Key Takeaways

- Bitcoin has soared by extra than 26% since July 12.

- On-chain data displays a spike in overleveraged traders whereas promoting stress surges.

- BTC wants to take care of above the $20,500 pork up stage to withhold a ways off from a correction in direction of $16,000.

Bitcoin has skilled a huge set broaden all the diagram thru the last few days, but the motion looks driven by leverage as community job continues to deteriorate. These prerequisites broaden the possibilities of a steep correction within the mid-term future.

Is Bitcoin’s Upward Payment Circulate Sustainable?

Bitcoin has enjoyed bullish momentum all the diagram thru the last 9 days, but on-chain data counsel the latest upswing is now now not sustainable.

The tip cryptocurrency has rallied by extra than 26% since July 12, rising from a low of $19,230 to a high of $24,280. Even supposing Bitcoin seems to hang extra room to ascend, there are causes to have confidence that the bullish set action is also short-lived.

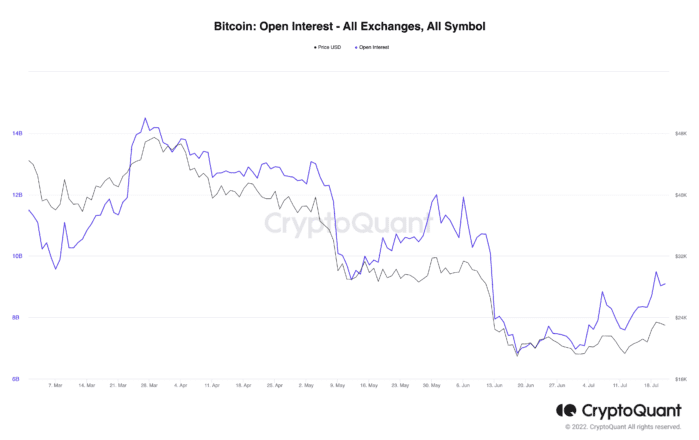

The gathering of birth long and short BTC positions across all main crypto derivatives exchanges has progressively risen this month. Roughly 1.44 billion positions had been opened since July 12, contributing to the upward set action. Such market habits indicates that the futures market is attracting liquidity and curiosity, but on-chain data unearths that the Bitcoin community has now now not considered the the same spike in count on.

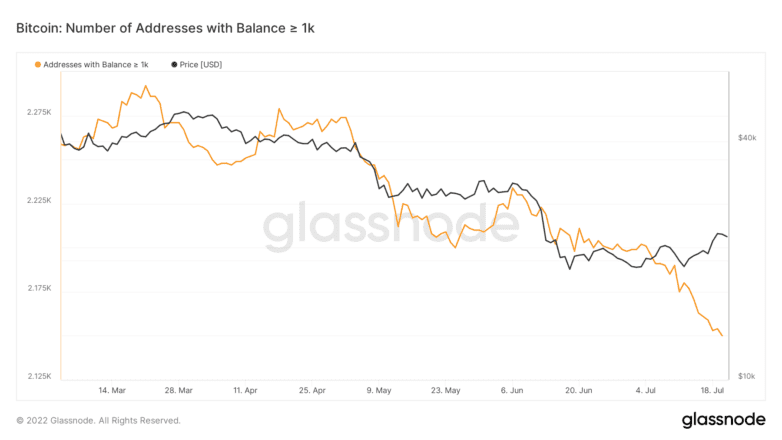

The gathering of addresses keeping as a minimum 1,000 BTC has progressively declined over newest months. While Bitcoin has gained 5,050 aspects in market price since July 12, many so-called “whales” hang redistributed or sold parts of their resources. On-chain data displays that 30 addresses, every keeping extra than $23 million price of BTC, would possibly per chance well also hang left the community.

