Terra’s native stablecoin TerraUSD (UST), which has been the debate of town for the previous few weeks now, is at its worst for the time being.

Stemming from UST liquidations and the broader market demolish, UST is currently purchasing and selling at a much less dear model of seven%, whereas Terra’s native token LUNA is down by 37.6 on the week%.

Terra’s Stablecoin Loses Peg

The final 24 hours beget been terribly uneventful for Terra ecosystem patrons as TerraUSD, identified to be the largest decentralized stablecoin, lost its peg. The depegging change into initiated due to the a bunch of withdrawals from the largest Dapp on Terra chain, Anchor Protocol.

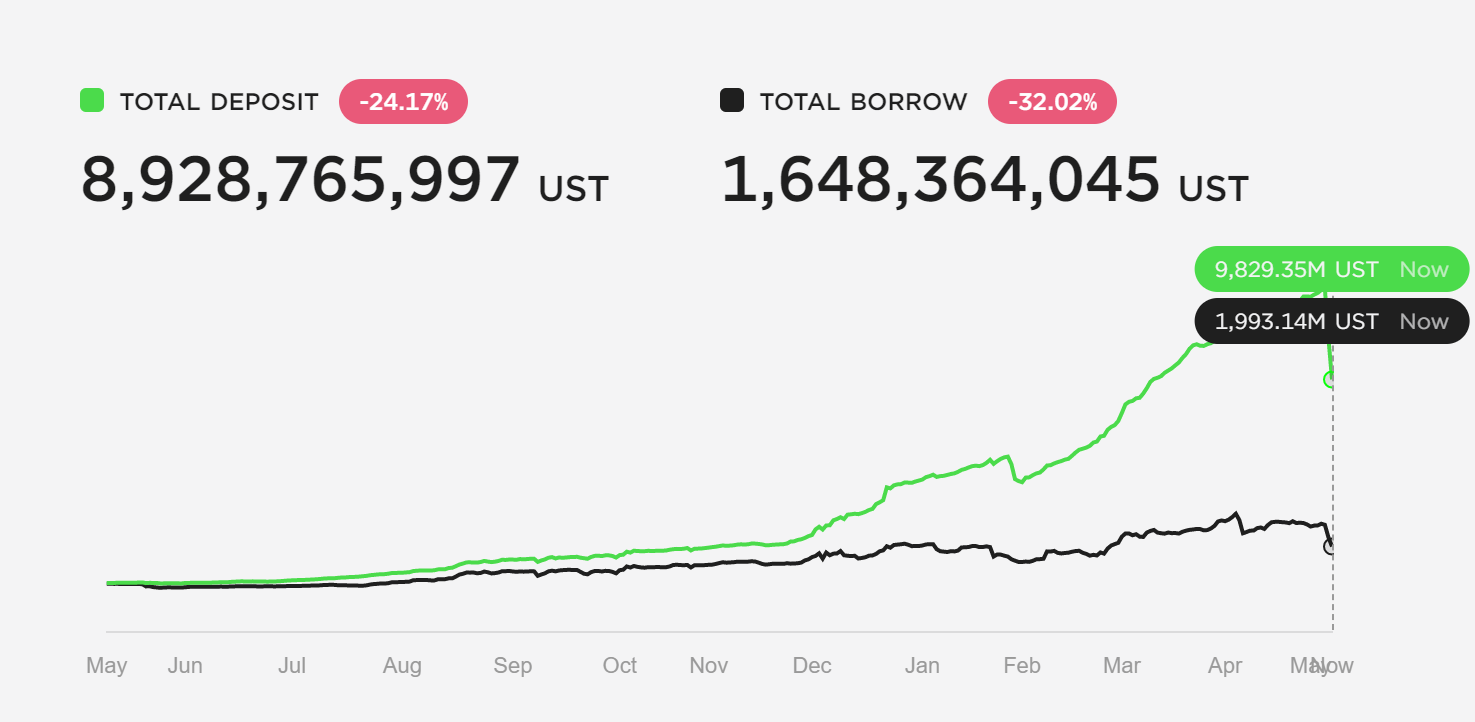

The lending platform noted the total price locked on it declined. Loads of the patrons on the platform pulled their investments ensuing in the total deposits on Anchor falling by $5 billion.

At this time, down from $14 billion, the deposits on the protocol fully amount to $9.3 billion.

Following this, UST started being pulled out of liquidity pools on Curve, and Terra additionally joined in by liquidating $150 million in UST. Though it redeposited $100 million, the fright had already ensued.

