- What’s the Point of RWAs?

- Why are RWA’s Getting So Much Hype Lately?

- What is On-Chain Credit in Crypto?

- On-Chain Credit: Apply the Yield

- On-Chain Credit and Right-World Sources: Top RWA Companies

- The Risks of Right World Sources on the BlockchainL Now not All Code is Gold

- Closing Tips: Are RWAs in Crypto Legit?

The theory that of a RWA is gleaming easy– take one thing that exists within the valid world and tokenize it on the blockchain.

That “one thing” would perhaps perchance be a part of valid-world artwork, a Rolex, or a dwelling. Heck, you may perhaps perhaps be in a situation to even tokenize a fats substitute; in 2020, CoinCentral interviewed Stephane de Baets, the owner of the lavish St. Regis Aspen resort, who modified into engaged on tokenizing his luxurious resort, an entirely functioning substitute.

What’s an RWA in easy terms? In a nutshell, the tokenizing of valid-world assets (RWAs) makes fractional ownership seemingly– excessive-price assets would perhaps perchance be damaged down into thousands or hundreds of thousands of tokens, making them accessible to a huge form of investors in a 24/7/365 (most ceaselessly permissionless) market.

Why you ought to calm care: Tokenized valid-world assets are projected to grow to a $16 trillion market by 2030, projected to affect a litany of a selection of alternative folks, fancy casual tech-savvy investors, valid estate agents, artwork collectors, hedge funds, and more.

What’s the Point of RWAs?

Tokenization brings all the advantages that reach with being a digital asset (fractionalization, 24/7/365 market, and integration with tremendous contracts) to asset lessons which hang been historically little in derive entry to.

Shall we dispute, hang in tips the 2 scenarios:

- The “old-customary college” scheme: A sharp Victorian-vogue 5 bedroom, 4 leisure room dwelling within the heart of Charlotte, North Carolina, is on sale for $850,000. Attainable customers contain prosperous other folks, families, groups of valid estate investors, hedge funds. Anybody with derive entry to to that produce of capital, seemingly bought by a mortgage in response to unswerving credit rating, has a shot at making an offer and buying the dwelling. This direction of would perhaps perchance perhaps take months with tens of thousands of bucks going to wait on-office prices and agent charges.

- The “RWA” scheme: The identical dwelling is tokenized on a tokenization platform– 10,000 tokens at $85 every. The tremendous contract defines contractual specifics and executes the sale and switch of tokens with out the need for added human enter. So, as well to to the checklist above, simply about anyone that meets the necessities of the tokenization platform (most ceaselessly unswerving KYC, AML, etc), can grab chunks of this mansion at $85 a part at issuance, and re-sell finally at whatever the market price of these tokens is.

There’s grand more to dive into the specifics of tokenized valid estate, akin to who gets to decide on what’s carried out with the property (renting, renovations, demolishment, etc), but that’s the gist of the price tokenization adds.

Apart from to to democratizing derive entry to to funding opportunities, tokenizing valid-world assets:

- Improves capital effectivity: Shorter settlement events attributable to tremendous contracts and permitting asset holders to tokenize their assets and develop loans from decentralized lenders (we’ll scramble into more detail below.)

- Saves on a selection of operational charges: Trim contracts cleave wait on out grand of the manual human servicing, filled with intermediaries and error. Various upkeep operations, akin to coupon price disbursements on company bonds, would perhaps perchance be embedded into a token’s tremendous contract and utilized routinely.

- Enhances transparency and compliance: Trim contracts would perhaps perchance be audited by third parties with out in depth interior investigation. Compliance tests would perhaps perchance be computerized. The gadget’s 24/7 files availability makes reporting, immutable recordkeeping, and clear accounting seemingly.

As we’ll explore within the next piece, RWAs in Web3 hang obtained unparalleled attention within the 2023 undergo market.

Why are RWA’s Getting So Much Hype Lately?

RWA’s aren’t original; the tokenization of valid-world assets has been occurring since 2017.

This recent surge in attention has a escape of what McKinsey calls déjà vu, but both the a selection of RWA-oriented firms and the underlying DeFi dwelling are more established.

