Submit date:

The flexibility to like a flash transfer bitcoin over the Lightning Network lets in traders to portray themselves to minimal third-procure collectively effort.

The flexibility to like a flash transfer bitcoin over the Lightning Network lets in traders to portray themselves to minimal third-procure collectively effort.

The below is an instantaneous excerpt of Marty’s Twisted Declare #1130: “The Lightning Network is organising effectivity for traders.” Join the e-newsletter right here.

Here is a tall blog put up from the team in the support of Kollider, an replace that lets in traders to alter bitcoin the utilization of leverage. In it, they dive into the long-established desires and workflow of margin traders who’ve positions on extra than one exchanges at the identical time, how they plan natively with on-chain bitcoin transactions and how the utilization of the Lightning Network adjustments these operations and makes them extraordinarily environment pleasant. I extremely point out you freaks strive the put up if and if you procure an opportunity.

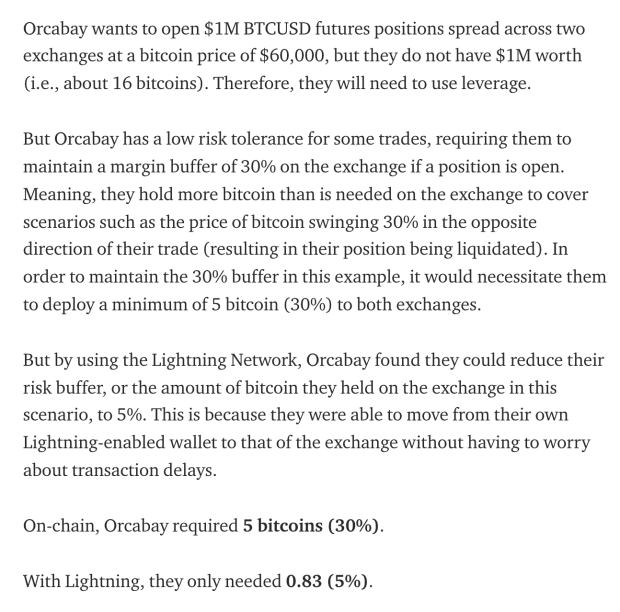

As you might possibly possibly perhaps also look from the screenshot above, due to the nature of the style of instantaneous settlement that the Lightning Network can present in comparability to on-chain transactions, the amount of sats a bitcoin algo trader desires to care for up on an replace as a margin buffer is lowered enormously from 30% of cost at effort to five% of cost at effort. The flexibility to like a flash transfer sats over the Lightning Network from a pockets owned by a explicit trader or purchasing and selling fund to an replace lets in these traders to portray themselves to as small third procure collectively replace effort as conceivable. And as you’ll look for folk that be taught the put up, this 5% buffer is even rather conservative because it factors in doable channel liquidity issues that will possibly perhaps come up if many traders are transferring quite rather a lot of sats at some level of sessions of high volatility. The margin buffers might possibly possibly perhaps procure even smaller if fears over a channel liquidity are ready to be quelled by increased liquidity on the Lightning Network, which appears to be coming on every single day foundation.

Factual now, intra-replace divulge by technique of the Lightning Network is a actually cramped share of overall intra-replace divulge. As time strikes on, as the Lightning Network continues to feeble, and as traders become extra well versed on how one can defend an eye on their funds over the Lightning Network we are able to ask extra and further traders to originate leveraging this utility. Elevated utilization of this utility must have some certain externalities that encompass lower costs for traders (which manner higher margin – as a minimum temporarily as the comfort of the purchasing and selling world gets caught up to speed), and less third procure collectively effort which comes with holding funds on an replace. The Lightning Network is enabling traders to care for up less and less sats in a third procure collectively pockets while restful reaping the identical benefits of the purchasing and selling platforms that they’d when doing intra-replace arbitrage by technique of on-chain transactions.

It will be fun to leer this house of the market develop in the arrival years.

Onward!