Terra is a blockchain-based fully mostly ecosystem with a local algorithmic stablecoin (UST) designed for exact-world adoption and native token (LUNA) used to stabilize UST’s buck peg. TerraUSD (or UST) is the third-largest stablecoin by marketcap, nonetheless is strange in that its payment (currently $18.6 billion) is determined algorithmically, as an alternative of by an same fiat deposit.

The Terra residence page

As we’ll stumble on under, Terra makes use of its native token LUNA to stabilize UST’s payment through reasonably just a few burn mechanisms.

The undertaking gained gargantuan traction and consideration in 2021 and 2022 for just a few reasons:

- Its two tokens rose in designate. Every UST and LUNA take a seat within the tip 10 market cap coins. UST sits at spherical $18.6 billion; LUNA is spherical $30 billion.

- Terra offers valuable advantages over used funds networks and most cryptocurrencies. UST can supply instantaneous settlement, low costs, and a permissionless, uncensorable, inappropriate-border substitute– all with a earn asset.

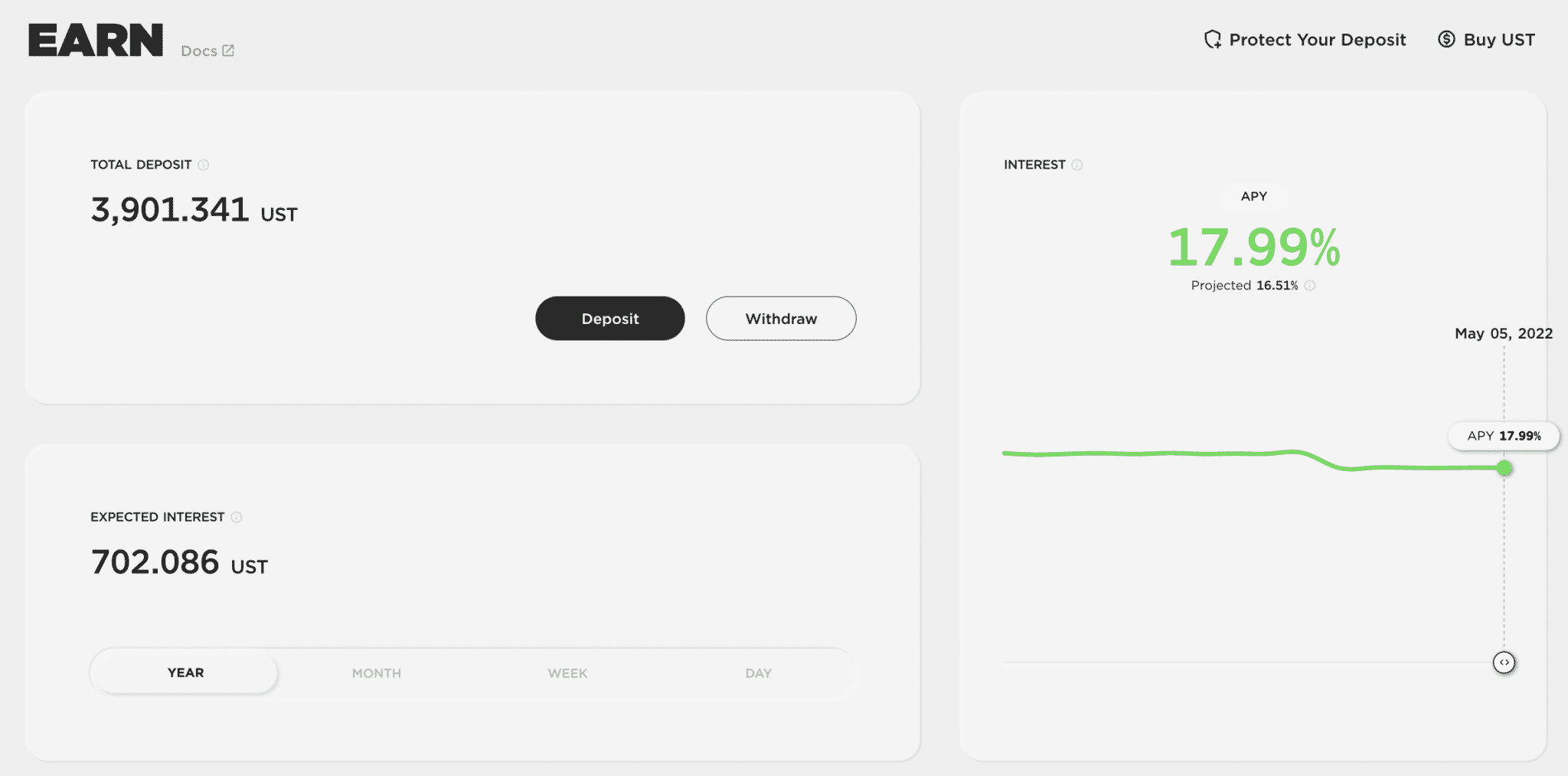

- Anchor Protocol, a dApp, capabilities as a decentralized excessive-yield hobby yarn, providing between 18% to 20% APY on UST.