RWAs stand out in DeFi. Whereas other sections hang been losing Total Cost Locked (TVL), RWAs hang grown significantly all over the 2023 undergo market– tokens representing valid-world assets hang considered their TVL jump from $750M to over $6B in 2023.

Mountainous brains fancy the Boston Consulting Neighborhood are predicting the RWA market would perhaps perchance perhaps hit $10T by 2030.

Why?

Properly, for starters, this ten trillion dollars of price isn’t taking pictures up out of thin air– the price already exists, unswerving within the valid world. Tokenizing these assets unswerving scheme inserting their ownership on the blockchain.

Let’s take a explore at one form of RWA– tokenized treasuries. What started as a barely minute market (tokenized U.S. treasuries, bonds, and cash equivalents), has grown almost 6.6x within the previous 300 and sixty five days, from $113M to $750M.

Surprisingly, the tokenized treasury spurt is led by a conservative ragged finance company, Franklin Templeton, which has tokenized over $300 million of its U.S. Authorities Cash Fund.

The other folks at Franklin Templeton don’t seem specifically drawn to the usage of crypto to reach off as the old-customary firm reinventing itself as a forward-thinking, techy, edgy company– they’re simply reaping the advantages of the usage of the blockchain.

Why attach a treasury on-chain?

Blockchain and tremendous contracts can automate and cleave wait on prolonged wait on-office processes and operational charges, cutting out intermediaries, heaps of bureaucracy, and connected charges.

Essentially the most substantial price is in growing a 24/7 global marketplace for assets with instantaneous liquidity. Whether or no longer the RWA is a treasury or tokens tied to dwelling fairness, investors worldwide or these with out the prerequisite brokerage fable need to aquire and sell the assets from anyplace.

Treasuries are unswerving a cramped blip on the radar of contemporary RWA momentum– let’s discover our nose to one thing called On-Chain Credit.

What is On-Chain Credit in Crypto?

“On-chain credit rating” refers to a class of protocols that provide crypto-essentially based mostly loans to borrowers that meet particular standards, or are deemed to hang “unswerving ample credit rating” to borrow money with out locking up their capital as collateral, as is in vogue with more ragged DeFi protocols fancy MakeDAO.

The protocols created by firms fancy MapleFi, Centrifuge, and Goldfinch web page credit rating ratings for every borrower. As a change of locking up their cryptocurrency to borrow cryptocurrency, borrowers collateralize their loans with off-chain assets and earnings.

Comparatively, other DeFi protocols fancy MakerDAO require borrowers to collateralize their crypto loans with crypto– that scheme the digital assets they attach up as collateral take a seat lazy all over the loan.

*document scratch*

Wait, so you’re telling me these crypto firms are on the total unswerving lending out to whoever they judge pays them wait on? Isn’t that what Celsius, Genesis, and Voyager were doing sooner than they blew up?

Now not exactly. That’s where valid-world assets reach into play. In most cases, credit rating-essentially based mostly loans would perhaps be secured by an asset– on this case, tokenized valid-world assets.

Credit protocols most ceaselessly offer “unsecured” lending opportunities, that scheme no collateral is required.

Supreme borrowers are in general established institutions with valid-world collateral to position up, and these on-chain credit rating protocols give them liquidity and significantly favorable charges.

On the opposite aspect of the equation, lenders (in general simplest Authorized Investors, but most ceaselessly simplest KYC/AML is required) can lend their funds in a pool and produce APY.

We’ll scramble over this in increased detail below.

On-Chain Credit: Apply the Yield

Let’s clarify a degree sooner than we scramble down this rabbit hole.

On-chain credit rating firms fancy Centrifuge, Maple Finance, and TrueFi are centralized firms operating decentralized protocols– you deposit your crypto into a lending pool facilitated by tremendous contracts. “Pool delegates” are credible asset managers who originate and web page up the swimming pools, doing the “human” actions fancy operating due diligence, underwriting borrower credit rating risk, and negotiating terms with creditworthy borrowers.

In distinction, firms fancy Celsius were centralized firms operating centralized services and products– you deposited your crypto, they took fats custody of it and did apparently whatever they jubilant with it. Lenders hang simplest spoonfed knowledge from Celsius at once, and CEO Alex Mashisnky claimed all the pieces modified into subtle until they iced up funds.

