- Luxury Valid Estate 101: A Bound Via with Stephane De Baets

- What’s AspenDigital?

- How can an asset holder leverage the perks of tokenization?

- Law and Innovation: A Historically Poisonous Relationship

- Final Tips

Stephane De Baets visualizes a future the assign every asset, whether or not a puny business or property, will also be tokenized and sold on the blockchain– and he’s inserting his tokens the assign his mouth is.

Stephane is a Belgian-born right estate, hospitality, and funding entrepreneur with a penchant for standing out in every respective alternate. As the Founder and President of Elevated Returns, an worldwide asset management firm, Stephane launched the first most fundamental tokenized commercial right estate public sale to sell a section of his possession stake in a single of his properties– the idyllic Aspen St. Regis Resort in Aspen, Colorado. Stephane is furthermore the Founder and Owner of Chefs Club, a cafe community with a rotating residency of world-class cooks at its locations in Aspen and New York Metropolis.

Stephane believes the tokenization of the St. Regis will lead to an avalanche of ardour from right estate developers and mainstream investors into the blockchain alternate. As a self-described “ultra-conservative outmoded man in capital markets,” Stephane posits that his colleagues gorgeous dangle to gape tangible proof of tokenized sources in motion to gape the set apart of allocating capital to blockchain-based mostly investments.

“Blockchain is set giving folk the tools to attain one thing that used to be restricted to a couple selected folk,” says Stephane. “Blockchain is a same evolution as going from fax to email– used to be for conversation. It made it more uncomplicated and more efficient. Of us began discovering new applications for conversation thru email, after which SMS.”

Stephane’s decade-lengthy gallop into blockchain isn’t gorgeous about making extra cash– there’s a rebellious component to his funding philosophy. Stealing fire from the gods and democratizing entry for the heaps is a sentiment not unheard of to those within the cryptocurrency alternate. In Stephane’s case, this prodigal fire is the flexibility to make investments in tasks in total outside the purview of the ordinary investor. On the heart of Stephane’s key message is the disintermediation of the finance alternate and constructing an instantaneous route for the introduction and sharing of set apart between companies and their customers.

“At Elevated Returns, we mediate the most up to the moment world is too elitist,” says Stephane. “Access to capital is limited to a only a few privileged folk. Giving entry to this better echelon of investing on a democratic basis, a la tokenization, would dash an out of this world distance in direction of promoting equality. It’s not unique that 5 corporations defend watch over an amount of wealth that’s better than the leisure of the NASDAQ 100 blended. I mediate tokenization is low striking fruit. I dangle a plentiful deal of have faith and conviction that at last, there shall be a plentiful disintermediation that takes space no matter what, and the folk would possibly perchance also smooth be forward of it.”

Editor’s boom: Listed here is written as tutorial and informational, and will not be to be construed as an endorsement, sponsorship, or funding advice for any of the entities mentioned within. Cryptocurrency is an inherently very dangerous asset class, and in any admire times attain your safe research and search the advice of a certified financial advisor before making any funding or have.

Luxury Valid Estate 101: A Bound Via with Stephane De Baets

Stephane walks us thru the normal process for luxury right estate entrepreneurship.

“If you need to always safe a resort, you realistically must be plugged into a extremely selective community of those that would possibly show you what’s readily available for sale,” says Stephane. “Then, you need to always elevate the capital– typically a section of debt and a section in equity. Then you definately must attain your due diligence, divulge for the asset, negotiate the contract, enact the contract, and in case you’re successful, you will safe property. Making an income on that property contrivance it would possibly probably well perchance be fundamental to furthermore be correct at successfully managing the asset to flip a profit, which is the extra of cash drift over the debt servicing and diversified expenses. Whilst you flip the property, you safe a capital compose.”

That is the outmoded contrivance of better-conclude commercial right estate, and based totally on Stephane, a puny, incestuous world with a restricted type of avid gamers.

“There isn’t grand set apart added previous solving those cashflow inefficiencies,” says Stephane. “Tokenization adjustments the sport fully. As a retail investor, you would possibly well also dash to a market and judge a token same to a property. Shall we embrace, you would possibly well also dash on tZERO and ogle at AspenCoin, the digital token for the St. Regis. There is a disclosure assertion, and also you would possibly well also peruse the performance of the asset.”

tZero, is a venture launched by Overstock that capabilities as a platform for asset holders to tokenize their sources. This methodology enables average investors to piggyback on the work of any individual love Stephane, a process typically performed privately.

So, what incentivizes somebody love Stephane has to permit the general public to reap the fruits of his labor?

Stephane describes the journey of owning a luxury property as excellent when it involves bragging rights, but immediate-lived.

Owners love Stephane can be pleased the nice thing about their property, but this romanticism is rapidly dampened with the determining that they aren’t able to entry their equity with out the wide amount of issues that come from selling the property.