- Founder Create Kwon emerged as a key figure within the broader cryptocurrency ecosystem, orchestrating a $1.6 billion BTC pick for Terra– the undertaking is amassing considered one of many excellent stockpiles of Bitcoin to extra strengthen UST.

Nowadays I:

– Watered my vegetation

– Wrote some emails

– Offered 230M in $BTC

– vacuumed the dwelling

– had some mcdonaldsNow off to stroll the canines 🤝

— Create Kwon 🌕 (@stablekwon) April 6, 2022

Forward of we originate on our Terra (UST and LUNA) recordsdata, let’s plot the scene: Terra is an mettlesome undertaking with a payment proposition revolving spherical a series of stablecoin merchandise, yield opportunities, and its growing ecosystem of decentralized applications, all of which invent utility and expect of for UST.

Direct that this recordsdata is ready 3,600 words, which is ready a 12-minute bustle read; we inform you now to now not toddle through each piece, nonetheless rather use our recordsdata as a sherpa while exploring the reasonably just a few Terra choices on one other tab.

We are in a position to stumble on a bird’s perceive take a look at of the Terra ecosystem with accompanying deeper dive articles into Luna-associated initiatives, starting up with the put Terra matches into the original monetary panorama and why it’s price paying consideration to.

What is Terra (LUNA) and Why Might per chance maybe presumably presumably also serene You Care?

Okay, within the occasion you’re taking a observe up a recordsdata on Terra, this potentially isn’t your first cryptocurrency rabbit gap, and it seemingly won’t be your final.

In very huge strokes, this present day’s cryptocurrency innovation largely occurs in three necessary buckets:

- Bitcoin: BTC is barely dominant these dates, nonetheless just a few years within the past the competition to be the king of decentralized sight-to-sight currency turned into once rife with forks (LTC, BCH, and so forth).

- Ethereum: Price a collective trillion dollars, Ethereum’s sturdy ecosystem bustles with developer exercise. The tip canines additionally has its trouble choices– costly gas costs, network congestion, and so forth. Layer2s take care of Polygon contrivance to befriend the network scale.

- Third Technology Blockchains Attempting to Assemble a Greater Ethereum: Dispute Solano, Cosmos, Cardano, and Terra.

Terra is strange amongst other Third era blockchains in that it isn’t necessarily competing for developers and cryptocurrency native customers– it’s going after exact-world participants.

Terra and the Steady (Analog) World: Who Uses UST?

Terra’s founder Create Kwon envisioned a stablecoin product constructed to compete straight away with used monetary settlement networks on a customer basis, as in opposition to constructing into a cryptocurrency world that tends to fabricate straight away for its enjoy crypto-native demographic.

In level of truth, building the next Stripe or Paypal with the blockchain.

Thousands of brick-and-mortar, eCommerce, and Web2 retailers require a earn currency to supply their merchandise and products and services. Rather than forcing them to use a unstable cryptocurrency, Terra gives a buck-pegged stablecoin with low transaction costs, and is ready to supply retailers a sooner and extra immediate settlement at a section of the designate.

Incumbent retail payment applications take care of Stripe, Sq., and PayPal payment spherical 3% for payment processor costs, whereas Terra’s network transaction costs are spherical 0.5 to 2%. Extra, used funds can hold days to be “final” whereas the blockchain most frequently defaults to final settlement, that will hold just a few minutes or hours.

Terraform Labs, Terra’s creator turned into once in actual fact fashioned to delivery a mobile funds app called Chai in early 2018. Focusing on the South Korean market, Chai used the blockchain to fluidly swap between fiat and stablecoins:

- Users enter their existing monetary institution, debit/credit rating playing cards, and PayPal, and might maybe maybe seamlessly store online for lower transaction costs than the long-established payment suppliers.

- Merchants purchased lower costs and sooner settlement.

