Tezos seems to net shrugged off the uncertainty within the cryptocurrency markets after rebounding strongly.

Key Takeaways

- Tezos is up greater than 36% within the previous 18 hours.

- Prices appear to be drawing near a pivotal point.

- If XTZ breaks by strategy of the $7.20 barrier, it may perhaps upward thrust to $12.25.

Tezos has broken out into the NFT market, and it seems that investors net noticed. XTZ has managed to rebound strongly after a steep correction, which may lead it toward original all-time highs.

Tezos Looks Primed for Unique All-Time Highs

Tezos seems to net a gleaming future earlier than it after making a establish for itself as an eco-pleasant NFT blockchain.

Non-fungible tokens net change into a success on Tezos, with rap star Doja Cat launching her genesis sequence on the OneOf platform earlier this month. Earlier within the Twelve months, F1 racing groups McLaren and Pink Bull Racing moreover launched NFT on Tezos, citing the chain’s low carbon footprint as a predominant reason at the aid of picking it over its competitors.

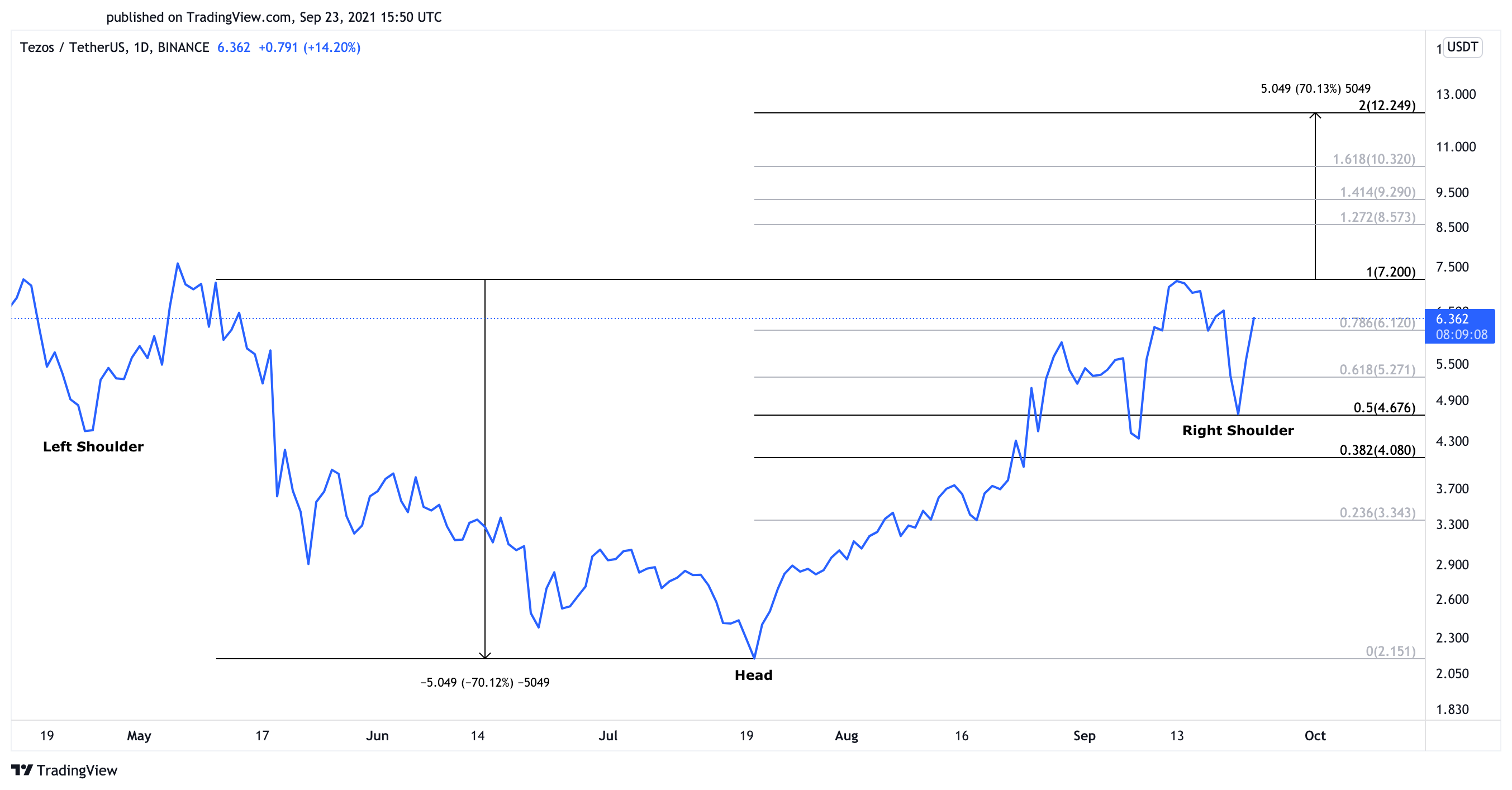

The XTZ token seems to had been growing a head-and-shoulders pattern on its on daily foundation chart since mid-April. The so-known as “Ethereum killer” is as we tell off forming the apt shoulder of the bullish formation.

Extra will enhance in procuring stress may push Tezos above the head-and-shoulders’ neckline leading to predominant features. Cutting by strategy of the $7.20 resistance barrier may ignite a original 70% bull flee toward $12.25.

This bullish target is dependent upon measuring the peak between the pattern’s head and neckline and adding that distance to the breakout point.

The Fibonacci retracement indicator, measured from the Jul. 20 low of $2.15 to the Sep. 13 high of $7.20, suggests that Tezos may face just a few hurdles on its technique to original all-time highs. These obstacles sit down at $8.60, $9.30, and $10.30, respectively.

It is some distance charge noting that if Tezos fails to interrupt by strategy of the head-and-shoulders’ neckline at $7.20, a rejection may occur, leading to a spike in selling stress. XTZ would then retrace, but it may perhaps need to preserve above the $4.70 to $4.10 imprint pocket for the bullish outlook to remain intact. Failing to preserve this ardour region as make stronger may lead to a steep correction to $3.30.