Are you conserving bitcoin on an alternate?

Let me disclose you a story about what happens while you, and others, scuttle away your bitcoin on exchanges. You would per chance well presumably presumably be bowled over to listen to what which technique to your holdings. It would per chance well presumably sound plenty indulge in your possess.

Let’s call our personality Bill. Bill has been cautiously searching at bitcoin for years, listening to about it in passing and studying a few articles. After inadvertently saving masses of money because of the lockdowns, he made up our minds to dive into bitcoin in a roundabout design. A chum told him to test out Coinbase, Binance or one other in trend and “depended on” alternate in snort in self assurance to remove his first chunk of bitcoin.

So, Bill created an legend and uploaded his face, ID, social security number, deal with and every diversified related detail about his lifestyles until he finally reached the “Decide Bitcoin” conceal. He picked up a allotment of a bitcoin, nonetheless in any case that wretchedness, he belief to himself:

“I form no longer maintain to study all these difficult technical little print about hardware wallets and self custody — I elegant need my bitcoin get.”

Bill reviewed the alternate’s web page and made up our minds that the protection experts on the alternate, with their wiz-bang cool storage and cutting-edge work encryption, would be better at securing his bitcoin than he himself would be.

Bill used to be very delighted with himself after making that call — no longer handiest did this alternate get investing in bitcoin easy, it gave him peace of tips radiant that somebody else used to be accountable for conserving his resources get from to any extent extra or less theft or malicious exercise. In spite of the entire lot, why would per chance well just serene he maintain to wretchedness about such issues when there had been experts available who would per chance well presumably deal with them as a replacement?

Bill has since change into somewhat delighted with the premise of trusting exchanges along with his bitcoin — his money on the second are get from his possess errors!

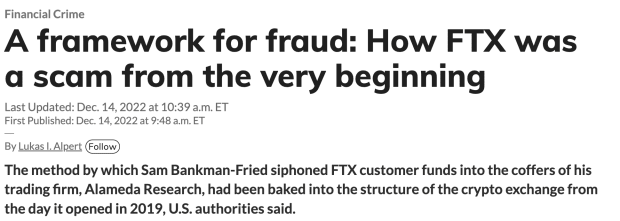

When Belief Disappears: The Tumble Of FTX

When Bill turned on the news one morning and discovered that the big crypto alternate FTX had elegant paused withdrawals and looked as if it would “accidentally” lose $10 billion, roughly a third of its market cap, he used to be panicked.

How would per chance well presumably a agency with its emblem on the facet of a main sports actions stadium and a CEO who appeared on CNBC, Bloomberg and in entrance of the U.S. Congress(!) to discuss digital resources and law maintain lost — or seemingly stolen — so principal from elegant beneath everyone’s nostril?

Now Bill used to be caught between a rock and a though-provoking recount. He used to be suspicious of his possess alternate, nonetheless organising his possess hardware wallet appeared so difficult and upsetting. It would require him to speculate in a physical tool, develop the considerable data to get it wisely and be conscious of his seed phrase backup. Even supposing he figured out the basics, there used to be serene the chance of misplacing his tool or improperly storing his backup and shedding get entry to to his bitcoin.

FTX used to be scary, nonetheless no doubt Bill’s alternate would by no technique habits itself the same technique. Of us would discover about it sooner than it used to be coming, and he’d maintain time to get out, elegant?

Causes To Seize Your Bitcoin Off Exchanges

It is particular that trusting your bitcoin to an alternate brings with it the chance that you will log in one morning to search out that your bitcoin elegant is no longer there. Whenever you retain your bitcoin your self utilizing a hardware wallet, this can’t occur.

On the other hand, there could be one other colossal reason or no longer it is important to maintain interplay your bitcoin off exchanges: the bitcoin worth.

How would per chance well presumably self custody maintain an tag on bitcoin’s worth? All the pieces in economics says that procuring and selling maintain an tag available on the market worth for a elegant, no longer who holds it. On the other hand, self custody is terribly fundamental to cost — and it has to form with one thing I will call “paper BTC.”

Introducing The Next Extensive Thing: Paper BTC

Let’s search for at how an alternate works by smitten by a hypothetical alternate known as ExchangeCorp, owned and operated by a jolly entrepreneur named Bernie. ExchangeCorp built an uncomplicated technique to remove bitcoin, and hired a group of security experts to make certain that hackers are saved at bay. Over time and through immense marketing campaigns, ExchangeCorp built believe with traders and traders, drawing many in to store their bitcoin on the alternate.

When users take their bitcoin with ExchangeCorp, the CEO Bernie and his group retain alter over those money. Possibilities simply maintain a claim on their money: they’ll log in and discover about their balance as well to request of to withdraw their money. On the other hand, if Bernie wants to transfer those money owed to his prospects to diversified Bitcoin addresses, he’s technically able to form so with none buyer’s permission.

