The crypto commerce went through a period of evolution in 2023 to reiterate its assign within the realm market. This evolution became once namely spearheaded by Bitcoin’s dominance, with the crypto registering beneficial properties within the last quarter that were practically absent within the earlier substances of the 365 days.

All the signs are there; ardour is selecting up, expansive money from institutions is sniffing spherical again, quite a lot of most important technical and on-chain pricing gadgets this 365 days were confirmed, and the mud seems to be to maintain sooner or later settled from the prolonged endure market in 2022.

Total market cap at $1.59 trillion | Source: Crypto Total Market Cap on Tradingview.com

The Crypto Winter Thaws: Signs of Lifestyles in 2023

2023 became once majorly a 365 days of correction for the prolonged endure market in 2022 which saw Bitcoin fall 76% from its all-time excessive to commerce at a bottom of $15,883. In response to a file from Glassnode, main market structure shifts are truly taking assign contained within the crypto commerce to replicate rising optimism.

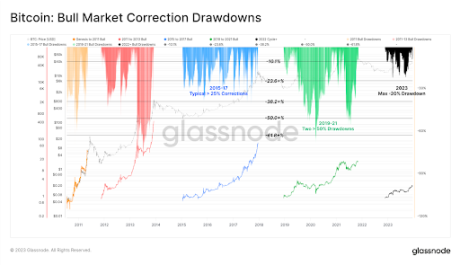

Bitcoin, for one, is showing a sturdy ardour from its long-time period holders, as the commerce awaits the birth of self-discipline Bitcoin ETFs within the US. One explicit feature of the 365 days that indicated a sturdy bullish momentum became once the shallow depth of market correction, indicating the commerce is maturing proper into a more earn market by manner of tag volatility.

Bitcoin’s deepest correction in 2023 closed exact -20% below the local excessive, better than historical pullbacks of least -25% to -50%.

Source: Glassnode

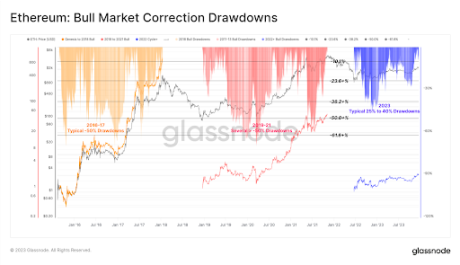

Ethereum additionally saw shallow corrections, with the deepest reaching -40% in early January.

Source: Glassnode

From an on-chain level of view, the realized cap within the 2022 endure market for every and every sources showed a rep capital outflow of -18% for BTC and -30% for ETH. The momentum kickstarted in October, as the news of diverse purposes of self-discipline Bitcoin ETFs turned the crypto market on its heels. As a end result, Bitcoin sooner or later broke above the $30,000 level which it had traded below for the large majority of the 365 days.

This cascaded into the altcoin market, with Solana, Cardano, and Ethereum all seeing renewed ardour and growth in costs and DeFi TVL. In response to Glassnode, the total worth locked into Ethereum’s layer-2 blockchains elevated by 60%, with over $12 billion now locked into bridges.

In response to CoinShares, the bullish sentiment has additionally flowed into institutions. October’s rally sparked an 11-week flee of inflows into digital asset funding funds. On the time of writing, the 365 days-to-date inflows now take a seat at $1.86 billion.

The crypto commerce, namely Bitcoin, is primed for unheard of growth in 2024, with hundreds of tag catalysts admire the SEC’s approval of self-discipline Bitcoin and Ethereum ETFs within the US, and the following Bitcoin halving. The altcoin market can maintain to peaceable additionally follow, spearheaded by Ethereum.

On the time of writing, Bitcoin is up by 159% this 365 days, outperforming diversified asset classes. On the diversified hand, Ethereum and Solana maintain dominated the altcoin market, up by 82% and 616% respectively.

Featured image from CNBC, chart from Tradingview.com

Disclaimer: The article is outfitted for academic functions superb. It would no longer yell the opinions of NewsBTC on whether to buy, sell or withhold any investments and naturally investing carries dangers. You are informed to conduct your have study sooner than making any funding decisions. Exercise files supplied on this web web page totally at your have probability.