The below is an excerpt from a recent edition of Bitcoin Magazine Educated, Bitcoin Magazine’s top payment markets e-newsletter. To be amongst the foremost to receive these insights and other on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

Phrase Of The Day: Volatility

Are you ready for elevated volatility? It’s long-established for markets to handiest accept extra unstable as we slouch deeper into undergo markets. As uncertainty, illiquidity and impatience grows, extra market contributors initiating as a lot as hope for market extremes: either that the market has bottomed and a brand unusual bull cycle is one Federal Reserve pivot away or that the limit down, margin call liquidation day will happen imminently on checklist of a Credit Suisse crumple. Everybody hangs on the brink with every foremost market circulate to present them some form of signal. Mark ranges initiating as a lot as widen and a few (would-be) weekly or monthly strikes are condensed into honest correct a single day of action.

Even arguably one in all the finest investors of all time, Stanley Druckenmiller, finds nowadays to be one in all the toughest environments to establish:

“I in fact had been doing this for 45 years and between the pandemic, the battle and the loopy protection response in the U.S. and worldwide, this is the toughest ambiance I in fact win ever encountered to hold a survey at and win any self belief in a forecast six to twelve months ahead.”

For many, it’s finest to sit down down out the action and win a immense menace-off build, in a position to deploy after markets win stabilized or calmed down.

We gentle take our same glimpse that unusual lows have a tendency to be made and that we’ve yet to attain a final conclusion yet to the cycle for equities, menace sources and bitcoin.

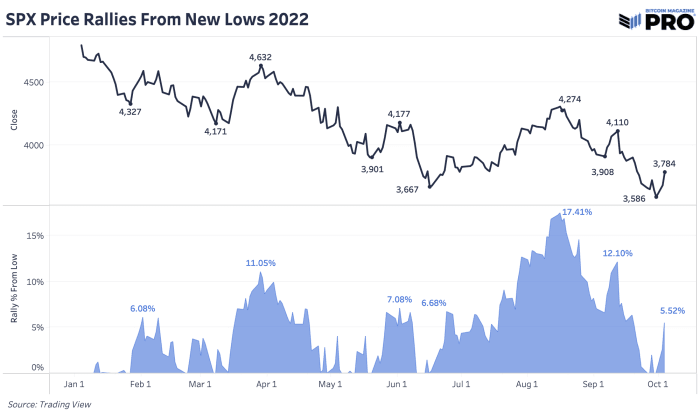

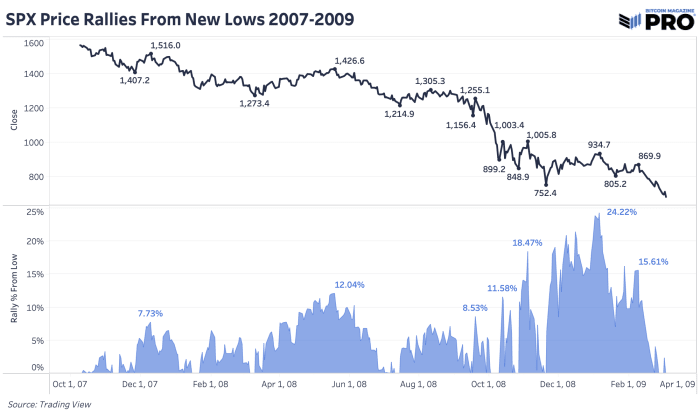

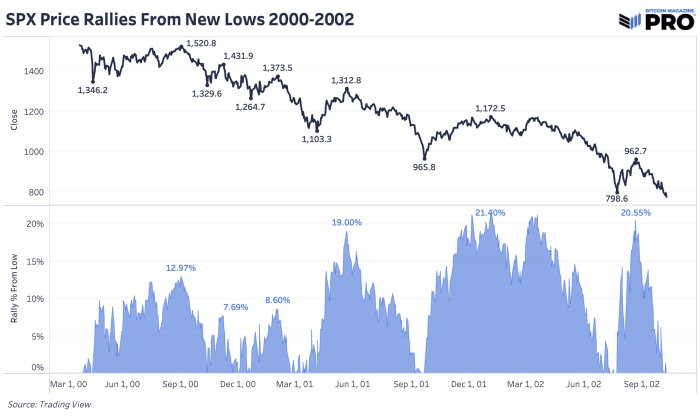

We are able to remind readers of the magnitude of undergo market rallies that we’ve considered thus far and the magnitude of these rallies in 2000 and 2008 analogues. There are other cycles to seem for and review but these are honest correct just a few recent examples.

We’ve already considered a vital 17.41% rally from lows for the SPX with bitcoin working to $25,000. But, that didn’t substitute its next reversion lower and, what we deem, is the medium-time interval downside trajectory taking half in out gentle. Even in the closing-stage collapses of 2002 and 2009, the S&P 500 saw rallies over 20% prior to going lower. As the market piles in to overshort bloody conditions and doomsday news on higher leverage, do now not fail to recollect that there’s no free lunch.

One other interesting showcase point to is that undergo markets are fundamentally rapid, lasting 10 months on lifelike. That 10-month benchmark would roughly build us to the build we are nowadays. But, there’s a in fact helpful notion and thesis to be made that the recent destruction we’ve considered thus far has been in regards to the readjustment to a peculiar and ancient time for charges, bonds and credit ranking. We’ve barely even arrived at what’s the classic and cyclical earnings undergo market.

As bonds, currencies, and world equities all win continued buying and selling with increasing levels of volatility, the recent ancient and implied volatility of bitcoin is eerily muted when put next with ancient standards.

While the shortcoming of recent volatility in bitcoin in most cases is a save that indispensable of the leverage and speculative mania of the bull market has been almost entirely washed out, our eyes remain on the outsized legacy markets for signs of fragility and volatility, which would possibly perhaps well perhaps encourage as a rapid/intermediate-time interval headwind.

While the arena around bitcoin’s save action appears to be to be turning into an increasing selection of hazardous, the Bitcoin community remains entirely unaffected on the protocol level, continuing to entire its job as a just financial asset/settlement layer, despite its substitute payment volatility.

Tick tock, next block.

Linked Previous Articles