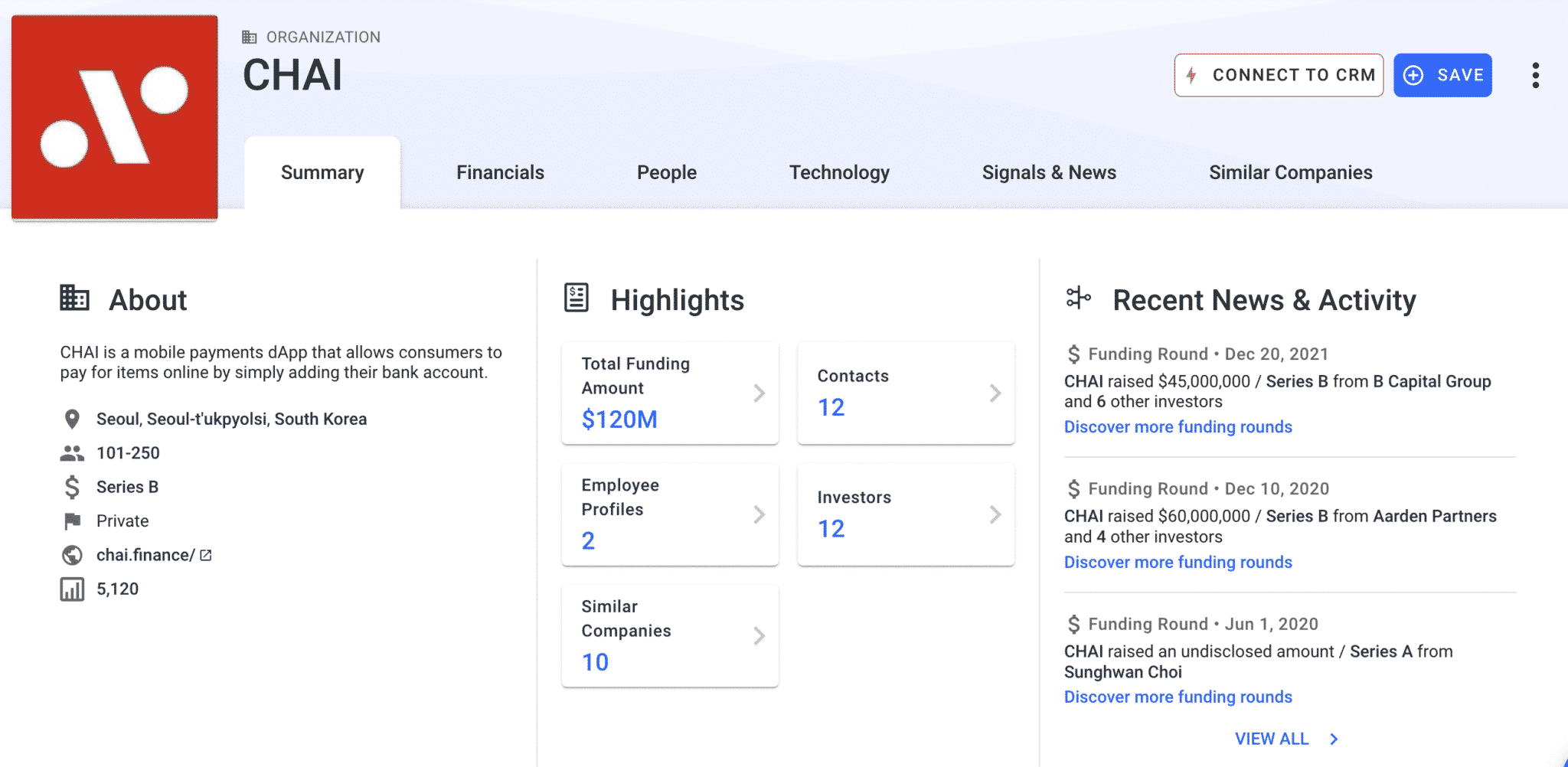

Chai would dawdle on to become considered one of potentially the most original South Korean mobile funds firms, attracting over $120 million in investments. The corporate has since spun out from Terraform Labs and is a growing force in its market and past.

As Chai gained traction, Terraform’s founders spun out Terra. Chai laid the groundwork for Terra to believe a global network of retailers and customers the use of Terra’s stablecoin product with out even brilliant they’re the use of the relaxation blockchain-based fully mostly.

Whereas other Layer 1 blockchains appear to compete over developer and crypto-native customers, Terra objectives to facilitate UST consumption through a combination of exact-world and cryptocurrency initiatives.

Terra and the Crypto World

UST is designed to be fully censorship-resistant money, providing customers a earn dawdle of substitute to digitally switch payment rapid and for low costs.

Most particularly, UST’s payment is determined algorithmically. Terra can crawl out tokens that video display other fiat currencies take care of Euros or Japanese Yen, placing the undertaking in earn rivalry for becoming a in fact original worldwide payment contrivance.

It objectives to supply the same decentralized sight-to-sight advantages of a Bitcoin, nonetheless with earn payment.

Its necessary characteristic is additionally its most controversial– algorithmic stablecoins are serene very sleek and experimental, and early algorithmic stablecoin initiatives own ended in fracture.

None, nonetheless, own performed the traction and strengthen Terra has to this level, making it a in fact consuming undertaking to observe– even supposing most spicy from an experimental monetary level of take a look at.

The Terra Team: Who Made UST and LUNA?

Terra turned into once created by Terraform Labs, a startup based by Create Kwon (CEO) and Daniel Shin. Terraform Labs is headquartered in Seoul, South Korea.

Terra launched in January 2018 with the contrivance of ushering in mass cryptocurrency adoption by making digitally native earn property pegged to main fiat currencies such because the U.S. Dollar.

