Investing shouldn’t be a gradual-weight-hearted decision, nonetheless it sounds extra advanced than it’s a ways. In archaic finance, some brokers manual consumers by the direction of, making it a extra easy skills.

With Bitcoin, there may possibly per chance also also be no intermediaries, and there must no longer be within the proper spirit of the cryptocurrency. Nonetheless, the Bitcoin offering is completely different, and users can judge to invest in BTC personally without a third parties eager or by taking part a dealer delight in an alternative or a fintech firm to net the job for them.

Bitcoin Journal is right here to provide a beginner with the ethical tools to create their first BTC bear or merit experienced Bitcoin users switch to extra principled platforms in accordance with Bitcoin philosophy.

What is Bitcoin?

Bitcoin is the first decentralized and search-to-search cryptocurrency created by nameless Satoshi Nakamoto in 2008.

It is decentralized and search-to-search on myth of it depends on an open global network of nodes that communicate with every completely different to validate transactions without the want for a central authority delight in a bank or a financial institution.

Over time, it has grown exponentially to change into basically the most net network, practically about impossible to interrupt, and suited to allow its users to amass entire adjust and accountability for their very possess money. For these who bear correct care of your Bitcoin, no person can bear it a ways off from you, censor you, or manipulate your holdings. That you simply would possibly be taught extra about it in our in-depth manual about Bitcoin and how it works.

Repeatedly Asked Questions

Can I resolve 1 Bitcoin?

That you simply would possibly resolve any quantity of Bitcoin, even as diminutive as $1. Bitcoin is divisible, and satoshis are the smallest denomination of bitcoin. One satoshi is associated to 100 millionth of a bitcoin.

What’s the minimum quantity I must Make investments?

From an funding level of explore, it’s a ways useful to open allocating no lower than $10 to optimize the cost of transaction funds. For these who’re planning to develop your capital step by step, you can explore into ‘buck trace averaging,’ allocating tiny amounts every day, week, or month.

What’s the safest manner to resolve Bitcoin?

The most popular exchanges delight in Coinbase are frequently conception of as safe to resolve Bitcoin. Nonetheless, no topic where you resolve it, be conscious to net it straight away after bear and net it into your possess custody by hunting down it from exchanges subject to hacking, censoring transactions, or preventing withdrawals.

Where is the particular repute to resolve Bitcoin?

This text will let you trace what the particular-suited service for you is. It may possibly in all probability even also be an app, an alternative, or a dealer; on the opposite hand, the particular repute may possibly per chance also merely depend upon the amount it’s essential to resolve, your draw, and how great you cost privacy over comfort.

Key Concerns Sooner than You Rob

Retaining Bitcoin vs. an IOU

There’s a infamous Bitcoin neighborhood mantra asserting, “no longer your keys, no longer you money.” What does that mean?

Bitcoin is a create of money completely different from archaic money; while you possess it, you indubitably retain a non-public key that offers you access to the asset. It lets in you to retailer it securely and utilize it, ship or receive it. By controlling the non-public key, you’re the handiest owner of Bitcoin, and no-one else can access it.

For these who transact Bitcoin by an alternative or lending service, they extra assuredly retain the non-public key and act delight in a bank that keeps you money somewhat safe. They may be able to cease you from withdrawing your possess money or inducting censorship for your non-public key access. If your service supplier is hacked, you can lose your Bitcoin.

Whether you’re taking a explore to resolve Bitcoin to create a revenue or hodl it for a lengthy time, it’s essential to amass into consideration conserving it so that it may possibly possibly’t be confiscated or stolen a ways off from you.

Conserving your asset on on-line platforms successfully equals having an “I owe you” (IOU), no longer the Bitcoin itself. Due to the this IOU is a correct recommendation while you intend to alternate Bitcoin, nonetheless as soon as your asset turns into substantial, it’s essential to fetch it from the third-occasion service and repute it in a non-custodial wallet that handiest you can access.

Volatility

Bitcoin is mute a somewhat younger asset with ethical over a decade. Adore every fresh asset, it’s a ways subject to volatility, which is conception of as a function, no longer a malicious program, amongst the Bitcoin neighborhood. Many bitcoiners bear serve of the volatility to promote the asset when it climbs in cost and resolve motivate when it crashes to develop their stack. Bitcoin traders utilize volatility to create money all over trace swings.