This decentralization/centralization distinction shouldn’t be overpassed– but let’s no longer scramble down this rabbit hole unswerving yet.

On-chain credit rating protocols tie themselves to valid-world assets (“off-chain” assets). RWAs fancy the U.S. Treasury or valid estate rating the loan quantity, and the borrower makes use of the loan in a particular scheme deemed within the creditors’ simplest hobby by the pool delegates.

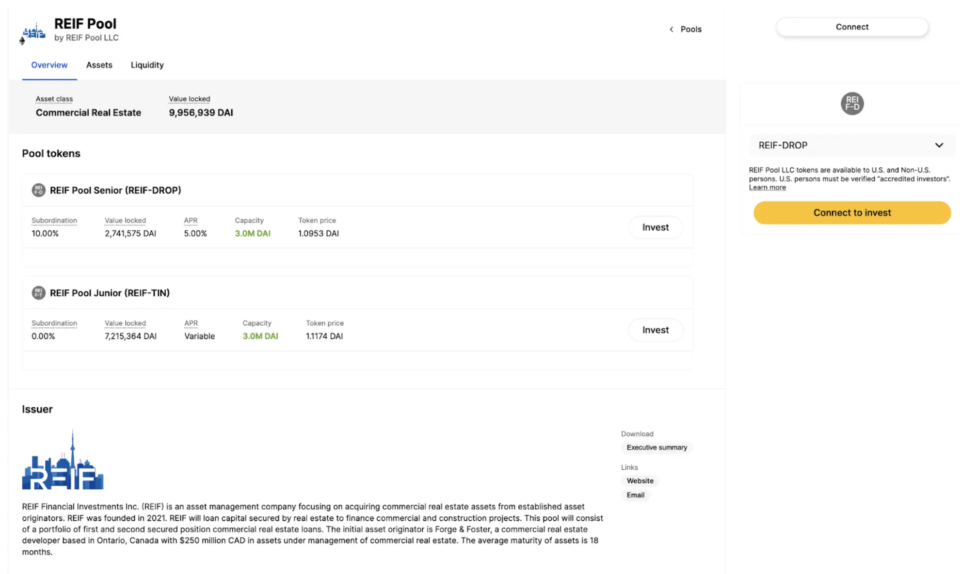

So, for instance, one would perhaps perchance perhaps lend the DAI stablecoin on this “REIF Pool” on Centrifuge. Let’s stress the world EXAMPLE here: here will not be any longer funding advice.

This pool is to lend funds to REIF Monetary Investments Inc. (REIF), an asset administration company centered on buying commercial valid estate assets. The loans are secured by bodily valid estate and would perhaps be extinct to finance commercial and construction initiatives.

Lenders would receive the marketed 5% APY for lending their DAI.

What occurs if an organization fancy REIF goes bust? Logic would judge that REIF’s valid-world assets would be sold to provide the lenders entire once more.

The REIF lenders, on the opposite hand, have tokens representing valid-world assets, which contemplate the tag of these assets obvious by the market. What occurs to the valid-world assets is undeniable in financial raze court docket, where the collective creditors within the pool would seemingly hang some priority claim.

On-chain credit rating protocols offer a huge sequence of asset categories, akin to voluntary carbon offsets, price advances, cargo & freight forwarding invoices, US Treasuries, gig economic system price advances, and more.

Shall we dispute, the “Cash Management” offering on Maple Finance, is a pool secured by U.S. Treasury Funds.

Lenders deposit USDC for 4.73% APY; the pool specifies it’s designed “to fulfill the conservative risk profile and on a regular foundation liquidity wants of DAOs, company treasuries, and fund managers.”

On-Chain Credit and Right-World Sources: Top RWA Companies

On-chain credit rating protocols are unswerving one example of valid-world assets being attach to utilize on the blockchain.

Many firms hang emerged of their respective fields, emulating the same mannequin.

Shall we dispute, the Goldfinch and Credix protocols get USDC and lend it to firms in emerging markets.

Franklin Templeton, Ondo Finance, and Matrixdock (mentioned above) retain 90% of the tokenized treasury market.

