Bitcoin used to be rejected as it approached the high plan around its most trendy stages. The first crypto by market cap would possibly presumably presumably return to previous lows as it continues to change in a staunch fluctuate.

Linked Reading | Bitcoin Retail Reaches 2d-Highest Buying Price In History. Moral Or Spoiled?

The originate up of the Bitcoin Miami Conference 2022 would possibly presumably presumably present the bulls with some pork up. The occasion is mostly crammed with certain announcements with an instantaneous affect on BTC’s tag.

On the opposite hand, the macro-factors combating Bitcoin and completely different anguish-on sources to reached contemporary highs seem like re-gaining relevance. The U.S. Federal Reserve (FED) began its tapering path of within expectations but would possibly presumably presumably flip extra aggressive as inflation persist.

On the time of writing, Bitcoin trades at $43,900 with a 5% loss in the ideal 24-hours and 7-days.

In the short time-frame, Bitcoin have to defend above $44,000 in the day-to-day to quit additional losses. Knowledge from Cloth Indicators records minute pork up for BTC’s tag except around $42,000. This means that truth, any transient selling stress would possibly presumably presumably put off BTC to revisit the low of its most trendy stages.

In the prolonged time-frame, Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone talked about the benchmark crypto flashed a trying to search out signal in its BI model signal. Faded to measure momentum available in the market, the analyst talked about right here is the first time since unhurried 2021 that BTC turns bullish.

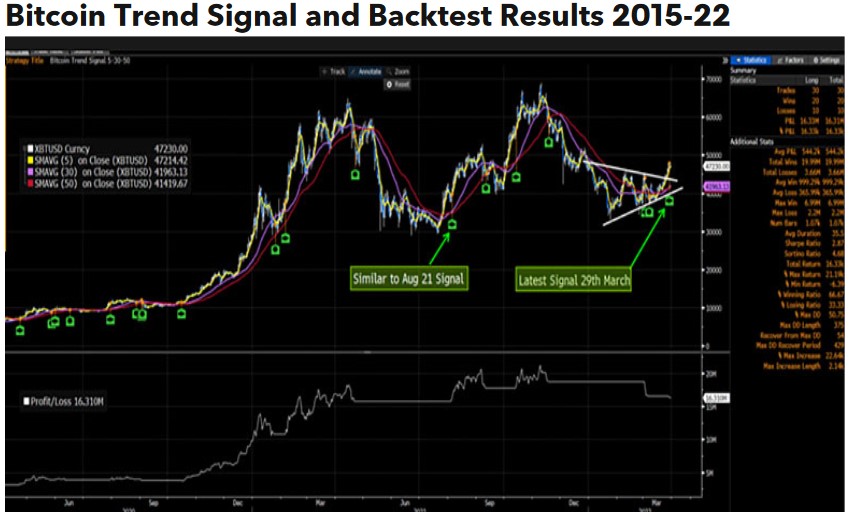

As seen below, the signal has proceeded with necessary rallies over the previous 7 years. McGlone added the next on the potential for BTC to reclaim higher stages:

In the previous seven years there had been 30 indicators, with a somewhat high 66% of them notionally profitable. Though macro factors stay sinful, and the broader sample is aloof a massive fluctuate of $30,000-$70,000, primarily the most trendy rally would possibly presumably presumably also unbiased get dangle of legs an much just like the signal of August 2021, which preceded a rally of 65%.

A Trusty Dollar Might possibly Play In opposition to Bitcoin

The rally in the U.S. greenback appears to be fueling primarily the most trendy downside tag trot. Doubtlessly connected to the warfare between Russia and Ukraine and rising inflation in the united states.

As seen below, the U.S. greenback has been on an uptrend for nearly a year. In Might possibly 2021, the currency touched its yearly low shut to the 89 marked and has been signaling extra appreciation as uncertainty in world markets will increase and investors search to guard their wealth.

FTX Entry believes the crypto market faces a transient hurdle with the upcoming FED Federal Originate Market Committee (FOMC) meeting. As talked about, the monetary institution would possibly presumably presumably flip extra hawkish rising their interest charges from 25bps to 50bps.

Linked Reading | Will Crypto Hit a Ceiling? Crypto Corporations Plan to Terminate It

FTX Entry urged traders to video show the FED steadiness sheet. This would possibly present extra clues into the institution’s means to the inflation challenge and the aggressiveness of their monetary coverage. FTX Entry talked about:

It’s that which you would possibly presumably presumably mediate that this meeting used to be too quickly to secure a QT thought agreed, but given how a ways they’re falling in the motivate of inflation it appears slightly possible that we create FOMC officers get dangle of guided us that the steadiness sheet unwind shall be sooner than ideal time (which started at $10b/month).