Terraform Labs constructed and launched the Chai mobile funds app in 2019, which utilized the Terra blockchain within the abet-end. Merchants on Chai purchased sooner final settlement instances whereas customers purchased salvage valid of entry to to a extra streamlined payment machine. Chai currently boasts over 2.5 million customers in South Korea.

Chai company knowledge (courtesy Crunchbase)

Terra has raised $58 million from over 31 organizations much like Coinbase Ventures, Pantera, Hashed, Galaxy Digital (lead), Kinetic Capital, and Arrington XRP Capital.

How Does Terra Work?

Terra makes use of two tokens, Terra UST (earth) and Luna (moon), to feature.

LUNA is Terra’s native staking token designed to hold Terra’s stablecoin merchandise (UST) earn. Luna absorbs volatility from the UST ecosystem. In huge strokes, if expect of for UST goes up, extra UST is created and LUNA is burned. If expect of for UST goes down, extra LUNA is created and UST is burned. The right kind mechanics of the burning and introduction of tokens aren’t fully computerized, as they enjoy human labor arbitraging designate differences.

Terra gives a diversity of stablecoins pegged to high fiat currencies, much like:

- TerraUSD (UST): pegged to U.S. Dollar. Here is Terra’s predominant stablecoin.

- TerraCNY

- TerraJPY

- TerraGBP

- TerraKRW

- TerraEUR

Moreover its stablecoin merchandise, Terra additionally hosts a growing network of decentralized applications (dApps.) There are currently over 100 dApps within the Terra ecosystem, each of which generates expect of for Terra and the $LUNA token.

We’ll salvage into how each particular token works under.

What is UST? Exploring the Stablecoin Terra (UST)

Terra’s flagship product is the UST stablecoin, a digital asset theoretically continuously price $1.00.

It turned into once designed to obtain a steadiness between blockchain’s benefits and day after day utility.

Terra’s blockchain itself, constructed with the Cosmos SDK (as are Cosmos, Thorchain, and Chronos), is terribly hasty, low-designate, and gives nearly immediate settlement instances.

Whereas most stablecoins (USDC, GUSD, USDT) are constructed by third events on the Ethereum blockchain, Kwon wished to bundle the blockchain and UST product under the same roof.

One can believe if Ethereum had stout relieve a watch on and possession of USDC, the use of it as a earn dawdle of payment for all other decentralized applications in its ecosystem.

But that’s about up to now as that stablecoin comparability goes– UST is an algorithmic stablecoin, whereas USDC derives its payment from fiat reserves of equal payment.

Algorithmic stablecoins prevent their payment from floating spherical through a flowery series of mechanisms, most frequently that pick, burn, or delivery sleek coins to robotically relieve the buck peg.

Imagine an algorithmic stablecoin as a fixed, computerized, calculated, originate of quantitive easing; as an alternative of the authorities accurate printing out tons of of tens of millions of greenbacks (money printer dawdle BRRRR), an algorithmic stablecoin is continuously either issuing sleek coins to lift supply or shopping & burning already issued coins to diminish supply.

In distinction, a collateralized stablecoin take care of USDC or USDT will (in principle) own the actual quantity of fiat currency in custody in a monetary institution because the issuance of the stablecoin. Every collateralized stablecoin maintains its buck peg because of its 1:1 parity with the fiat.

The case for algorithmic stablecoins is that if the stablecoin most spicy has its payment because of bodily property somewhere, it might maybe maybe in point of fact per chance’t be decentralized because there is a central level of failure– what does it topic in case your stablecoin makes use of the blockchain if any person robs the monetary institution the put the deposits are kept? The market will seemingly tear away from this husk of a digital asset because its inherent payment is now non-existent.

Is UST an algorithmic stablecoin? Yes, Terra’s UST is an algorithmic stablecoin– it maintains its designate peg through a plot of arbitrage opportunities and pre-programmed principles, tidy contracts, and tool applications, as an alternative of being collateralized by an underlying asset take care of many other stablecoins. It additionally contains human capital into putting forward the peg which we’ll salvage into later.

It’s additionally much less complicated to invent a stablecoin with out billions of greenbacks within the vault somewhere. Algorithmic stablecoins take care of UST are decentralized money for a decentralized ecosystem.

This “inherent payment” thing is a doubtful conception for stablecoins, and since the payment is determined by the market, algorithmic stablecoins are continuously working to hold supply off or add supply to the market.

Now, algorithmic stablecoins are a pretty toddler deer-legged innovation, and inherently riskier since they’re now now not collateralized. Detractors of algorithmic stablecoins emphasize that the stablecoin’s payment is vulnerably tied to the continuing hobby of individually motivated market actors. Long-term sustainability is on the total in expect of.

Nonetheless, this isn’t the details for the professionals and cons of algorithmic stablecoins (we’re working on that, too, and might maybe maybe serene link it here when finished.)

Anyway, abet to Terra.

