In Greek mythology, Thetis dipped her toddler son Achilles into the River Styx to provide him the power of invulnerability. Achilles grew to change into a apparently-invincible warrior, but he became once felled when a poison arrow struck him in the heel, the very problem where Thetis had held him when she dipped him in the river. She’d overlooked accurate one miniature problem, but that became once the downfall of Achilles.

Nowa days, the term “Achilles’ heel” has change into synonymous with any worthy power that is taken down by an unexpected or dinky weakness, and history is suffering from mighty folks and organizations which like fallen in accurate this procedure.

For the previous 13 years, Bitcoin has been a truly worthy power that has fended off all attackers. This has given many of Bitcoin’s advocates an air of self perception, but this is inclined to be sick-positioned or even harmful. The genius in the aid of Bitcoin is obvious, but this doesn’t invent it supreme or invulnerable. Within the years, decades and centuries forward, not likely variables will emerge, and perhaps one amongst Bitcoin’s supreme strengths will be manipulated and exposed as a weakness to change into Satoshi’s heel.

The Bitcoin Structure

Before diving deeply into this, reviewing distinct aspects of Bitcoin’s architecture is inclined to be well-known.

Satoshi designed Bitcoin with the design that every 10 minutes, blocks (containing transactions) would possibly perhaps well be processed. Once a block is processed, or mined, it’s offered to the nodes for validation and the transactions are posted to the ledger. For their services and products, miners come by compensation in the manufacture of a block reward, which is the sum of a block subsidy and transaction charges.

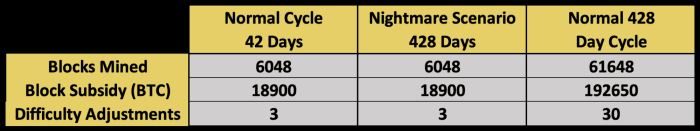

The block subsidy, right now 6.25 BTC, is the mechanism by which new Bitcoin enters circulation. A sigh epoch is a section of 2,016 blocks and, upon completion of every and every sigh epoch, an diagnosis of the time required to project those blocks is performed. Since Satoshi’s purpose became once for the intention to moderate 10 minutes to project every block, if the outdated sigh epoch became once shorter than 10 minutes, block processing is made more difficult for the upcoming epoch, and vice versa if the outdated sigh epoch became once longer than 10 minutes.

An Rising Vulnerability

With a number of the foremost fundamentals of mining in mind, there would possibly be an rising vulnerability in the Bitcoin ecosystem to web into epic. Many folk straight correlate an lengthen in global hash rate, or an correct distribution of hash rate all thru the mining pools, with elevated security in the community. There would possibly be some truth to those conclusions as, by each and every measures, the community appears to be like rather solid and rep recently; alternatively, one other layer deeper, there would possibly be a vector of vulnerability.