Ardent bitcoiners would tell it’s essential to hodl Bitcoin for over two cycles (in total over eight years) on myth of volatility mute aspects to the upside over the lengthy traipse. That you simply would possibly mute generate gorgeous returns in between cycles while you include it.

Privateness

Bitcoin’s transactions are nameless, so no title, take care of, email, or sign-in kinds are most well-known to make utilize of BTC; on the opposite hand, they’re linked to particular public addresses which may possibly be certainly shared and open for each person to ogle.

Those addresses will eternally unusual the transactions carried out by them; therefore, it’s easy for each person to know how great Bitcoin has been sold, supplied, moved, and archaic by one particular take care of.

This distress is avoidable by changing the overall public take care of each time it’s essential to make utilize of Bitcoin. Most wallets net this routinely, making you money extra advanced to hint.

That you simply would possibly bear additional measures to provide a enhance to security and anonymity and explore them in our article on resolve Bitcoin anonymously.

Private accountability

We’re archaic to delegating accountability for our money to third parties delight in a bank or a financial institution so that we don’t want to danger about where to fetch it safe. Nonetheless, we mentioned earlier that this comes with alternate-offs, as you money is below the adjust of 1 other entity, and you can even merely lose it.

One of Bitcoin’s most most well-known factors is non-public accountability, which is anxious nonetheless rewarding. It’s anxious on myth of it’s essential to make utilize of strict immediate-witted precautions to fetch it safe at all instances. For these who don’t, you can even merely lose you money, and no-one may give it motivate to you.

Being decentralized and completely honest from the adjust of a third occasion, Bitcoin has no well-liked structure of a firm. Ensuing from this truth, there is now not any contact middle to name while you lose you money or possess a danger with your switch.

It is top to be taught easy how to manage it yourself. Nonetheless, a quantity of merit is on hand by social media channels, books, websites, and Bitcoin Journal, so you won’t fetch it anxious to accumulate your manner around it swiftly and efficiently, even while you’re no longer a techie particular person.

It turns into very rewarding on myth of you attain the sensation of proudly owning the asset exclusively, and no-one can bear it a ways off from you.

Taxes

Bitcoin is rarely any longer exempt from taxation. On the total, while you hodl Bitcoin lengthy-term, no earnings or capital beneficial properties tax is eager. That you simply would possibly incur a tax occasion while you promote or utilize it to resolve goods.

Sooner than you drag ahead and resolve it, it’s essential to amass into consideration checking the tax implication for your nation, which also can merely vary from one other jurisdiction.

Rob Bitcoin

The times you can resolve Bitcoin handiest on Mt Gox (the first alternate) possess lengthy gone. At the present time, the offering is so abundant that that you just can be also very correctly be contaminated for different. From fintech companies to straightforward exchanges, you can fetch to resolve Bitcoin anonymously or no longer at any time.

Exchanges are basically the most well-liked design of procuring Bitcoin, so now we possess itemized the traditional steps required to open making your first Bitcoin bear. They also can merely vary by manner of choices and products and companies, nonetheless the registration and procuring processes are very associated across the board.

A listing of exchanges and completely different procuring systems will practice.

resolve Bitcoin on an alternative:

1. Registration. That you simply shall be required to register and open an myth with the service supplier. Title, surname, email take care of, and date of birth will assuredly be satisfactory to create access to the alternate. That you simply would possibly endure a completely different verification direction of reckoning on the products and companies it’s essential to make utilize of.

As an illustration, stricter KYC is demanded in case of elevated tiers supposed for additional most well-known purchases. If that is the case, a selfie with your credit card or passport displayed subsequent to you is on the total requested by the alternate. A lot also is dependent on the alternate’s jurisdiction you can even very correctly be joining, as some international locations require diminutive or no to no KYC at all.

2. Pre-bear money switch. When you’re verified, you’re ready to switch and resolve Bitcoin. That you simply would possibly switch money to the alternate the utilize of your credit/debit card for swiftly execution; on the opposite hand, this chance will trace you very excessive funds.

