The below is an excerpt from a recent version of Bitcoin Journal Respectable, Bitcoin Journal’s top price markets e-newsletter. To be amongst the first to receive these insights and other on-chain bitcoin market prognosis straight to your inbox, subscribe now.

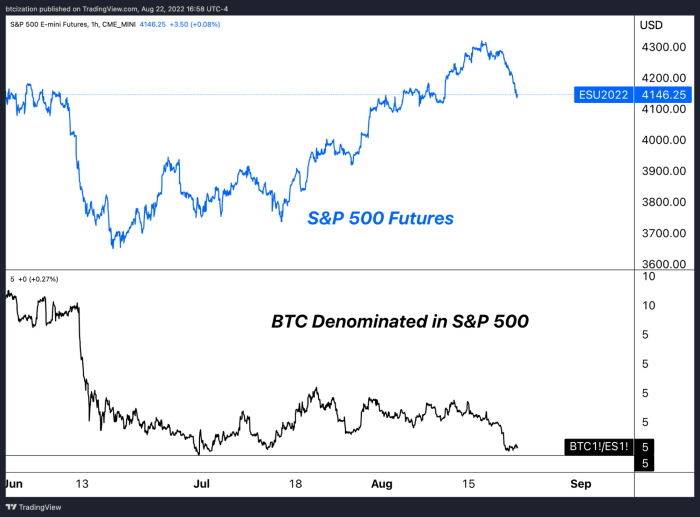

This text will mask legacy market dynamics and evaluation the scorching sing of the “liquidity tide.” Bitcoin Journal Respectable readers are familiar with bitcoin and equity markets procuring and selling in tandem; we mask the connection closely.

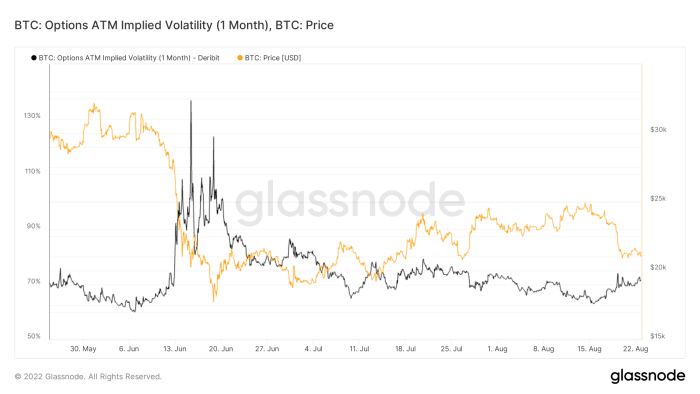

We additionally closely apply the volatility dynamics across asset classes, as the levels of historical and implied volatility in an asset class are very vital for evaluating relative risk.

Sooner than diving in, let’s revisit our recent thesis on the sing of worldwide risk markets:

A extensive slowdown is amidst throughout the worldwide financial system, as brief-sighted power coverage has worked to abet inflationary pressures elevated. Despite the proven fact that equities and risk broadly enjoy felt relief for the reason that middle of June, we were and are of the perception that right here’s a endure market rally with additional inconvenience to be felt across risk.

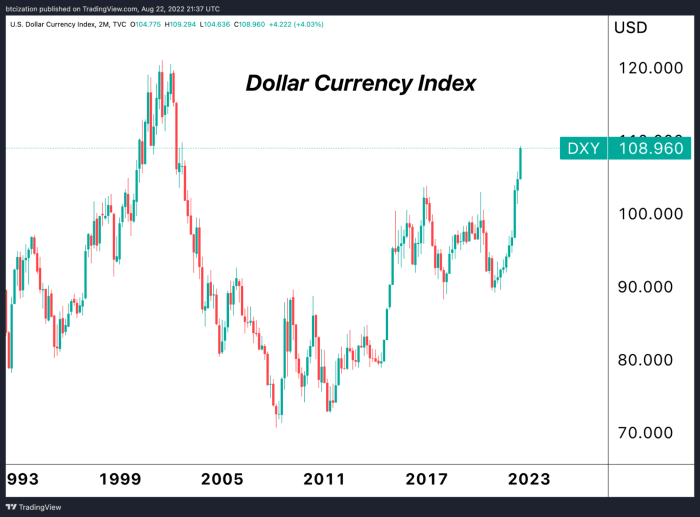

Global markets opened risk-off on the open of Sunday evening futures procuring and selling, and sold off additional into the morning, as volatility jumped, and the buck (as seen by the DXY) drawing shut multi-decade highs yet again.

Proven below is the month forward implied volatility for bitcoin, which is able to be belief of identical as the VIX. Whereas equities are within the intervening time procuring and selling with a 24% anticipated volatility for the next month (as expressed by VIX at 24), the alternatives marketplace for bitcoin implies 71% volatility for 1-month contracts.

Thus, bitcoin’s underperformance relative to equities throughout the endure market rally and subsequent blueprint down from its local excessive, is worrisome for bulls, and telling in fashionable about search knowledge from for the asset at recent market prices.

We’re greatest being goal. Bitcoin has served as beta to equities to the upside and downside during 2022, however greatest barely rallied with the identical fervor and upside volatility during this summer season leap as equities melted upward.

With this in thoughts, the length in-between consequence is telling of a lack of relative efficiency against worldwide risk markets.

As rising yields and a worthy buck predicament rising stress on worldwide equities, one should place a demand to themselves what are the probably outcomes of additional risk-off positioning in equities, and what’s the probably response for the much less liquid bitcoin market.

As equity markets starting up to teeter over, and volatility within the legacy machine increases thru this deleveraging, we are extra and extra assured in our perception that extra inconvenience is the probably direction sooner than lengthy within the bitcoin market, and opportunistic investors should in flip be ready with a cash allocation.

Bitcoin denominated in shares of the S&P 500 is drawing shut its 2022 lows:

Given the relative historical correlation between the two asset classes, the historical and implied volatility of the bitcoin market, and the probably direction forward for the worldwide financial system, this day’s label action reiterates our brief/medium-term market outlook that the low for bitcoin isn’t any longer yet in.

Over the brief/medium term, a cash predicament is probably the asymmetric wager (in bitcoin terms).

Over the lengthy-term, bitcoin remains solely mispriced as a fair nerve-racking monetary asset reason built for the digital age.