Terra (UST) combines the advantages of fiat currency and the blockchain:

- Unalterable public ledger (blockchain)

- Stable payment (fiat)

- Quick final settlement instances (blockchain)

- Decrease costs (fiat/blockchain looking on the network)

What is LUNA? Introducing Terra’s Native LUNA Token

$LUNA and UST are take care of a shapely observe-saw: extra UST contrivance much less Luna, much less UST contrivance extra Luna.

Dispute we want to mint $200 of TerraUSD (UST). First, we must convert an same payment of LUNA tokens (let’s bewitch LUNA is $40). We’d need 5 LUNA to mint the contrivance $200 UST. Our 5 LUNA are burned, we salvage $200 UST.

Reversely, we’re going to be in a position to mint 5 LUNA tokens with $200 UST.

Terra itself will continuously take care of UST as equal to $1, even supposing the peg is rather off, let’s disclose $0.97.

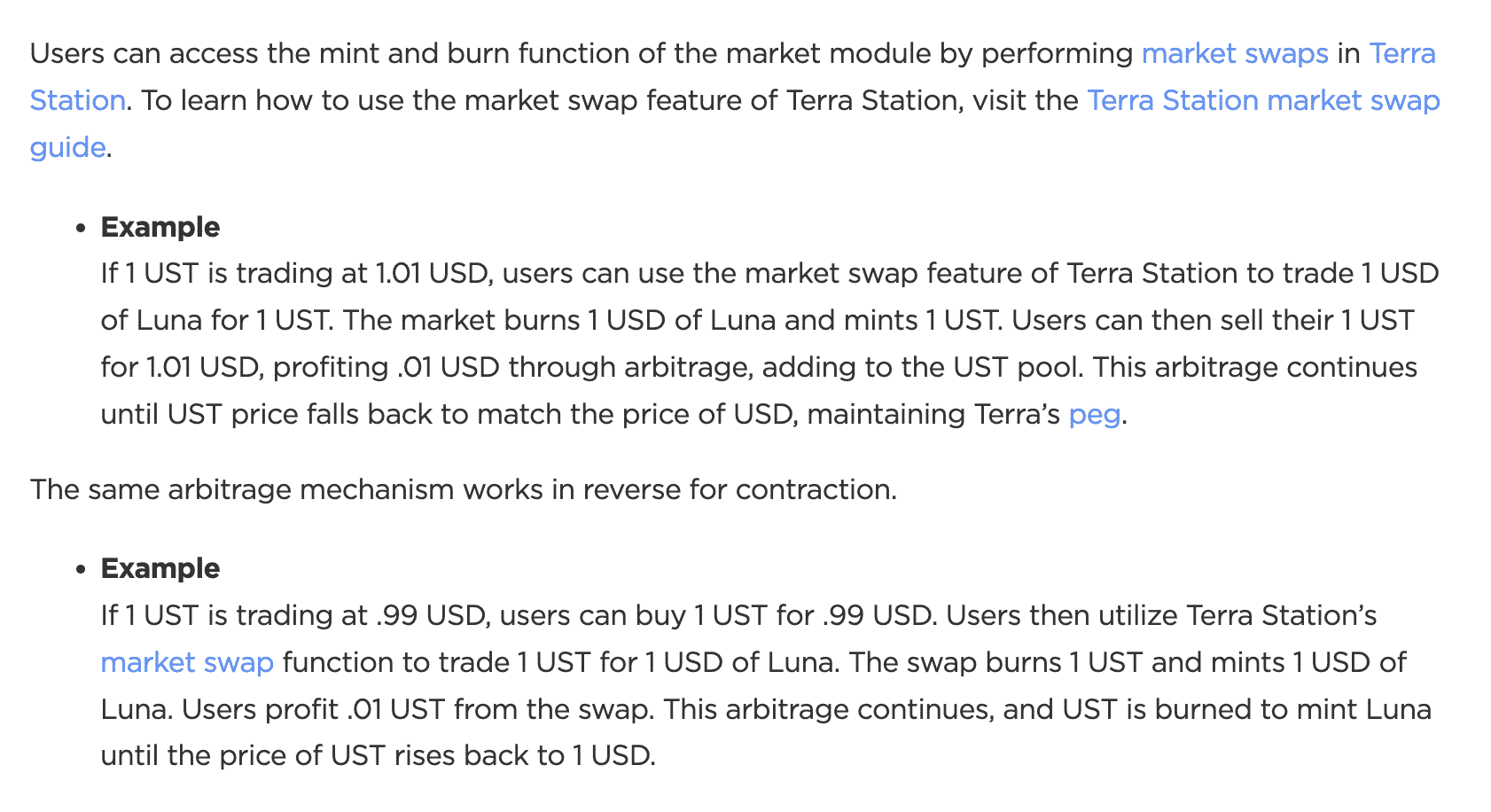

Market swaps on Terra (supply: https://doctors.terra.money/doctors/be taught/protocol.html)

So, what’s stopping any person from arbitraging the designate difference?

