The under is an excerpt from a most up-to-date version of the Deep Dive, Bitcoin Journal’s top class markets newsletter. To be among the many well-known to salvage these insights and diversified on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

This Every day Dive will touch on one of the important important latest macro tendencies and correlations within the BTC market. At the same time as you haven’t read this most up-to-date thread on the bitcoin market, compare it out.

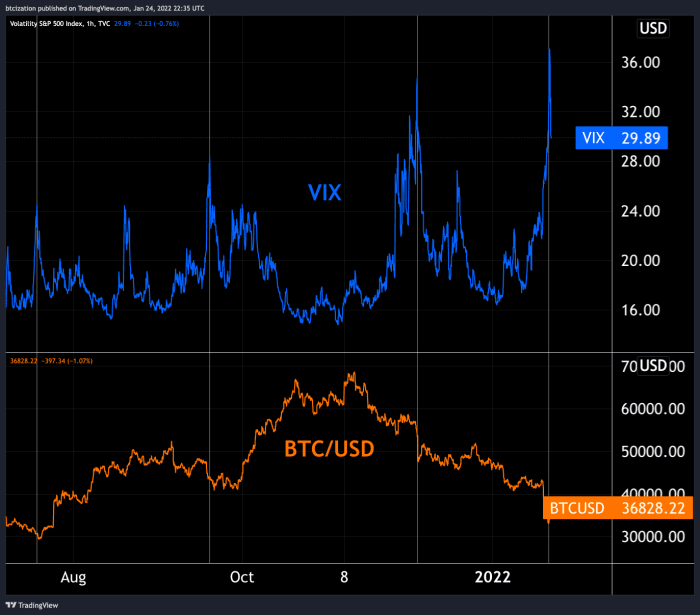

In Friday’s Every day Dive, with bitcoin under $40,000, we current to protect an quiz on the VIX, as menace sources continued to dump in unison over the next month.

“If things proceed to internet gruesome in equity markets, support an quiz on the VIX, which is a volatility index for the S&P 500. If stocks proceed to tumble, this could well possibly well seemingly consequence in continued weak point in bitcoin. The proper query is what’s the threshold where bitcoin derivatives markets face cascading liquidations, which is what worsened the promote-off in March of 2020.”

Precise a mere three days later, U.S. markets opened down mountainous and bitcoin used to be shopping and selling shut to $33,000 as volatility exploded, with the VIX touching as high as 38 sooner than an enormous reversal came about:

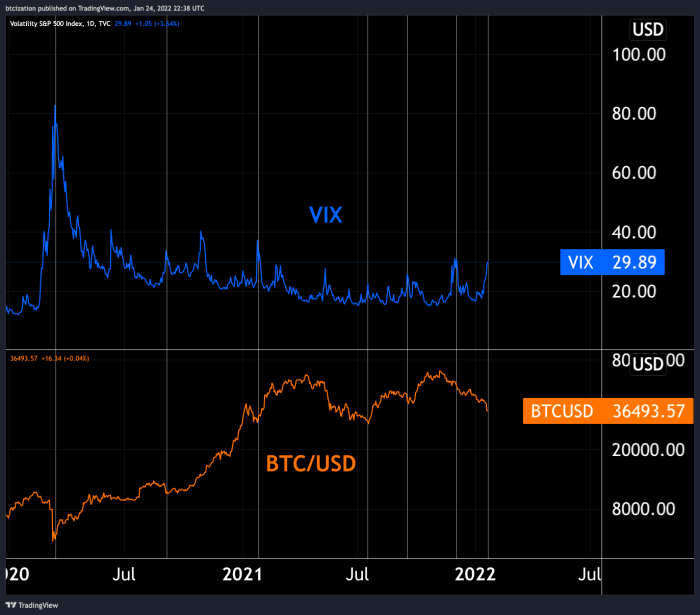

As bitcoin matured as a worldwide macroeconomic asset, it elevated its correlation to equities and supplied off for the period of strikes elevated within the VIX (menace off moments). Right here are some highlighted moments over the closing two years where this has came about:

We furthermore obtain monitored the market’s expectations for the Federal Reserve Board through the Eurodollar futures market, a futures market on the expected Fed funds fee. Expectations fell at the contemporary time as equity markets tanked, which used to be an implicit nod to the rotten “Fed build aside.”