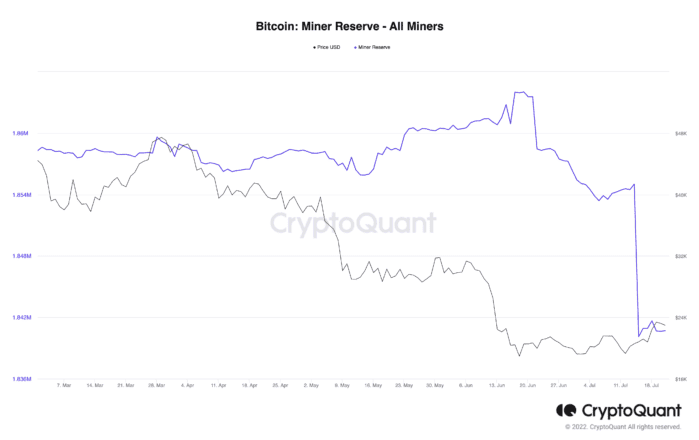

Miners additionally appear to hang taken ultimate thing about the latest upward set action to book some earnings. The amount of Bitcoin held by affiliated miners’ wallets has dropped by nearly about 1% since July 12. Roughly 13,850 BTC price over $318 million has been sold by these miners within the past 9 days.

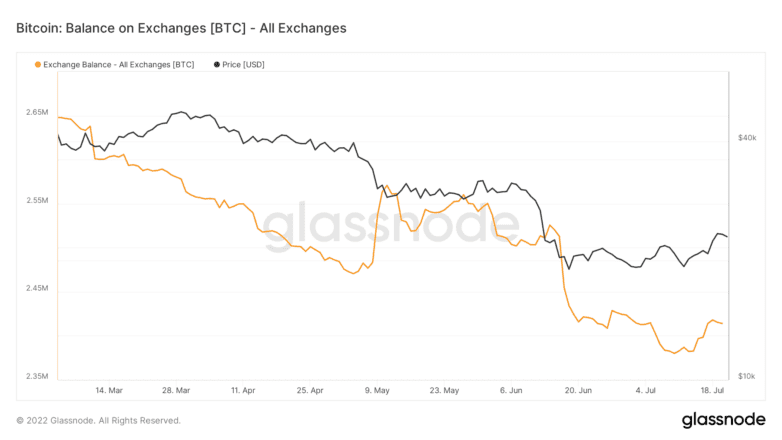

The Bitcoin stability held on trading platforms additionally displays a spike in inflows since July 12. Records from Glassnode unearths that extra than 27,030 BTC price over $621 million has been deposited on known cryptocurrency exchange wallets. The growing collection of BTC held on exchanges means that promoting stress is mounting within the attend of the cease cryptocurrency.

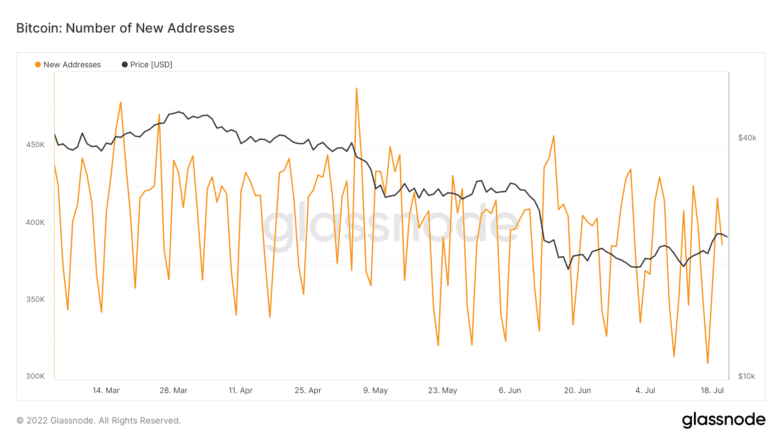

While Bitcoin whales and miners appear as if promoting their holdings, the collection of newest on a typical basis addresses created on the community is declining. This indicates that there is a scarcity of curiosity in Bitcoin among sidelined investors at the latest set levels. Network pronounce is frequently one of primarily the most trusty set predictors, and a real decline in most cases outcomes in a steep set correction over time.