“Owning a property most frequently contrivance you’ve got a balance sheet that tells how grand you owe the bank and the set apart of your equity,” says Stephane, lowering the glamour of luxury property possession to accountant-be in contact. “There is no set apart discovery, neither is there a device so that you can monetize that equity space diversified than selling the resort. Whilst you tokenize your asset because the asset holder, you’ve got set apart discovery and know the full set apart of your equity. Greater yet, you’ve got liquidity. Let’s affirm you safe married and are starting a family. Likelihood is you’ll well perchance per chance also sell off a few tokens of your asset. If you suspect the token set apart is too low-set apart, you would possibly well also aquire them back.”

Having you cash locked in an asset not often ever caters to the ebbs and flows of life; because the proprietor of a tokenized asset, Stephane suggests, you’ve got the flexibility to amplify or decrease your space and know the most up to the moment going charge of your equity. To that conclude, giving asset householders the luxury of liquidity furthermore makes that asset that contrivance more pretty to defend.

What’s AspenDigital?

AspenDigital is the token connected to Stephane De Baet’s tokenization of the St. Regis in Aspen, Colorado– a prestigious getaway for society’s pinky-up better echelon tucked into the Rocky Mountains.

How has the tokenization of sources been applied to this level?

“We created a digital safety as segment of an possession privilege program,” says Stephane. “For us, it’s excellent due to this of we’re able to reward token holders love a neatly suited proprietor. We assign on marketing charges, gallop agent charges, and heaps others. The price to us, the property proprietor, is minimal and the profit to the user is maximum.”

In accordance with Stephane’s description of the tokenomics of AspenDigital,

- If you safe 10,000 tokens for 30 days or more, you’re entitled to a 20% cash rebate on your expend correct thru your cease.

- If you safe 100k tokens: 35% cash rebate.

- If you safe half 1,000,000 tokens:50% cash rebate.

