Michael Saylor’s firm Approach continues to make Bitcoin headlines with its gigantic purchases, making it indisputably one of basically the most piquant holders on this planet.

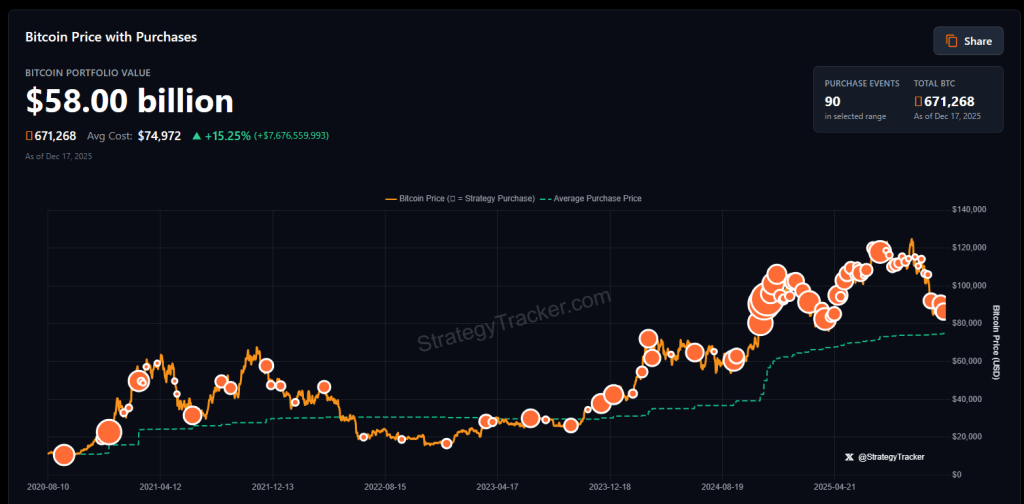

Reports expose the company owns 671,268 Bitcoin, roughly 3.2% of the total provide, valued at about $58.61 billion on the time of e-newsletter, in accordance to Saylor Tracker.

Bitcoin entrepreneur Anthony Pompliano said on his podcast that it could perhaps well per chance be extremely demanding for every other public company to compare Approach’s looking out to search out gallop.

Wide Holdings And Most up-to-date Private

Approach announced a singular buy of 10,645 Bitcoin for $980.3 million, paying a mean of $92,098 per coin. That switch pushed its entire hoard to roughly 3.2% of all Bitcoin in existence. Those are big figures. Besides they expose why competitors would want big sums to shut the gap.

Pompliano On The Scale Wished To Compete

In accordance with comments made on The Pomp Podcast, Pompliano said that a company looking out to compare Approach would must “elevate a entire bunch of billions of dollars.” He said it could perhaps well per chance be “very engaging to figuring out that occuring.”

He pointed to Approach’s early entry in 2020, when Saylor’s initial buy turn out to be about $500 million whereas Bitcoin traded between $9,000 and $10,000.

That initial stake, in accordance to contemporary costs cited in experiences, is now price more than $4.8 billion with Bitcoin trading round $86,950.

Market Impact And Buying Methodology

Market watchers beget flagged Approach’s rising fraction as one thing to witness. Some pains a single big holder could perhaps well per chance impression stamp strikes. Others expose the firm does most of its looking out to search out via over-the-counter desks.

OTC trades are old to handle huge orders with out sending shockwaves via trade present books. Many investors observe the regular, big purchases as a obvious label for Bitcoin demand.

Preserving Approach And Influence Concerns

Pompliano described 3.2% as “a huge number, however it completely’s also a diminutive number.” He added, “It’s no longer take care of they occupy 10%.” That ogle captures a reduce up: the keeping is big enough to topic for provide dynamics and market psychology, however no longer so big that it provides absolute succor watch over. Nonetheless, the combination of measurement and repeated buys attracts consideration from merchants and regulators alike.

Outlook And Long Time frame Plans

Reports quote Approach’s CEO Phong Lee as asserting the company doubtlessly won’t sell any Bitcoin till at least 2065. Saylor has also posted that he plans on “looking out to search out the pause perpetually.” Those statements reinforce a long-timeframe stance reasonably than non permanent trading. The market tends to treat such commitments as bullish, and plenty of participants alter expectations for future demand accordingly.

A Dominant Purchaser

With 671,268 Bitcoin on the books and a customary program of purchases, Approach stays a dominant public buyer.

In accordance with contemporary numbers and public comments, it shall be demanding for one other listed company to compare that level of accumulation with out very big capital raises or a dramatic trade in company behavior.

The gallop field by Approach is likely to succor drawing consideration from investors staring at provide and demand for Bitcoin.

Featured image from Pexels, chart from TradingView