The analyst says February would possibly maybe well perchance survey a inexperienced candle if $37,000 holds as key month-to-month enhance, which would possibly maybe well perchance potentially beginning the lunge to $50,000.

Bitcoin designate has did no longer interrupt above $39,000 this week, having bounced strategy the stage a pair of times since the upside from lows of $33,000 final week.

BTC is currently 2% down and taking a search for to retest the $38k enhance stage, which if it fails to sustain, would possibly maybe well perchance survey the flagship cryptocurrency dip further.

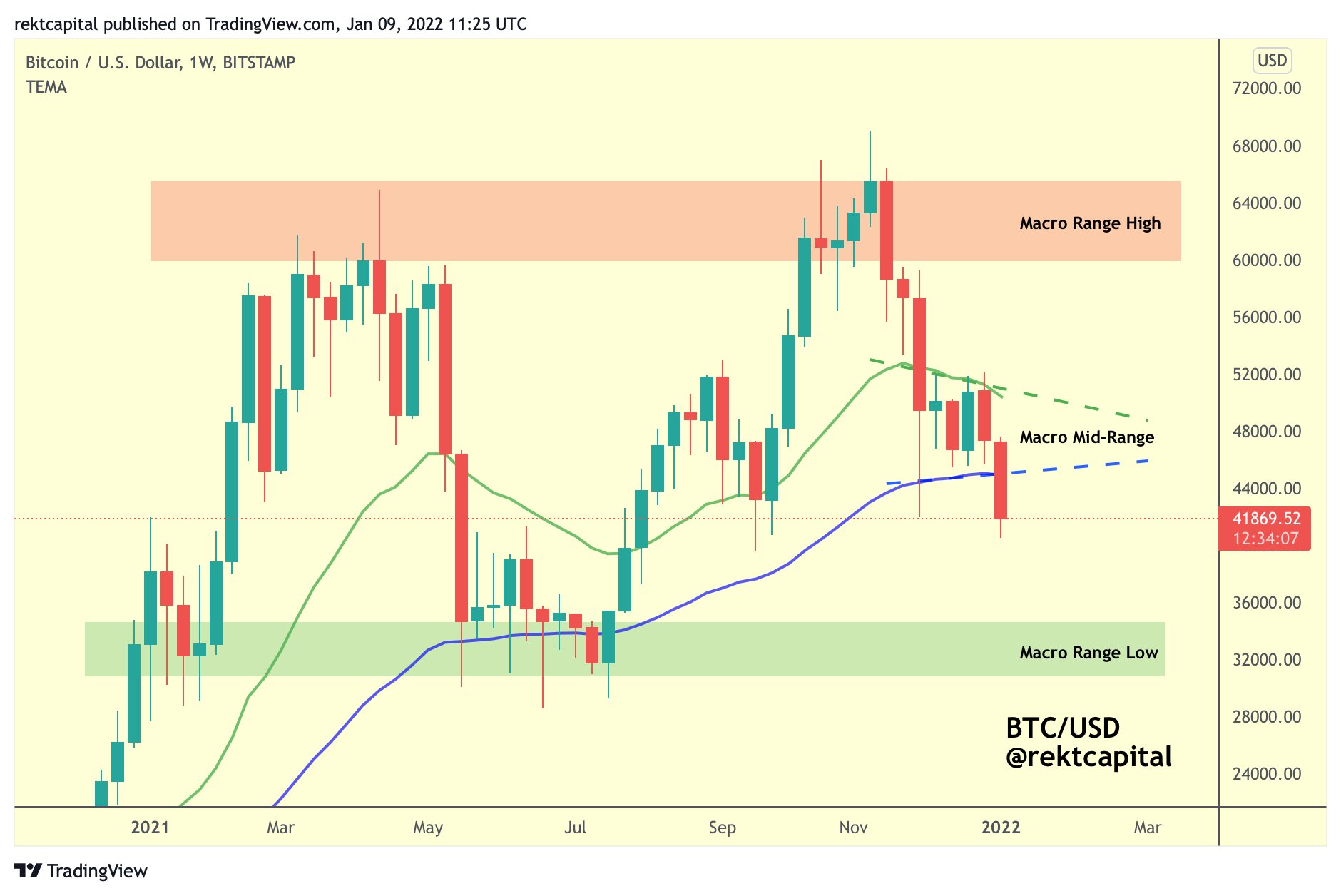

Pseudonymous crypto dealer and analyst Rekt Capital says the declines sustain Bitcoin in a consolidation fragment, with enhance and resistance at two exponential transferring averages (EMAs) on the weekly chart.

Per him, Bitcoin designate has dipped beneath the two EMAs which macro-intriguing, symbolize the mid-vary home.

“Since BTC lost its Mid-Vary home as enhance… [It] has revisited the Macro Vary Low home (inexperienced).Macro-intriguing alternatively, BTC is soundless objective consolidating between $28000-$68000 (inexperienced-purple),” he famed in a tweet shared on Wednesday.

Chart showing BTC designate beneath the two EMAs. Offer: Rekt Capital on Twitter.

Chart showing BTC designate beneath the two EMAs. Offer: Rekt Capital on Twitter.

The analyst says Bitcoin is thus converse to alternate internal the lower half of of its vary low-vary highs of $28Good satisfactory-$68Good satisfactory. The benchmark crypto will set internal this “macro vary for the next weeks,” Rekt added.

He highlights the $43-$48Good satisfactory vary as a necessary barrier beneath which BTC designate is seemingly to skim unless bulls reclaim the two EMAs. If this scenario performs out, he believes recent momentum will survey Bitcoin ruin motivate into the upper half of the $28k-$68k.

Weeks within the past, #BTC lost its Mid-Vary as enhance

Which methodology BTC will salvage the lower half of of the $28Good satisfactory-$68Good satisfactory macro vary for the next weeks

BTC will set beneath $43-$48Good satisfactory unless BTC is in a predicament reclaim these two EMAs to verify a return into the upper half of of the vary#Crypto #Bitcoin https://t.co/2Gs7jL6cvo pic.twitter.com/6m1SWgtSZG

— Rekt Capital (@rektcapital) February 2, 2022

BTC converse for a “inexperienced February”

month-to-month enhance, the analyst notes Bitcoin has had three successive opposed closes up to now. It involves January that saw BTC/USD stir over 20%.

Per Rekt, Bitcoin is seemingly to survey a reversal in February. His outlook is that the month-to-month candle shows a retest and jump off a key stage at $37,000.

Beyond the inexperienced Monthly enhance stage, #BTC has handiest ever seen a 3-month downtrend, at most

The final time $BTC experienced a 3-month downtrend past the inexperienced stage…

BTC loved a inexperienced Monthly candle

May perchance BTC be surroundings itself up for a inexperienced February?#Crypto #Bitcoin pic.twitter.com/MJQXv4QC0q

— Rekt Capital (@rektcapital) February 2, 2022

“The final time BTC efficiently turned this stage into enhance changed into in August 2021 [and] that retest preceded a transfer to $50,000,” he added.

The final time Bitcoin rebounded off lows of $30k changed into in July 2021, with an uptick to highs above $52k followed by a retest of $40k and one other jump your total strategy to its all-time excessive in November.