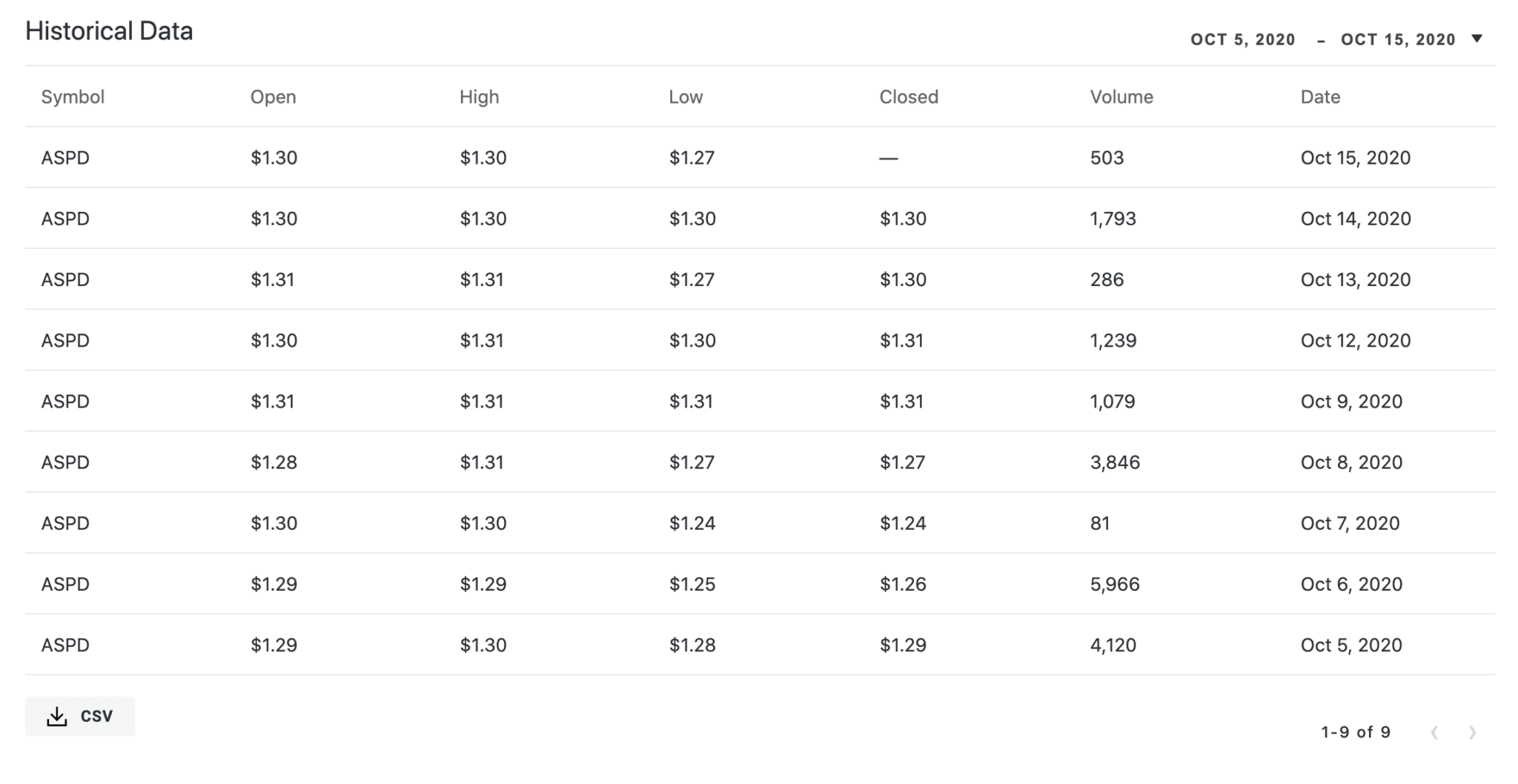

Stephane implores us to judge a patron spending Christmas or New Year at the St. Regis: The average room charges about $2,000 per day round this time, and in case you come to cease for seven days with a family that requires two rooms, you’ll be taking a blueprint at a $28,000 invoice. If the most up to the moment set apart of one of those tokens on tZERO is $1.31, 10,000 tokens will flee you about $13,100.

This lump sum of tokens entitled you to twenty% cashback on your cease, or about $5,600 back, which is a minute bit over 42% return on the set apart of your tokens for that one cease.

I’m dreaming of a world the assign I don’t dangle any bank loans, and I’m gorgeous sending rebates to folk purchasing for pre-paid stays at my resort. I will show that here’s a inexpensive contrivance for an proprietor to finance a property than a ancient mortgage.

In diversified words, Stephane needs to decrease bank loans out of the hospitality alternate, and compose the infrastructure for business householders to elevate capital from their high customers.

“We deserve to search out a device to repay 100% of our debt and yield the benefits of savings on you cash drift to the user,” says Stephane. “All that the bank is doing is bridging a mismatch in cash flows as entrepreneurs compose companies to give providers and products to customers. Your user is if truth be told the celebration providing you with cash to pay your workers, pay your bank loans, and safe a profit. The closing line of disintermediation is to safe funding prison from the user.”

Express fundraising from customers is not very a brand new concert. Shall we embrace, Elon Musk did it recently with Tesla, selling the Roadster at a excessive set apart boom elevate capital. Selling your future product tends to be the most affordable supply of capital.

How can an asset holder leverage the perks of tokenization?

The agonize with the most up to the moment system is that set apart that can in another case be dedicated to enhancing the business-user relationship leaks into the coffers of third-celebration intermediary banks.

“If you raised capital from banks and non-public investors, it would possibly probably well perchance be fundamental to component loan duties and keenness into the equation,” says Stephane. “The bank will affirm, Stephane, I need my 6% ardour charge. After which you’ve got non-public investors and companions asking for his or her 15% return on their cash. So, as an asset manager, I’m primarily incentivized to pay my debts first, and this typically isn’t aligned with providing absolutely the most efficient journey for the user.”

Likelihood is you’ll well perchance per chance also smooth be obvious you pays your householders and investors, or in another case, you’re in a sizzling seat.

The carrier provider and customers are awful by that detrimental intermediary known as banking. If we can take dangle of away the bank out of the equation and dangle customers fund us straight away, we can focal level our efforts on constructing an even bigger relationship between us as a carrier provider and our customers.

How can safety tokens or utility tokens substitute the field of right estate? When companies are funded by customers straight away, Stephane asserts, an total asset class will also be modified:

- The valuation of the asset becomes critically inappropriate. Somebody buys an asset due to this of they dangle got to make exercise of it eventually at an even bigger set apart. They wish an correct deal. They don’t deserve to safe the asset, they dangle got to entry a carrier eventually at a more pretty set apart.

- Tokenization simplifies the relationship between a carrier provider and a user. Shall we embrace, as a resort provider or resort operator, your job is to give the most efficient carrier to your user. You need them to be very jubilant with the journey he receives at your establishment. If you’re raising cash from your customers, who now change into partial householders of your non-public home, you’re better incentivized to make investments further into the customer journey. Similarly, your customers are incentivized to enhance what you are promoting.

“In reveal to give perks, you need to always safe the asset,” says Stephane. “If somebody is promising perks on somebody else’s asset, I safe uneasy. In reveal to attain success within the mannequin we’re constructing, it would possibly probably well perchance be fundamental so as to safe the asset you’re providing perks on.”