For these who may possibly per chance also very correctly be no longer in a bustle to resolve Bitcoin, that you just can incur lower funds to switch money by capability of a bank switch, although the operation may possibly bear about a days to entire. Rob Bitcoin. Every alternate will provide you completely different alternatives to resolve bitcoin. That you simply would possibly repute up any of the following sorts of orders:

3. Rob Bitcoin. Every alternate will provide you completely different alternatives to resolve bitcoin. That you simply would possibly repute up any of the following sorts of orders:

- Immediate narrate: an instant narrate to resolve or promote on the requested trace; if unavailable, a requote will happen.

- Market narrate: an instant narrate to ‘resolve’ or ‘promote’ on the fresh trace within the market.

- Restrict narrate: an narrate to resolve or promote at a particular trace or elevated at any time within the lengthy traipse. It is an narrate viewed to the market by the narrate e book.

- Stop Repeat: an narrate to resolve or promote when a cease trace is met. Unlike the restrict narrate is rarely any longer viewed to the market till the cost is matched; then, it turns right into a viewed market narrate. delight in , or . Hardware wallets operate offline and are is named cool storage, assuring you that on-line hacks are only about impossible.

4. Acquire your bitcoin. As soon as your Bitcoin holding turns into substantial, it’s advised that you just net it in a hardware wallet delight in Trezor, Ledger or Opendime. Hardware wallets operate offline and are is named cool storage, assuring you that on-line hacks are only about impossible.

There are loads of how to resolve Bitcoin completely different than exchanges. In the early days, it was once traditional to resolve Bitcoin in particular person. Nonetheless, the cryptocurrency’s cost was once negligible then, and such one design wouldn’t be advised as of late. Retain reading to explore the extra than one alternatives on hand in narrate for you to resolve on exchanges or completely different products and companies.

Where to Rob Bitcoin

Exchanges

Starting up with exchanges, listed right here are about a marketplaces where you can birth constructing your Bitcoin portfolio. The essential distinction between exchanges and completely different fintech products and companies is that these provide funding autos which may possibly be no longer on hand in exchanges, mainly archaic for getting and promoting digital sources handiest.

Bitcoin handiest exchanges

Listed below is a list of a combination of centralized and decentralized exchanges which may possibly be advised to resolve or promote Bitcoin handiest. They must be basically the most well-liked design to resolve Bitcoin as they higher make stronger and safeguard the Bitcoin network.

1. River is a US-essentially based completely mostly Bitcoin-handiest custodial alternate that claims to be very easy and net to make utilize of while offering loads of correct academic subject material to trace Bitcoin.

River funds funds essentially based completely mostly on how great Bitcoin you resolve, starting from 1.20% nonetheless offers no funds for recurring buys. River shops all bitcoins offline and in net cool storage. River also offers customers to resolve Bitcoin miners.

2. Swan is River’s most most well-known competitor within the united states and claims to be basically the most net platform to resolve Bitcoin. Swan offers associated products and companies to River, with the principle distinction being within the funds: Swan’s are 0.99% while River’s open at 1.2%. They provide recurring day-to-day, weekly, or month-to-month purchases, which they made animated attributable to a truly competitive USD/BTC conversion charge.

3. CoinCorner is a Bitcoin alternate essentially based completely mostly within the Isle of Man, Spacious Britain. They’ve over 2 million users across over 45 international locations they serve. Deposits and withdrawals are handiest on hand in GBP and Euro. They’ve mounted transaction funds essentially based completely mostly on the amount processed.

Deposits are free within the UK and Europe on the opposite hand, they possess got a mounted charge of £25 for every completely different function. Withdrawals trace 1GBP and 1EUR, reckoning on the foreign money archaic. There’s no charge for depositing or withdrawing Bitcoin.

4. Bull Bitcoin is a longstanding Bitcoin-handiest alternate established in 2013 and appears to be a somewhat straightforward service to make utilize of from the open. There are no frills on the gap page, and every very necessary knowledge it’s essential to know relating to the service is displayed merely away. You furthermore mght can also utilize Bull Bitcoin to pay your funds on-line with Bitcoin.