When Bernie kicks up his feet and appears on the balances in ExchangeCorp’s vault, he’s delighted to search around for tens of hundreds of bitcoin that his prospects maintain deposited sitting somewhat. Since ExchangeCorp is doing wisely, more bitcoin are repeatedly coming in than going out.

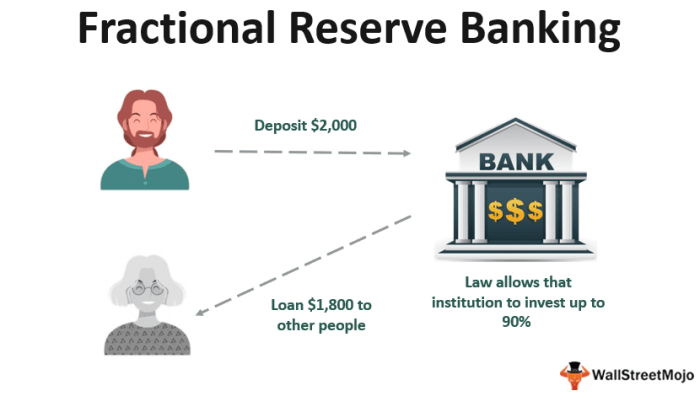

So Bernie gets a pragmatic belief. He would per chance well presumably lend out a few of those buyer money, beget some curiosity, and get the money attend with out any individual noticing. He would get richer, and the chance of enough ExchangeCorp prospects asking for withdrawals at one time to contrivance its vault’s big balance all the trend down to zero is miniscule. So Bernie loans out hundreds of money right here and there to hedge funds and companies.

Supply. Primitive banks are even worse than ExchangeCorp. And from March 2020, they’ll now lend out 100% of your money!

Now there could be one other set of claims to put in tips. Possibilities maintain a claim on their bitcoin at ExchangeCorp, nonetheless ExchangeCorp no longer has the accurate bitcoin — they handiest maintain a claim on the coin they lent out. What prospects now maintain is a claim on Paper BTC held by ExchangeCorp, with the accurate bitcoin in the palms of borrowers.

Right here’s the set up issues get uncommon. All of ExchangeCorp’s prospects serene judge they’ve an instantaneous claim on accurate bitcoin held safely by ExchangeCorp. On the other hand, that accurate bitcoin is of route in the palms of folks that borrowed from ExchangeCorp, and those entities are selling it out in the market.

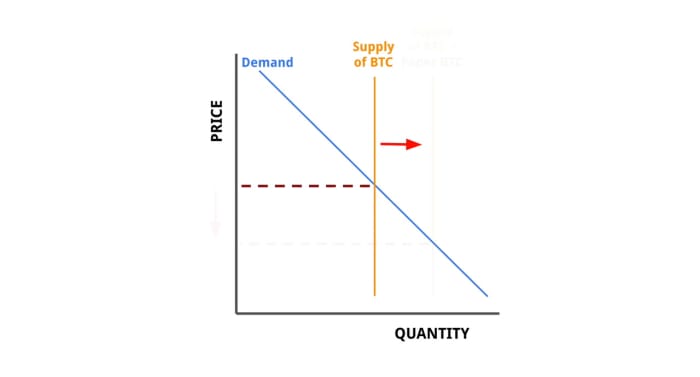

What happens when ExchangeCorp lends out a vivid quantity of the bitcoin its prospects deposited? Hundreds of extra bitcoin begins to drift around in the market, on legend of traders who judge they’re maintaining accurate bitcoin are handiest maintaining paper BTC. All of that extra present of bitcoin in the market absorbs put finish strain, which suppresses the pricetag of bitcoin.

Let’s search for at easy present and quiz right here:

When paper BTC comes into the market, on legend of market participants are unaware that this fresh present is no longer accurate bitcoin, it has the same attain as growing the present of accurate bitcoin — until the fraud is uncovered.

Does this hypothetical story sound the rest indulge in the hot news around FTX?

The Paper BTC At The Heart Of The FTX Fraud

The story of ExchangeCorp and Bernie is precisely the story of FTX and its founder Sam Bankman-Fried, with some keep-the-world complexes, discover about treatment and polyamorous orgies redacted.

By lending out buyer funds, FTX if truth be told inflated the present of bitcoin by taking profit of the believe users positioned in FTX to safeguard their funds. FTX created a complete lot paper BTC.

Factual how principal paper BTC would per chance well presumably FTX maintain created? We can no longer be obvious that of the accurate amounts given its completely gross bookkeeping, nonetheless the estimate beneath suggests FTX had 80,000 paper BTC on its books — bitcoin owed to prospects that is no longer backed by accurate bitcoin.

That would per chance well presumably portray a staggering 24% of the roughly 330,000 fresh bitcoin that had been created over the past one year throughout the predictable mining issuance process. That would per chance well presumably be a ton of extra bitcoin getting into the market that no one — other than a little group of insiders at FTX — knew about!

It is not likely to reveal the set up the pricetag would maintain long gone with out that extra bitcoin present getting into the market, nonetheless we’ll be nearly certain that the pricetag would maintain climbed higher than it did in 2021.