If UST is meant to be $1 nonetheless its market designate is de facto lower or elevated, can’t I accurate swap between LUNA and invent a earnings on the variation?

In principle, yes, that it is seemingly you’ll also, by construct. The token burning and issuance mechanism is partially designed to let human arbitrageurs salvage UST closer to its buck peg.

Let’s disclose UST’s market payment is $0.97. An arbitrageur buys $10,000 for $9,700 on the delivery market and goes to transform it to LUNA on Terra. Since the Terra protocol values UST at $1.00, the dealer would salvage $10,000 in LUNA (250 LUNA if it’s $40 per coin), in actual fact making $300 on the synthetic (much less any network costs.)

Terra burns the UST within the midst of, taking UST supply off the market, making a deflationary force that nudges UST closer to $1.00.

So, UST maintains its buck peg with a seemingly limitless handy resource of human beings aiming to invent a rapidly buck. The expect of for UST by the reasonably just a few retailers and dApps additionally retains the wheel in movement.

The LUNA token is additionally used for a diversity of different capabilities, much like mining and governance.

Users can stake Luna to validate the network and receive rewards accrued through transaction costs.

Methods to Stake LUNA

When you occur to’ve made it this a ways in a Terra recordsdata, staking LUNA is an endeavor effectively close by.

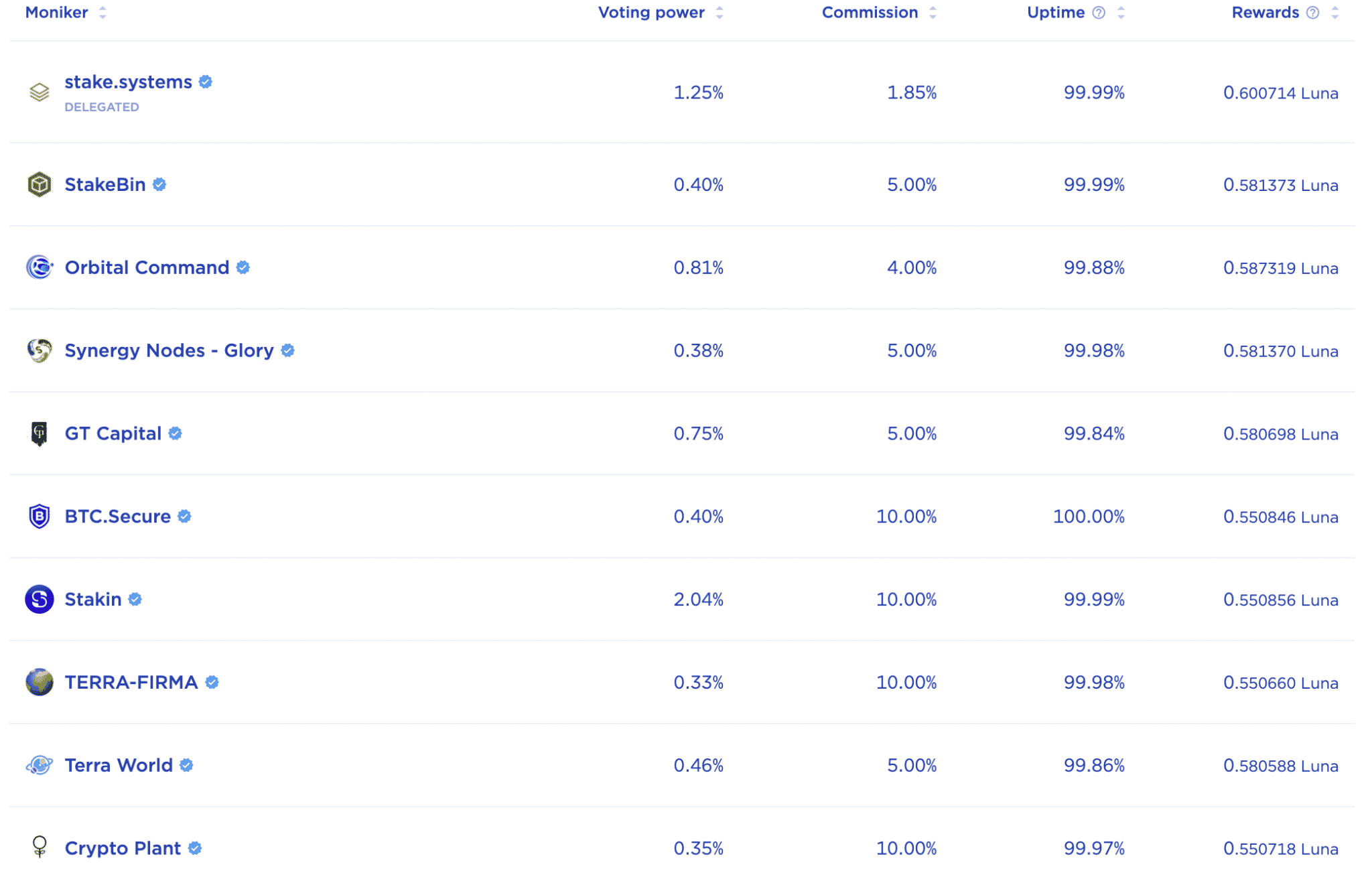

Like most other proof-of-work coins, stake LUNA frequently contrivance bonding the coin to a validator and receiving staking rewards.

