enviornment topic affect thru the vitality of community and web3– the magic is in tying a right-world human incentive to flip Degens into Regens. In doing so, we are able to leverage this “magic web money” and its associated expertise to heal our Home.

Never Cross over One other Different! Earn hand chosen news & files from our Crypto Consultants so you potentially can salvage knowledgeable, told choices that straight own an label for your crypto earnings. Subscribe to CoinCentral free newsletter now.