The Terra crew doesn’t appear to select a destroy no longer too prolonged within the past. This time, prosecutors in South Korea have summoned representatives and employees at Terraform Labs to review the collapse of TerraUSD (UST), the company’s now failed stablecoin.

Terra Staff Has Already Testified

As per a file from a local newspaper, the Monetary Crime Joint Investigation crew of the Seoul Southern District Prosecutor’s Space of job has known as all Terraform Labs employees to ranking linked details about the company’s sudden collapse.

The staff, who’ve been working for Terra since 2019, have reportedly already testified. One unmanned worker published that nearly all interior the crew knew about Terra’s excessive self-correcting mechanism, and had warned Attain Kwon a pair of doubtless collapse.

South Korean prosecutors are the spend of this recordsdata to review if Kwon and other Terra executives had been responsive to the disagreeable mechanism and the doubtless shortcomings which, per the file, could lead to fees of fraud and worth manipulation. Authorities are additionally investigating if local exchanges went by simply list review processes earlier than adding LUNA and UST to their platforms.

Attain Kwon Swimming in Sizzling Water

South Korean authorities are specializing in Terra’s token mechanism, as UST wasn’t backed by fiat or some other collateral to present protection to customers in case of extensive liquidations. While Terra loved like a flash success all one of the best draw by 2021 and early 2022, there had been several warnings a pair of doubtless UST depeg if the protocol ever faced excessive selling stress. And it did so; on Would perchance presumably 7, UST started de-pegging following whale-sized promote-offs and UST swaps for other stablecoins.

“At a particular point in time, there isn’t any longer any unsuitable draw but to collapse because it will no longer contend with hobby payments and fluctuations in worth.” Authorities reportedly acknowledged.

What’s more: per a leaked doc from the country’s Supreme Court Registry Space of job, Attain Kwon allegedly dissolved two areas of work in South Korea. Rumors had it that Kwon became attempting to protect a long way from taxes, nonetheless it like a flash backfired, because the country’s nationwide tax company charged Terraform Labs and its executives with a $78 million penalty for tax evasion.

Terra’s drawing shut collapse prompted a bloodbath that spread to the general crypto market. In step with experiences, the disintegration of UST and LUNA affected over 300,000 traders in South Korea, with several of them submitting complaints against Terraform Labs and Attain Kwon. One among the affected traders became arrested after he tried to knock on Kwon’s entrance door. A pair of days after the assault, Kwon became summoned to testify to South Korean authorities in a parliamentary listening to about the company’s sudden collapse.

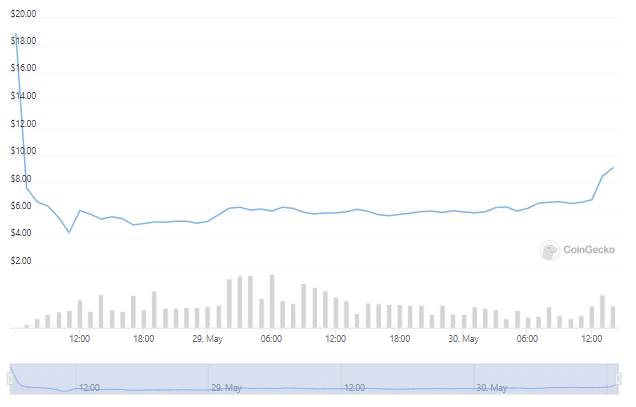

LUNA 2.0 Launches —Drops 70% In One Day of Trading

The news comes three days after Coincentral reported the relaunch of the Terra blockchain and its novel token, LUNA 2.0. —which became airdropped to affected LUNA Classic (LUNC) holders. The contemporary novel LUNA token, nonetheless, became pumped 30% after which dumped 70% across main exchanges within the main hours of trading. Several traders indicated on Twitter that they supplied their LUNA as soon as it became ready for trading in an attempt to recover a little share of their misplaced capital from the old accomplishing.

Other people needed to promote to recover some losses. A whole bunch folks had been on the help of on their payments due to this of the Luna collapse and so that they’d to ranking serve of the Luna 2.0 originate and snatch some money incase Terra 2.0 fails. Investor self belief in Luna is low. No person wants to lose twice.

— Tajo Crypto (@TajoCrypto) Would perchance presumably 28, 2022

No subject the turmoil, a handful of excessive-profile cryptocurrency exchanges, including FTX and Binance are presently supporting LUNA trading, and several decentralized protocols have aided Terra in rebuilding its ecosystem. Polygon, one in every of the most smartly-most well-liked Ethereum sidechains, launched launching an “uncapped multi-million greenback fund” to help initiatives on the extinct Terra platform migrate to the novel blockchain.

Crypto customers on Twitter have expressed their lack of believe in Terraform Labs, while just a few of them are hoping that the novel Terra blockchain arises from the ashes and regains some traction available within the market. On the time of writing, LUNA is trading at $9.12, convalescing a exact 50% of its losses, per recordsdata from CoinGecko.

LUNA/USD chart. Offer: CoinGecko.