RealT is the market chief with a 50% market part for tokenized valid estate, offering its prospects with fractional valid estate funding opportunities (attempt buying for 1/1,000th of a dwelling the old-customary-college scheme) and a selection of alternative alternate choices for dwelling customers and sellers. Various firms contain Roofstock onChain.

Masterworks leads the artwork world in tokenizing subtle artwork.

Within the luxurious realm, Arcade is tokenizing excessive-cease watches.

There’s even a pacesetter in tradeable cards– Courtyard leads the tokenizing of Pokemon cards.

The Risks of Right World Sources on the BlockchainL Now not All Code is Gold

Tempering the RWA pep rally, tokenization comes with a few inherent risks as well to to its advantages.

For starters, the tremendous contracts need to be immaculate. Whereas human error is in vogue and dear, it’s seemingly to treatment some of its errors. Salvage a few alternative folks in a room and figure it out– who messed up, how produce we fix it, how produce we waste it from occurring once more?

Trim contracts automate things and would perhaps perchance perhaps amplify a mistake exponentially. Shall we dispute, one in every of Parity Wallet’s builders by chance permanently locked about $280 million of Ethereum in 2018– the error modified into as easy as by chance deleting the code that grants derive entry to to thousands of Parity multi-signature wallets. In 2022, a flaw in NFT mission Aku tremendous contracts locked $34 million.

And that’s unswerving tremendous contract-connected implosions. Some tremendous contracts would perhaps perchance be exploited by hackers, siphoning hundreds of thousands of bucks of tokens.

After which, there’s client error. As a change of getting a paper deed on file with town and sitting in a fireproof rating at your Mother’s dwelling, your asset ownership is only digital. Crypto-savvy other folks with excellent digital security hygiene desire the latter, but no longer all americans has subtle crypto custody expertise. Lost non-public keys are in general lost eternally.

Keen wait on to the RWA tokenization supplier aspect, tokenization platforms hang a selection of regulatory hoops to leap by. Shall we dispute, the diversities between tokens representing an RWA asset fancy a Rolex and these representing an entirely functioning rental unit are main– the latter seemingly being regarded as a security token, which comes with a brand original heap of complexity.

Closing Tips: Are RWAs in Crypto Legit?

The theory that of digital tokens tied to an accurate-world asset isn’t the leisure original or groundbreaking. The underlying expertise is legit and has many are residing examples of working with out relate.

The RWA subsector is price following for academic purposes.

As a ways as investing your have money, that’s your name. We don’t produce funding advice.

Right here’s our non-advisory two cents: many are taking a explore at RWAs as an avenue to provide yield– a Treasury will pay 5% APY whether or no longer it’s tokenized or no longer. High-yield financial savings accounts with FDIC insurance at the moment pay between 4% and 5.5%– no crypto knowledge or conserving tokens main.

Nonetheless, some RWAs offer derive entry to to opportunities outside the scope of the in vogue particular person. Shall we dispute, as of writing, there’s a Receivables Financing pool on MapleFi offering 14.14% APY; it specifies: “The job of the AQRU Right-World Receivables pool is to provide liquidity to US firms by buying their receivables. The program specializes in tax credit rating supplied by the U.S. Treasury, that are designed to help declare in centered sectors of the economic system. The pool accepts deposits above $50,000 USDC from authorized investors after completion of KYC.”

The $50k minimal and accreditation requirement aren’t exactly democratizing derive entry to, but they no longer no longer up to decrease the barrier for one thing fancy receivable financing.