The broaden in birth curiosity mixed with a decline in community pronounce and rising promoting stress from whales and miners means that the latest upward set action that Bitcoin has skilled is driven by leverage. These community dynamics broaden the likelihood of a steep correction.

Mute, transaction historic past displays that Bitcoin is currently sitting on top of stable pork up that would possibly per chance well limit its downside doable.

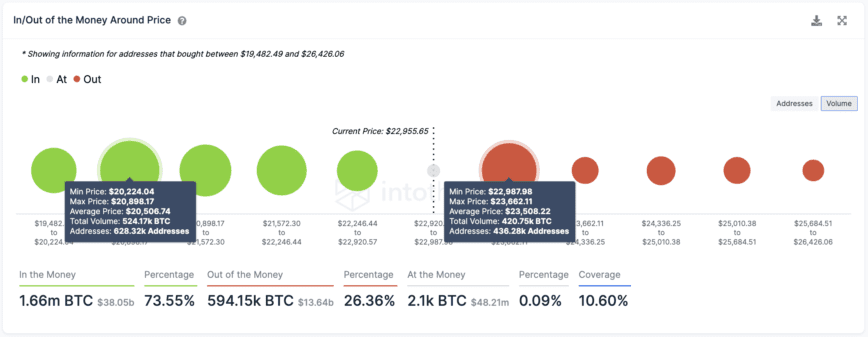

Fixed with IntoTheBlock data, roughly 630,000 addresses beforehand bought 524,000 BTC between $20,220 and $20,900. This count on zone must preserve within the event of a downswing to cease outsized losses. If Bitcoin fails to take care of this stage, a sell-off would possibly per chance well send it to the next essential pork up area at around $16,000.

Bitcoin would doubtless wish to print a on a typical basis candlestick shut above $23,660 with a view to method elevated. Overcoming this obligatory resistance barrier would possibly per chance well attend BTC upward push in direction of $25,000 and even $27,000. Then all over again, so long as the whales and miners continue promoting and community pronounce declines, the specter of a steep correction remains intact.

Disclosure: On the time of writing, the author of this fragment owned BTC and ETH.

For extra key market trends, subscribe to our YouTube channel and opt up weekly updates from our lead bitcoin analyst Nathan Batchelor.

The guidelines on or accessed thru this net location is got from fair sources we have confidence to be trusty and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any recordsdata on or accessed thru this net location. Decentral Media, Inc. is now now not an investment marketing consultant. We kind now now not give personalized investment advice or other monetary advice. The guidelines on this net location is self-discipline to alternate with out see. Some or all of the guidelines on this net location would possibly per chance well also change into out of date, or it’s a ways also or change into incomplete or inaccurate. We would possibly per chance well also, but are now now not obligated to, update any out of date, incomplete, or inaccurate recordsdata.

It’s seemingly you’ll well also collected by no methodology carry out an investment decision on an ICO, IEO, or other investment according to the guidelines on this net location, and you most doubtless can also collected by no methodology interpret or in every other case count on any of the guidelines on this net location as investment advice. We strongly suggest that you just consult a certified investment marketing consultant or other qualified monetary reliable if you are searching for investment advice on an ICO, IEO, or other investment. We kind now now not ranking compensation in any invent for analyzing or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

Tesla Offered 75% of Its Bitcoin within the Last Quarter

Tesla now holds most attention-grabbing $218 million price of Bitcoin, down from extra than $1.2 billion. Most efficient $218 Million in Bitcoin Left Tesla has sold most of its Bitcoin. In its…

Ethereum Leads Bitcoin Right into a Bullish Breakout

Bitcoin seems prefer it wants to take up with Ethereum after the number two crypto’s bullish set action all the diagram thru the last three days. While ETH has outperformed BTC, the cease…

ECB Says Bitcoin Ban “Probably” As a result of Native climate Concerns

A brand new European Central Monetary institution bid has puzzled whether climate threat is priced into crypto resources comparable to Bitcoin. ECB Condemns Proof-of-Work Blockchains The European Central Monetary institution is bearish on…