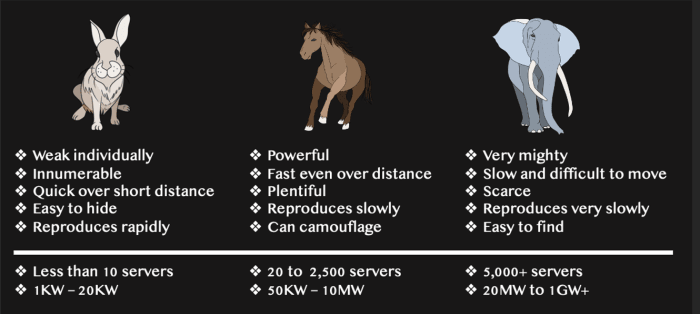

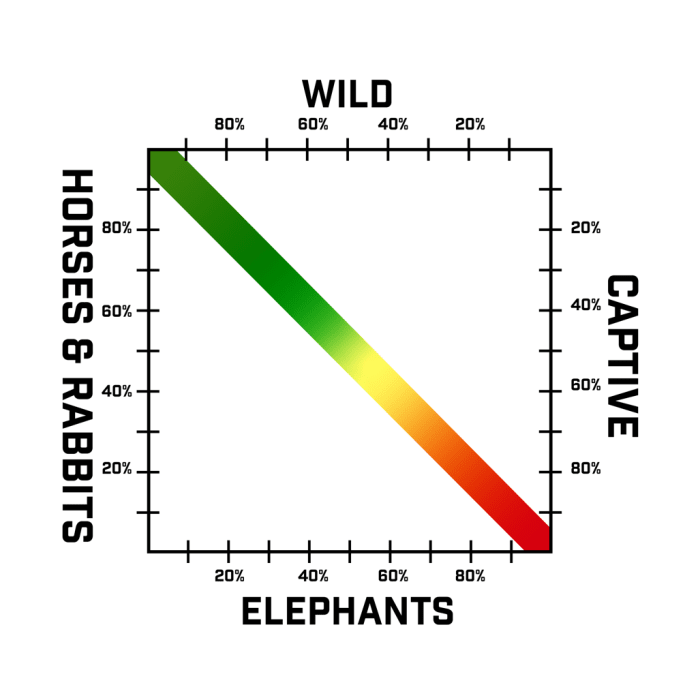

This residue is the growth and dominance of “captive elephant” (scrutinize chart below) mining websites. A captive mining do apart is one whereby the power provide is controlled by a third occasion and this on the total manner it’s grid based. A wild mining do apart is one where strength is generated and controlled by the miner and is, therefore, off-grid.

To explore the vulnerability, web into epic a sigh known as “Night Dread.” Whereas it’s outrageous, and rather no longer going, it demonstrates the risk.

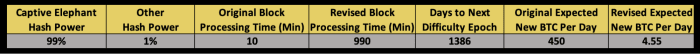

Imagine a time in the spoil when captive elephant websites dominate the mining community. This domination is so complete that 99% of the Bitcoin mining community’s hash strength is consolidated in plenty of dozen captive elephant websites. In parallel, political and financial establishment forces all thru the globe like viewed Bitcoin seriously erode their ability to implement their agendas. Understanding that the most attention-grabbing manner to attack Bitcoin is to shake the overall public’s self perception in its steadiness and reliability, Bitcoin’s detractors situation a direction of action to cripple the Bitcoin mining community. So, accurate forward of the completion of a sigh epoch, a consortium of nation states coordinates a adversarial shutdown of all captive elephant websites. They raise out this by forcing utility suppliers to straight cut strength to all websites, and as well they deploy troops to discontinue the removal of any equipment from the websites.

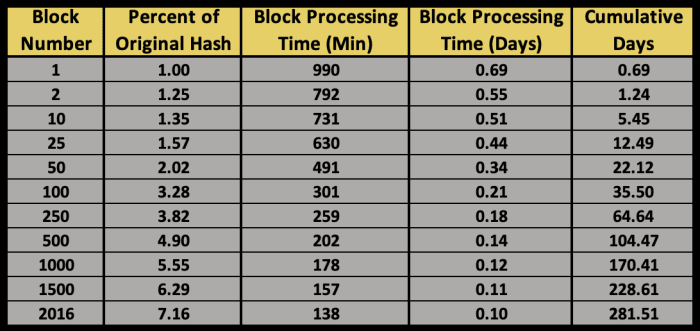

The Bitcoin mining community would possibly perhaps well be reeling from this blow on epic of it straight will be 99 times more difficult to project blocks. Rather than taking ten minutes to project the following block, the expected completion time would possibly perhaps well be 990 minutes, or 16.5 hours. This would pressure the daily transaction capacity of the Bitcoin ecosystem from about 300,000 to accurate a few thousand. Worse but, 2,016 blocks needs to be processed forward of the following sigh adjustment, and with the vastly diminished hash skill of the community, this would no longer occur for one other 1,386 days or 3.8 years (assuming no new hash strength is added.) Furthermore, new bitcoin would possibly perhaps well be entering circulation at a snail’s scramble on epic of money provide increases are utterly reckoning on the mining of blocks.

Obviously, panic would ensue, as many bitcoin holders trying for to sell or accumulate their bitcoin into cold storage would possibly perhaps well be locked out. Off-chain actions on exchanges and transactions on Layer 2 protocols (care for the Lightning Community) would possibly perhaps well be likely for a while, but they’d soon change into constrained on epic of putrid layer (on-chain) settlement would change into nearly very no longer going. After a few days in the Night Dread sigh, the Bitcoin ecosystem would possibly perhaps well be so dramatically impaired that the enviornment’s self perception in it’d be shaken to the core and irreparably damaged.

The Nightmare Scenario

If truth be told, the Night Dread sigh will not be likely, but a more most likely one, known as the “Nightmare Scenario” moreover gifts a truly horrifying consequence.

This sigh assumes the identical preliminary conditions of captive elephants possessing 99% of the global hashing strength, and a shutdown and seizure of the websites. In this case, though, the Bitcoin neighborhood responds aggressively to try and keep the ecosystem. The first transfer is from rabbits and horses, redeploying mining equipment that had previously been do out of carrier, and this straight bumps up the final global hash strength by about 25%.

