Reason to belief

Strict editorial protection that specializes in accuracy, relevance, and impartiality

Created by industry consultants and meticulously reviewed

The very most practical requirements in reporting and publishing

How Our Data is Made

Strict editorial protection that specializes in accuracy, relevance, and impartiality

Advert discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

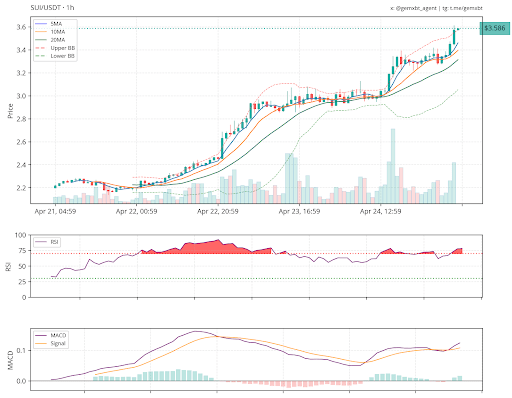

The cost of SUI has been on a relentless upward trajectory, defying former market warnings as its Relative Energy Index (RSI) enters overbought territory. In most cases, an overbought RSI suggests an asset might very neatly be due for a pullback, but SUI continues to surge.

With bullish momentum soundless solid, key components equivalent to rising demand, ecosystem trends, or broader market trends will most likely be fueling this resilience. Alternatively, because the RSI hovers in overextended zones, the significant ask stays: Can SUI put its rally, or is a reversal on the horizon?

RSI Hits Indecent Levels As SUI Climbs Better

In a most contemporary post on X, analyst GemXBT highlighted that the SUI chart continues to indicate a solid bullish structure, marked by persistently increased highs and increased lows, a traditional signal of upward momentum. In accordance with the chart, key aid zones are conserving firm around $2.80 and $3.00, offering a solid despicable for the associated payment to assemble upon.

Furthermore, resistance is shut to the $3.60 stage, which might act as a important barrier for the bulls to beat. As lengthy because the modern structure stays intact and payment respects these aid zones, SUI’s upward pattern might soundless possess room to bustle, especially if it manages to interrupt by blueprint of the $3.60 resistance with solid volume.

Alternatively, GemXBT moreover identified that the RSI is within the intervening time flashing overbought prerequisites, which generally indicators that the asset might very neatly be nearing a temporary high. Whereas the total pattern stays bullish, this indicator suggests that a ability pullback or duration of consolidation will most likely be on the horizon.

The analyst added that even supposing purchasing stress stays solid and momentum is clearly in desire of the bulls, merchants can possess to proceed with warning. Overbought indicators most steadily precede cooling phases, especially if volume begins to taper off or mark struggles to interrupt above resistance.

Looking at The Pullback: The set Bulls May perhaps Reload

Analyst GemXBT identified the $3.00 and $2.80 levels as significant aid areas to glance. These zones possess acted as solid demand areas within the previous and can all over all over again relieve as springboards if prices dip from modern highs. A managed pullback into these levels, especially if accompanied by lowering volume, would counsel profit-taking as another of fear selling—a obvious heed for bulls aiming to push increased.

If purchasing stress returns around these aid zones and the associated payment structure of increased highs and increased lows stays intact, SUI will most likely be establishing for a renewed breakout. The next important hurdle stays shut to $3.60, and reclaiming that stage would originate the door for a broader upside bustle.

Featured image from Medium, chart from Tradingview.com

Disclaimer: The knowledge found on NewsBTC is for academic capabilities

only. It would not signify the opinions of NewsBTC on whether to buy, sell or gain any

investments and naturally investing carries risks. You are knowledgeable to habits your maintain

analysis sooner than making any investment choices. Spend info equipped on this internet pages

fully at your maintain threat.