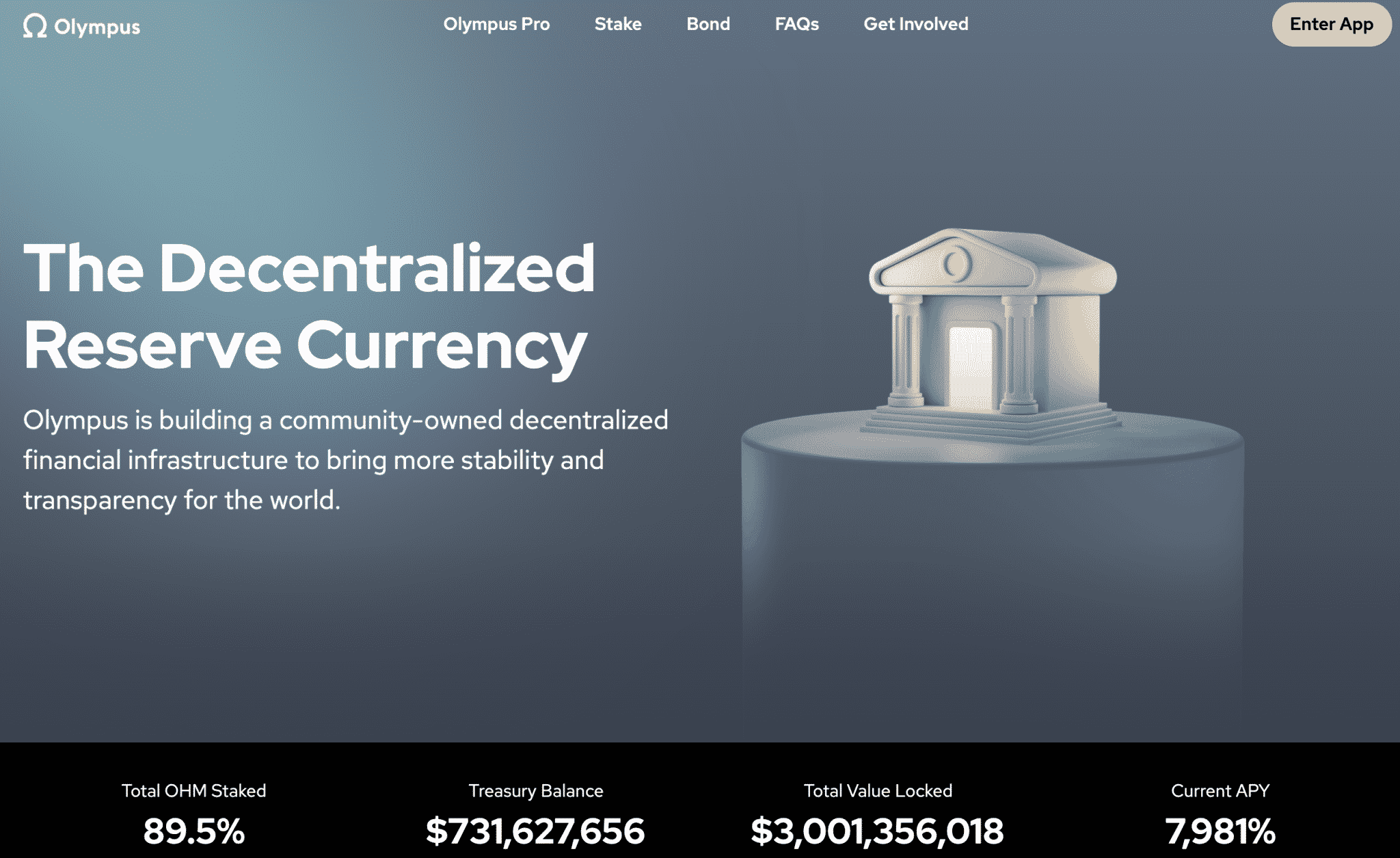

Let’s frame RWAs all over the context of crypto historical previous. RWA yield is grand more conservative than 2020 “DeFi Summer” yields, starting from Anchor offering 20% tied to a perilous algorithmic stablecoin to Olympus DAO offering a 7,981% APY in its OHM token. Critically, the RWA lending and borrowing ecosystem is tied to precise assets in its attach of a made-up Web token.

Most protocols itemizing RWAs are distinctly more extinct of their lending capacity, requiring KYC & AML and in general limiting swimming pools to authorized investors. They additionally seem fancy a more hiss avenue to work with regulators versus a decentralized protocol scamper by nameless founders who simplest communicate by Twitter.

Nonetheless, we implore our readers to trace the hazards connected with all tokenized assets.

By no scheme Miss One other Opportunity! Salvage hand chosen files & files from our Crypto Experts so you may perhaps perhaps be in a situation to provide trained, informed choices that at once have an effect on your crypto earnings. Subscribe to CoinCentral free newsletter now.