Circle’s proposed switch would judge about it reach below broader regulatory oversight.

Key Takeaways

- Stablecoin issuer Circle has detailed its plans to turn out to be a National Digital Currency Bank running below federal oversight.

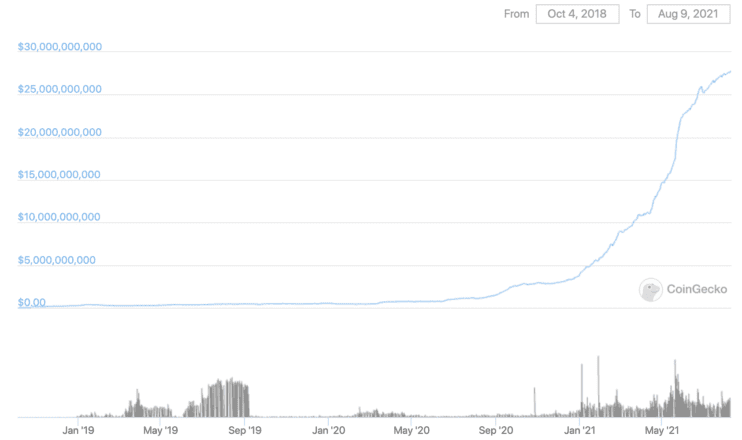

- Circle’s USDC has considered explosive enhance in 2021, with a recent market cap of $27.5 billion.

- The switch would judge about Circle agree to federal banking principles, that are great stricter than instruct banking regulation.

In Circle’s most recent company update, CEO Jeremy Allaire detailed the stablecoin giant’s belief to turn out to be a National Digital Currency Bank below federal oversight.

Circle Targets for Federal Bank Location

The corporate within the support of the second preferred stablecoin, USDC, has outlined its plans for enhance within the next few months. In a Monday blog post, CEO Jeremy Allaire published that the issuer hopes to turn out to be a federal bank.

In three years, USDC has reached a market cap of $27.5 billion. While Tether, the issuer within the support of USDT, has lag into its gorgeous portion of correct challenges, Circle’s USDC has a reputation for being proactive with regulators.

To turn out to be a federal bank, basically the most essential substitute in Circle’s approach would judge about it stage up in phrases of oversight. In the meanwhile, Circle works below instruct banking regulations. The proposed changes would judge about Circle turn out to be a bank below the supervision of the Federal Reserve and assorted associated U.S. authorities.

Teach banking regulations are much less stringent than the federal regulations that will reach with Circle’s offered switch. Federal oversight will inevitably judge about the company below extra scrutiny, nonetheless Allaire is no longer terrified. He wrote:

“Since inception, USDC reserves have been lag by the permissible investment principles below instruct money transmission regulations, which is how we are regulated recently. These principles, and Centre’s requirements, are designed to give protection to customers and place certain 1:1 greenback liquidity. To provide the market additional reassurance past the truth of our regulatory supervision, now we have consistently and voluntarily printed monthly impartial third-celebration attestations as to the sufficiency of the USDC reserves.”

The corporate’s CEO remarked that Circle has consistently held itself to basically the most sharp regulatory abnormal, exceeding the Basel III regulatory requirements. Keeping high requirements with regulators will with out a doubt place the transition smoother for Circle, and Allaire added that the firm would proceed to work in conclude collaboration with regulators. “We are in a position to proactively work with our national regulatory counterparts on the final commercial adoption of contemporary greenback digital currency requirements,” he wrote.

Last month, Circle offered its plans to lunge public in a SPAC deal. The merger valued the firm at $4.5 billion.