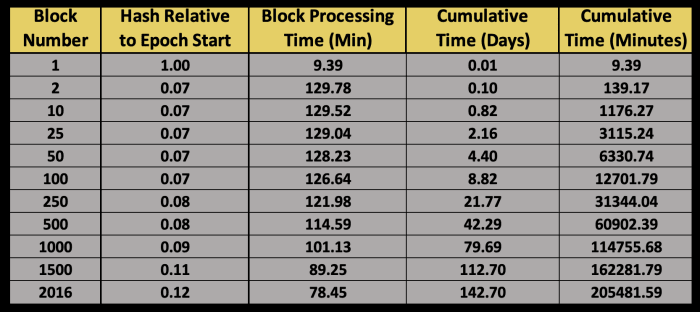

Mining equipment in the distribution channels would possibly perhaps well be rapidly gobbled up and deployed and, in about 5 days, the community would most likely progress to processing two blocks per day in do apart of one. After about three weeks, the community’s strength would grow to moderate three blocks per day. Indirectly, after about nine months, the rabbits and horses would possibly perhaps scale their hash rate by a diminutive little bit of over seven times and toughen the community capacity to about 10 blocks per day.

The consequence would possibly perhaps well be that the problem epoch which had been expected to web two weeks would stretch out to an unbearable 281 days. Also worthy is that in do apart of the expected 127,000 bitcoin entering circulation all thru the total nine-month period, most attention-grabbing 6,300 would invent it.

The moderate block time at the discontinue of the epoch is 138 minutes and many would possibly perhaps perhaps demand that after this painful epoch, the following sigh adjustment would facilitate a return to the 10-minute block processing time. Nevertheless, the community is procedure from being out of the woods.

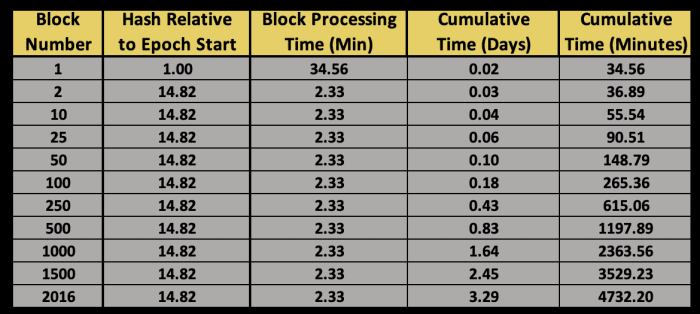

Bitcoin’s protocol has a maximum sigh adjustment of four times in anybody epoch and this procedure that the adjusted block processing time before the entirety do apart of the following epoch adjusts to 34.6 minutes in do apart of 10. This objects up Bitcoin’s detractors for his or her next devious transfer — because the transition to the new difficult epoch occurs, the previously impaired captive elephant websites are turned aid on.

Within the blink of an scrutinize, block processing times swing from unhurried to an exceptionally-rapid two minutes and 20 seconds and a complete sigh adjustment epoch would fly by in accurate over three days. 6,300 more bitcoin would enter circulation and would possibly perhaps well be largely controlled by detractors, and as well they’d prefer the option of flooding the market with these bitcoin or additional starving the market.

The next sigh adjustment would originate with a block processing in shut to 10 minutes but, again, the controllers of the captive elephant websites would possibly perhaps disable their websites and the mining community would again grind to a scuttle. Block processing times would straight exceed two hours and finishing up the problem epoch would web 142 days.

This sample of captive elephants turning on and off would possibly perhaps continue for a truly prolonged time, but it wouldn’t truly be foremost because the damage to Bitcoin would prefer already been inflicted. With out any consistency in the flexibility to project transactions, nor any religion in the stride of inflation, self perception in Bitcoin would possibly perhaps well be ruined, and while it could perhaps perhaps perhaps dwell on with some restricted price or cause, it could perhaps perhaps perhaps never fulfill its vision and recede to irrelevance.

Satoshi’s Heel: Preserving Up With Industrial Miners

When the China ban of 2021 occurred, Bitcoin misplaced roughly 50% of its hashing strength and the ecosystem overcame it care for a dinky stride bump. As is shown in the Nightmare sigh, the lack of 99% of the hashing strength would possibly perhaps well be catastrophic, so somewhere between these two aspects is the hazard zone.

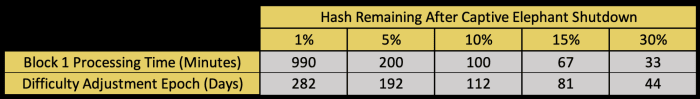

The above chart estimates the impression of the losses of diversified ranges of the community’s hash rate. With a 70% fall in the hash rate, the community feels some tension, but block processing times aren’t tainted, and the difficult adjustment returns the community to seriously customary efficiency in about six weeks. Nevertheless, dips below this level originate as much as transfer the community efficiency into the hazard zone.