Whereas the FTX give design is fresh and serene unfolding, historic past has a few cautionary tales to reveal relating to the dangers of paper resources and cost manipulation. The story of gold’s failure to withstand centralized discover, as an illustration, can disclose us the set up Bitcoin is headed if we proceed to believe exchanges and third events to retain our bitcoin for us.

The Tumble Of Gold

Gold used to be once aged in day-to-day transactions — it takes no higher than a search the advice of with to a museum of earlier historic past to search around for the collections of oldschool gold money once circulating in native markets. The dilapidated peek of the loss of life of gold as a transactional forex used to be that it turned too cumbersome or too treasured to proceed to operate wisely as a technique to remove groceries and beer.

On the other hand, this story omits a few key ingredients that handiest existing themselves after we note the evolution that societies took from gold money to paper payments and digital financial institution accounts.

Centuries ago, banks started taking buyer’s gold in alternate for financial institution notes — giving prospects a measure of security for his or her gold and a more convenient technique of transacting. On the other hand, entrusting a financial institution along with your treasured metal intended the financial institution used to be able to lend it out or get imperfect investments with out the depositor’s consent. When a financial institution used to be caught between imperfect loans and a high fee of depositor withdrawals, they needed to characterize financial catastrophe and shut down — leaving many depositors penniless, maintaining paper claims on gold now worth nothing the least bit.

Then central banks got right here along to “fix” the mumble of bankrupt banks leaving depositors penniless. Central banks held gold for fogeys and industrial banks, giving them banknotes from the central financial institution as receipts for his or her gold. By 1960, central financial institution official holdings accounted for about 50% of all aboveground gold stocks, with their banknotes circulating freely. Commercial banks and folks didn’t tips, since every divulge used to be convertible to a suite weight of gold by the central financial institution that issued it.

Trace the divulge in the upper left? This $5 Federal Reserve divulge — incessantly is named a $5 invoice — is redeemable in gold. Supply

This could maybe maintain labored wisely, other than that central banks — in particular the Federal Reserve in the U.S. — started creating more payments than they had gold to attend. Rising more payments than the Fed had gold to attend used to be if truth be told creating paper gold, since every invoice used to be a claim on gold. Doing this in secret intended the Fed used to be manipulating the pricetag of gold, given the extra circulating present which the market used to be no longer conscious of. When many depositors of gold on the Federal Reserve — indulge in the French govt — started questioning the Fed’s gold holdings and creating the threat of a scuttle on gold in the U.S., the U.S. govt needed to intervene.

In 1971, this got right here to a head with the Nixon shock. One night, President Nixon launched the U.S. would prefer a flash live allowing depositors to alternate of their Federal Reserve notes for the gold they promised.

This short-term live in withdrawals used to be by no technique lifted. Since all currencies had been linked to gold throughout the U.S. greenback beneath the Bretton Woods agreement, the Nixon Shock intended that the full world went off the gold favorite straight away. All currencies had been now elegant objects of paper, pretty than notes giving the holder a claim on a quantity of gold.

This used to be handiest achievable on legend of gold, over time, used to be deposited into industrial banks after which to central banks. As soon as central banks held a entire lot of the gold, they would per chance well manipulate the pricetag of gold and put it completely from day-to-day commerce. Day after day folk chose the comfort of paper notes over the protection of maintaining gold, and paid the pricetag.

In recount of a fair money backed by a treasured metal that is difficult to dig up and not likely to synthesize, currencies turned easy to print and thus extremely politicized. Retaining the greenback on the tip of the meals chain no longer required restraint and elegant stewardship to make obvious that its backing in gold. As an different, it required navy expeditions and mighty policing to make obvious that global governments and voters continued to expend the greenback to transact.

A return to gold at this point would be impractical — the field’s industrial networks span too immense a distance with transactions occurring at too high a tempo. With paper forex and at final digital banking techniques, what we gained in tempo and comfort we lost in soundness and neutrality. We lost our savings, our social brotherly love and our political establishments which capability.

Stopping Bitcoin’s Tumble

Taking your bitcoin off of your alternate is no longer elegant elegant note to your possess security, or no longer it is defending the pricetag of your bitcoin as wisely. Our freedoms depend upon folks having alter over their possess wealth. When we entrust our wealth to companies or states, we scuttle down the route we witnessed with gold.

Attributable to bitcoin’s divisibility and digital nature, it overcomes the hurdles that held gold attend from supporting our in trend, interconnected financial system. Bitcoin can present a take to a worldwide marketplace, nonetheless this can handiest get there if we every retain our possess bitcoin.

Don’t let the banksters and bureaucrats manipulate the pricetag of your bitcoin: engage it off the alternate and get it for your possess hardware wallet.

Right here’s a customer post by Captain Sidd. Opinions expressed are completely their possess and form no longer necessarily reflect those of BTC Inc or Bitcoin Magazine.