That’s the reason, Stephane concedes, ancient banking relationships will in any admire times dangle a space in business. In reveal to defend sources with out your safe capital, you’d like somebody to lend you cash. Then again, lending must evolve with the field, not antagonize it.“I peruse the lending market changing very a lot within the next decade,” says Stephane. “Keep in mind it; if in case you have Aspen Digital, you’ve got the leverage which is if truth be told the mortgage of the asset. Let’s think I pay the mortgage tomorrow and stutter more tokens. Strive so as to show a lender you safe tokens that describe unlevered possession over a resort and rep a question to for an amplify of leverage on your wallet. I mediate you’ll eventually originate seeing asset-based mostly leverage transferring to user sinister leverage.”

Stephane sees a future the assign digital asset holders, whether or not that be Bitcoin or a coin representing a luxury mountain resort, can seamlessly take dangle of out loans from mainstream banks.

*Effect: There are a few cryptocurrency loan providers equivalent to BlockFi and Celsius that supply crypto-collateralized loans on cryptocurrency deposits.*

There is furthermore a fundamental utility of those tokens, Stephane posits, that shouldn’t be overpassed.

“Utility contrivance folk dangle a exercise for it, which creates pure liquidity into the asset class,” says Stephane. “The perks you receive from your tokens can grant token holders a set apart grand better than doable capital gains.”

Waxing philosophical, Stephane describes cash as merely a medium to compose goods and providers and products eventually.

“Cash is an instrument to safe an substitute,” says Stephane. “If you don’t need that instrument due to this of you’ve got entry to the providers and products simply by keeping the asset and not spending it, you’ll substitute the relationship between folk and cash.”

In diversified words, in space of set apart slipping out of the business-customer relationship into the fingers of third-celebration intermediaries, customers can enact fully new benefits typically most efficient granted to the excessive-rolling householders.

Law and Innovation: A Historically Poisonous Relationship

Stephane’s gallop into blockchain searching for an alternative choice to a extremely getting older capital market and banking system, a search spanning a long time.

“The truth that we’re smooth counting on the Securities Act of 1933, coping with paper securities, and the usage of a clearing agent is fun in that it’s with regards to 100 years outmoded. The total finance alternate and spinoff of finance were if truth be told ready for a revolution, and I judge the flexibility to tokenize sources on the blockchain is a rallying bawl.”

Stephane encourages a future the assign law grows alongside innovation, in space of impeding it.

“As entrepreneurs, we must be respectful of the authorities and regulators, due to this of whereas innovation can open new doors, it would furthermore allow rip-off, fraud, and abuse,” says Stephane. “Collaborative law ensures we don’t shut down an total enterprise gorgeous to guard the heaps from a extremely puny few detrimental actors.”

To if truth be told stimulate the evolution of a landscape, you’d like a wholesome regulatory ambiance, infrastructure to onboard new customers, and market leaders.

“If you mediate about 2017 because the first mainstream wave, we’re taking a blueprint at the 2nd one now,” says Stephane. “We’ve had the precise component of a relatively real financial system to permit innovation to stabilize before this 2nd wave, and now this more unstable financial ambiance pushes the dangle to impart financial encourage straight to the fingers of the folk. It brings us to mediate about what are the right strengths of the legacy banking ambiance, and how properly-suited is it to the folk’s most efficient pursuits?”

Coming from capital markets, Stephane argues, this revolution isn’t a matter of if; it’s a matter of when, who, and how.

“I can affirm within 5 years, the total lot’s going to be digital, including the Dollar and Euro,” says Stephane. “We can dangle a digital wallet in our fingers and we are able so as to defend watch over our sources with out having to transfer to the bank or an ATM machine and withdraw cash or deposit cash.”

Final Tips

Access to capital isn’t equally disbursed internationally, and as Stephane notes, it’s a extremely puny community of those that are inclined to dangle the supreme entry. The corporations that herald the supreme returns aren’t typically readily available as funding choices for the on each day basis Joe.

The first lever of any business relationship sits within the fingers of the celebration who holds the capital. This capital has historically not often ever left the grips of banks and society’s ultrawealthy, and the barrage of tax breaks and bailouts within the United States, particularly, dangle made obvious that huge cash stays rep.

Then again, by eradicating the capital intermediaries by democratizing entry to investments by tokenization, the luxuries of society’s ultrawealthy will within the waste trickle the full contrivance down to the heaps. On the very least, that’s the argument Stephane De Baets is making with the tokenization of the St. Regis resort.

These intermediaries, a category the Elevated Returns Stephane De Baets admittedly falls into, don’t act within the most efficient ardour of the Hotel Owner Stephane or the Customer Stephane. Then again, the multi-faceted Stephane appears to align his expert identities below one banner: the democratization of entry and the disintermediation of the engorged third-celebration of banks, and he needs to make exercise of AspenDigital to revolutionize the right estate alternate.

Never Leave out Another Replacement! Procure hand selected recordsdata & recordsdata from our Crypto Consultants so you would possibly well also safe expert, suggested choices that straight away dangle an impact on your crypto income. Subscribe to CoinCentral free newsletter now.