As a staker, your formal title on this dynamic is a delegator– a class of particular person that needs to bolster the network and produce rewards, nonetheless does now not enjoy a stout node.

Folks who enjoy stout Terra nodes are called validators; they uphold the blockchain, as per the principles specified by the Tendermint consensus.

Terra most spicy permits the tip 130 validators on its staking platform; the ranks are obvious by the quantity of LUNA the validator has staked. The of us that delegate their LUNA befriend strengthen each particular particular person validator.

Rewards are generated from:

- Gas costs– validators plot the minimal gas costs

- Swap costs– the costs for swapping between stablecoins (take care of a foreign substitute payment).

- Spread costs– costs for swapping between UST (and other Terra stables) and Luna

The stout checklist of costs within the Terra ecosystem here.

To stake LUNA, you’d deposit LUNA into the Terra Living wallet, dawdle to https://put of residing.terra.money/stake, lift a validator, and stake it.

Staking Luna on Terra Living

Nonetheless, as you are going to inevitably be taught, getting LUNA into Terra Living on the total is a grief. Create NOT simply send the model of LUNA (WLUNA) you pick on Coinbase Skilled to here, as it’s now now not take care of minded. Advanced, each person knows, nonetheless we’ll add a recordsdata here once we’ve finished writing it.

The Terra Living, The Wallet for the Terra Community, and Varied Terra Tools

The Terra Living is the gateway for someone to have interaction with the Terra network; The Terra Living is to Terra what MetaMask is to Ethereum.

It helps LUNA and other Terra ecosystem property take care of Anchor ($ANC) and Mirror Protocol ($MIR). It facilitates interaction with many of the dApps in Terra’s ecosystem, besides swapping property, staking $LUNA, and managing wallet balances.

Anchor Protocol in movement

Nonetheless, Terra Living has an eCommerce bend– retailers can with out considerations plot up their very enjoy level-of-sale payment integrations on net and mobile applications and leverage the 2d settlement benefits of Terra. A freelance clothier might maybe maybe combine Terra Living as their necessary payment portal and originate accepting funds at a section of the costs of long-established processors take care of PayPal.

The Terra Bridge is a instrument enabling the inappropriate-chain switch of native Terra tokens. Equally, Wormhole, is a multi-chain salvage valid of entry to instrument, enabling Terra transfers between Ethereum, Solana, and BSC. Even handed one of those tools would might maybe maybe serene be used to “unwrap” WLUNA from Coinbase Skilled to be used in Terra Living.

The Terra Ecosystem

We discovered Terra’s dApp ecosystem contains utility for UST and LUNA. There are over 100 initiatives constructed on the Terra blockchain including initiatives take care of:

DeFi Ecosystem updated, did we miss someone? pic.twitter.com/OGbYBgk44o

— Terrians 🌕 (@Terrians_) March 4, 2022

Anchor Protocol: In all probability potentially the most original dApp in Terra’s ecosystem is the Anchor Protocol, which permits customers to provide upwards of spherical 18% to 20% APY on UST deposits. Even supposing same to a crypto hobby yarn, Anchor is distinctly reasonably just a few in that it’s non-custodial and gifts elevated risks. Here is additionally your pleasant reminder that every considered one of this is unhealthy industry, and this isn’t monetary advice.

Anchor is dazzling refined to originate with. We’ll link our stout recordsdata to Earning APY on Anchor here when we produce writing it, and might maybe maybe serene additionally half it in our newsletter, so be particular to subscribe within the occasion you haven’t but 🙂

Astroport: An computerized market maker (decentralized substitute) that has a extensive diversity of liquidity pools and token swaps.

Mirror Protocol: Even handed one of many extra controversial dApps that set apart Terra within the SEC’s crosshairs. Mirror permits for the introduction of fungible and synthetic property that video display exact-world property– someone on this planet can alternate property outdoors of their geography.

The Terra Ecosystem

In step with the Mirror controversy, Kwon notes that platforms much like Mirror and Anchor own particular particular person governance tokens and are “graceful launched” which contrivance Terraform doesn’t own fairness or possession in them. “We’ve constructed an ecosystem that turned into once, you realize, constructed by us nonetheless now now not necessarily owned by us,” commented Kwon.

