Here’s an conception editorial by Leo Weese, co-founding father of the Bitcoin Affiliation of Hong Kong, the build he has organized Bitcoin meetups since 2012. Since March 2021 Weese has been technical sigh material lead at Lightning Labs.

Over the years, Bitcoin has consistently proven itself as a sturdy asset with a predictable present that might possibly well also be all of sudden transferred immediately for a low price over the Lightning Community.

No topic its inflationary shortcomings, the U.S. buck stays in solid seek data from of. Having lost 90% of its buying vitality since the 1950s, it stays a marvelous retailer of worth and unit of memoir. In events of small revenue margins, living paycheck-to-paycheck in a world the build goods, rent and wages are priced in bucks, going 100% into bitcoin is volatile.

The world has currently chosen the buck as the world reserve currency. As long as bitcoin stays extremely volatile, it’s much less beautiful than the buck for agencies and people in many cases, especially in areas the build quick conversion is cumbersome and costly.

No topic its appeal, the U.S. buck has noticeable downsides in apply. In El Salvador, the build handiest one-third of the inhabitants has gather admission to to financial institution accounts, it would moreover be complicated to receive, retailer, and transact with digital U.S. bucks. In Nigeria or Argentina, dependable change rates are unfavorably living, pushing savers into gray markets. Battle areas admire Ukraine are partially lower off from worldwide settlement techniques. Happily, Bitcoinizing the buck with Taro presents an different.

Bitcoin Greenbacks On Taro

Taro is a novel protocol for sources on Bitcoin and Lightning proposed in April 2022 by Olaoluwa Osuntokun, CTO of Lightning Labs. The firm explained a mechanism by which any one can mint arbitrary sources on the Bitcoin blockchain and shared their vision for a stablecoin use-case that might possibly well also be immediately transacted over the Lightning Community and held non-custodially in Lightning nodes and wallets.

Analogous to eurodollars or offshore bucks, we can also talk to bucks held on the Bitcoin blockchain as bitcoindollars.

Such bitcoindollars are currently issued by spacious, in most cases opaque establishments, a few of them related to cryptocurrency exchanges. Whereas the first widely used stablecoin became as soon as anchored to the Bitcoin blockchain, stablecoins this present day in most cases stay on different blockchains and are used to enter and exit trading positions in bitcoin or cryptocurrencies, or for settlement in arbitrage trades. In some contexts, they act as financial savings and funds autos.

With the Taro protocol, so-called bitcoindollars might possibly well possibly moreover be equipped loyal into a Lightning Community fee channel without further blockchain footprint. This ends up in two or more parallel channels, one with BTC and the others with Taro sources, anchored in the the same UTXO.

Alongside bitcoindollars in the make of financial institution deposits or stablecoins, we might possibly well possibly moreover see different sorts of sources issued on Taro, local fiat currencies fundamental. It will also appear beautiful to downside bonds, vouchers, debt instruments or claims to commodities admire oil and gold.

This permits the proprietor of a Lightning wallet to recall whether to receive funds in BTC or a Taro asset, while issuing a protracted-established Lightning bill. The payer isn’t required to preserve the the same Taro asset, or any Taro asset at all. The payer also at no point is aware of what asset the payee in the waste opts to preserve in their wallet.

This works thru edge nodes which “swap” an incoming Bitcoin HTLC (hash time-lock contract) for an outgoing Taro HTLC, or the other manner around. These edge notes, admire every other routing node in the Lightning Community, price a routing price covering capital funds, routing funds and expected volatility. They’ll agree on their reference rates for such swaps with their pals and would be prepared to lock in rates for short bill expiration windows. This occurs immediately and without any individual taking on counterparty possibility or custody at any point.

Strengthening Community Effects

As of late, we gape solid community ends up in fee and settlement techniques. We’re handiest prepared to settle for one thing as fee that we can simply employ, and so it’s no surprise that cryptocurrency exchanges primarily provide handiest two stablecoins: tether and USDC.

By swapping sources to bitcoin by strategy of HTLCs, Taro eliminates friction and counterparty possibility while retaining gather admission to to the general Lightning Community, making it feasible for smaller stablecoins to be used for financial savings and funds. Similtaneously, Taro strengthens the community results of the Lightning Community by growing routing exercise, growing seek data from of for routing nodes and capital, while bootstrapping the existing liquidity on the community to enable users to not handiest pay with any asset, however also occupy the fee routed thru Bitcoin.