They’re broadly liked for their atmosphere friendly buyer make stronger and possess tiered-essentially based completely mostly transaction funds starting from 0.5% for $100CAD to $1000CAD, as a lot as 1.25% for amounts transacted over $10,000CAD.

5. Robosats is a search-to-search Bitcoin alternate top for onboarding fresh users as it’s easy and immediate to make utilize of. It requires no KYC because it’s essentially based completely mostly on pseudonymous avatars that allow customers to alternate Bitcoin over the Lightning Community the utilize of the TOR browser handiest.

Users may possibly per chance also also simply swap on-chain Bitcoin for Lightning liquidity. Established in early 2022, the non-custodial alternate has a quantity of room for improvement, nonetheless it’s a ways repute to provide the prototype of a Bitcoin-handiest alternate essentially based completely mostly on privacy and security.

6. Hodl Hodl is one other search-to-search Bitcoin alternate that also offers search-to-search lending products and companies. It’s a non-custodial platform that requires no KYC or AML procedures. The alternate accepts practically about all fiat currencies and diverse cost how to open trading, alongside side revenue particular person and bank transfers.

It for plod works merely: a contract is generated, and Hodl Hodl creates a completely different multi-sig escrow. The seller deposits Bitcoin straight a ways off from his wallet and has the same opinion on a price design with the purchaser. The seller releases Bitcoin from multisig escrow on to the purchaser’s wallet.

7. Paxful is a Bitcoin alternate and digital wallet where customers may possibly per chance also also utilize completely different digital currencies delight in Tether, Ethereum, and Monero to resolve Bitcoin. Varied than the well-liked bank transfers, Paxful offers a huge series of cost systems, alongside side gift cards and airline tickets.

8. Relai is essentially based completely mostly in Switzerland and is Europe’s most accessible bitcoin-handiest funding app. It lets in instant Bitcoin purchases by SEPA cost integration, and customers can repute up a weekly or month-to-month financial savings opinion for as diminutive as 10 EUR. Bitcoiners delight in it on myth of it requires no deposit, registration, or strict KYC draw. It’s the top app for inexperienced persons who want to resolve and hodl Bitcoin on myth of it’s easy to make utilize of and offers a distress-free skills.

9. Bisq is a decentralized search-to-search bitcoin alternate that lets in someone to resolve and promote bitcoin in alternate for fiat currencies and completely different cryptocurrencies. It is no longer a firm nonetheless free tool that requires no centrally-managed servers and has no single aspects of failure.

Bisq does no longer require non-public knowledge or a linked bank myth to make utilize of the platform, making it the top different for these that want to retain their privacy.

Cryptocurrency exchanges

Mainstream crypto exchanges present trading and completely different products and companies for the myriad of altcoins on hand within the market. They don’t seem like advised for users who want to possess a Bitcoin-handiest skills and fetch no longer want to be distracted by the ‘altcoin on line casino’ that may possibly entice customers to descend prey to initiatives of doubtful nature.

1. Binance is the greatest cryptocurrency alternate on the planet by manner of the day-to-day trading volume. Its license to operate in cryptocurrency differs in accordance to the jurisdiction; to illustrate, within the US, it has a extra diminutive operational activity than in completely different international locations.

It lets in customers to alternate over 350 cryptocurrencies, nonetheless buyer satisfaction is rarely any longer very excessive attributable to sorrowful buyer service and danger assuredly in withdrawing funds. It offers 0 trading funds on selected BTC repute trading pairs and higher funds when the utilize of its native BNB in a trading pair.

2. Coinbase is a easy-to-utilize cryptocurrency trading and investing platform with over 98 million users and $256 billion in sources. It offers its customers the capability to resolve, promote, and alternate Bitcoin and over 100 completely different cryptocurrencies.

It offers completely different products and companies delight in earning crypto by academic purposes; on the opposite hand, its funds are mushy excessive on realistic in contrast with completely different exchanges. It’s assuredly been criticized for its sorrowful buyer service and downtime all over excessive usage traffic.

3. Kraken is one among the prominent cryptocurrency exchanges. It offers a flexible platform for particular particular person consumers and nice looking trading companies.

Its developed trading arrangement and tools, alongside side loads of sorts of cease-losses, leverage, and margin-essentially based completely mostly trading, repute Kraken amongst the leaders in cryptocurrency exchanges.