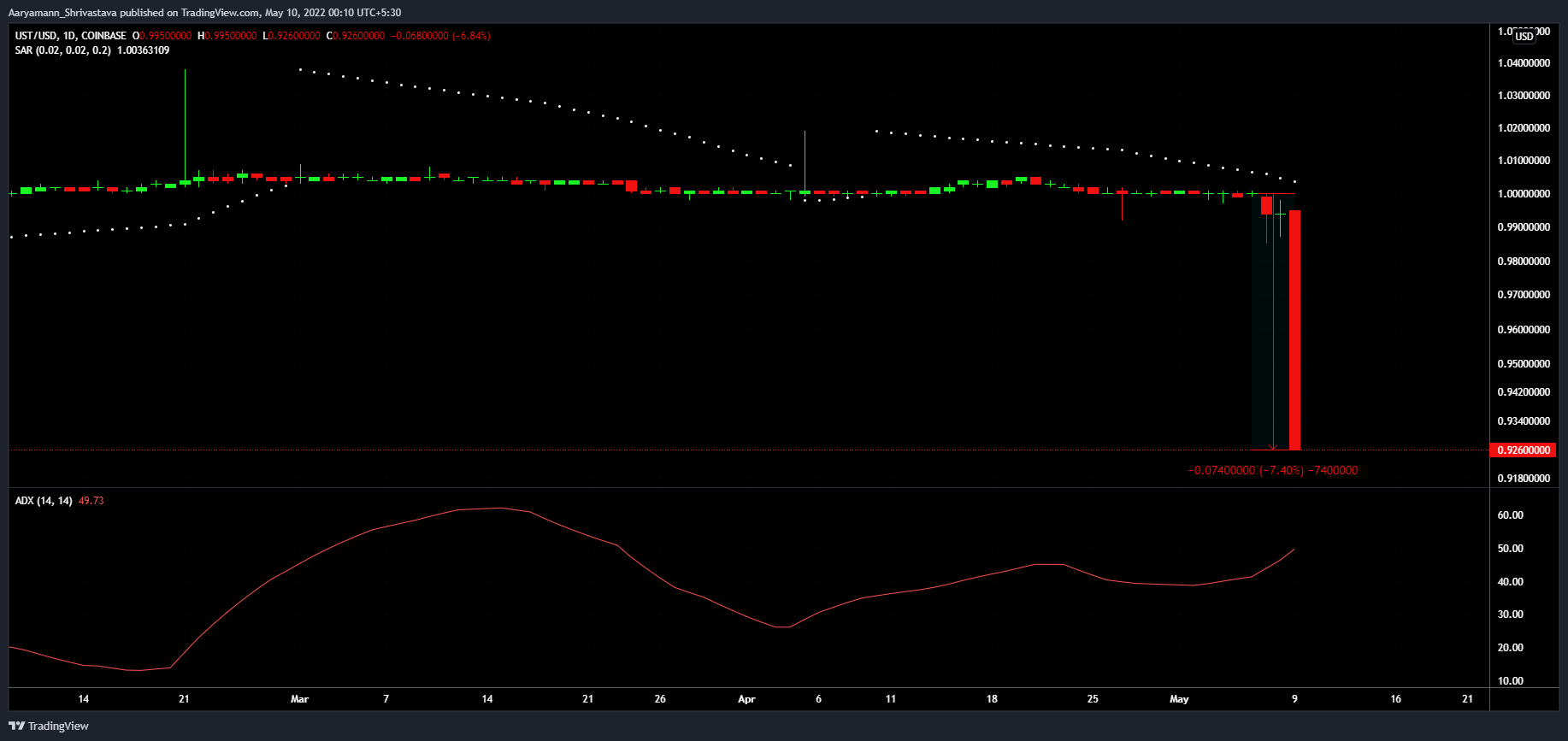

It did now not shield too lengthy for the UST peg to destabilize, and by the tip of the day gone by, UST change into purchasing and selling at a much less dear model of 1.2%. Alternatively, at the time of writing, the broader market demolish and Luna Foundation Guard’s (LFG) most traditional transfer has left the stablecoin broken.