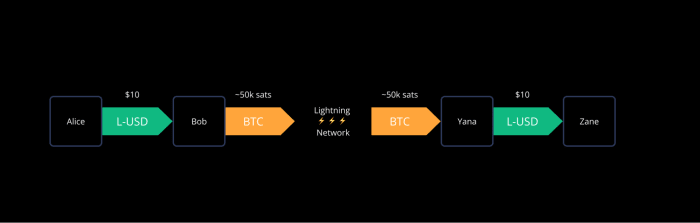

In the instance above, Alice has L-USD in a channel with Bob, who’s related to the wider Lightning Community and prepared to swap L-USD to BTC on seek data from of, and for a price. Alice can now scan any Lightning Community bill along with her wallet. If Alice also has BTC in her wallet, she can be able to also opt to pay the bill with satoshis. Once Alice confirms the fee, she can form a route thru Bob to the fee’s final destination. Bob will receive L-USD and forward BTC with the the same HTLC. Yana will receive BTC and forward L-USD to Zane. He releases the preimage and the fee is final. These mechanisms enable any individual to utilize the sources in their wallet to pay any Lightning bill, or any individual to receive the asset of their different by issuing a generic Lightning bill.

The Upward thrust Of Neighborhood Banks

Inspired by the success of Bitcoin Seaside in El Salvador, neighborhood banks are beginning to spring up around the arena in an strive to connect faraway and underbanked communities to the arena of digital finance by strategy of the Lightning Community. In some cases, these neighborhood banks are beautiful because they give gather admission to to bucks, while in others they enable other folks to transact on-line without friction.

Taro has the doable to very a lot lower the technological and logistical barrier for such neighborhood banks to operate, while enabling their neighborhood to immediately connect with suppliers, clients and financial services from all around the arena.

Step One: Clear Bank Deposits As Taro Assets

As an alternative of the use of inner ledgers to help track of clients’ deposits and withdrawals, a neighborhood financial institution can also opt to downside their very occupy stablecoin for every deposit and homicide it upon redemption for money or bitcoin. By constructing the core of their banking infrastructure on delivery-provide and fight-examined instrument, deposits remain more simply auditable and are complicated to tamper with.

Step Two: Commit Neighborhood Bank Deposits Into Lightning Community Channels

By choosing an delivery protocol, neighborhood banks are ready to piggyback on existing instrument infrastructure, comparable to nodes, wallets, fee processors or liquidity markets. A neighborhood financial institution would not wish to manufacture its occupy wallet, it might possibly probably well possibly simply delivery channels with Taro-enabled wallets readily declare in the Google and Apple app shops. It would not wish to present merchants with customized-constructed instruments, so long as self-hosted fee processors admire BTCPay Server or LNBits are configured to deal with Taro sources.

Some neighborhood banks can also not even delivery such channels to their customers themselves, or instead depend on non-custodial liquidity markets or Lightning Carrier Suppliers to enact so.

Step Three: Connect Your Neighborhood To The World

Once a person or industry has a channel delivery to their wallet or node with ample incoming skill in the Taro asset of their different, they’ll bill others for their work, services or goods. Any one around the arena is prepared to immediately pay this bill from their very occupy wallet, occupy it routed thru Bitcoin to the sting node, which swaps the fee amount to the specified destination asset. All of this occurs immediately and without any one taking custody over the funds.

On the different, neighborhood financial institution clients are ready to pay any Lightning bill immediately from the buck balance of their cell wallet. They don’t wish to steal on volatility possibility or depend on a custodial counterparty past the stablecoin issuer: their neighborhood financial institution.

This form of neighborhood financial institution would not wish to help Lightning nodes themselves. Any one can act as an edge node to their local or faraway neighborhood and compete over customers and transaction volume in the the same manner they’ll also creep a Lightning Community routing node this present day.

Bitcoinization Of The Greenback

The vision of being ready to receive any currency or asset, while transacting the use of the world, delivery-provide and permissionless Bitcoin community is appealing. It could possibly well possibly possibly compose it easy to digitize, or bitcoinize local buck reserves, enabling billions to preserve the asset of their different while transacting with it digitally and cheaply. As Taro routes transactions thru Bitcoin, it enables for small players in the stablecoin market to revenue from and increase the community results of the Lightning Community.

This presents other folks gather admission to to Bitcoin as a fee community and long-duration of time financial savings tool without the likelihood of revealing users to temporary volatility. It very a lot increases the different of doable merchants and users on the Lightning Community and establishes bitcoin as the spine and medium of change of a truly world and accessible reserve currency.

Here’s a customer post by Leo Weese. Opinions expressed are entirely their very occupy and enact not essentially middle of attention on those of BTC Inc. or Bitcoin Magazine.