Solana (SOL) has been making waves in the cryptocurrency industry, reaching an all-time high of $265 on November 23, 2024. The surge of Bitcoin toward the $100,000 impress and the enthusiasm for meme currencies had been the catalysts for this mighty rally.

Solana-basically based entirely tokens receive skilled vast beneficial properties prior to now month, with some exceeding a twofold expand in cost. In the crypto put, Solana’s presence is turning into increasingly extra evident, as shown by its $121 billion whole market capitalization.

Solana’s Prominent DEX Exercise

On a standard basis trading quantity over $6 billion has made Solana’s decentralized exchanges (DEXs) highly in question. This reflects a 45% market share. The low transaction fees of Solana helped the platform to face out as a well-known quite rather a lot of to Ethereum, Binance Coin (BNB), and Polygon.

Investor optimism has been additional bolstered by this level of exercise, as analysts receive acknowledged the possible of ongoing enlargement. Solana’s put in the DeFi sector has been additional solidified by the network’s Whole Value Locked (TVL) increasing to $9.35 billion, surpassing BNB Chain’s $6.21 billion.

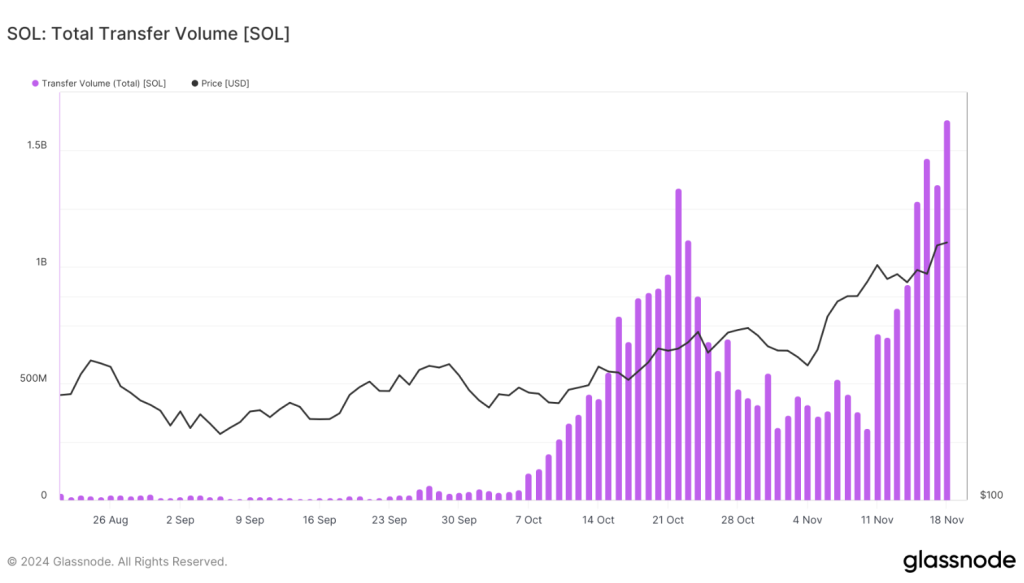

Moreover, Solana reached a ancient $318 billion in switch quantity, atmosphere a brand contemporary file for the blockchain. Irrespective of some indicators of bot-pushed exercise inflating these figures, this high throughput demonstrates Solana’s skill to tackle big transactions.

On November 16th, Solana’s switch quantity hit an all-time high of $318 billion, while the decision of active addresses spiked to over 22 million.

Nevertheless, suggest and median transaction volumes dipped all around the identical interval. This sample of network exercise inflation is doubtless to be… pic.twitter.com/RJcE6Kjnkn

— glassnode (@glassnode) November 19, 2024

Market Dangers And Resistance Stages

Solana’s contemporary performance has been noteworthy; on the quite rather a lot of hand, analysts warning that the coin is impending serious resistance traces. SOL is for the time being trading at $261, representing a 2.60% expand prior to now 24 hours.

A breakout level has been acknowledged by sure consultants above $226, with key resistance ranges at $271 and $309. Solana has the possible to advance into contemporary territory if it must retain momentum and overcome these resistance ranges.

Nevertheless, some are scared relating to the overbought stipulations and receive even speculated that consolidation would possibly well well presumably moreover happen ahead of SOL accomplishes its aim. The Relative Strength Index (RSI) is getting shut to its upper limit, that can perchance well presumably divulge a immediate market correction is imminent.

A Positive Prognosis With Some Reservations

Many analysts count on that Solana’s label will proceed to expand, with a forecasted 8.70% expand to $275 by December 25, 2024. The label is for the time being exhibiting a solid favorable momentum.

The Apprehension & Greed Index for the time being stands at 80, which signifies solid investor self assurance and heightened avarice. Though the final mood is upbeat, investors prefer to take into story the risks and volatility of the market.

It would possibly well possibly perchance well presumably moreover be mentioned that the enhance story of Solana is but to be written entirely, as viewed by the contemporary trading quantity and price action fluctuations. This is in a position to perchance well, on the quite rather a lot of hand, need cautious maneuvering as it continues its ascent.

Featured picture from MoneyCheck, chart from TradingView

Disclaimer: The info came all the contrivance thru on NewsBTC is for tutorial functions

finest. It does no longer tell the opinions of NewsBTC on whether or now to now not buy, promote or abet any

investments and naturally investing carries risks. You are knowledgeable to habits your hold

study ahead of making any investment choices. Exercise info provided on this web sites

fully at your hold danger.