Terra (Luna) Designate Predictions

Smartly, if all goes according to the team’s blueprint, UST will continuously be $1.00, or at most accurate just a few pennies in either course. UST’s market cap might maybe maybe develop exponentially as its expect of grows.

As expect of for UST goes up, extra $LUNA is burned, reducing LUNA’s supply. If expect of for LUNA stays unchanged, the per-unit designate of the LUNA might maybe maybe lift.

In principle, a Terra bull would salvage pleasure from retaining LUNA and hoping the ecosystem spherical Terra grows in a substantial contrivance.

The reverse is additionally upright; if expect of for UST goes down, extra LUNA will be created, which might maybe maybe decrease the designate of the LUNA token.

Nonetheless, what units the Terra undertaking rather than much of the speculative designate predictions which own historically been made about cryptocurrency initiatives is that the corporate is onboarding an ecosystem of exact-world customers, creating expect of for the stablecoin past the confines of the latest cryptocurrency market.

So, LUNA’s designate might maybe maybe accurate be a feature of how effectively merchandise take care of Chai entice exact-world customers.

As of writing (Might per chance maybe presumably presumably also 2nd, 2022):

UST has a market cap of$18,585,793,989

LUNA has a market cap of $29,064,789,028 and a per-unit designate of $83.77.

Doomsday Hypothesis: Will Terra UST and Luna Fracture?

As an algorithmic stablecoin, UST is now now not with out its critics snarling into the toddler’s crib.

Granted, Terra works to this level– nonetheless as we’ve discovered in cryptocurrency over time, to this level most spicy goes to this level.

Hypothetically, Terra UST would rupture if everybody with out note sold all their LUNA and all their UST. The undertaking would no doubt hold a success if, let’s disclose, one thing take care of Anchor Protocol turned into once hacked and tons of of tens of millions of UST had been lost. *knocks on wood*

Or, if the undertaking’s programming turned into once come what might maybe corrupted.

Or if a supervillain unplugged the arena’s Net and compelled us into a post-apocalyptic agrarian society the put potentially the most excessive-tech product turned into once a scythe.

Terra for Developers: The Technical Aspect of the Moon

Terra runs on its enjoy proof-of-stake blockchain, constructed on the Tendermint Core the use of the Cosmos SDK.

In level of truth, Tendermint Core and the Cosmos SDK are united in their blueprint that other blockchains are inefficient by construct:

- Bitcoin’s blockchain is seen as “monolithic” which makes it powerful for decentralized applications to bustle niche use cases;

- Ethereum’s blockchain limits programmers to coding in languages take care of Solidity and Serpent, and additionally inclined to network congestion.

Cosmos made a framework for self-sovereign blockchains, which contrivance initiatives take care of Terra can use the Cosmos SDK and plot up their very enjoy store with out any strings connected to the Cosmos network.

For our extra tech-inclined readers, we counsel sorting out the Tendermint recordsdata straight from the supply– it describes how and why this Byzantine Fault Tolerant tool will also be advantageous for applications take care of Terra.

Terra invests in making creating on its platform a gratifying experience; it hosts a extensive diversity of developer tools, documentation, and guides for someone who wishes to fabricate within the Terra ecosystem.

Here are just a few to hand Terra developmental links to salvage you started:

Final Thoughts: Terra, UST, Luna, and Previous

Wow, you made it to the end (we won’t in finding you for skipping forward for our juicy Final Thoughts piece).

In our Terra recordsdata, we discovered that UST is designed to be utilized by someone. In Terra’s most spicy world, participants won’t even know they’re the use of a blockchain– it all melts into the background.

Abstracting the blockchain layer isn’t a brand sleek conception, nonetheless Terra appears to be main the pack in constructing one thing exact-world participants in actual fact use.

Nonetheless, Terra is currently a pip-squeak (third-era blockchains are) when put next with Ethereum, which is ready 12x higher in market cap and a family title even within the analog world.

To be graceful, Ethereum launched in July 2015. It wasn’t until 2017 that ETH’s designate broke $10, closing out that yr at nearly $500, then $1500 the following yr, nearly touching $5000 in 2021– 6 years after it launched.

Comparatively, LUNA launched in April 2019, broke $10 in 2021, reaching a excessive of $116 in 2022. The undertaking went from unknown to a high 10 cryptocurrency market cap in rather over a yr. Given the spicy time restrict the put stablecoins are a dominant dialogue of the contrivance forward for finance, Terra’s UST is engaging.

Terra’s attainable might maybe maybe be eclipsed by Ethereum solving its scalability components with a network upgrade– Eth 2.0 has been hinted at for years and delayed nearly as long. A Terra fanatic, “Lunatic,” might maybe maybe inform the extensive diversity of dApps participants in actual fact want to use because the upright pulse of the network’s payment.

Nonetheless, we dawdle away it as much as you, our dear readers. Given the complexity of Terra’s sprawling ecosystem, what guides attain YOU want to sight? Let us know, and join our newsletter to quit updated.