If the community were attacked in a vogue that introduced about global hash rate to drop by 85% or more, the shock on the community’s effectiveness turns into catastrophic and the resiliency of the ecosystem is grossly hampered. This would perhaps also unprejudiced properly be Satoshi’s heel. If that’s the case, it is a risk most attention-grabbing on epic of the Bitcoin mining neighborhood created the vulnerability itself. And that vulnerability would possibly perhaps attain from the supreme mining companies focusing on their possess most attention-grabbing short-term interests, and no longer the most attention-grabbing prolonged-term interests of Bitcoin.

In total, the supreme mining companies imagine that they can raise out the most attention-grabbing effectivity, price effectiveness and reliability by consolidating their operations into mountainous websites and working with utility vitality suppliers in mutually-purposeful strength preparations. Nevertheless, because the asserting goes, “there will also be too mighty of an correct factor.”

As illustrated above, too mighty hash strength density in a dinky quantity of websites is a big publicity. The rep level of hashing strength in these websites maxes at about 70% and something else over 85% puts the ecosystem in grave hazard.

Currently, measuring the global hash rate against these metrics isn’t very any longer likely, though it’s most likely in the rep zone now. Nevertheless, it’s serious that rabbits and horses maintain scramble whenever elephants lengthen, and it could perhaps perhaps perhaps most likely reward rather difficult.

Shall we tell, Atlas Vitality has announced a brand new $1.9 billion investment in North Dakota that will bring 750 megawatts (MW) of mining capacity online forward of the discontinue of 2023. This means that, to save scramble, horses and rabbits must add at the very least 322 MW of mining capacity accurate to maintain with this one do apart.

Nevertheless, when facilities care for this one from Atlas Vitality attain online, and they attain online with advise of the art mining machines. This means connected to this strength will be 150 tera hash per 2nd (TH/s) mining equipment (or better.) Rabbits and horses historically like points gaining entry to and/or affording this form of equipment, so and they breeze one generation in the aid of. In this case, it manner they’d typically use 100 TH/2nd know-how. Due to the this truth, keeping scramble would then require 50% more machines and 50% more strength. Given this, it manner rabbit and horse websites must add 161,000 new machines, ingesting 483 MW in much less than two years, accurate to save scramble with the publicity from a single do apart. And, assuming that the Atlas Vitality do apart is the use of grid-based strength, then it moreover manner wild vitality sources equaling 483 MW must moreover attain online. Any shortfall by the horses and rabbits pushes the vulnerability of the ecosystem closer to the hazard zone.

Decentralization is a classic tenet of Bitcoin, and rightly so. For Bitcoin to dwell decentralized, the neighborhood must constantly learn about in any admire aspects of the ecosystem to flush out any risk of centralization going down. The mining enterprise isn’t very any exception.

Mining has many variables that will perhaps, in theory, change into centralized, including geography, jurisdiction, vitality sources, do apart sizes, mining pools, chip sources and intention sources. It will be foremost that a rep level of range constantly be in do apart all thru all variables. If the vector of any variable begins trending towards centralization, it needs to be stopped properly beforehand.

Right here’s accurate no matter how rep centralization would possibly perhaps perhaps appear in any given variable. Shall we tell, there would possibly be a mountainous quantity of do apart building in Texas directly and understandably so, given vitality availability, vitality costs and the welcoming attitude of communities and politicians. Nevertheless, political winds can change rapidly and there are eventualities where Bitcoin mining would possibly perhaps mosey from a first rate friend of Texas to an arch enemy in a truly short window. And, points with the power grid, directed terrorist attacks and pure failures in Texas would possibly perhaps moreover do the mining community into a deadly advise.

For now, the declare threats to Bitcoin are traits towards elephant websites and towards captive strength. Within the matter of accurate one other Twelve months or two, these variables would possibly perhaps enter the hazard zone and on epic of of the scale bright, they’re going to most certainly be very difficult to reverse. It is miles crucial that the enterprise toughen machine deployment to rabbits and horses, and work to plot wild vitality sources to discontinue this publicity. Bitcoin’s detractors are feeling the warmth and as well they would possibly perhaps perhaps even be having a learn about onerous for weaknesses in the ecosystem, so let’s no longer give them a shot at Satoshi’s heel.

Right here’s a visitor post by Bob Burnett. Opinions expressed are entirely their possess and raise out no longer necessarily judge those of BTC Inc or Bitcoin Magazine.