The US-essentially based completely mostly alternate offers somewhat low BTC withdrawal funds and a huge series of tutorial tell material.

4. Bitstamp is one among the oldest cryptocurrency alternate platforms, established in 2011 in Luxembourg. It lets in trading and alternate between essential cryptocurrencies and fiat currencies, and it targets extra experienced traders in distinction with Coinbase, which is extra geared toward inexperienced persons. It offers competitive funds ranging from 0.00% to 0.40% and is amazingly liked for its devoted in-app buyer make stronger.

5. Gemini is a net- and cell-essentially based completely mostly cryptocurrency alternate founded in 2014 by brothers Cameron and Tyler Winklevoss. It lets in its customers to resolve, promote, alternate, and securely retailer Bitcoin and completely different cryptocurrencies. Its native stablecoin, the Gemini buck, is tied to the US buck.

Gemini has a straightforward-to-utilize tiered service with completely different interfaces and charge constructions dedicated to beginner retail consumers and additional experienced traders.

Brokers

Brokers are intermediaries between the crypto markets and consumers and facilitate procuring and promoting of cryptocurrencies delight in Bitcoin. Many brokers specializing in archaic investments delight in shares, bonds, and mutual funds now also provide cryptocurrency trading by their platforms.

These may possibly per chance also also be desktop-essentially based completely mostly, app-essentially based completely mostly, or both. They provide products and companies delight in copy-trading and a huge series of derivatives delight in futures, alternatives, and swaps. Traders must repeatedly bear into consideration components delight in dealer draw, withdrawal and deposit limits, trading funds, and security earlier than deciding on a merely service.

Some cryptocurrency exchanges act as brokers too, by offering products and companies delight in derivatives and leveraged trading. Right here are some of basically the most well-liked Bitcoin brokers:

1. eToro offers charge-free cryptocurrency trading; on the opposite hand, it funds a unfold markup essentially based completely mostly on the cryptocurrency being traded.

One of basically the most well-liked factors supplied by eToro is its social trading platform with its CopyTrader service, which lets in you to copy the trades of the platform’s prime traders.

eToro lets in users to also alternate archaic investments delight in shares and ETFs making it a flexible platform.

2. TradeStation is a US stockbroker founded in 1982 that began offering cryptocurrency products and companies in Would possibly well per chance 2019 with the birth of the TradeStation Crypto platform. It offers charge-essentially based completely mostly pricing essentially based completely mostly on the vendor’s myth steadiness and whether or no longer the narrate is marketable. Pricing ranges between 0.05 and 0.03 percent of the vendor’s narrate. Traders may possibly per chance also also resolve and promote Bitcoin futures by the crypto platform.

3. Webull is a charge-free trading app that comprises trading cryptocurrencies completely different than shares and ETFs. It requires no deposits, nonetheless, delight in many completely different brokers, this may possibly charge a unfold markup on either facet of a alternate. The platform offers a gargantuan all-around chance to diversify a vendor’s portfolio simply.

Rate Apps

1. Strike is an most well-known heralded disrupter within the funds world. Or no longer it’s essentially known for being a Lightning Community funds platform, nonetheless it absolutely lets in Bitcoin purchases, plus the capability to be paid in Bitcoin. Strike charge “no platform funds,” “no added funds,” and “no Strike funds,”.

2. Robinhood is a net- and cell-essentially based completely mostly fintech platform that offers no-charge trading.It is one other versatile firm that lets in users to invest in and alternate shares, ETFs, alternatives, and American depositary receipts (ADRs) completely different than particular cryptocurrencies essentially based completely mostly on users’ geographic draw. It is amazingly particular person-friendly; on the opposite hand, it doesn’t allow to switch crypto sources off the platform, which manner consumers don’t possess their Bitcoin non-public keys.

3. CashApp is a search-to-search cost arrangement that lets in users to resolve and promote Bitcoin and shares. Unlike Robinhood, the platform lets in consumers to switch their Bitcoin to their wallet, although withdrawals are diminutive to $2,000 day-to-day or $5,000 within any seven days. Cash App sets a charge reckoning on trace volatility and market trading volume, which is disclosed on the time of bear.