LFG Sells $750 Million in Bitcoin

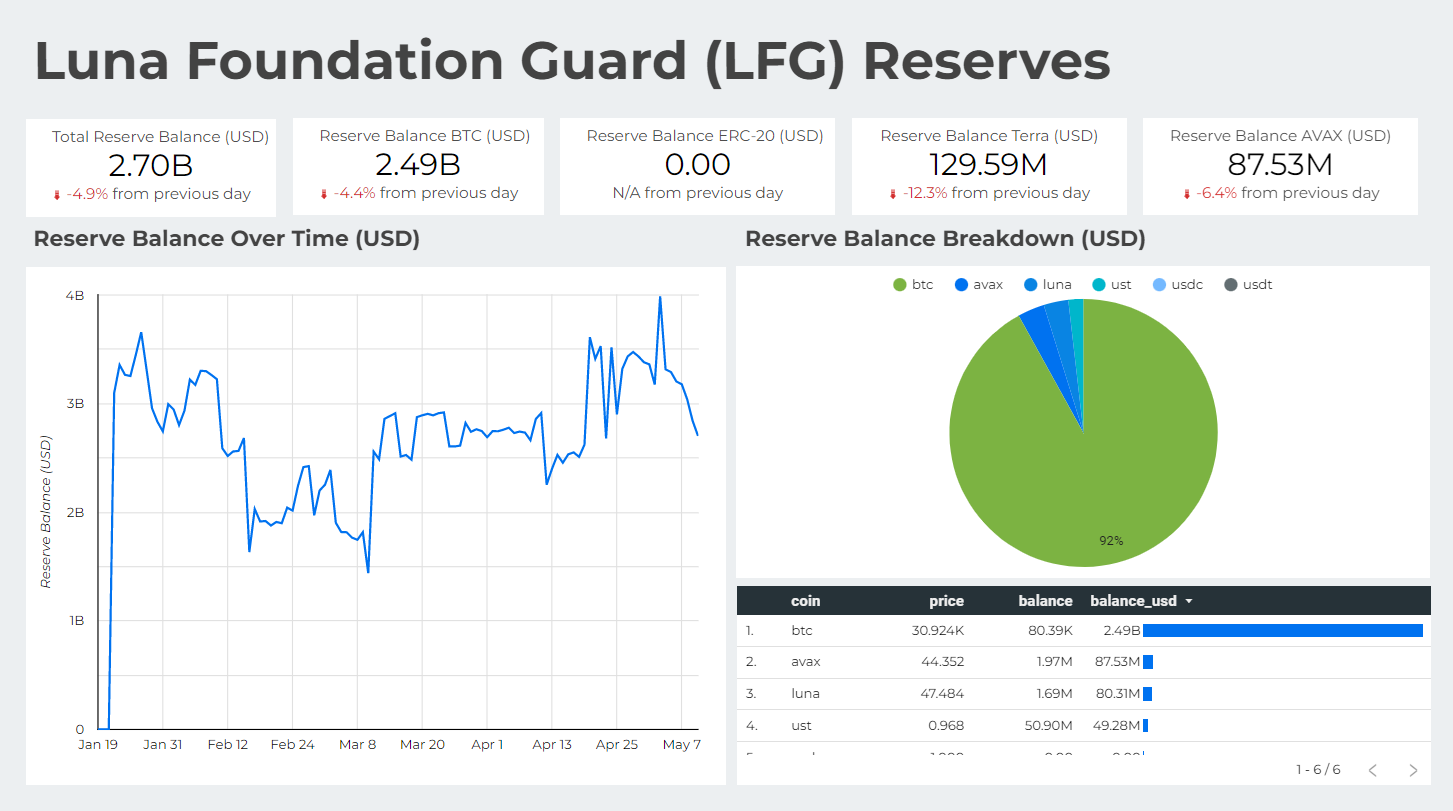

In a chain of tweets, the LFG announced that owing to the bearish market situation, the organization will be promoting about $750 million price of Bitcoin.

Alternatively, they disguised this promoting by calling it a loan to OTC purchasing and selling corporations and stated that the an identical amount of Bitcoin would be repurchased as quickly as the market cases improved.

This left the LFG reserve stability at dazzling $2.7 billion when it change into at $3.9 billion a week prior to now. As reported by CoinCentral, the LFG had lately purchased $1.5 billion price of Bitcoin for the reserve to run closer to its $10 billion target.

Alternatively, this dumping left patrons infuriated, and extra participants withdrew their Anchor deposits, leaving LUNA and UST in a bind.

At the time of this listing, the stablecoin UST change into purchasing and selling at a 7.4% much less dear model at $0.926, the lowest it has ever been at, and it looks admire the LFG reserve has now not been ready to repair it actively.

Consequentially, with the broader market crashing and the Terra ecosystem noting backlashes from the team, the DeFi chain’s native token LUNA additionally plunged by 35.59%, leaving it purchasing and selling at $43.86.

This demolish added to the already bearish week where the altcoin lost over 20%, bringing the weekly decline to 45.57%.

Though, as per Terra founder Quit Kwon about $1.5 billion in capital has already been deployed to stabilize the UST peg, this could per chance well additionally unbiased be a whereas sooner than it shows its trace.

7/ This would possibly occasionally per chance well additionally unbiased be a in truth crucial different for the terra and wider crypto team to collect empirical recordsdata on how LFG operates & fits into the Terra ecosystem.

Gaze over the following couple of days now not on whether or now not LFG selected to deploy reserves, however on how.

— Quit Kwon 🌕 (@stablekwon) Can also 9, 2022