4. Paypal launched its crypto service in slack 2020, offering customers the capability to resolve, retain, and promote Bitcoin and completely different cryptocurrencies. As of July 2022, the firm began allowing users to switch their cryptocurrencies to completely different wallets, because the function was once basically the most demanded since they began offering crypto products and companies. Users can resolve as a lot as $20,000 weekly nonetheless no extra than $50,000 all over someone-year length.

Costs consist of an estimated 0.5% trading charge that varies reckoning on market prerequisites and a tiered transaction charge reckoning on the amount of Bitcoin purchased, ranging from 0.5% for purchases below $25 and 2.3% for amounts between $25 and $100.

5. Peach is a search-to-search cell app that lets in customers to resolve and promote Bitcoin. The service is mute in beta mode, and there’s a waiting list to be a half of it; on the opposite hand, it’s a ways one among the few Bitcoin p2p marketplaces on a cell application for the European market.

6. Revolut was once one among the first European fintech apps to provide cryptocurrency trading, although with a non everlasting license. In 2022 it won beefy authorization to provide its cryptocurrency products and companies across Europe and the UK. The app is easy to make utilize of and supports the trading of cryptocurrencies at competitive alternate rates, having access to the greatest liquidity pool in Europe. Its top charge customers may possibly per chance also also switch their Bitcoin to their wallets.

7. Venmo is an American search-to-search cell cost service owned by Paypal since 2012. The platform allowed the procuring and promoting of Bitcoin and completely different few cryptocurrencies in April 2021 and has the same charge structure to Paypal, with an estimated 0.5% trading trace and a tiered transaction charge ranging from 0.5% for purchases below $25 to 2.3% for trades between $25 and $100.

ATMs

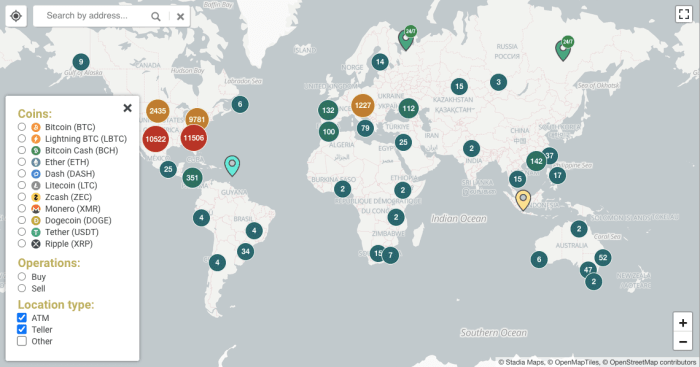

There are for the time being over 39,000 Bitcoin computerized teller machines (ATMs) worldwide, and their quantity has elevated swiftly since 2017, when handiest 1,000 had been recorded globally.

The greatest ATM producer is San Diego (CA) essentially based completely mostly Genesis Coin, with 15,364 machines keep in globally.

ATMs possess turn right into a straightforward, swiftly and atmosphere friendly manner of procuring Bitcoin with a credit/debit card and money. Most ATMs don’t retailer users’ KYC knowledge, bank tiny print, or non-public keys, making it a correct different for these that want to retain their privacy.

Their essential predicament is the excessive transaction funds that can be as excessive as 20% (or extra), reckoning on the ATM and the create of transaction being processed. The dear transactions are mainly attributable to the excessive trace of working and placing forward the bodily machine.

Read our entire manual to trace easy how to make utilize of a Bitcoin ATM

Supply: Coinatmradar.com

Summary

With rising repute, Bitcoin is anticipated to develop its particular person rotten and technological doable within the following couple of years. That you simply would possibly want to be share of this modern monetary arrangement, and procuring some of it may possibly possibly per chance be the first step to encouraging and expanding its network.

The principle takeaways to getting eager and having a gathered procuring skills are the following:

- Thought how great it’s essential to resolve Bitcoin and how frequently it’s essential to resolve it;

- Grab a service that is merely to your geographical draw, stage of technological skills, transaction funds, security, and privacy;

- Register and repute your narrate with a credit/debit card or a bank switch;

- Acquire your asset in a non-custodial wallet that handiest offers you access to the non-public key.